Recently, GenBridge’s portfolios, Harvest(Shiyuedaotian, 09676.HK) and Guoquan(Guoquan Shihui, 02517.HK) have completed IPO on HKSE in October and November respectively, achieving outstanding market performance. Despite incremental challenges faced by consumer market in 2023, concerns are various, it has become clear that in the current challenging landscape, there are still billion-dollar opportunities within the consumer sector that were previously overlooked.

In the first half of 2020, amid the initial stages of the pandemic, we discovered and invested in Harvest and Guoquan, Today, the remarkable growth and solid profits achieved by these two portfolio companies over the past three years are well beyond our expectations. Their impressive performance, robust growth, and leading positions within respective sectors lay a solid foundation for their IPO in 2023. The entrepreneurial spirit of innovation and diligent work has been ingrained in their journey from the very beginning, and their commitment remains unwavering.

Harvest completed IPO on HKSE on Oct.12

Guoquan completed IPO on HKSE on Nov.2

As their shareholder, we sincerely celebrate their entrepreneurial journey post-IPO. Established in 2017, GenBridge has carved a niche in consumer investment, consistently focusing on the ” next generation of national brands” and “next generation of nationwide chains”. Harvest and Guoquan are exemplary cases under these two major themes.

Most external interpretations of these two companies entering the capital market revolve more around market value and their past achievements. However, our journey with the entrepreneurs has offered us a broader perspective, as we witnessed how they face the ever-emerging challenges and solve real-world problems. As investors, GenBridge pays more attention to the underlying logic behind why Harvest and Guoquan can navigate market cycles, evolve into ” China’s next generation of consumer champions,” and sustain high-quality growth.

We believe that as leading companies in the “next generation of consumer champion” category, Harvest and Guoquan show notable parallels. A more profound exploration into their growth trajectories has identified the unique competitive advantages these two companies have achieved in their respective fields.

The first thing they share is their emphasis on essential, daily staple products and creating nationally recognized quality products. Harvest’s commitment is evident in its rice products, the staple food for Chinese people, sourced from premium production areas in Northeast China, with Wuchang Longfengshan organic rice acclaimed as the best in China. Guoquan, on the other hand, initially specializing in hot pot, has expanded into diverse categories like barbecue and daily cooking. Bolstered by a founding team with extensive experience in the catering industry, and sourcing quality ingredients globally, Guoquan continues to refine its products, introducing a wide range of creative and excellent products to meet the consumers’ demand for daily home-cooked meals.

GenBridge also continues to explore innovative “super product managers” in essential staple product categories. We firmly believe that there are still many “billion-dollar-level” systemic opportunities in these fundamental categories.

Harvest Rice Products

Guoquan “eating at home” products

Secondly, both Harvest and Guoquan have gained a leading market share due to the powerful competitive advantages and barriers they have built in the supply chain.

According to the prospectus of both companies, Harvest is the highest revenue-generating entity in China’s pre-packaged premium rice market for 2022, as well as in the market for coarse grains, beans, and seeds. It also ranks among the top five companies in terms of revenue in the Chinese kitchen staple food sector. Guoquan, on the other hand, dominates in the “eating at home” retail track. In 2022, it secured the top among all retailers and is the largest self-owned brand retailer for at-home dining in China.

Their success largely stems from their solid input in the supply chain. Harvest, for instance, has established a substantial and highly efficient supply chain infrastructure in Northeast China. Guoquan, not only identifies the best suppliers in each category nationwide but also establishes high-standard and heavily invested food industrial parks for the R&D and production of these excellent food products. During the pandemic, both companies have enhanced supply chain efficiency, streamlined organization structures, and sharpened their competitive edges in the industry, thereby surpassing competitors. These initiatives have laid a solid foundation for the companies to achieve scalable revenue and profits.

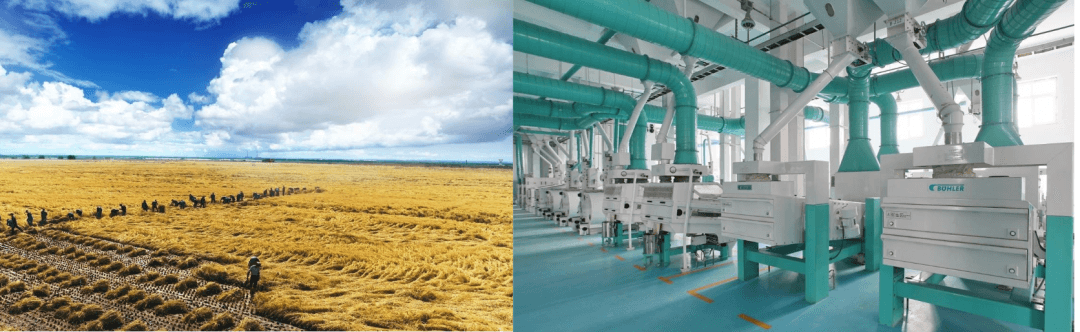

Imported rice milling machine from the source area of Harvest and factory

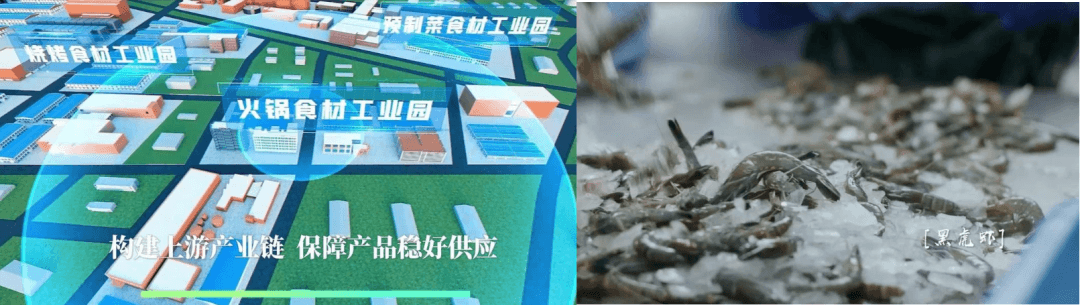

The upstream factories and food ingredient supply chain built by Guoquan

Thirdly, they have leveraged the significant changes in the channel structure over the past decade to achieve high-speed growth. Harvest has harnessed the efficiency of China’s online channels, starting from platforms like JD and Tmall and expanding to offline supermarkets and wholesale channels after covering the entire online channel, gradually advancing towards a billion-dollar brand. On the other hand, Guoquan has strategically tapped into the vast potential of the lower-tier market, extending the reach of quality ingredients from tier 1 and 2 cities to county and township markets. Their nationwide chain with thousands of stores has facilitated consumer access to high-quality ingredients in lower-tier markets. Furthermore, the digitization of the entire supply chain has improved Guoquan’s efficiency in serving its users.

Harvest entered offline supermarkets and wholesale channels

Guoquan tapped into lower-tier markets

Harvest and Guoquan have achieved high-quality growth in their respective channels through highly efficient expansion, paving the way for their success in recent years. The vast depth of the Chinese market and the improvement in corporate capabilities have also left immense room for their future development across all channels.

These two companies have gradually developed core competitive advantages throughout their growth journey and now possess opportunities for further replicated growth. Harvest has extended its advantageous capabilities in rice to diverse categories such as coarse grains and corn. Guoquan has expanded from hot pot to categories like barbecue and pre-cooked dishes for daily cooking. Fundamental food ingredients in China are intricately tied to the national economy and people’s livelihoods, and entrepreneurs who can identify scalable and high-growth competitive advantages, coupled with sustainable business models will gain the momentum for continuous development.

Harvest extended to diverse categories

Guoquan has expanded from hot pot to categories like barbecue and pre-cooked dishes for daily cooking

In conclusion, we believe that entry into the capital market marks a new development phase for both companies. The Chinese basic food industry, with its expansive market size, is currently undergoing a crucial period of transformation and upgrade. The next generation of champion companies aims to provide better products rooted in the fundamentals, catering to a wider range of consumers, thereby realizing enhanced consumer value and long-term enterprise value.

Harvest and Guoquan are highly representative cases within the consumer investment industry. We have confidence in the innovative transformations made by outstanding entrepreneurs in the sector of basic products. We are committed to accompanying our partner companies throughout the growth journey to jointly creating the “next generation national brand” and “next generation nationwide chain.”

GenBridge will continue to solidify its presence in the consumer sector, exploring the next investment opportunity. We are proud to be alongside more exceptional companies, bringing better products and higher quality life experiences to billions of consumers in China.