The current camping trend is an immersive experience and also represents the maturation of leisure pursuits.

People find relaxation in nature while also experiencing spiritual liberation and inspiration. The ending of the COVID-19 pandemic has further fueled the demand for deep engagement in outdoor activities.

Capitalizing on this trend, functional clothing brands such as Beneunder and Ohsunny have garnered attention, with some local outdoor brands securing financing. However, in comparison to the United States (16%) and Japan (7%), the penetration rate of camping in China remains low, indicating that the overall market is still in its infancy.

The cyclical nature of this trend not only reflects recent changes in the overall consumer industry but also represents a long-term challenge for the outdoor sector. In this article, we aim to provide a more objective framework and perspective for analyzing the current camping phenomenon:

- Firstly, changing consumer demands: The shift from “nature” to “outdoors” is a product of urbanization and social structural changes. What changes is not nature itself but “us” as consumers of nature. The transformation can be summarized in three points, which are also the essential conditions for the formation of the outdoor market: nature awareness, social structure, and environmental infrastructure. This article combines these conditions into the framework of the “Three Elements of Outdoor Development.”

- The outdoor market exhibits cyclicality, and the current camping trend is somewhat contingent. Every industry experiences cycles, and the outdoor sector is no exception, though the specific situation varies significantly from country to country. The unique historical background of the United States has made camping less cyclical. However, examining Japan’s development history allows us to observe how non-outdoor-oriented countries embrace camping and other outdoor activities, and the demand elasticity influenced by economic income, population, and trend changes.

- There are standard paths for outdoor brands to navigate the cycle and become classic: Many overseas companies have overcome industry cycles, and their development follows common patterns. This article introduces the regular changes in functionality, fashionability, and cultural aspects, termed the “Golden Trio of the Outdoor Industry.” and takes the example of Snow Peak to analyze its business approach in navigating the cycle in Japan.

The outdoor market is an all-encompassing concept, and it is impossible to cover all aspects in one article. Readers are welcome to leave comments at the end of the article for further discussion.

01 Three Drivers Behind Outdoor Demands

The concept of “outdoor” is the product of urbanization, based on the maturation of nature awareness, social structure, and environmental infrastructure. We summarize it as “Three Elements of Outdoor Development.”

(1) Changes in industrial structure accompany shifts in vacation demands and evolving environmental awareness, turning the outdoors into a “utopian” destination.

The rise of vacation demands coincides with the emergence of the tertiary industry, leading to heightened expectations for quality leisure time. The outdoors offers mental laborers a space for relaxation and rejuvenation. The term “outdoor recreation” in English more directly conveys the significance of outdoor activities. The tertiary industry, with its core focus on the service sector, involves work that not only takes physical energy but also mental and intellectual energy. This characteristic amplifies the societal need for adjusting mental states. The stress-reducing effects of natural environments have made the outdoors a preferred destination for more individuals during their vacations.

People’s nature awareness has also evolved with the rise of the tertiary industry. As industrialization peaked, the interpretation and perception of “nature” shifted from “conquering nature” to the stance of “utilizing nature” or “respecting nature.”

A turning point in ideological transformation arose from people’s reflections on environmental pollution. In 1962, the book “Silent Spring” criticized pesticide pollution in the United States, which was a social sensation at that time and became a pivotal moment in the shift of environmental awareness.

A similar turn took place in Japan in 1960. After experiencing rapid economic growth post-World War II, Japan faced environmental pollution diseases such as Minamata disease and Itai-itai disease, making people realize the importance of the natural environment.

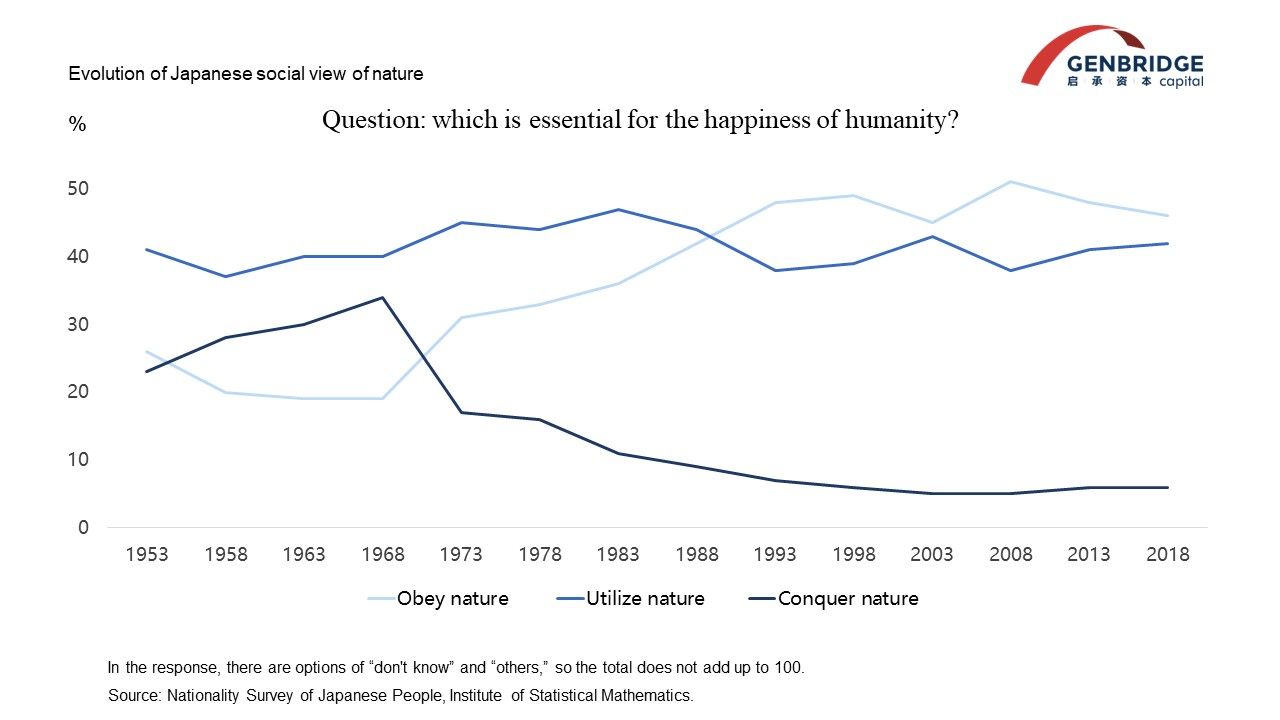

During that time, a survey asked, “For the happiness of humanity, how do you think we should approach nature?” The majority of respondents believed that nature should be utilized and conquered. However, as environmental pollution issues surfaced in Japan, the number of people advocating conquering nature sharply decreased. In a 2018 survey, 46% of respondents believed in obeying nature, while 42% believed in utilizing nature.

With environmental issues in recent years and a slowdown in economic growth, there has been a fundamental shift in natural awareness in Chinese society. People have been increasingly longing for a pastoral-style life. From the ambitious motorcycle leap across the Yellow River in the 1990s, to large-scale dance productions integrating natural scenery by Director Zhang Yimou in the 2000s, to recent creators like Li Ziqi and Chuangxi Xiaoge immersing themselves in creating pastoral lifestyles.

The relationship between people and nature has transformed from opposition to integration. CNKI (China National Knowledge Infrastructure) also sees surges in the number of articles on nature conservation and outdoor themes. Society’s view of nature has evolved from being a resource for full utilization to becoming an interactive, consumable, and experiential entity.

(2) Changes in industrial structure have compressed working hours, and the prevalence of convenient transportation modes has led more people to choose outdoor activities.

For outdoor consumption, people need to have leisure time. The development of the outdoor market is closely linked to people having more vacation time. On one hand, labor laws protect the workforces’ rights and set an upper limit on working hours. On the other hand, the transformation of the social-industrial structure has resulted in a reduction in working hours. According to OECD statistics, the average annual working hours per employed person in major developed countries worldwide have significantly decreased. From 1970 to 2020, European and American countries reduced from around 2000 hours per person per year to about 1600 hours, and Japan and South Korea reduced from 2200 hours and 3000 hours to around 1700 hours and 2000 hours, respectively.

Having sufficient time is not enough; there is also a need for efficient means of transportation to reach outdoor destinations. The ongoing development of transportation methods has brought new opportunities and transformations to the outdoor industry. The popularization of automobiles, the expansion of railways, and the reduction in airfare have provided consumers with more convenient means to reach outdoor destinations.

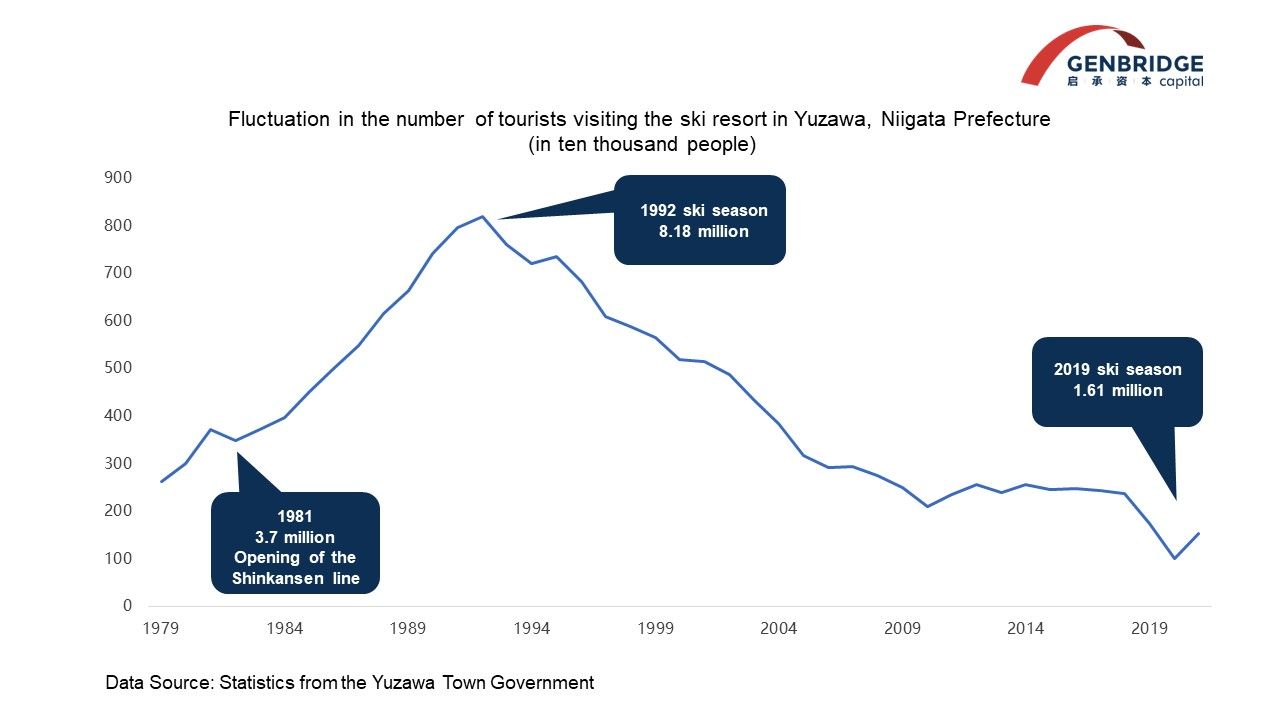

Taking the example of Yuzawa in Niigata, a skiing destination in Japan, after the Shinkansen (bullet train) opened direct access from Tokyo to Yuzawa in 1982, the number of skiers skyrocketed, rising from 3.7 million in 1982 to 8.18 million in 1993. Many young people living in cities chose to go skiing on weekends, even making same-day round trips, turning skiing from a vacation into a daily “convenient travel.”

We find through comparison that the most significant factors affecting the outdoor market in China are the excessive concentration of vacation time and insufficient public transportation. Firstly, China’s vacation time is concentrated during National Day, resulting in a surge in demand nationwide for specific areas. This leads to short-term, low-frequency and concentrated outdoor consumption, detached from the novelty-seeking attribute. Secondly, most outdoor facilities in China require self-driving, lacking sufficient public transportation, and the popularization of automobiles is also limited by external constraints such as urban restrictions on vehicle purchases and parking locations.

(3) Environmental infrastructure determines if people adopt the outdoors as a lifestyle.

What people seek is not true wilderness, but a relatively comfortable outdoor experience. Another prerequisite for outdoor demand is the appropriate exploitation and utilization of nature, turning it into a consumable space and continually attracting urban residents by providing a comfortable environment.

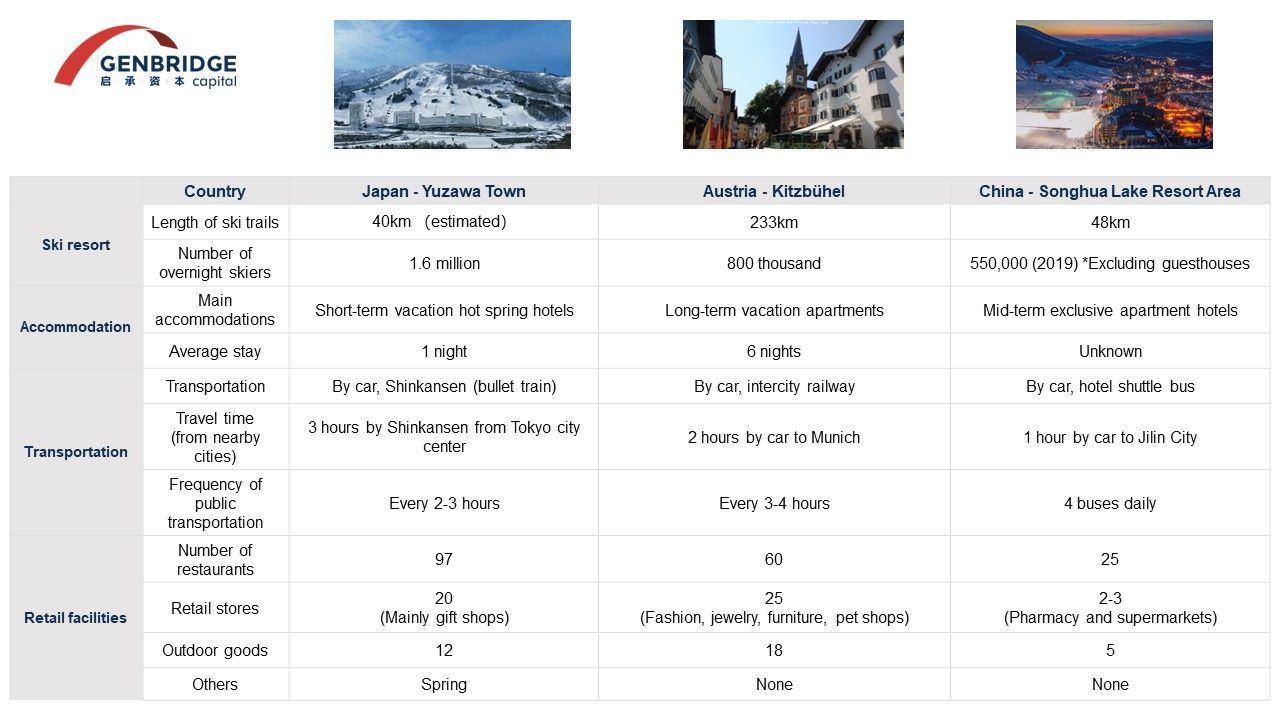

The maturity of outdoor infrastructure directly influences user experiences, impacting the lifecycle of outdoor activities. Comparing skiing resorts in China, Japan, and Austria, Kitzbühel in Austria not only boasts a superior ski environment but also features a richer array of supporting facilities such as retail infrastructure, residential options, and catering services. Excellent infrastructure results in an average stay of up to 6 nights for skiers, ensuring stable repeat business and making it a choice for family vacations.

This outcome sharply contrasts with Japan’s “convenience-oriented travel” in skiing. In the late 1980s, during the skiing boom, Japanese ski resorts, to cope with the concentrated demand during the Golden Week and weekends, built large-scale resort hotels. Ski resorts were overcrowded during holidays, while were relatively deserted on weekdays. This convenient travel model compromised consumer experiences and deep interactions with the local community, making skiing easily substituted by other recreational activities. The skiing market in China may face similar challenges in the future. Japan’s camping market faced similar issues, which we will analyze further through the development of the camping markets in the United States and Japan.

02 Essential Demand in the U.S. and Cyclical Trends in Japan

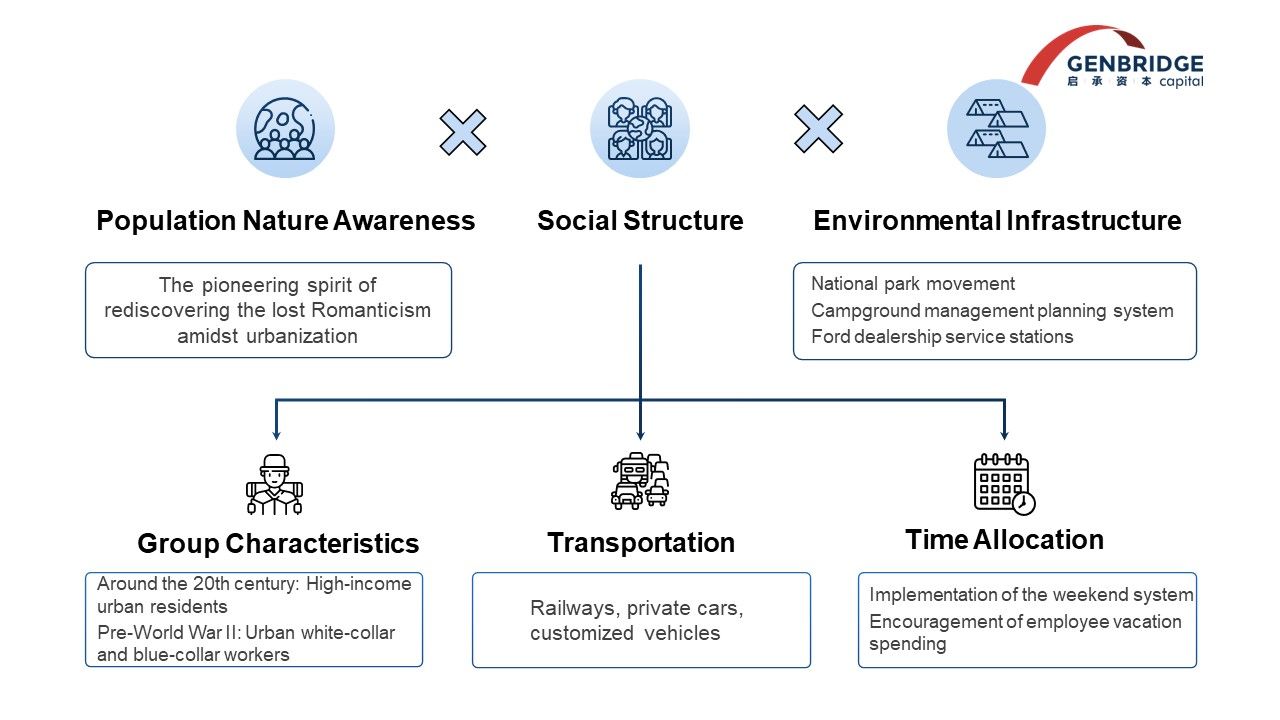

Natural awareness, societal structure, and infrastructure are three core factors influencing the development of the outdoor industry. Analyzing the camping industry development in the United States and Japan based on the “Three Elements of Outdoor Development” framework, we observe that the elasticity of outdoor demand brings significant cyclicality to the industry.

Camping in the United States has a history of over 150 years, originating in 1869 with William H.H. Murray’s book “Adventures in the Wilderness.” This work narrates the author’s camping expedition from New York to the Adirondack Mountains, capturing the experiences and emotions encountered during the journey.

Camping, deeply rooted in the American culture as a representation of wilderness, has been a fundamental element of American civilization. Roderick Nash, in “Wilderness and the American Mind,” asserts that the outdoors is a basic element of American civilization, symbolizing a self-awareness unique to American culture. In the late 19th century, as the United States recovered from the Civil War, and was in the middle of rapid economic development, increased urbanization, and severe pollution, American cultural values were challenged. People sought a romantic, non-urban, and anti-modern spirit, and a need for escape began to emerge.

For American society, camping is not just a means of relaxation but a process of experiencing and gaining self-awareness, characterized by a kind of religious exploration. American camping has become a pilgrimage of the American spirit. The United States has become the world’s largest camping market, driven not only by the awakening of collective consciousness but also by factors such as increased car penetration, shortened working hours, and the emergence of the national park movement.

If camping in the United States is considered natural behavior, camping penetration in Japan is not as smooth and stable.

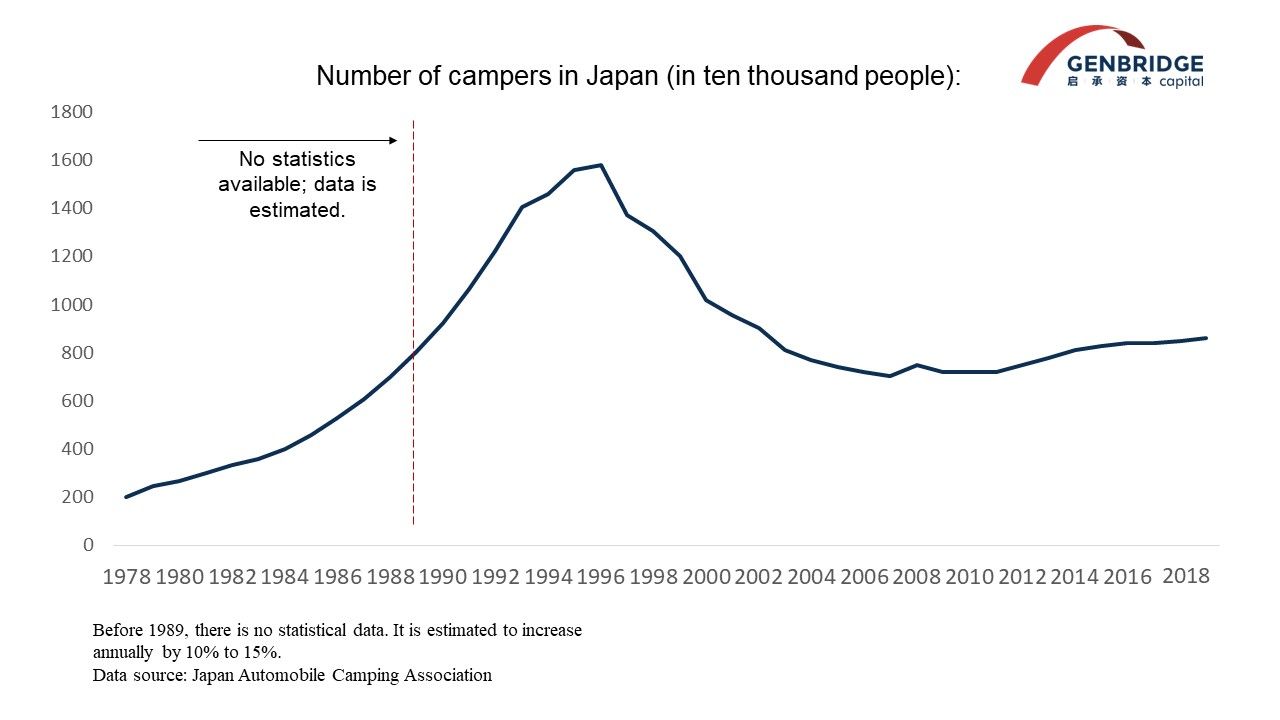

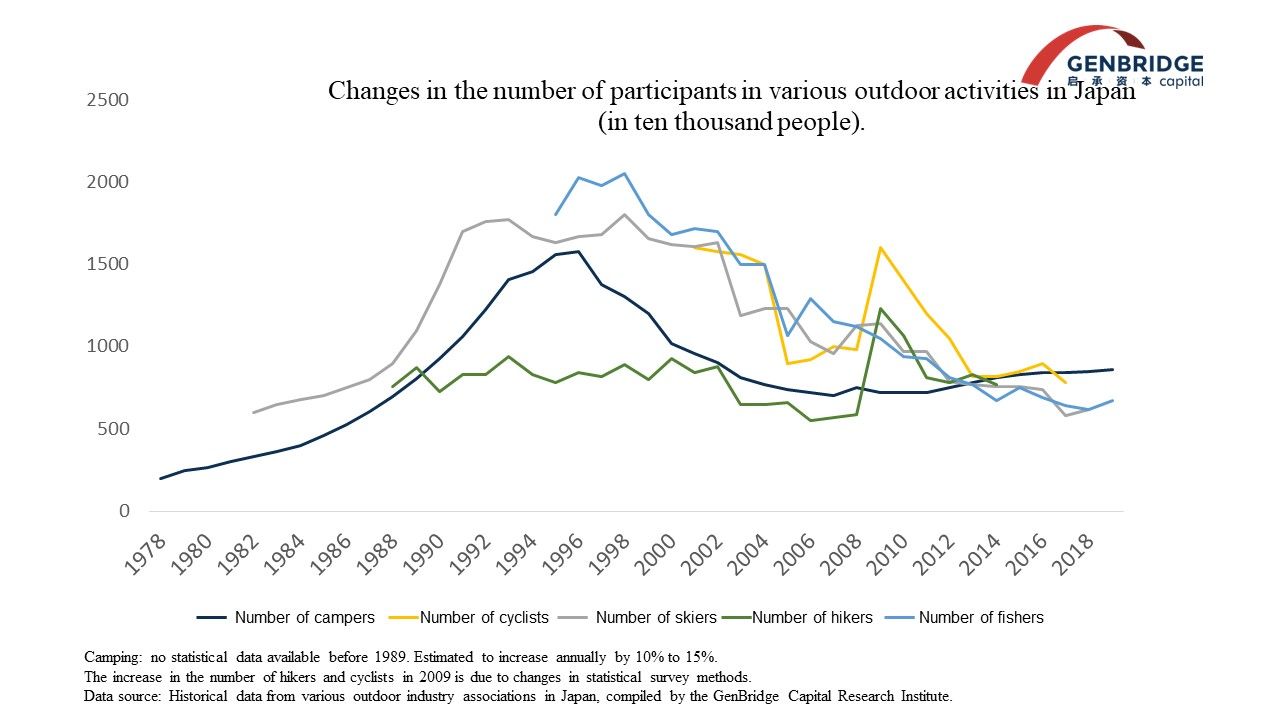

The camping equipment market in Japan is not large, with a market size of approximately 87.6 billion yen (around 700 million USD) in 2020. Camping in Japan gradually gained popularity in the 1980s, with camping population estimates reaching 4 million in 1984, 8 million in 1989, 14 million in 1994, peaking at 15.8 million in 1996 and plummeted to 8 million by the early 2000s since the Japanese camping market has entered a period of decline from 1996.

The Chinese market shares a similar background with that of Japan. Japan, compared to the U.S., has more historical scenic areas for visitors, making outdoor activities seem like a culturally imported phenomenon targeted at specific demographics. This characteristic has contributed to the strong cyclicality experienced by the Japanese camping market.

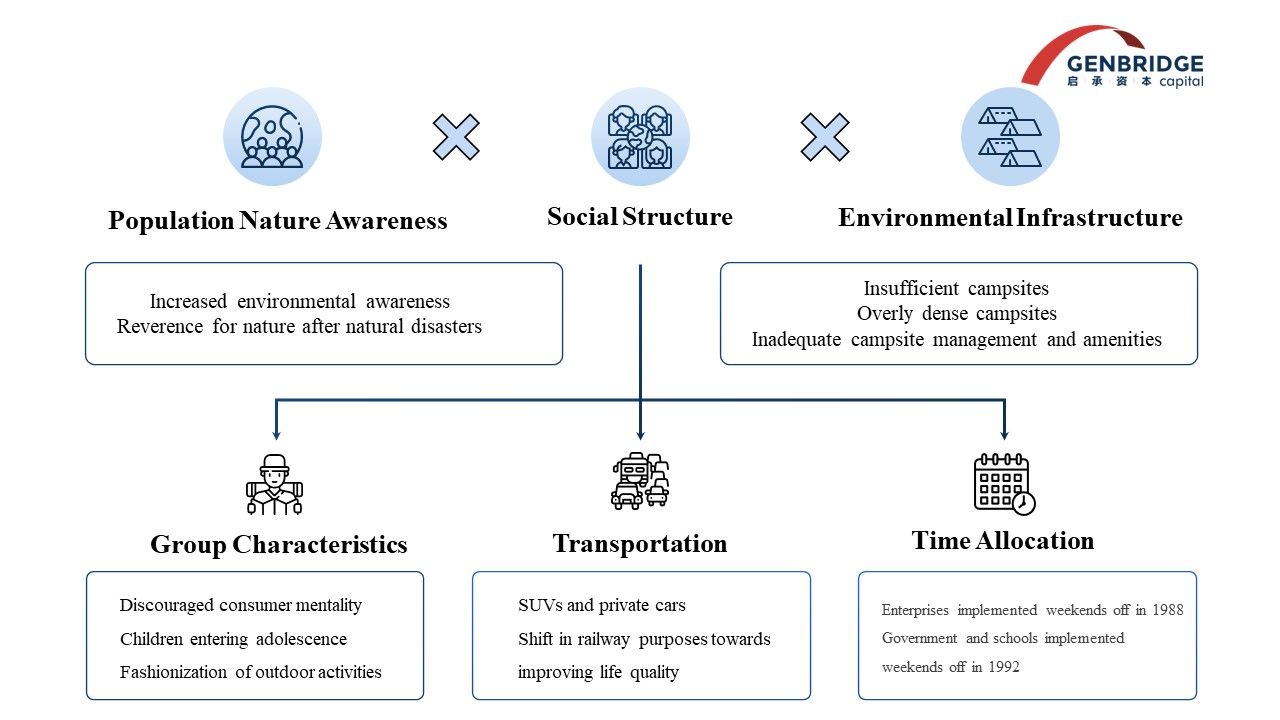

The popularity of camping in Japan in the 1990s was boosted by several external factors:

Camping met the family bonding needs of the second generation of the baby boomer generation, providing fathers, who typically lacked a sense of presence due to long working hours, an opportunity for parent-child time. These camping users, mainly aged between the mid-20s and 35, grew up in urban areas and formed their own families. Fathers, often absent due to work, found a way to enhance their presence through physically demanding activities like building fires and setting up tents, making camping an excellent choice for family bonding.

The second generation of the baby boomers was the most trend-chasing consumer generation in post-war Japan. They experienced waves of consumer trends from DC fashion and Shibukaji style to techno-disco, Fusion Rock, City Pop in music. Their deep-rooted interests coexisted with their consumption habits. Starting families did not hinder their enthusiasm for following trends and camping. In 1996, the camping-themed movie “July 7th, Clear Skies” was released nationwide. Accompanied by the theme song from the popular band Dreams Come True, camping was pushed to its historical peak.

The automotive industry also prepared suitable vehicles for young fathers on excursions. Urban versions of off-road vehicles, especially Mitsubishi’s Pajero, became the best-selling models. SUV sales accounted for over 10% of Japanese car sales. Purchasing a large-displacement four-wheel-drive SUV was considered a symbol of status and became a necessary condition for Japanese families choosing camping by car.

Social progress has granted Japanese consumers greater freedom in allocating their time. The pivotal shift occurred in 1988 with the labor law reform, mandating the implementation of the two-day weekend system. This reform abolished the previous system of staggered weekly holidays in government institutions and schools, providing an additional 20 to 30 days of annual rest per person, elevating the average yearly leave from 90 to 110 days.

The Japanese camping market witnessed a significant downturn around 1995-1996, marking a turning point. Three reasons contributed to the emergence of cycles in the Japanese camping industry.

(1) Outdoor activities, considered imports, became optional consumption in Japan, and the overall decline in the outdoor industry was influenced by changes in economic conditions. The sustained economic downturn since the 1990s affected the overall demand for outdoor consumption. Fishing, skiing, and camping all declined more or less. While the introduction of snowboarding and its accelerated popularity due to its inclusion in the 1998 Nagano Olympics, managed to buffer the decline for the skiing market.

(2) Most campers were part of a trend-following consumer group. As mentioned earlier, the primary demand for outdoor camping came from the families of the second generation of the baby boomers. When these families went camping, their children were still in elementary school, and as they entered junior high, camping activities significantly decreased. For them, outdoor camping is trend-following. They are initially drawn to mountain climbing, later captivated by skiing, and then camping, before being replaced by fishing and cycling. The sudden influx of consumers into the outdoor industry after camping activities became a fashionable pursuit creates an illusion of sustained prosperity.

(3) The number and content of camping sites were insufficient, and the industry failed to meet the demand. In the 1980s, there were approximately 200 campsites in Japan, around 500 in 1993, and about 1,000 in 1998, currently fluctuating around 2,000 sites. In the 1990s, it took approximately five years from the application for private campsites to formal opening. During the 1990s, when the camping penetration rate reached 13% to 15%, the supply of campsites could not keep up with the demand. By the time government approvals were granted, and campsites were ready, the dividends on the demand side had already disappeared.

Additionally, at that time, Japan’s campsites lacked systematic management and quality content. Witnessing the camping boom, many town governments quickly established campsites to attract visitors. However, these sites only provided a space for consumers to pitch tents without offering family entertainment, farm learning, or other interactive activities. This led many consumers to become disinterested after a single visit, and the trend failed to hatch into regular business. This pain point was addressed after 2010 through events like the Mountain Festival organized jointly by Goldwin and Beams, and brand-hosted activities like Snow Peak Way by Snow Peak. Some publicly managed campsites transitioned to private management models, enhancing both site management and content experiences.

03 How to Navigate Industry Cycles

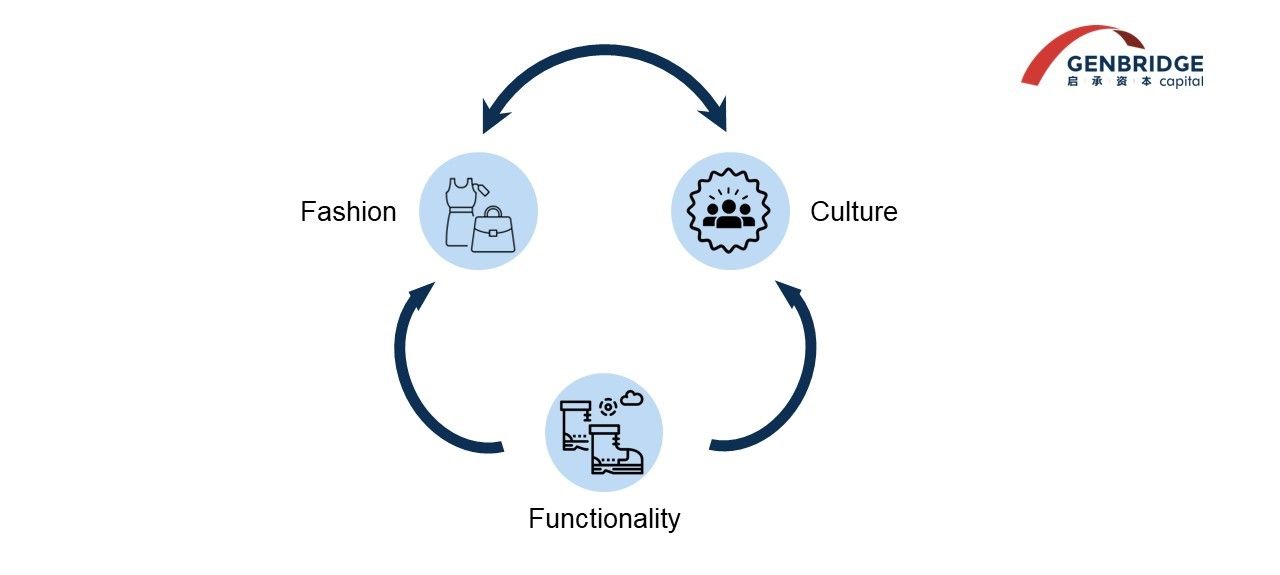

In the dynamic landscape of the outdoor market, many enterprises have successfully weathered industry cycles. GenBridge Capital, recognizing the pivotal role of extensibility in outdoor businesses, outlines a path through what is termed the “Golden Trio of the Outdoor Industry.” At the apex of this triangle lie three core elements: functionality, fashionability, and cultural significance.

Functionality means product innovation based on functional needs, like ease of movement, waterproofing, sun protection, breathability, and safety. Given the potential threats posed by nature’s elements such as cold, humidity, and heavy rain, functionality holds paramount importance. Additionally, in different natural environments, users may need to wear outdoor clothing for extended periods during sleep and movement. Therefore, outdoor apparel must place significant emphasis on comfort and usability. Brands often initiate their foray into the market with a focus on functionality. Examples include Montbell’s sleeping bags using Dupont’s latest materials, North Face’s waterproof zippers invented by YKK, and Patagonia’s camming devices.

Fashionability revolves around differentiation, using imitation and the acquisition of specific labels to stand out and adjust social relationships. Outdoor lifestyle serves as a material for urban individuals to attach symbols of differentiation to themselves. This remains particularly pronounced in Asian countries where outdoor activities still represent a fashionable and luxurious lifestyle. Outdoor pursuits can effectively alter relationships among individuals. Examples include LL Bean capitalizing on the Preppy Trend, North Face’s Urban Outdoor style Nanamica Purple Label series in Japan, and Descente’s fashion-oriented differentiated designs in South Korea.

Cultural significance refers to a brand becoming a shared understanding among a group of people, possessing and sharing the same values and belief systems. Cultural attributes often encompass fashionability, but the primary goal is not differentiation. Cultural attributes are likely developed through iconic events, brand community activities, and brand ethos. Notable cases include Burton’s snowboarding culture, Snow Peak’s “Wilderness Adventure is Life”, and Patagonia’s environmentalism.

Case Study of Snow Peak: How It Transitioned from Functionality to Cultural Significance and Weathered Industry Cycles Through Brand Service Innovation

Snow Peak, a renowned Japanese camping equipment enterprise, gained strong brand momentum by providing high-end tents, camping facilities, furniture and apparel. Its revenue soared from 3.6 billion Japanese yen in 2014 to 16.7 billion in 2021, with its market value surpassing hundreds of millions of Japanese yen.

Entering the camping scene in the late 1980s, Snow Peak introduced its first high-end tent, priced significantly above the market average. To everyone’s surprise, this tent not only succeeded but garnered exceptional feedback. By 1993, leveraging the success of high-end tents, Snow Peak achieved its peak with revenues reaching 25 billion yen and an operating profit of around 4 billion yen.

However, the Japanese camping trend experienced a decline in 1995-1996, leading to an operational crisis for Snow Peak. Revenues plummeted rapidly to 1.4 billion yen in 1997, as dwindling camping enthusiasm resulted in fewer channels willing to procure Snow Peak’s products. Facing rejection from channels, the founder and employees found themselves at a crossroads. In 1998, the second-generation leader, Tohru Yamai, officially assumed the role of president, seeking a transformation opportunity. The breakthrough came from an employee’s simple observation:

“After being rejected several times, I began to question whether Snow Peak still held meaning for society. It’s not just me, my team felt the same way. Then we noticed that with the decline of camping, camping activities across Japan were fading away. At that moment, a team member said, ‘We may not know our purpose in society, but we know that seeing smiles on our users’ faces gives us more motivation.’ This made me realize that we should enjoy camping with our users and began planning Snow Peak camping events. The guiding light on our path forward was our users.”

With this newfound perspective, Snow Peak published a small-page ad in a magazine and organized its first camping event in January 1998, with only 30 participants. This event became an opportunity to listen to consumer needs and gradually evolved into the IP camping event series known as Snow Peak Way, which continues to thrive to this day.

In the first event, Yamai Tohru obtained two crucial pieces of feedback through direct communication with consumers:

- Consumers acknowledged the excellent quality of Snow Peak’s products but expressed concerns about the high prices.

- The predominant sales channel was wholesale to distributors, resulting in no single store displaying the brand’s entire product range. Consumers were unable to see the true face of the brand.

Subsequently, in 1999, Yamai Tohru made two bold reforms. Firstly, he terminated all collaborations with intermediaries and shifted to direct-to-consumer (2C) retail or collaborated directly with retail channels to open in-store boutiques. The number of terminal sales points decreased from 1000 to 250, bringing price down by roughly 25%. Product originally priced at 80,000 yen dropping to 59,800 yen. A dedicated full-time employee was stationed at each in-store boutique in major channels to enhance consumer understanding of the brand and products. Simultaneously, Snow Peak established large-scale flagship stores to showcase the brand’s lifestyle and worldview, featuring not only tents but also a variety of categories, including cookware, accessories, outdoor furniture, and more.

Following these changes, Snow Peak implemented policies such as permanent guarantee, further strengthening its relationship with consumers. If a weekend camping product broke, consumers could bring it to the store on Monday, the store would send it to headquarters on Tuesday, repair it by Wednesday, and ensure it was back in the hands of consumers by Friday for weekend use. This permanent guarantee nurtured customer trust. High product quality and service provided ample support for selling products at high added value.

Despite a decline in revenue, Snow Peak’s net profit has consistently increased year by year since 2000, resulting in more stable and healthy growth. The brand has also gained a group of high-net-worth users, establishing unique brand assets and recognition.

Snow Peak’s path through the industry cycle aligns with the “Golden Trio of the Outdoor Industry.” Initially, Snow Peak achieved substantial growth during the dividend boom by introducing differentiated high-end and high-performance tent products based on functionality. However, during the industry downturn, the company strengthened its interaction with consumers through initiatives like Snow Peak Way, offline flagship stores, and a lifetime warranty system, deepening the brand’s cultural tone. Choosing cultural significance over fashionability in the camping industry is a strategic decision based on the unique attributes of the camping industry.

The camping industry, like a beach, faces continuous waves from surrounding industries. Camping is a consumption scenario that combines various product categories, making it easy for product demand to be diverted by adjacent fields due to a lack of sufficiently differentiated major categories. For example, tent categories are prone to competition from comprehensive retailers like Montbell and Decathlon, clothing categories are susceptible to infiltration by outdoor or functional clothing brands like The North Face, Patagonia, and Uniqlo, while cookware, furniture, and some hardware products can be easily replaced by affordable alternatives in the Home Center format. Establishing barriers in a specific category is challenging for brands in the camping industry.

Snow Peak’s first generation of L Field Tent (Source: Official Website)

Faced with the dual pressure of the industry’s inherent characteristics and the downturn cycle, Snow Peak, through service innovation akin to community operation, has garnered a group of high-net-worth users. In the downturn of the camping trend, what often remains is a group of consumers who are most passionate about camping. These users have become the brand’s most effective ambassadors, providing stronger potential energy for the brand when the next cycle arrives. They acknowledge the value of the products and are willing to accept premium pricing. Snow Peak’s brand culture, “Wilderness Adventure is Life”, is considered a part of their life values.

The strategy of targeting high-net-worth users with strong product performance and a robust cultural approach has been reinforced under the Diderot Effect in the consumer goods industry. The Diderot Effect is a “the more you get, the more you want,” a common law in the consumer industry. Starting from small products like cups, Snow Peak’s products deepen the relationship with the brand every time consumers use, repair, or participate in Snow Peak activities, permeating beyond the campsite scenes. This turns consumers into regular customers for the brand. For Snow Peak, the product itself not only needs sufficient differentiated performance but also requires maintaining the consumer experience, allowing the Diderot Effect to grow larger.

Extending from functionality to culture, as seen in the case of Snow Peak, is a relatively rare occurrence in the outdoor industry. The majority of enterprises achieve brand culture by starting with fashionable product innovation, capturing a larger audience through continuous interaction with consumers and eventually crystallizing the brand’s cultural identity. The path from functionality to fashionability includes various cases such as The North Face’s Nanamica, Descente’s fashion extension in South Korea, and L.L.Bean capturing the Preppy trend. This path has enabled these enterprises to successfully traverse the cycles of the outdoor industry.

04 Insights for Start-Ups in the Camping Industry

Based on the content above, GenBridge Research has three recommendations for Chinese outdoor camping enterprises:

- Product innovation, i.e., the functional perspective, is always the first step for outdoor enterprises. Even the most fashionable designs need a practical foundation. These products often stem from insights of product development personnel into consumers, uncovering unmet needs through their own experiences. The founder of Patagonia titled his book “Let My People Go Surfing,” emphasizing the continuous innovation needed by most consumer goods companies based on insights into demand.

- Strengthening relationships with consumers and acquiring high-net-worth users are crucial pathways to becoming a brand. Brands need to place greater emphasis on interpersonal relationships in outdoor scenarios. Snow Peak deepened its relationship with consumers through Snow Peak Way, continuously expanding through the Diderot Effect. Chinese camping sites have their characteristics, with consumers having diverse needs such as family-oriented, social, and youth education. Brands should connect these needs, build trust, and achieve differentiation and innovation in services.

- Be cautious about the occurrence of an industry crisis similar to the complete collapse experienced by Japan. Economic downturns, demographic cycles ending, and the fading of fashion trends dealt a severe blow to Japan’s outdoor camping industry, and it took over a decade to recover. China’s camping boom has similarities with Japan’s situation back then. To mitigate cyclical risks, the industry needs collective efforts to strengthen the foundation of outdoor consumption, attracting more avid campers. After the tide recedes, only true gems will remain.

* Outdoor Activities Trending as Fashion: Similar to the trend in Japan, the fashionization of outdoor activities also occurred in South Korea. The South Korea saw a surge in the hiking market after breaking through a GDP of $20,000 per capita in 2005. The market size leaped from $800 million in 2006 to approximately $6 billion in 2014, with footwear and apparel products accounting for 95%. However, it dropped to around $3 billion in 2017.

** The Diderot Effect refers to the tendency for consumption to escalate when individuals obtain a new possession, leading to harmonization of one’s belongings to fit a particular style or theme.

References

“Let My People Go Surfing: The Education of a Reluctant Businessman” Yvon Chouinard,Penguin Books, 2006

“L.L. Bean: The Making of an American Icon”,Leon Gorman, Harvard Business School Press, 2006

“Heading Out: A History of American Camping”, Terence Young, Cornell University Press, 2017

“American camp culture: a history of recreational vehicle development and leisure camping in the United States, 1890-1960”,David Harmon, Ohio State University Ph.D Dissertaiton, 2001

「創造と進化:オンウェー25年の軌跡から概観する日本のアウトドアファニチャー」泉里志 誠文堂新光社 2020

「Leisure Studies レジャー・スタディーズ」 渡辺潤編 世界思想社 2015

「スノーピーク 楽しいまま!成長を続ける経営」 山井太著 日経BP 2018

「スノーピーク「好きなことだけ! 」を仕事にする経営」山井太著 日経BP 2014

「FIELDWORK─野生と共生」山井梨沙 マガジンハウス 2020

「余暇学を学ぶ人のために」瀬沼克彰/薗田碩哉編 世界思想社 2004

「スキーリゾートの発展プロセス 日本とオーストリアの比較研究」呉羽正昭 二宮書店 2017

「スキー研究100年の軌跡と展望」日本スキー学会編 道和書院 2021

「新しい家族旅行としてのオートキャンプ―日本におけるオートキャンプ・ブームの発生要因について」長谷川教佐 麗澤大学紀要 100 55 – 62 2017

「2nd アウトドアファッション大全。」Vol.161 枻出版社 2020

Internal document “Track Judgment and Opportunity Challenge of Outdoor Industry”, April 2022

Expert Interview with Mr. T Former Executive Director of the headquarters of Descente Japan, March 2022

Expert Interview with Mr. W, currently Deputy Brand Director of Goldwin Group, October 2021