- GenBridge Capital: Empowering the Next Generation of Consumer Champions

- Starting Point of Consumer Recovery: Entering a New Consumer Cycle

- Innovating Around Quality and Efficiency Offers the Opportunity to Create the Next Hundred Billion Company

- The "Slow Start, Fast Later" Offline Model Will Hatch Marathon Champions

After experiencing significant fluctuations in the consumer market over the past three years, we are entering a new phase of consumer entrepreneurship and investment. At this juncture of a budding rebound, Robert Chang, Founder & Managing Partner of GenBridge was invited to give a speech on the “Road to Longevity • Third Annual New Wave Brand Conference” to discuss the core barriers of future high-value consumer companies, the long-term opportunities of offline models, and the evolution of consumer investment capabilities.

In this new phase, GenBridge will continue to seek significant investment opportunities in mass and essential markets, with a foundation based on the two fundamental dimensions of “quality” and “efficiency”. We believe that innovating based on quality and efficiency has the potential to recreate consumer companies worth hundreds of billions.

The offline business model, which starts slow and then accelerates, will also produce a new batch of champion companies. It is highly likely that China will hatch 10-20 chains with thousands of stores each, giving rise to a new generation of marathon champions.

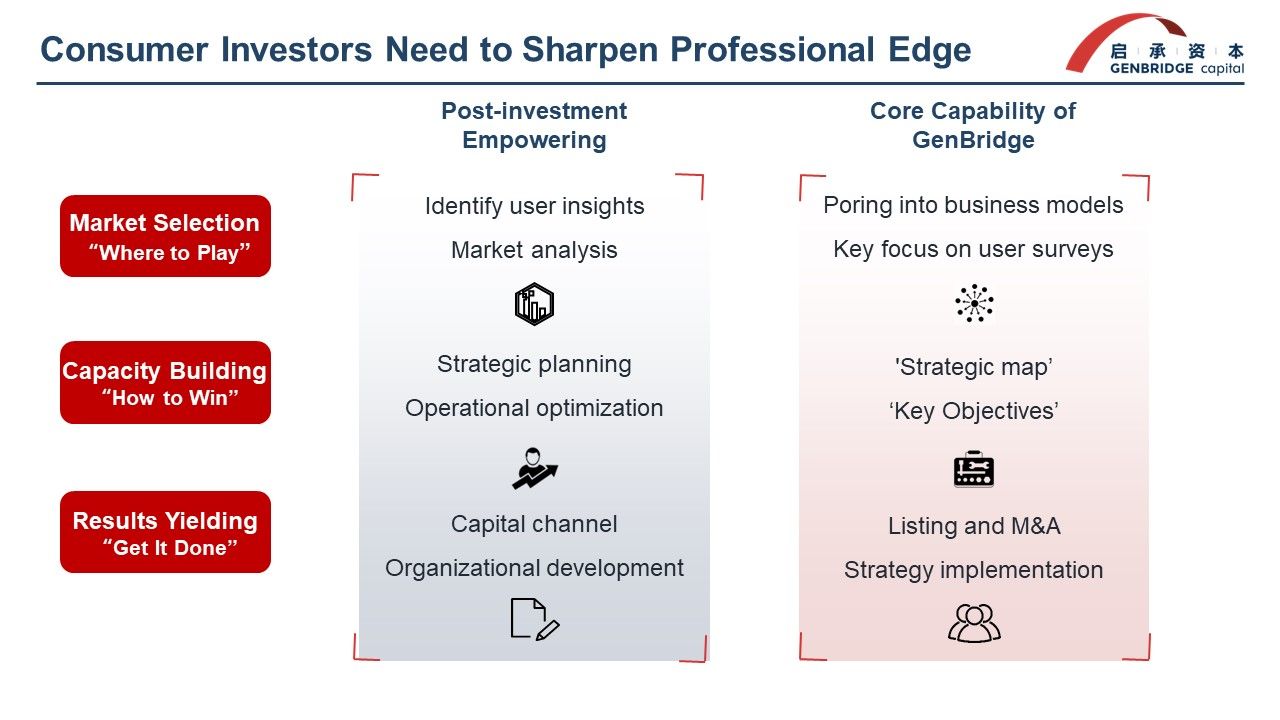

Consumer investment has returned to rationality and caution. As professional investors, Genbridge is continuously enhancing its capabilities to truly empower businesses.

Complete Speech Content:

GenBridge Capital: Empowering the Next Generation of Consumer Champions

It’s a pleasure to be here after such a long time. Over the past two years, the consumer industry has faced many challenges, but we are finally welcoming a new era of growth.

Today’s theme is “Road to Longevity”. GenBridge Capital, as a fund specializing in consumer investment, also wants to take this opportunity to engage in a deep discussion. “Pursuing longevity” is a long-term and ambitious goal that requires us to correctly understand the current consumer market, entrepreneurship, and investment rhythms. Hence, my speech today is titled “Entering a New Phase of Consumer Entrepreneurship and Investment.”

Firstly, a brief introduction. GenBridge Capital, founded in 2016, focuses on investing in growth-stage companies in the consumer sector, assisting them in becoming the next generation of Chinese consumer champions. Over the past seven years, we have invested over 4 billion in more than 20 companies, focusing on two major patterns in the consumer sector: branding and retail. We are excited about the prospect of investing in the next generation of national brands and nationwide chains.

Starting Point of Consumer Recovery: Entering a New Consumer Cycle

As an investor entirely dedicated to the consumer sector, I am deeply concerned about the market trends and the overall cycle.

In the past three years, market fluctuations posed significant challenges, especially in the latter half of last year.

Therefore, GenBridge adopts a cyclical perspective to view the market. Here’s a viewpoint: we have now reached the starting point of consumer recovery, and the entire market is entering a new cycle.

Before discussing the new cycle, let’s review the previous ones:

1. Boom: 2020-2021 H1

The first boom cycle was roughly from 2020 to the first half of 2021.

Despite the challenges posed by the pandemic, it propelled the online transformation of brands and retail: online super-consumption platforms provided a new growth engine for the entire industry. Whether it was live streaming, short videos, or community group buying, these new businesses provided significant boosts.

The capital market recognized this with substantial appreciation. For instance, the market value of Haidilao soared to hundreds of billions. For consumers, numerous brands continuously catered to new demographics, and consumers were eager to try these new products.

2. Challenges: 2021 H2-2022

The good times reversed around mid-2021, and for the next one and a half years, consumer trends gradually cooled. The pandemic began affecting the fundamentals of many consumer companies.

If the previous focus was on growth, many companies shifted their priorities to preserving cash flow and preparing for challenging times. Survival became paramount.

Accompanying this was a near-freeze in investment across primary and secondary markets.

3. Rebound: 2023—!

Starting this year, from the bustling Spring Festival to the May Day holiday, consumption has been gradually recovering, confirming that we are in a rebound phase.

But will the new cycle resemble the previous one? There are significant differences:

Firstly, reflecting on the previous cycles, a notable change is in consumer purchasing power and willingness.

During the last boom, platforms boosted a new wave of entrepreneurship and resonated with consumer enthusiasm. Even during this year’s May Day holiday, foot traffic returned to 120% of 2019 levels, but revenue was only at 100%.

Many offline entrepreneurs now note that while foot traffic has returned, purchasing power hasn’t fully recovered. Why? After a cycle, it takes time for consumer purchasing power and willingness to recover.

Secondly, the anticipated synergy between businesses and the capital market might also take time. The capital market is waiting for new benchmarks, and this year, GenBridge anticipates three companies from its portfolio to potentially go public.

Innovating Around Quality and Efficiency Offers the Opportunity to Create the Next Hundred Billion Company

1. Two Core Dimensions for Future Consumer Investments: Quality and Efficiency

We will discuss the consumer companies we are closely watching for the future. Compared to previous years, the entrepreneurial approach in recent years differs significantly from the previous one.

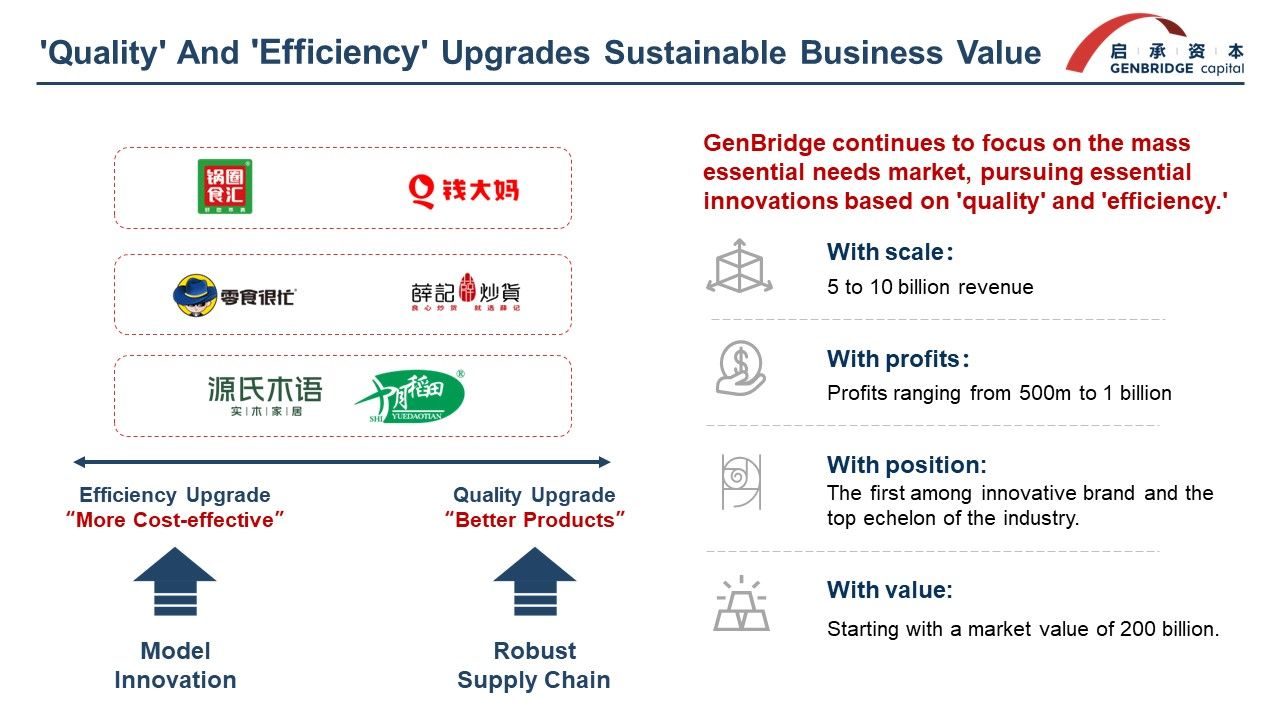

GenBridge continues to seek significant investment opportunities in the mass and essential markets, primarily focusing on the fundamental dimensions of “quality” and “efficiency.”

In this new cycle, companies centered around these two dimensions might be more robust than those based purely on products, demands, or insights.

To put it in consumer terms: “I need better quality, but I also need higher cost-effectiveness.” While these two terms can be a “either, or” situation, realizing both could be more appealing.

In the previous cycle, many high-quality products were introduced, such as ice creams priced between ten to twenty yuan or beverages priced at five or six yuan. Yet there were challenges.

For instance, setting prices too high might limit market size, or establishing a suitable business model could be challenging. Similarly, relying too much on white-label or generic products might be a sustainable choice.

For entrepreneurs aiming for quality innovation, strengthening the supply chain is crucial. If aiming for efficiency innovation, building a sustainable competitive advantage in business models is even more important.

2. Innovating Based on Quality and Efficiency Can Lead to the Birth of New Hundred Billion Companies

Next, I will dig deeper with some cases from GenBridge portfolios.

Start with nationwide chains. Over the past year, many people have been dining at home, and two companies are noteworthy:

The first is Qiandama. They introduced the “100% sold daily” model, ensuring that urban consumers can access fresh and convenient products. Currently, they have over 3,000 stores in Southeast China.

The second is Guoquan. They brought high-quality hotpot and barbecue ingredients to vast lower-tier markets. These frozen foods represent a quality upgrade for locals while remaining cost-effective. In just three years, they expanded from 1,000 stores to 10,000 stores, with the potential to reach 20-30,000 in the future.

Additionally, last year GenBridge also focused on the snack sector, both in upgrading quality in high-tier cities and providing higher value in lower-tier markets.

One such company is Xueji. They use better-quality sunflower seeds, chestnuts, and innovative snacks, moving from street-side stalls to shopping centers, offering a “try before you buy” shopping experience, therefore fueling rapid growth.

Another is Busy for You. Starting in Changsha, they sell over 1,000 types of snacks at community convenience stores at supermarket discounts. This year, they are expected to expand to 2,000 stores in Hunan, with sales exceeding tens of billions.

Our investment logic remains similar when it come to brand companies, such as our portfolios Harvest(Shiyuedaotian) and Yeswood.

Many consumers speak highly of Harvest because they use high-quality long-grain fragrant rice from the Northeast. Coupled with a faster e-commerce fulfillment model, both their products and business are satisfying.

Similarly, many appreciate the aesthetics and value of Yeswood products. Their furniture uses upgraded solid wood, and their online services reduce markups, offering consumers perceivable value.

From these practical examples, we firmly believe that in core large categories, innovating based on quality and efficiency can yield significant long-term value:

Firstly, achieving scale is crucial. The companies we invest in are already achieving or are on track to achieve 5-10 billion in revenue.

Secondly, identifying the value of a business model. The goal is to generate 500 million to 1 billion in profits. Consumer entrepreneurship should focus not only on revenue but also on profitability.

Thirdly, securing the position. In innovative brands and categories, aspiring to be the best is essential. Even competing with industry leaders, aiming for the top tier is essential.

Lastly, while the capital market might not be fully recovered now, starting with a market valuation of 10-20 billion offers the opportunity to build a hundred billion company.

The "Slow Start, Fast Later" Offline Model Will Hatch Marathon Champions

1. To Become the Next National Brand, One Must Venture Offline

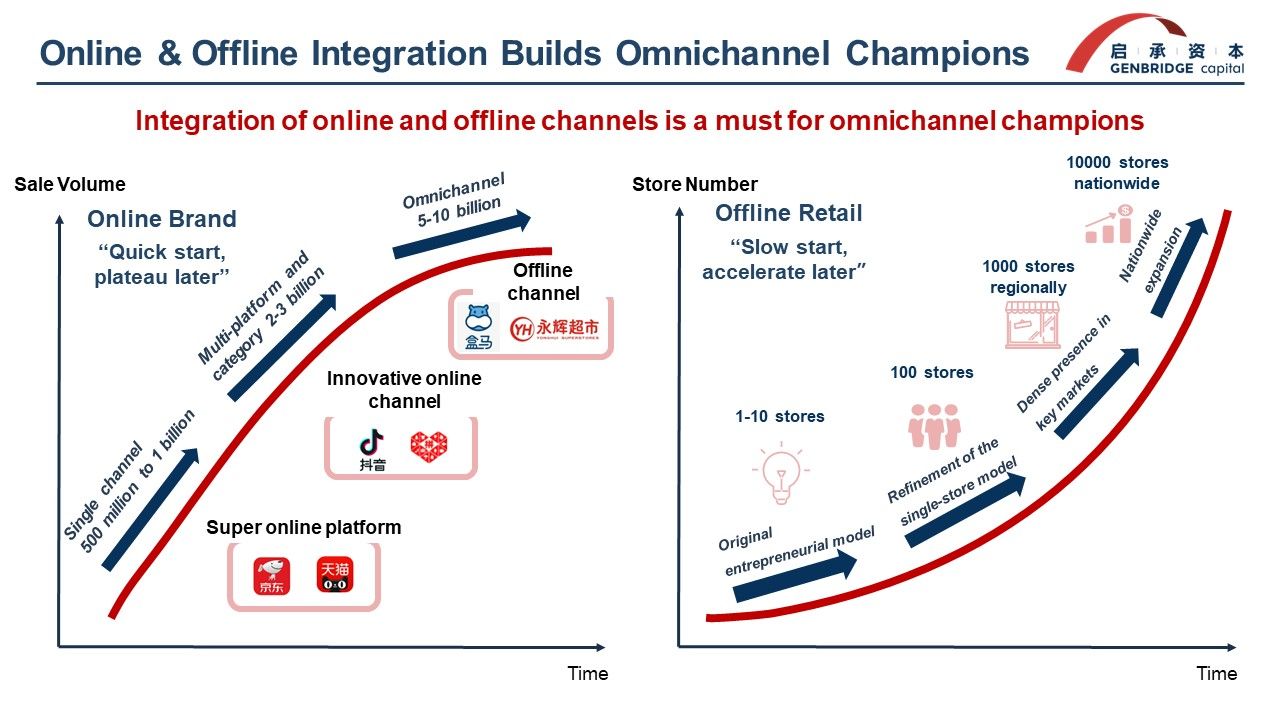

Lastly, I want to emphasize offline strategies. The integration of online and offline has been discussed for years, but in the new cycle, it will become a must for champion companies.

Previously, many brands focused on online because of its efficiency. Platforms like JD, Tmall, Tiktok, and Pinduoduo could generate 500 million to 10 billion in revenue in just one channel. By leveraging multiple channels, some even reached 40-50 billion.

However, to become a new national brand, offline presence is essential. Our estimates suggest that if one can achieve 100 million online, they can potentially achieve 200-500 offline. Hence, only by omnichannel presence can a company have the opportunity to become a hundred-billion brand.

In recent years, it has become evident that offline can create more scalable and robust consumer business models.

Previously, people thought community group buying online was rapid. However, the emergence of thousands or tens of thousands of offline stores will become a more familiar commercial form. In the next five years, China might produce 10-20 chains with tens of thousands of stores.

The trajectory for these companies might differ from online businesses. Online businesses might experience rapid growth initially but plateau later. In contrast, establish 1 or ten offline businesses might take years, and even longer to expand to 100 or 1000..

How long it took Mi Xue to expand to 1000 or 10000 stores is still a vague number, but it took only two years to expand 10,000 to nearly 30,000 stores.

Thus, the “slow start, fast later” business model offline can create a new batch of champion companies. Companies overlooked from an online perspective might be the future marathon champions.

2. No One Can Build the Best Company in the Most Challenging Times

In the upcoming cycle, entrepreneurial approaches must evolve. As investors, we also need introspection to elevate our investment capabilities.

Many LPs and investors have remarked that consumer investments seem to have declined significantly, perhaps by 80% compared to the previous boom.

Why the decline? Is it because the consumer business is shrinking? No, the consumer industry remains resilient and vibrant.

The decline can be attributed to the previous wave of consumer investors, most of whom just follow the trend.

The first type transitioned from early-stage venture capital, aiming to invest in younger companies. However, as they realized the barriers to building new brands were relatively low and success rates weren’t as high, they opted out.

The second type favored late-stage investments, hoping to profit from mature consumer companies going public. With policy changes favoring A-shares, many consumer companies chose HKSE as their primary exit route. However, HKSE valuations for consumer companies are often conservative, requiring companies to prove themselves over longer periods. Consequently, such investments have dwindled.

Now, the investors and entrepreneurs that stayed in the game must have a long-term belief in the consumer sector. This is an opportune time for consumer entrepreneurship and investment because only the most dedicated remain.

In conclusion, great companies emerge during challenging or lukewarm times. No one can build the best company during the most challenging periods. In such situations, the remaining investors must elevate their expertise.

Traditional investors preferred grand narratives, like “this is a massive arena where global giants emerged, and China is about to produce the next champion.”

This is what we call “Where To Play” – investing in promising markets, sectors, and companies. But does a good market always birth new companies? Does a great product always lead to a big company?

Could it be that it is precisely because a market is challenging that the companies that emerge from it are of superior quality?

Therefore, whether one is an entrepreneur or an investor, merely employing the aforementioned mindset when considering investments might lead one to exit prematurely when faced with challenges.

To what extent, then, should one be prepared? If you are an entrepreneur, it’s crucial to understand the capabilities required to realize your vision.

Investors, too, must possess this discernment. An investor once asked me, “Why would you choose to invest in traditional Chinese roasted snacks like rice and sunflower seeds instead of the trendy Chinese baked goods?”

The crux of the matter lies in understanding “How To Win.” Why is one business superior to another? Why is one founder’s approach more effective than another’s? Only with accurate insights can one invest in genuinely valuable enterprises.

At GenBridge Capital, we are committed to leveraging our expertise, and this journey is ongoing. Entrepreneurs increasingly seek partners who provide capital, but more importantly, partners that understand and support their long-term vision.

As consumer specialist, we have spent recent years honing our skills to genuinely empower businesses:

Firstly, select the right market. Those familiar with GenBridge will recognize our unparalleled depth of research and insights into various business models. Our firsthand information on business models from Japan, the U.S., and user research within specific Chinese industries positions us at the forefront of the market.

Secondly, capacity building. Drawing from my experience at JD.com, I have acquired tools such as the “Strategic House” that enable us to assist many companies in crafting a growth roadmap for the next 3-5 years. At the beginning of each year, founders have clear objectives, including the “three major battles”: immediate goals, annual objectives, and three-year milestones. We engage in profound discussions with these founders to solidify their strategies.

Lastly, deliver tangible results. Many founders can envision their goals, but executing them is where real impact lies. GenBridge Capital is continuously working to enhance our strategic deployment capabilities, facilitate companies’ capital market financing and IPO processes, and bolster post-IPO merger and acquisition developments.

As we tread the path to enduring success, we find ourselves entering a new phase in consumer entrepreneurship and investment.

Compared to previous cycles of enthusiasm and disinterest, this phase presents new avenues for exploration: How can businesses create models that combine quality and efficiency in markets with limited purchasing power? How can the integration of online and offline operations be genuinely realized? How can the relationship between founders, their teams, and investors be further strengthened?

GenBridge Capital, as a specialized investment institution focusing on consumer growth stages, looks forward to discovering and supporting the next generation of consumer champions in this new phase. We are eager to continue this journey with all our partners!