In early November, we hosted our annual gathering with nearly 50 founders and executives from over 20 GenBridge portfolio companies at GenBridge’s new office in Beijing. Together, we explored opportunities in China’s consumer market, covering topics including:

- How to become industry leader in this transformative era of China’s consumer sector?

- Amid China’s retail evolving across generations, what can consumer companies seize upon?

- How can brands break through with emerging content-driven platforms?

- With growth peaking, how can we extract dividends from management?

How do consumer companies respond to change in the era of saturation?

The biggest shift in today’s market is the end of the incremental growth era and the beginning of the stock-based era. If the era of incremental growth was a sprint, then the saturation era is a knockout round.

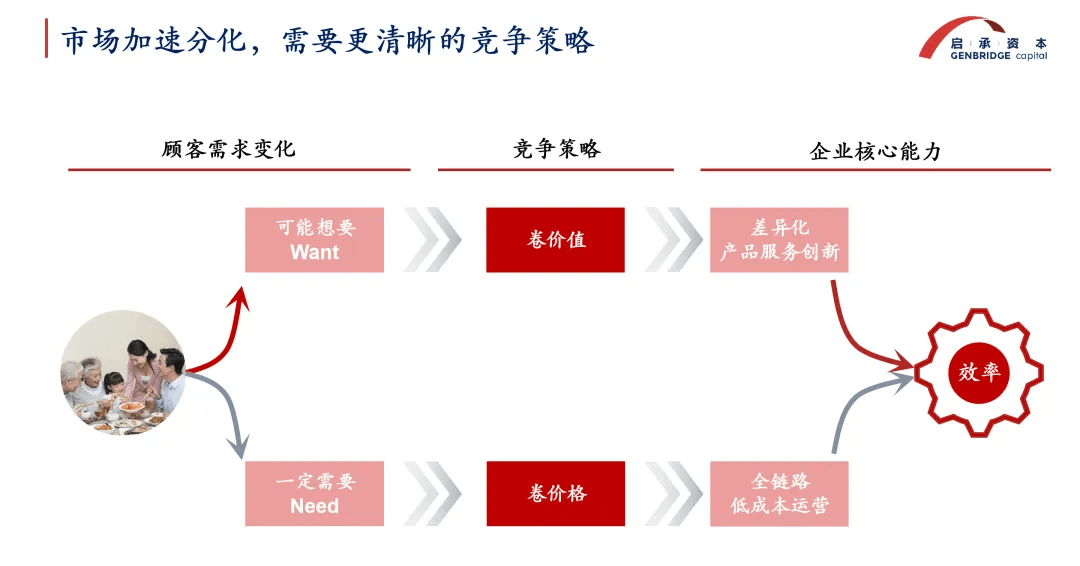

In the era of saturation, the market enters a state of intense competition—what’s commonly referred to in Chinese as being “卷” (extra-competitive). Harvard strategy guru Michael Porter once said there are only two types of competition: low cost and differentiation—either compete on price or compete on value. For staple goods, price competition prevails, but for emerging discretionary goods, only value competition can provide consumers with a reason to buy.

In the saturation era, efficiency is king. Whether competing on price or value, it's ultimately efficiency that determines success or failure.

Price-based competition demands low-cost operation across the entire value chain. Take Walmart’s EDLP (Everyday Low Price) strategy, whose true core lies in 'EDLC—Everyday Low Cost'. Value-based competition, on the other hand, requires innovation in product and service mechanisms, while minimizing trial-and-error costs in processes to maximize the success rate.

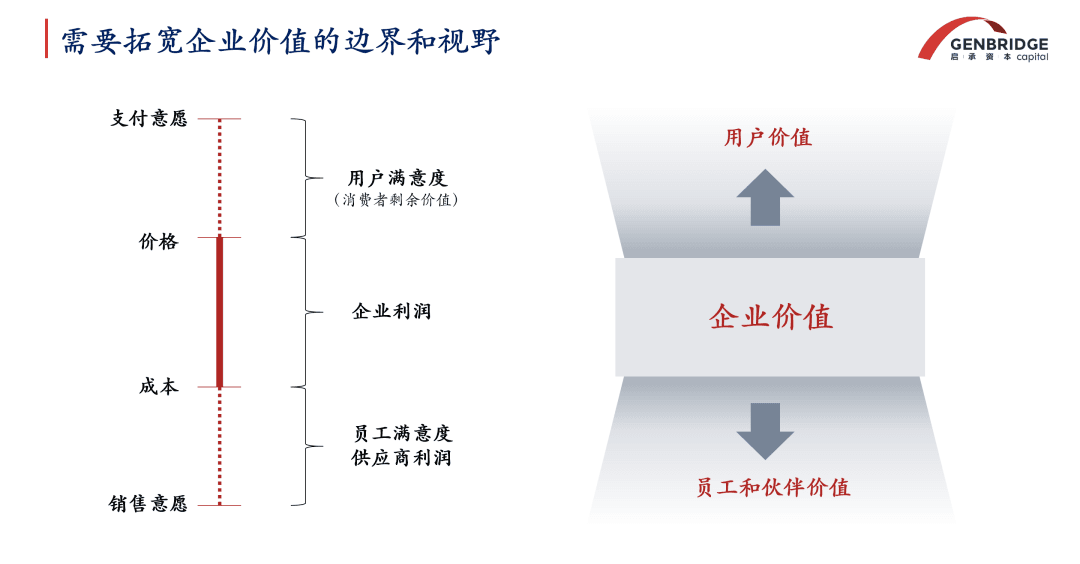

During the competition, price and value aren't necessarily in opposition. Even when pursuing cost-effectiveness, it’s still possible to enhance value. Harvard Professor Felix Oberholzer-Gee proposed the “Value Stick” model. In this model, the upper stick represents price—including the price offered to users and their willingness to pay—while the lower stick represents cost, covering employee wages, supplier expenses, and partner compensation.

In terms of user value, for example, China's tissue brand Botare drew inspiration from Hermès in its design, giving extra perceived value to tissues and maintaining its 29.9 RMB price point without ever cutting it. Similarly, 7-Eleven took an unconventional path in developing its private label by aiming for premium positioning, striving to offer restaurant-quality food at convenience store prices. After two decades, 7-Eleven's private label has become synonymous with higher quality at more affordable prices than eating out.

On the value stick of employee and partne, Trader Joe’s in the U.S. and China’s Pang Dong Lai stand out.

Trader Joe’s founder insisted on raising employee wages to match the average income of middle-class families in California. Pang Dong Lai recognized that high turnover from repeated hiring and firing leads to high life-cycle costs and difficulty in retaining top talent. In the food service sector, chains like Haidilao have in recent years adopted partnership and apprenticeship systems, turning many store employees into shareholders. Exploiting workers doesn’t lead to quality service—this is a value-creation model driven by service.

In China market, especially on e-commerce platforms, it is very difficult to build a truly differentiated brand. Therefore, the real opportunity lies in achieving the ultimate in cost-effectiveness, and then gradually elevating value from there.

Amid China’s retail evolving across generations, what can consumer companies seize upon?

The most significant aspect of generational shifts in China's retail sector is the transformation of the entire distribution order of consumer goods, from brand-led deep distribution in the past to today’s high-efficiency, retail-driven production-retail alliances.

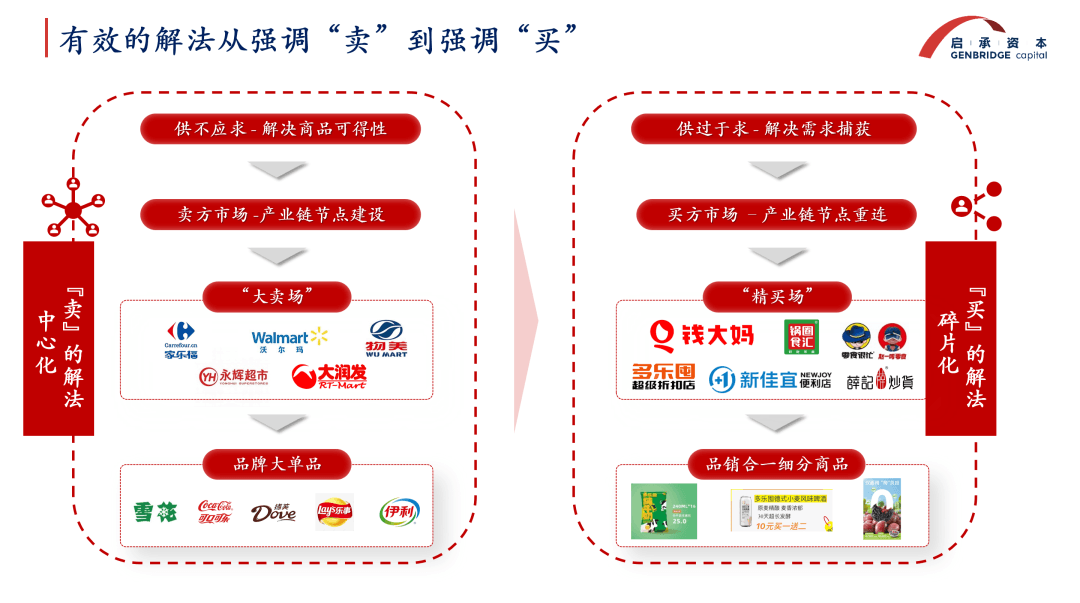

In the era of product scarcity, society’s core concern was the availability of goods. That led to the rise of large-format stores as distribution hubs, along with strong brands and hero SKUs (single best-selling items), to quickly address supply shortages.

When supply exceeds demand, the core issue shifts to capturing demand—how to find, stimulate, and precisely create the right products to meet increasingly diverse consumer needs.

The key to solving this lies in reconnecting industry nodes.

The first wave to emerge was the rise of curated retail formats, which focus on meeting consumers’ segmented needs more precisely and efficiently. Many of China’s rising enterprises started from niche markets and small-format models, breaking through category by category. Brands like Qian Da Ma, Guoquan, and Snack Is Busy are all excellent examples.

The decade from 2015 to 2025 marks a generational transition, during which several trends have gradually emerged. Overall, retailers are evolving toward community orientation, discount formats, manufacturing integration, and algorithm-driven operations.

New equilibrium formats are also emerging during this period of transition.

For example, Trader Joe’s undergoes significant format updates every three to five years. Similarly, Snack Is Busy has already evolved into different retail formats such as bulk snack shops and discount convenience stores. These are merely temporary equilibriums, and the future boundaries of product categories are something that entrepreneurs must explore.

So how does one explore? The key is to understand user scenarios and create new category combinations within them. Take Luckin Coffee for instance—it introduced coffee drinking to China’s broader population, especially in lower-tier cities. Later entrants could then build on this educated market to integrate coffee into their own product lineup, increase foot traffic, and improve single-store models—creating a cycle of continuous iteration.

Therefore, retailers can’t afford to stand still. Retail is a long-cycle business, and only through ongoing transformation can one build the competitive strength to win.

As the knockout round begins, how can brands break through with emerging content-driven platforms?

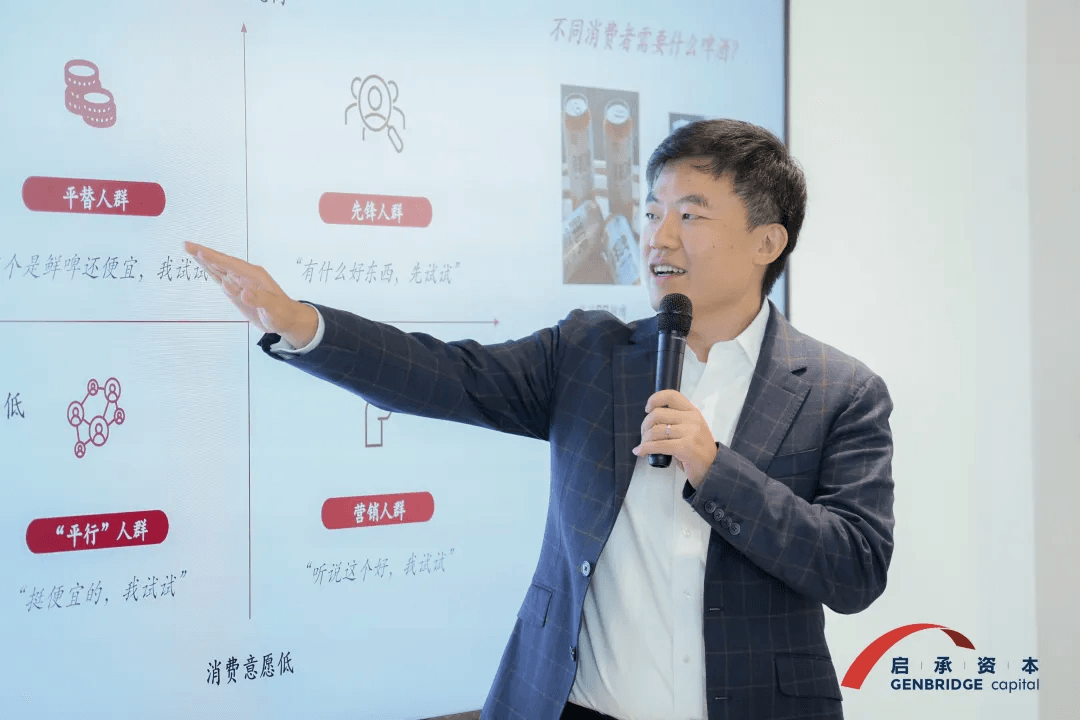

Many startups are no longer just facing a saturated market—they may already be in a shrinking market. In this contraction dilemma, most players in the past have competed through price or efficiency.

Today, we want to offer a new approach: breaking through with content innovations.

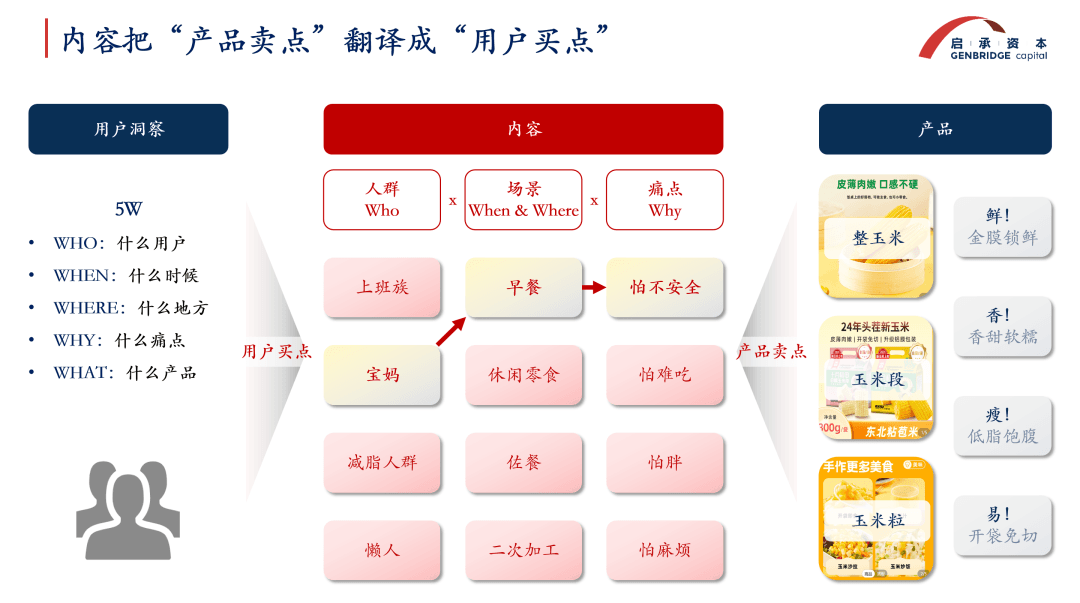

Content is a key catalyst for creating demand.

The corn product launched by Harvest, featuring a golden film wrapping. If only showing users the packaging of golden film, they might feel it’s irrelevant or unimpressive. But introducing through innovative contents—such as mothers wanting to prepare fresh, healthy breakfasts for their kids, and this golden film wrapping helps keep the corn fresh during transport—then the product’s selling point is precisely matched to a user need. This is how content drives purchase decisions.

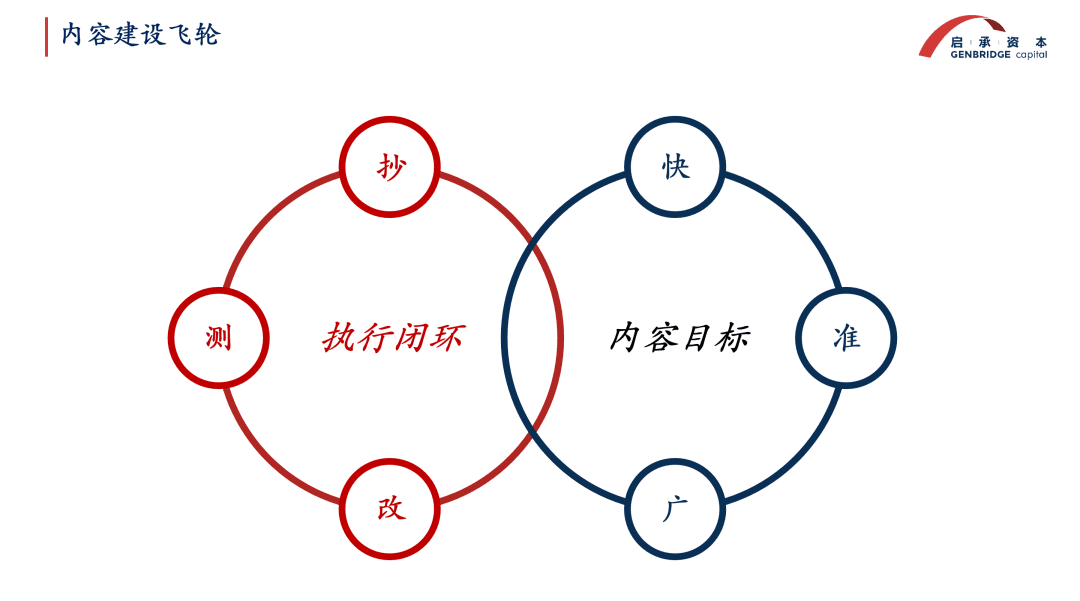

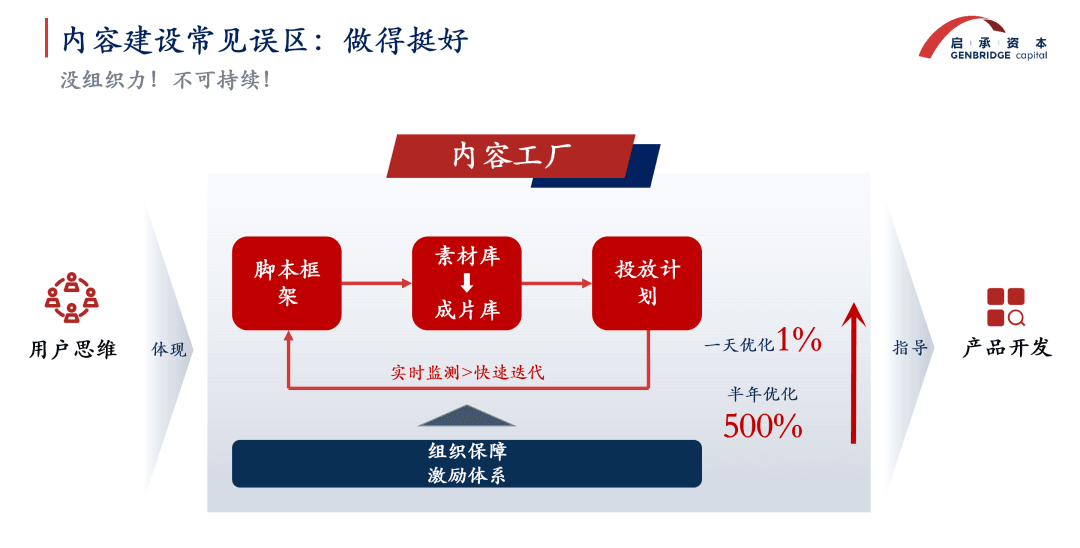

So how to build a strong content system? At its core, content creation works like a flywheel, with the key actions being copy, test, and refine. Originality is not the goal—resonance with users is. You can borrow the logic behind trending content, adapt it to your brand, test it across channels, and quickly refine it based on results. This creates a closed-loop execution system.

The goal is to produce content that is fast, accurate, and wide-reaching:

Fast, meaning quick response and daily iterations;

Accurate, meaning precisely aligned with user needs and continuously optimized;

Wide, meaning a broader range of formats and greater reach—encouraging more people to create content for you. For instance, Botare now has 30,000 to 40,000 influencers promoting their products.

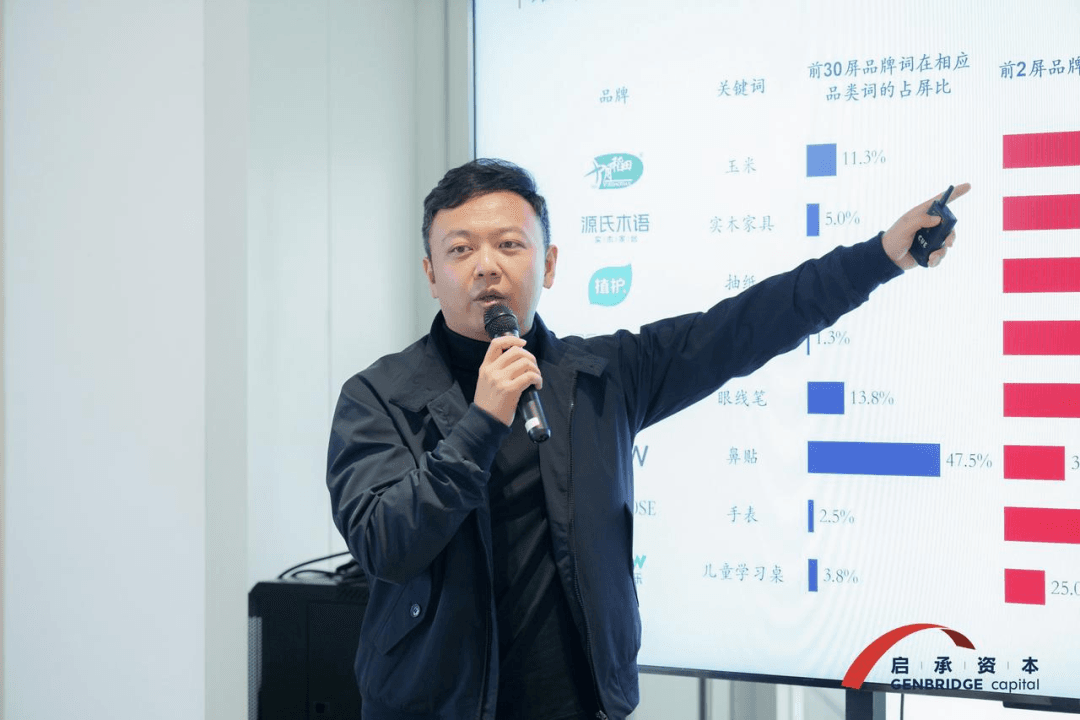

In the past, content depended on creativity. Today, it’s driven more by logic and execution. Some content-savvy brands use tools like TikTok to track user behavior frame by frame in short videos, then analyze that data to identify points of interest. By building a capable content team and a material library, they store high-performing clips extracted from data-backed analysis, gradually increasing the success rate of content creation.

In the future, there may be two supply chains emerging: product supply chain and content supply chain. The ability to develop great content needs to be converted into organizational capability, covering the full process—from scripting frameworks, asset creation, editing, distribution, to optimizing scripts and materials based on user feedback. Behind this is a need for supportive organizational structures and incentive systems.

This type of organizational model enables companies to develop a user-centric mindset—a shift from product or seller thinking. It can even guide product development. This is an organizational capability, not just a channel expansion.

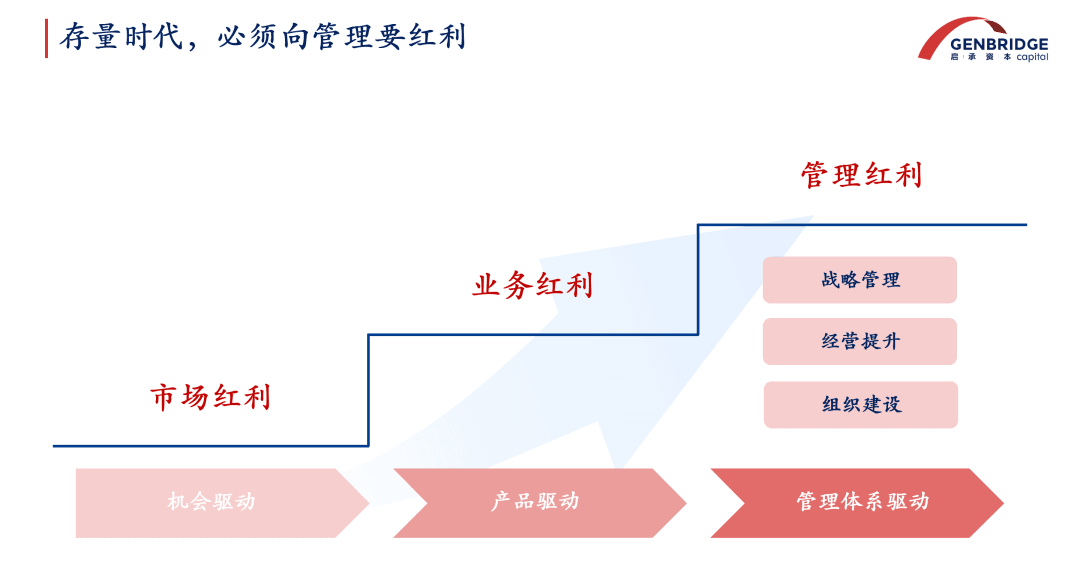

Growth has peaked—how can consumer companies extract dividends from management?

The traffic dividend and market dividend that many businesses once relied on may now have reached their limits. Some companies have shifted toward product-driven growth, hoping to capture business dividends through strong products or hero SKUs. However, products have life cycles. To secure longer-term gains, companies need to go one step further—by building robust management systems to unlock management dividends.

Over the past year, GenBridge has helped companies like New Joy Mart, Qian Da Ma, Himo, Peley, and Xueji achieve significant improvements through tools such as the Strategic Triad, Operations Review Meetings, and Cost Reduction & Efficiency Improvement Workshops.

For example, starting in November last year, GenBridge worked closely with New Joy Mart for two months, helping to initiate strategic projects and annual planning. Subsequently, they established a system for monthly and quarterly tracking and reviews. After a year of implementation, New Joy Mart achieved outstanding results—meeting both their expansion and franchisee profitability targets. Their private brand (PB) campaign was especially successful, with Q4 daily PB sales tripling and hero products exceeding 160,000 daily units sold.

Given the major operational challenges that businesses are facing this year, GenBridge conducted in-depth studies of companies like JD and Huawei to uncover key operational insights and distill the core problems enterprises face.

First, they developed a business diagnostic system. Second, when companies encounter issues like cash flow or profit shortfalls, GenBridge quickly initiates cost-reduction battle plans using specialized workshops. And if conventional methods fail, the team helps break cognitive barriers and explore innovative solutions, eventually codifying these into actionable methodologies.

The mission of GenBridge’s value-add service team is to solve real business problems. Qicheng is exploring a transformation from a self-operated model to a platform model, bringing in more expert partners to work deeply with companies—helping them compete, reshape growth, improve profitability, and strengthen management. The aim is to collaborate to tackle more challenges together.

Conclusion

In recent years, although the consumer investment market has experienced many ups and downs, and the path of business operations has been full of thorns and challenges, GenBridge Capital's commitment to consumer investment remains unwavering. We remain firmly rooted in China’s consumer market and continue to believe in the potential of consumer entrepreneurs.

We have been deeply involved in the transformation of China’s consumer society and have witnessed multiple generations of retail infrastructure evolve and adapt. We believe that in China’s massive, unified market, structural changes are still unfolding—not only in total volume but also in incremental growth—making it a vast and vibrant opportunity.

We are convinced that no matter how the macro environment changes, consumer investment remains a long-term, high-potential track, like a snowy slope with a long runway. The road ahead may be tough and winding, but we will always stand beside entrepreneurs—walking alongside them on their journey, shoulder to shoulder.