The discount retail industry has always been a closely monitored investment theme for GenBridge Capital. During economic downturns, consumers tend to prioritize cost-effectiveness. Both in the United States and Japan, outstanding discount store brands emerge whenever there is a shift in economic conditions. However, amidst the fluctuations of the economic cycle, which discount players can stand firm, and what are their core capabilities?

Among our portfolios are exceptional hard discount companies such as “Busy for You” and “Duoletun.” In the highly developed online consumer market of China, we unanimously believe that innovation in the food category is the breakthrough point for the growth of Chinese discount stores.

In this edition of “Consumption Champions Throughout the Cycle,” we aim to introduce the Japanese discount retail group Kobe Bussan and its discount store brand Gyomu Super. We selected them for two reasons:

Firstly, Kobe Bussan pioneered the hard discount model with a differentiated selection of products. The company initiated the growth momentum with the frozen food category and, in conjunction with high-margin imported food products, enhanced consumers’ shopping freshness, achieving a “Low Price But Unique” supply.

Secondly, the company’s supply chain coordination capability enables it to overcome cost fluctuations. During the decline of the Japanese manufacturing industry, Kobe Bussan sequentially acquired multiple food factories, skillfully utilizing self-owned production capacity to introduce differentiated products. This allows the company to effectively mitigate the pressure of rising raw material costs in the environment of changing costs across various categories, achieving Everyday Low Price (EDLP) operations.

Hard Discount Champion: Kobe Bussan

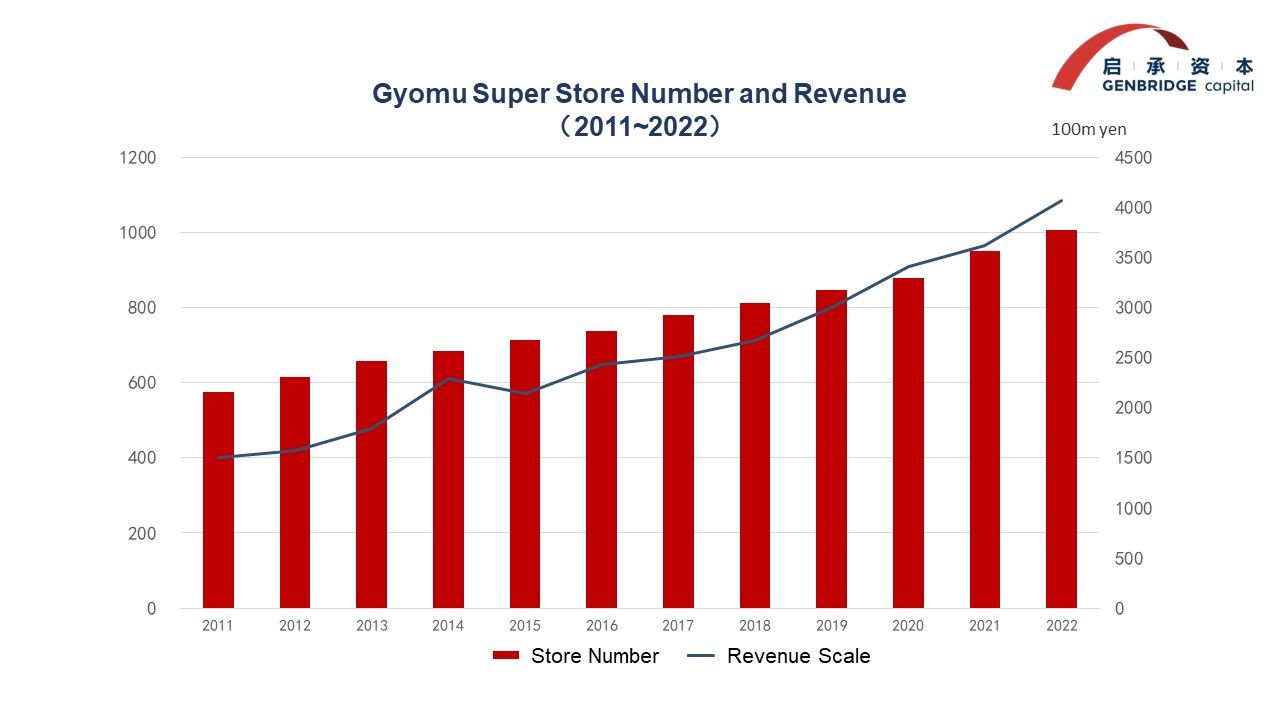

Kobe Bussan was established in 1981, and subsequently, in the year 2000, it established its discount store brand Gyomu Super. The company went public on the Osaka Stock Exchange in 2006. As of 2022, the company’s revenue is approximately CNY 20.5 billion, with a net profit of CNY 1.05 billion. It stands out as one of the fastest-growing retail enterprises in Japan in recent years.

Presently, Kobe Bussan operates 1,023 franchise stores, with a market capitalization of CNY 50.3 billion. Since 2013, the company’s market capitalization has surged approximately 50 times. An average Kobe Bussan store achieves an annual sales revenue of around CNY 25 million, with an average floor area of 450 square meters, and a monthly sales per square meter of approximately CNY 4,600.

Kobe Bussan’s corporate philosophy is encapsulated as “Professional Prices, Professional Quality,” a distilled essence of the company’s business values. The name “Gyomu Super” originally included the Japanese term “Gyomu”, which translated as “business” in English, as the company initially aimed to supply wholesale bulk ingredients to B2B businesses such as small restaurants. However, the high cost-effectiveness of Gyomu Super gradually attracted ordinary consumers, as they perceived the channel used by restaurants for procurement to offer both competitive prices and quality. Consequently, the company added “Welcome, ordinary consumers” above the entrance, and now, over 90% of Gyomu Suepr’s customers are ordinary consumers.

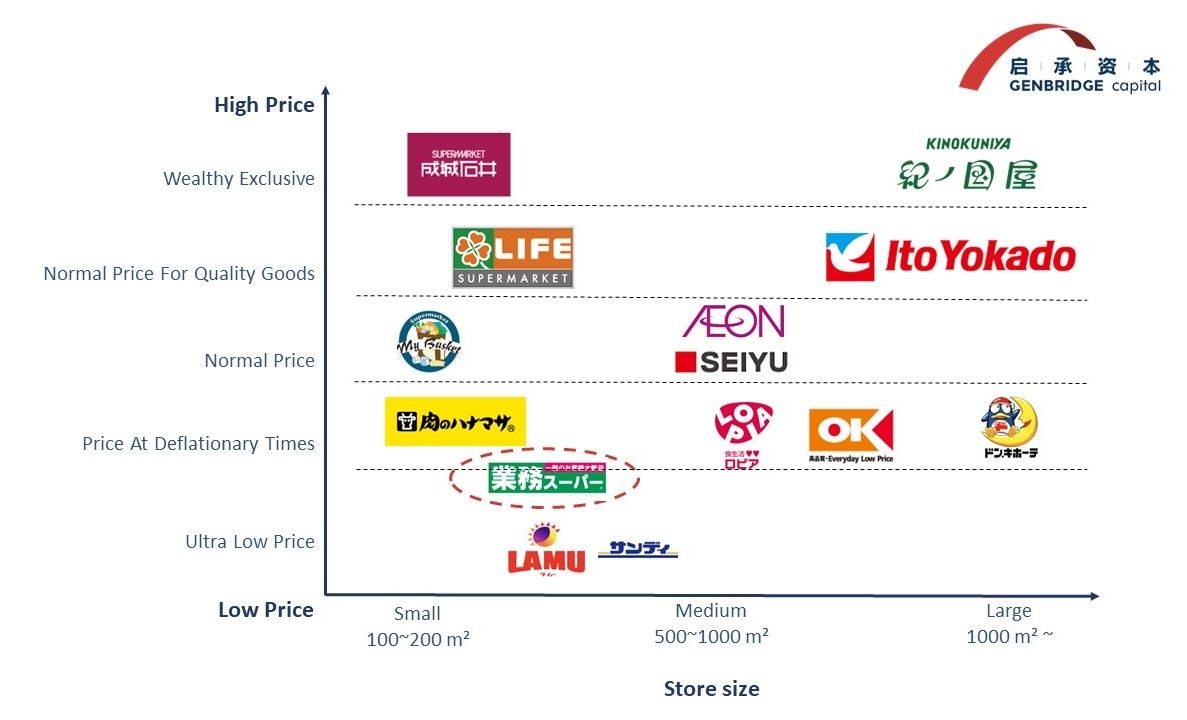

How “professional” are the prices? Gyomu Super is a product of Japan’s economic deflation, with prices in the low-price range and products typically packaged in 1-kilogram or 1-liter sizes. Kobe Bussan offers products at approximately half the price of mid-range supermarkets catering to the middle class, such as Ito-Yokado and LIFE. In comparison to newer generation discount supermarkets like Lopia and OK, prices are also 10% to 20% cheaper. For example, 1 kilogram of wheat flour costs only 156 yen, approximately half the price of LIFE supermarket. Similarly, 1 liter of soy sauce is priced at only 150 yen, only one-third of Ito-Yokado.

Behind the support for low prices is an efficient business model. Data from the fiscal year 2022 indicates Kobe Bussan’s gross profit is only 11.45%, operating expenses are a mere 4.6%, yet the company achieves a net profit of 5.12%. The inventory turnover cycle is a mere 16 days, a figure that includes the time spent in production at its food factories.

In comparison, the directly operated model of Don Quijote has a gross profit of 29.7%, but operating costs are as high as 24.8%. The final net profit is 3.4%, and the inventory turnover period is approximately 50 days. Both companies follow the discount store model, but their efficiencies are entirely different.

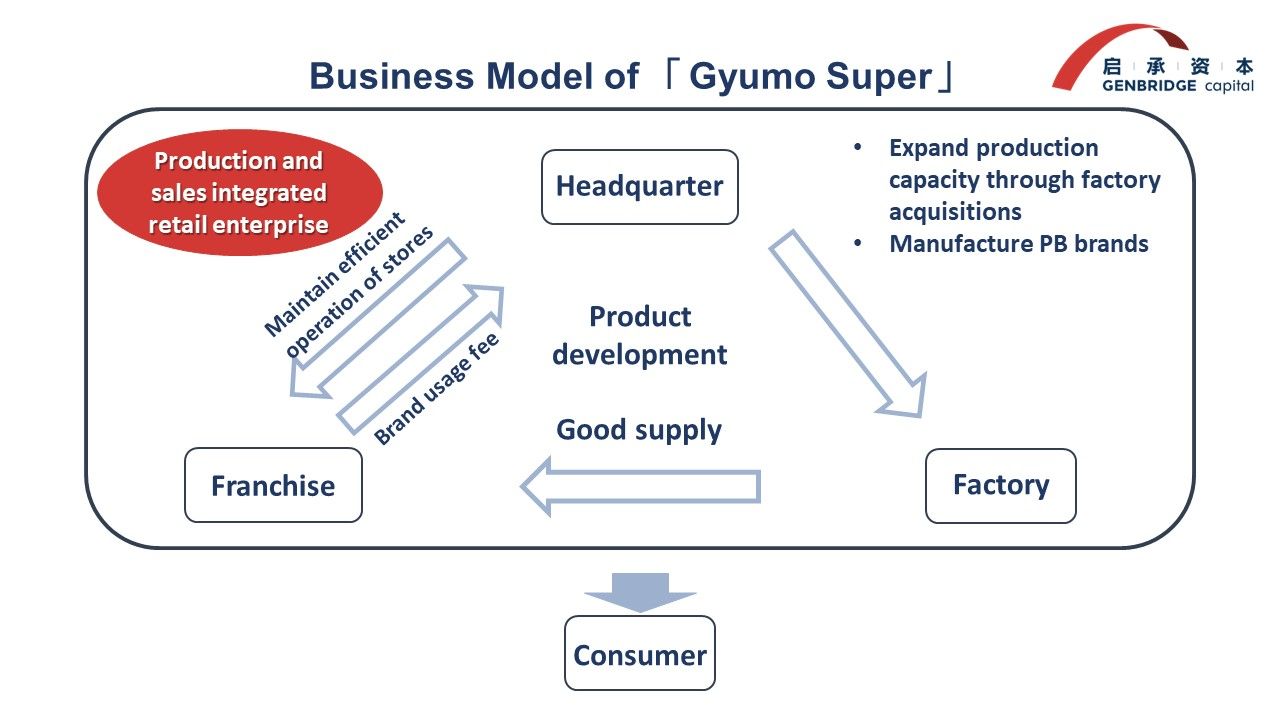

Model: Integrated Retail Channel with Production and Sales

Kobe Bussan defines itself as Japan’s largest integrated retail channel with production and sales. Integrated production and sales, commonly seen in the non-food sector, gave rise to Specialty retailer of Private label Apparel (SPA) such as Uniqlo and Nitori in the 1990s during the era of economic globalization. However, achieving the SPA model in the food and restaurant industry is not easy. It requires not only managing product freshness but also maintaining a significant scale to leverage the price advantages of large-scale production. Japanese Italian restaurant chain Saria and Kobe Bussan have successfully implemented this business model in the restaurant and food supermarket industries, respectively.

The integrated production and sales model originated from the founder’s early struggles in entrepreneurship. Kobe Bussan’s founder, Shoji Numata, initially worked at Mitsukoshi department store and later ventured out on his own. In 1981, he opened the first supermarket in a small town, but as major supermarket chains expanded, his small supermarket lost its price competitiveness, making it challenging to sustain competition with the giants.

The turning point came in the 1990s. With the opening up of China, Kobe Bussan established its own food manufacturing factory in Dalian, providing OEM services to European and American food retailers. Through dealing with top retail companies in Europe and the U.S., Shoji Numata discovered that overseas channels could provide brands with methodologies to enhance production efficiency, exchanging experience for lower factory shipment prices. This created a mutually beneficial relationship and a deeper level of collaboration between channels and brands.

Shoji Numata believed that a close tie with upstream factories could effectively reduce retail prices at the terminal. Following this idea, in 2000, the company tentatively opened Business Supermarket. Current CEO Hirokazu Numata reflects, “Back then, competing in a marathon with top companies was undoubtedly futile and will only widen the gap. We needed the courage to take a different path for differentiation.”

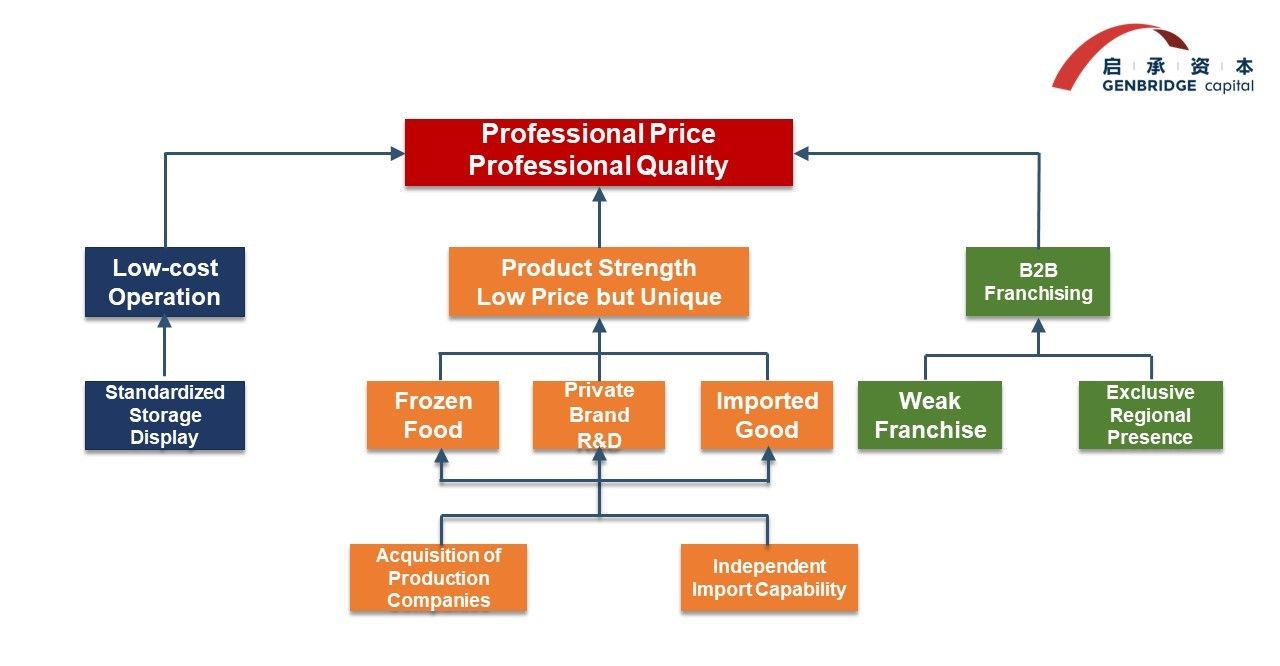

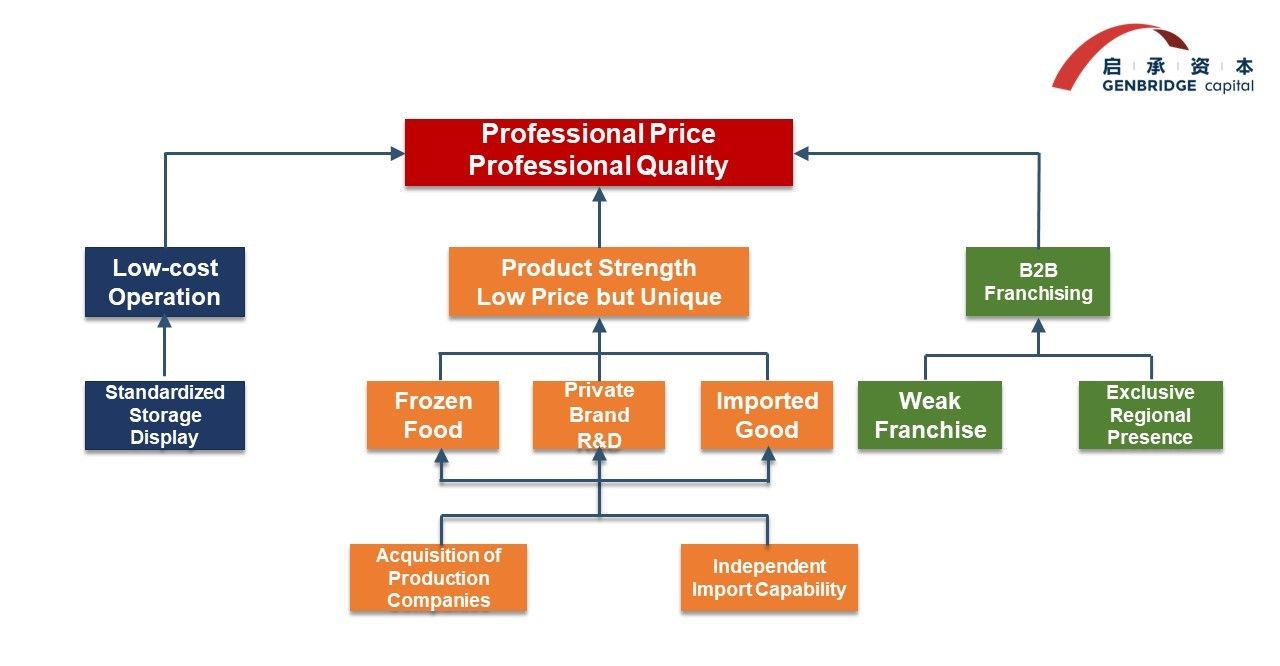

The characteristics of Kobe Bussan, “Professional Prices, Professional Quality”, are broken down into three categories: Unique product strength, efficient operational capability, and weak franchise system.

Product: Low Price But Unique

Products of Gyomu Super are defined by “Low Price But Unique” and primarily consist of three categories:

1. Frozen Foods

2. Private Brand (Own Brand)

3. Imported Foods

Gyomu Super operates a total of 5,590 SKUs, with frozen foods accounting for 50%, shelf-stable foods for 30%, and refrigerated foods for 20%. Frozen foods are considered a strategic category for the channel due to its relative independence from physical space constraints, facilitating large-scale production and lower prices. The frozen foods mainly include 500g and 1kg bulk packaging, featuring lightly processed foods such as chicken, beef, vegetables, and fruits. For example, 1kg of chicken wings is priced at approximately 640 yen or 32 Chinese yuan.

This product combination targets an often overlooked demographic: low to middle-income households with multiple members. As the number of single individuals increases and households become smaller in size, the packaging of pre-made frozen foods in Japan has gradually become smaller and more prefabricated. However, these innovations have also increased product prices, making it challenging to meet the needs of many low to middle-income, larger households who have a stronger demand for convenience.

Private brand product

Premade potato salad 399 yen per kilo

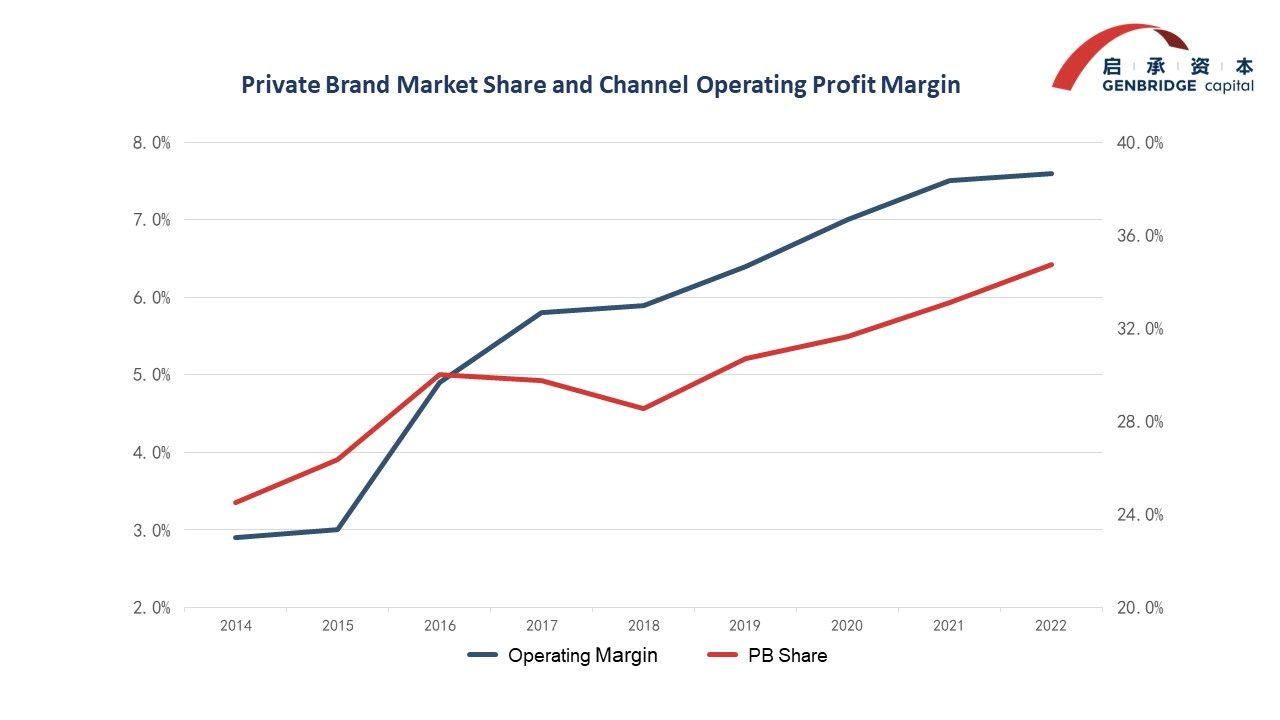

Most of these frozen food items are part of Gyomu Super’s private brand, sourced not through OEM but primarily from food factories acquired by Kobe Bussan. Kobe Bussan currently owns 25 private food factories producing 370 SKUs, accounting for 11% of the total revenue.

In the ever-changing competitive landscape, frozen foods can easily become entangled in price wars. However, consumers not only seek affordability but also crave freshness through channel-specific (unique) products. To address this, Kobe Bussan introduced food sourced directly from overseas through its trading company, bypassing import distributors. The supermarket actively seeks products from foreign brands, imports them to Japan, and sells them at lower prices. Gyomu Super has a turnover speed far higher than that of import food supermarkets, avoiding unsold inventory due to the expiration of imported food, which accounts for 24% of the total revenue.

The success of the imported food business is credited to Kobe Bussan’s second president, Hirokazu Numata. He once stated, “Every time I go to food exhibitions overseas, it feels exceptionally fresh. I hope to bring that sense of happiness to Japanese consumers.” Since his tenure, Kobe Bussan continuously introduces new products, increasing the proportion of imported foods.

The formation of a vertical supply chain has granted the company the ability to achieve low prices, while the combination of imported products has made it a unique channel. Even in deflationary times, consumers, while seeking affordability, also wish to improve their quality of life. Imported new products, coupled with media exposure, often become popular topics, making them more attractive to consumers. Examples include frozen macarons, waffles, milk tea, cream pies, among others.

Following the “Low Price But Unique” philosophy, the company successively launched popular desserts such as cheesecake in tofu packaging and one-liter containers of yokan (sweet red bean jelly). These products have become table desserts for many households, giving rise to a unique way of enjoying Kobe Bussan products—such as combining their own-brand bread with custard pudding to create French toast.

As the proportion of own-brand products continues to rise, Kobe Bussan’s profit margin has significantly increased. Emphasizing the importance of product development within the framework of the EDLP model, founder Shoji Numata once highlighted, “Since Gyomu Super follows the EDLP policy, offering the same low prices every day, if some specific products do not sell, the store’s sales will correspondingly decline. There is no advertising, no daily specials— we have nothing. We simply hope customers make a purchase, are satisfied, and return for more.”

Supply Chain: Robust Growth Despite a Decline

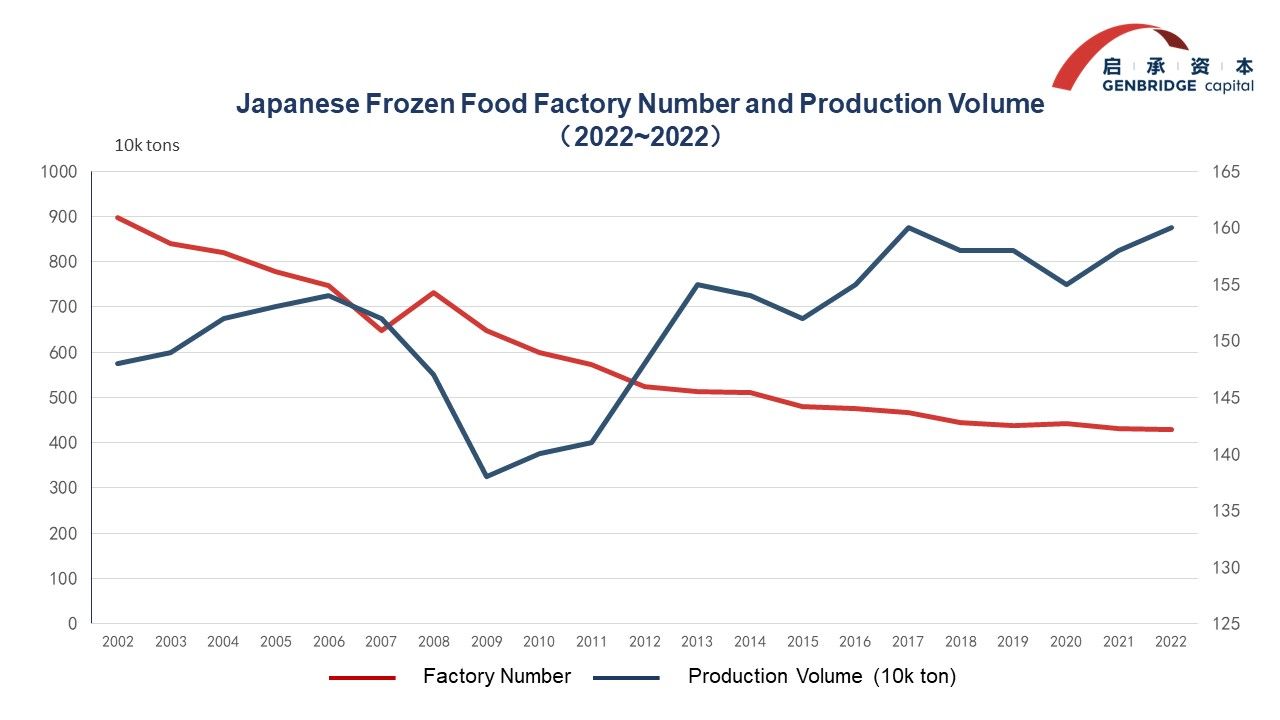

Kobe Bussan’s product advantage lies in its core capability of product iteration driven by a self-sustained supply chain. Starting from the Lehman Brothers crisis in 2008, Kobe Bussan started a series of acquisitions, obtaining nearly 25 food production manufacturers. The main targets of these acquisitions were companies capable of producing high-frequency consumption foods like bread and eggs, those producing differentiated products, or those with factories covering new consumer markets.

One of Kobe Bussan’s notable best-selling products is the large bowl of beef curry (55 yen/250g) from its subsidiary, Miyagi Seifun Co., Ltd, which, before being acquired by Kobe Bussan, experienced a surge in sales of Taiwan dessert soy milk flower in 2006 but faced bankruptcy in 2009 due to fluctuation in the fashion-attributed dessert industry. Kobe Bussan’s acquisition saved jobs and led to a threefold increase in the company’s revenue.

The supply chain capability not only brings about low prices but also allows flexible adjustment of product formulations, enhancing dynamic risk resistance. For example, during the Russia-Ukraine war, the price of rapeseed oil rose by 250%, potentially causing the company billions of yen in profit annually. To avoid directly passing on the cost increase to consumers, Kobe Bussan re-adjusted the formulas, reducing the amount of rapeseed oil by 20% in products, supplementing lost flavors with seasoning, and re-adjusting the emulsification process. The products retained their original taste at a reduced cost of 5%. Meanwhile, during the same period, prices for leading brands like Q.B. increased by 20%.

The supply chain’s capability is also reflected in the ability to improve products through optimization of production equipment and processes. For example, in Japan, the shelf life of most refrigerated udon noodles is one week, and many consumers complained about the short time window. Kobe Bussan successfully extended the shelf life of this high-frequency consumption product from one week to three weeks through adjustments in flour formulas and sterilization treatment before packaging, turning it into a core best-selling product.

Kobe Bussan seized the dividend of societal structural changes amid a recession and established its own supply chain capabilities. During Japan’s lost three decades, with the push for an aging and shrinking population, the societal “appetite” continually decreased. Small and medium-sized food enterprises bore the brunt. Taking the frozen food industry as an example, there were nearly 900 frozen food factories in Japan in 2002, but now, the number has decreased to 427. Kobe Bussan capitalized on the opportunity presented by structural changes in the entire industry.

In traditional retail logic, the retailer’s job is product selection. However, in a retail model focused on private brands, the value of the channel is created through collaboration with upstream partners to produce advantageous products. In reality, each private brand SKU may face competition from brands in the same category. Managing hundreds of private brand products can easily surpass the channel’s management and cognitive radius. Therefore, Kobe Bussan views acquired companies as alliance partners. After acquisition, the company does not dispatch executives for management, respects the autonomy of the acquired companies and retains their original trademarks and logos, turning external forces into internal strengths, therefore broadening the capability of product control and development for the enterprise.

Operation: Fully Utilizing Operational Leverage

Whether through franchising or direct operations, the efficiency is presented to consumers in terms of pricing. Each Kobe Bussan store has dozens of open freezers for consumers to directly access. The size of each section in the freezers is consistent with the packaging sizes of products, with each compartment perfectly fitting a box of goods. In addition, each freezer has individual shelves above, increasing the store’s display volume and providing choices for other ambient temperature food products.

Kobe Bussan can be seen as a “weak franchise” company, with profits mainly coming from wholesale of its private brand products. Store operations are delegated to experienced local B2B businesses, with an average of 10 stores managed by each franchisee. Kobe Bussan earns only 1% of revenue from the procurement of private brand products and franchisees. For brand-name products where consumers are price-sensitive, Kobe Bussan adds only a 2% fee to ensure franchisees can achieve the lowest retail prices in their business districts.

Kobe Bussan has two franchise models, A and B. Model A franchisees directly manage their region stores, and goods are directly distributed by the headquarters with transportation costs borne by the headquarters. Franchisees can actively open stores in these regions. Model B franchisees mainly operate in areas where the headquarters’ logistics cannot cover, and distribution costs are borne by local franchisees. However, local franchisees can obtain exclusive agency rights, and franchise fees are paid based on the percentage of the population in their business districts.

Franchisees chosen by Kobe Bussan share a common characteristic: they have business capabilities but lack good business targets. Many franchisees are liquor wholesalers who, with the decline in alcohol consumption in Japan, have gradually scaled down their operations. These wholesalers not only have regional resources but also control a considerable stable workforce. They need an investable business format to maintain their teams and businesses.

To ensure each store in its respective region gains a competitive advantage, Kobe Bussan allows franchisees to locally source fresh and meat products, high-frequency consumption categories that are likely to attract customers, in addition to purchasing from the headquarters, and can set their own prices for these products. This way, Kobe Bussan not only encourages franchisees to participate in competition but also avoids the cost risk associated with fresh product losses.

We believe that Kobe Bussan is a commodity producer with a standardized retail operating system. The high efficiency of the stores cuts operational costs, and optimizes the overall costs. The weak franchise model allows Kobe Bussan to better leverage social operational resources, further utilizing its competitive advantages in product development and supply chain management at the headquarters.

Challenges and Prospects of Hard Discount Model

Now back to the question at the beginning, amidst the fluctuations of the economic cycle, what are the core capabilities of discount players that can stand firm?

We believe in the hard discount business format based on EDLP, product strength and supply chain are vital. Kobe Bussan realized the dual growth of revenue and profit through its twin production selection of refrigirated foods and imported foods. The continuous iteration of products achieved through the self-owned supply chain at the core of the business has allowed the channel to create value for consumers, namely “Low Price But Unique”.

In line with the perspective shared by GenBridge’s Co-founder and partner, Victor Zhang, we believe that realizing a “harmonious dance between the supply chain and the channel” in retail is the greatest opportunity for the future. The front-end channels develop new products based on insights into user behavior, while the back-end supply chain continuously improves efficiency and product quality. The case of Kobe Bussan is highly comparable to the practices of GenBridge’s portfolios in China. We hope that more industry brands can draw inspiration from their paths to better establish themselves in China.

References

1. Annual Financial Reports

2014、2015、2016、2017、2018、2019、2020、2021、2022

2. Instutional Research Reports

Fisco Report: 2015、2016、2017、2018、2019、2020、2021、2022

3. Book

森本守人《業務スーパーの競争しない経営》ダイヤモンド社 ,2022

4. Video

テレビ東京《デカ盛り・激安だけじゃない!圧倒的差別化で再ブレークした業務スーパーの秘密》,11/12/2020日テレビ東京《独占!業務スーパーの舞台裏~値上げとの戦い~》,9/9/2022

5. GenBridge Internal Researches

Author: Tojiro Kataya, Senior Researcher of GenBridge Capital