- The importance of avoiding mistakes

- 01 Yoshinoya vs. Sukiya: The Two Sides of Crisis

- 02 Chipotle: Food Safety Concerns from In-store Preparation

- 03 Marugame Seimen: Price Increase Leads to Loss of Loyal Customers

- 04 McDonald's Japan: Structural Issues Revealed by a Food Crisis

- Conclusion: A Multi-Dimensional Marathon

The importance of avoiding mistakes

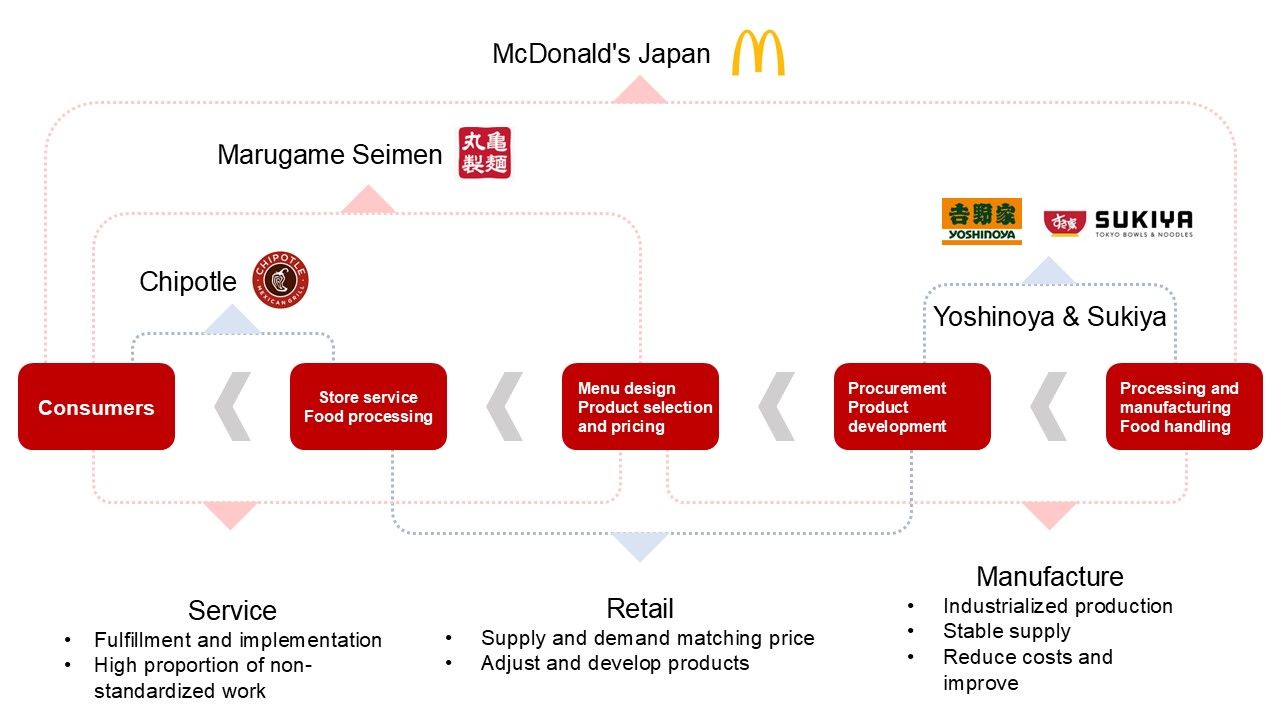

The restaurant chain industry is one of the key sectors prioritized by GenBridge Capital. Our extensive research into the history and competition of domestic and international restaurant enterprises have revealed a common trait within the industry: the rapid changes in the competitive landscape often result from fatal mistakes by some companies, rather than their exceptional performance.

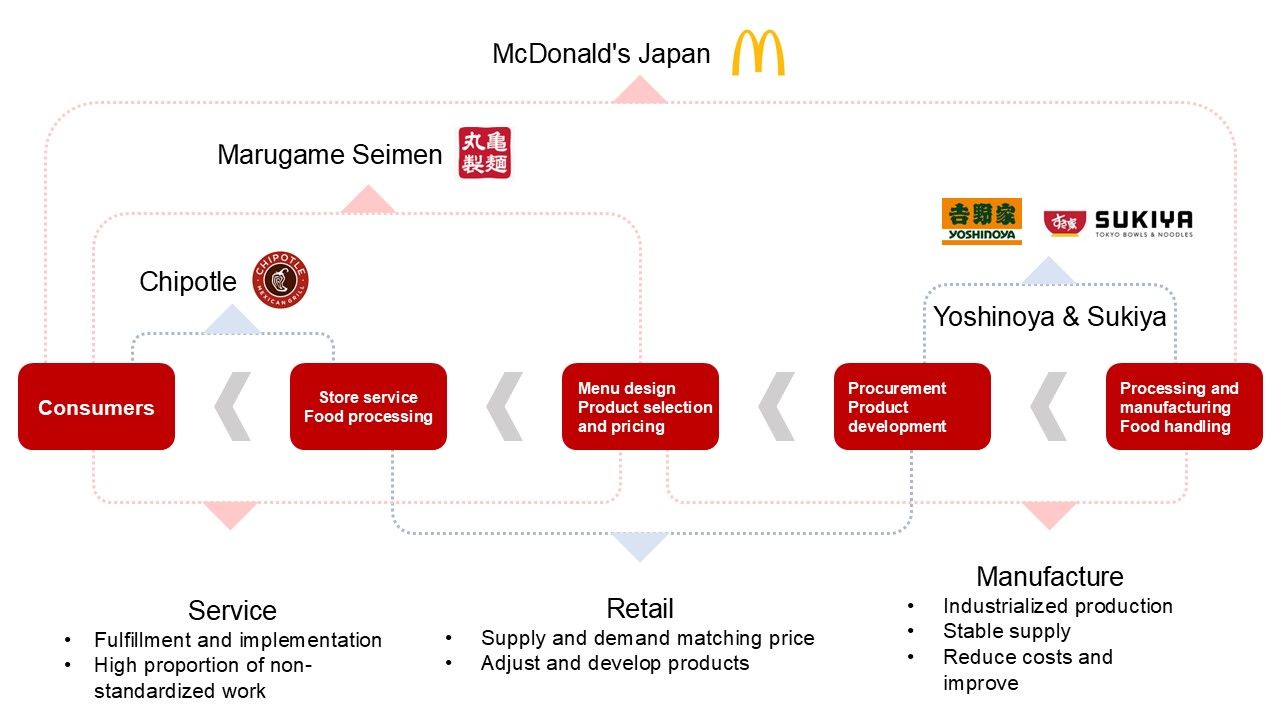

The restaurant industry is a comprehensive field that combines manufacturing, retail, and service sectors, making it inherently complex and prone to errors. This article introduces four types of typical mistakes, each occurring at different points in the supply chain. The direct losses caused by these cases amount to approximately 100 billion RMB.

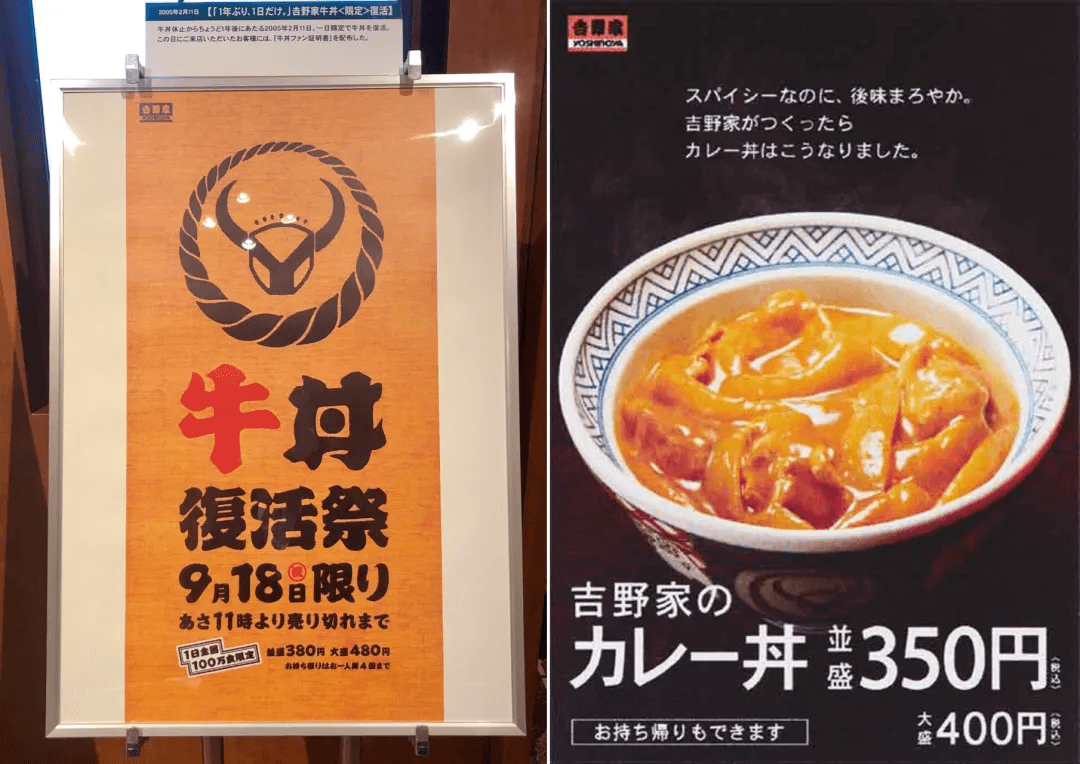

- “No Plan-B”- The Impact of Mad Cow Disease on Yoshinoya’s Beef Bowl Sales:

Yoshinoya, similar to Sukiya, faced a supply chain disruption in 2003 due to the mad cow disease outbreak in the United States, which halted the import of beef. Yoshinoya was unable to sell its signature beef bowls for over two years, while Sukiya adjusted its supply chain and pricing strategy, surpassing the long-established Yoshinoya.

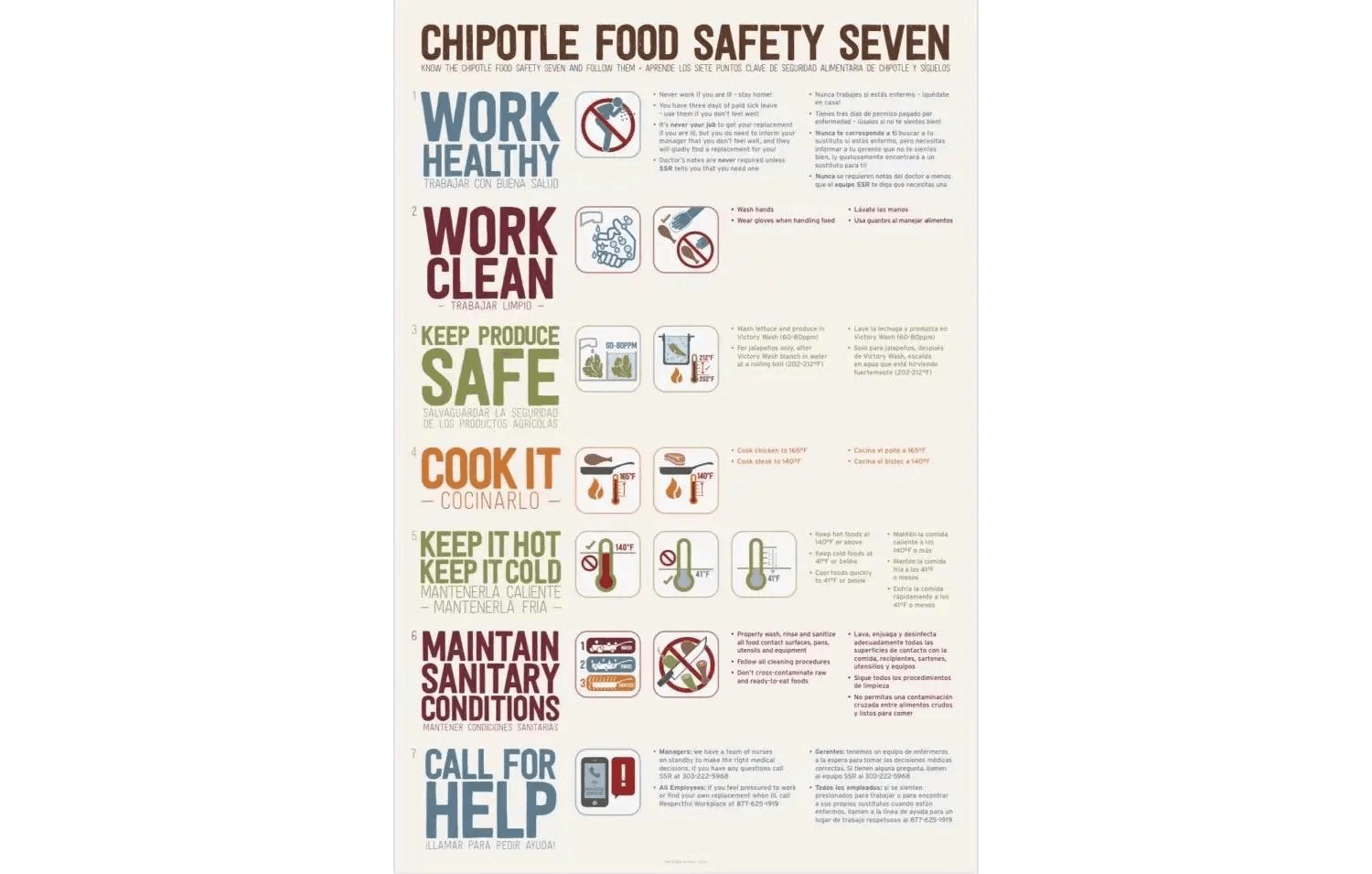

- “Neglecting Operations” – Chipotle’s Food Safety Crisis

Chipotle successfully differentiated itself by emphasizing freshly prepared food, creating a sense of value. However, this approach brought high food safety risks, eventually leading to a large-scale food safety incident. As a result, Chipotle’s revenue dropped from $4.5 billion to $3.9 billion.

- “Hasty Decision-Making” – Marugame Seimen’s Operational Issues Due to New Product Launches

The founder of Marugame introduced seasonal limited-time products because of his anxiety about performance growth. Although these products temporarily increased the average customer spend, they led to a 15% decline in customer traffic, nearly costing the company its market position.

- “Short-Sightedness” – Structural Failure of McDonald’s Japan

Professional managers, focused on short-term performance, depleted the brand’s long-term business assets. A series of issues occurred, including cutting franchisees, promotions, new product launches, employee turnover, and a food safety crisis was the last straw. As a result, the company’s revenue fell by 55% within five years.”

01 Yoshinoya vs. Sukiya: The Two Sides of Crisis

1. Background: Supply Chain Turmoil Amidst Intense Competition

The deflation in Japan has sent the restaurant industry into an era of fierce low-cost competition, where beef rice became the preferred quick and affordable lunch option. In 2001, following the liberalization of American beef imports to Japan, three beef rice chain enterprises—Yoshinoya, Sukiya, and Matsuya—swiftly engaged in a price war, aiming to expand market share through low-price sales. The price of a bowl of beef rice dropped from 400 yen (20 RMB) to 280 yen (14 RMB).

Sukiya, a chain under Japan’s Zensho Group, was the first chain brand to lower its prices. Unlike the long-established Yoshinoya, Sukiya was a newcomer to the beef rice market. Founded in 1982, it experienced growth in the 1980s and 1990s by opening stores in Japan’s suburbs.

Sukiya also differentiated itself in terms of taste. Unlike Yoshinoya, which targeted male blue-collar workers in urban areas, Sukiya appealed to a broader consumer base, including families with more dispersed dining times. Therefore, Sukiya’s menu was more diverse, offering toppings such as cheese, spicy cabbage, and cod roe on top of beef rice, providing a variety of flavors while also increasing the average customer spend and, more importantly, boosting Sukiya’s profit margin. In 2004, Yoshinoya’s profit margin was 59.8%, while Sukiya’s was 66.9%. With Sukiya’s price reduction, Yoshinoya and Matsuya also followed suit, lowering their prices to 280 yen.

However, in 2003, the competitive landscape of the beef rice market took a sudden turn. The United States experienced an outbreak of BSE (mad cow disease), prompting the Japanese government to urgently ban the import of American beef. Many beef rice chain enterprises faced an existential challenge.

2. Yoshinoya’s Response

Yoshinoya had always used American beef, and apart from the US, no other country could meet its demand for beef. Beef rice used beef belly, a part with high fat content and low cost. Approximately 10 kilograms of beef belly could be obtained from one cow. A regular-sized bowl of beef rice used 67 grams of beef, and Yoshinoya sold about 450 million bowls of beef rice annually, requiring approximately 30,000 tons of beef belly. Such a massive supply could only be met by the US, as Japan had only 1.2 million cows in total.

In the face of crisis, Yoshinoya had no choice but to completely remove its signature beef rice from the menu starting from 2004. This decision was based on three reasons:

- Australia had around 10 million cows at the time. If Yoshinoya were to source beef from Australia, prices would skyrocket, and Yoshinoya’s profit structure could not withstand a significant cost increase.

- Unlike the US, where beef is sold in separate cuts, the mainstream sales approach in Australia involved selling whole or multiple cuts of beef. This made it impossible for Yoshinoya to obtain only the beef belly needed for beef rice.

- American beef is grain-fed, while Australian beef is primarily grass-fed. The difference in feeding methods would affect the taste of Yoshinoya’s signature beef.

To compensate for the removal of beef rice, Yoshinoya drastically adjusted its menu structure, introducing a range of new products such as pork rice, beef steak rice, sukiyaki rice, curry beef rice, and grilled chicken rice. In 2004, the group acquired Hanamaru Udon, a udon noodle chain, accelerating the expansion of its multi-brand strategy. Ultimately, Yoshinoya’s revenue declined by about 10% between 2004 and 2006, with a deficit in 2004, but it returned to profitability in 2005. The signature beef rice was reintroduced in limited supply after September 18, 2006, and it was not until 2008 that beef rice was fully restored to the menu.

3. Sukiya’s Response

When Yoshinoya abandoned the sale of its signature beef rice, Sukiya also removed beef rice from its menu in February 2004, but reinstated it on September 17 of the same year. This move allowed Sukiya to surpass Yoshinoya successfully, becoming not only Japan’s largest beef rice chain but also laying the foundation for its parent company, Zensho Group, to become Japan’s leading restaurant group in the future.

Following the decline in beef supply, Sukiya quickly established a supply chain in Australia, switching its beef supply to Australian beef. It adjusted the beef rice recipe according to the characteristics of Australian beef, reducing the gaminess of grass-fed beef. Additionally, the variety of toppings at Sukiya effectively masked the drawbacks of beef.

Sukiya’s decision to use Australian beef was based on two reasons:

- Zensho Group’s multi-brand nature aligned well with the sales approach of Australian beef, which involves selling whole or multiple cuts of beef. In addition to the Sukiya brand, Zensho Group also owned the steak chain “Big Boy,” the hamburger chain “COCO’S,” and the barbecue chain “Tairyo.” The menus of these channels could consume multiple parts of beef, not limited to beef belly.

- Sukiya’s cost structure and pricing made it impossible for Yoshinoya to compete. Due to the diversity of its menu and unique toppings, Sukiya had a profit margin 8 points higher than Yoshinoya’s, allowing Sukiya to accept the higher price of Australian beef. As a result, Sukiya raised the price of beef rice from 280 yen to 350 yen, just enough to lock Yoshinoya out of profitability even if it introduced Australian beef, thereby securing the price range of the battlefield.

In 2005, Zensho Group’s revenue surpassed Yoshinoya’s, and in 2010, it surpassed McDonald’s Japan to become Japan’s leading restaurant group. According to the former procurement director interviewed by Kiseki Capital, after the BSE crisis in the US, Zensho Group significantly strengthened its management of the upstream supply chain, forming the following three core characteristics:

Food Testing Laboratory: A team of about 50 people whose main task is to scientifically study the composition of ingredients, processing methods, and hygiene management, and develop ingredients based on this scientific information. For example, adding a trace amount of calcium silicate makes apples cut crisper than any other brand.

Food Safety Mechanism: The procurement department has its own food safety certification mechanism and an internal safety inspection team, a function typically outsourced by other restaurant companies. Each procurement department head is accompanied by a food safety inspector responsible for sampling and testing all ingredients and checking their certificates and reports.

Increased Procurement Authority and Flexibility: Procurement department heads have higher incomes than their counterparts and have a certain degree of budget autonomy. These experienced department heads are familiar with the sources and qualities of various ingredients, enabling them to quickly find the desired ingredients. Flexibility determines the company’s sensitivity to introducing new quality and supply chain. In contrast, other Japanese restaurant listed companies have inexperienced individuals in procurement, with relatively low status within the company and limited budgets.

02 Chipotle: Food Safety Concerns from In-store Preparation

1. Outbreak of Food Safety Issues

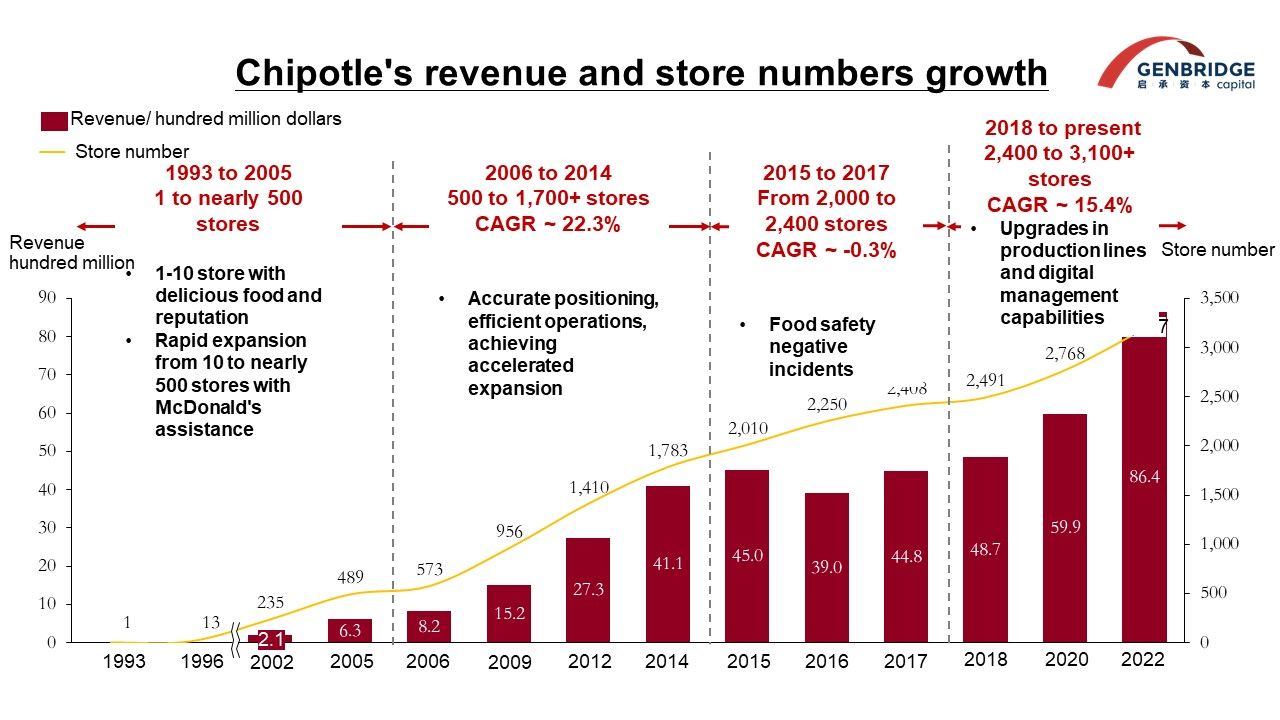

Chipotle is a U.S.-based Mexican-style fast food chain, established in 1993, and is the fourth-largest publicly traded restaurant company in the world. It operates 3,182 company-owned stores, most of which are located in the United States.

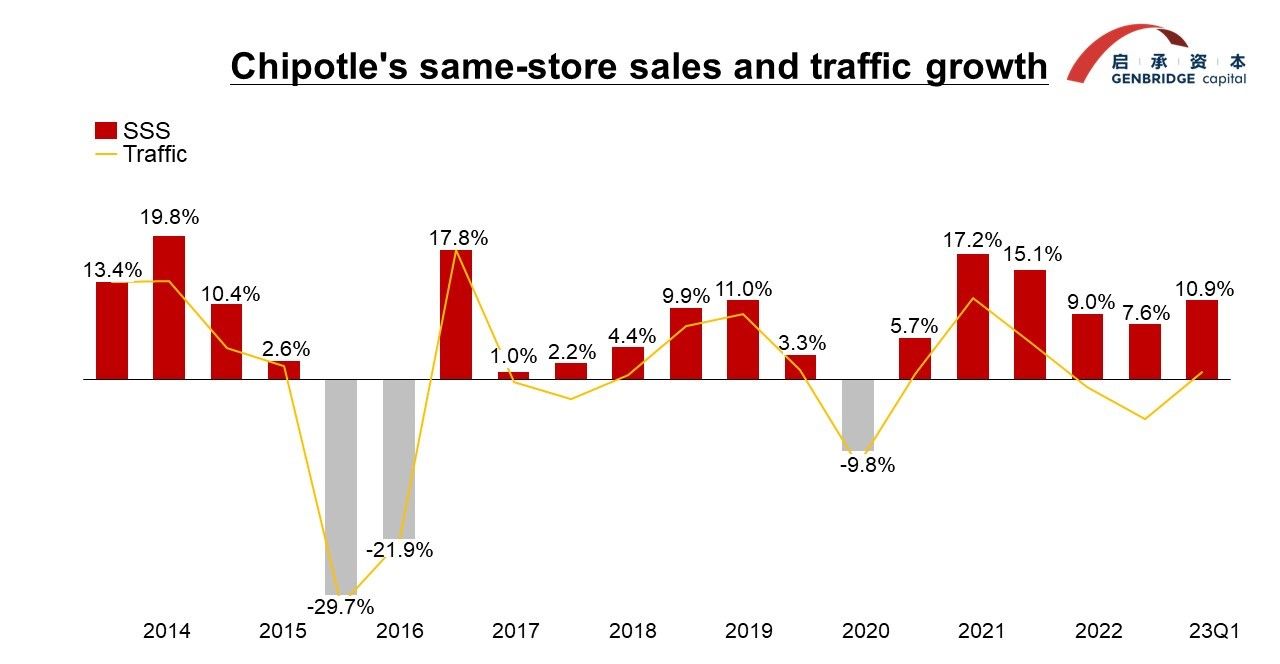

From 2015 to 2016, multiple significant food safety issues occurred across Chipotle’s stores in various U.S. states, each with different underlying causes. For example, in August 2015, a norovirus outbreak was confirmed in Simi Valley, California, affecting 80 customers and 18 employees. The outbreak was traced back to a kitchen manager who continued to work for two days after falling ill before being sent home. Similarly, in August and October of the same year, E. Coli and Salmonella outbreaks were reported in stores in Minnesota, Washington, and Oregon, due to improper food supply chain management and in-store practices.

After these incidents, Chipotle realized that the primary sources of bacteria and viruses were the fresh farm products and meats used in their stores. The use of organic fresh fruits and meats, especially those fertilized with manure, increased the risk of E. coli contamination. Additionally, Chipotle’s heavy reliance on employee handling also contributed to the higher risk of foodborne illnesses compared to some competitors.

The range of pathogens involved (Salmonella, E. coli, and norovirus) highlighted a systemic issue within Chipotle. However, their oversight and management of ingredients were lax, with only four people responsible for product quality control prior to the crisis. This number was inadequate given the company’s scale and the complexity of its operations. With 53 ingredients outsourced to 15 external suppliers and quality control managed only through contractual terms, the company struggled to trace the contaminated ingredients even two months after the outbreaks.

2. Chipotle’s Response

The series of food safety incidents served as a harsh lesson for Chipotle and prompted the company to adopt a more professional and mature management system. First, they hired a new food safety officer to implement a series of reforms, introducing a strict HACCP (Hazard Analysis and Critical Control Point) system to scientifically ensure the regulation and management of ingredients throughout the supply chain. Significant changes were made in the management and division of responsibilities between stores and the supply chain. For instance, stores were required to prioritize the use of dehydrated products over fresh ones, and common ingredients like lemons and onions had to undergo strict high-temperature sterilization. Central kitchens took on more pre-processing tasks to control raw material safety risks. They were also tasked with pre-cooking steaks and providing more pre-prepared ingredients to reduce the food safety burden on individual stores.

The extensive operational reforms at Chipotle were driven by deep adjustments in company management. In 2018, with the active involvement of Pershing Square, a key shareholder on the board, Chipotle appointed a new CEO, Brian Niccol. Formerly the CEO of Taco Bell, Niccol implemented two main changes while maintaining the brand’s core values: he strengthened brand management and operational efficiency and transformed the business into a multi-channel model to attract additional customers.

Focusing on operational efficiency, Brian Niccol optimized Chipotle’s core competencies, ensuring that the company focused on what it does best. For example, he called off ineffective promotions like “buy one, get one free” and instead emphasized quality through marketing campaigns such as “For Real.” In terms of store operations, Chipotle maintained its policy against franchising and avoided rapid globalization, prioritizing the expansion to 7,000 stores across the United States. Chipotle also declined the proposal of McDonald, its shareholder, to introduce breakfast items and combo meals, and resisted using frozen ingredients, preserving the brand’s original value image. These strategies further solidified Chipotle’s brand value in the minds of consumers and retained a loyal customer base.

03 Marugame Seimen: Price Increase Leads to Loss of Loyal Customers

Marugame Seimen is a direct-operated udon noodle chain under Japan’s Toridoll Corporation. Established in 2000, Marugame Seimen became Japan’s largest udon noodle chain by offering high value for money and freshly made dishes in-store, a unique feature in a market previously lacking branded udon chains.

The brand’s operational efficiency allows it to handle high customer volumes during peak times. With an average customer spend of 26 RMB, its stores serve an average of 630 customers daily (including takeout). During lunch rushes, it took customers only 18 seconds to place orders and receive their food. Currently, Marugame Seimen has 833 stores in Japan, generating revenue of 5.05 billion RMB.

1. Background of the Problem

Starting in 2005, Marugame Seimen experienced a decade of rapid growth, expanding from a few stores to approximately 600. However, as stores grew, founder Takaya Kuwata saw a ceiling to the company’s growth. The company was transitioning from a simple restaurant business to a more formalized dining group, bringing in a batch of executives from consulting firms to manage the original entrepreneurial team.

Founder Takaya Kuwata

Following the suggestion of a new executive, Marugame Seimen began introducing limited-time seasonal products, launching new items every quarter, or even monthly. Given that udon is a frequently consumed item in Japan, with many people eating it 2-3 times a week, leveraging this high repurchase rate through special products to increase average spend became a growth engine for the company.

The seasonal product strategy quickly proved successful. In August 2014, the launch of a 590-yen (30 RMB) large bowl of beef udon increased same-store sales by 15%. Amid a sluggish Japanese economy where most eateries were engaging in price wars, Marugame Seimen broke the norm by focusing on product innovation rather than price competition, introducing striking new items. This strategy repeatedly proved successful, and from 2015, the company began launching up to 10 new items per quarter.

However, this success was short-lived. While Marugame Seimen’s year-on-year customer numbers were still rising in 2017, they faced a sharp decline in 2018. By March 2018, same-store customer numbers had fallen to 94.3% of the previous year, and the dilemma lasted for about two and a half years. Although new product launches appeared to boost revenue, the actual number of customers per store continued to decline.

The constant introduction of new products is a stimulus for customers but also placed significant pressure on store employees. To cope with the frequent new launches, operational efficiency decreased, affecting both the taste and speed of service. An employee mentioned, “While boiling noodles, I would be called away to prepare other toppings. I couldn’t attend to it in time even if the noodle timer went off, and the noodles was overcooked by the time i was back.” This chaotic kitchen management led to a decline in customer experience and loss of trust.

Marugame Seimen’s appeal lies in its in-store preparation, with chefs making dough from flour every night and cutting and boiling noodles fresh the next day. In Japan, where frozen udon is prevalent, customers have higher expectations for handmade udon. If these expectations are not met, repeat purchases decline.

2. Marugame Seimen’s Response

Facing performance challenges, founder Takaya Kuwata makes the following operational adjustments:

- Reducing the Number of New Products: The number of new products was reduced to 2-3 items, lowering the complexity of store operations and ensuring that the introduction of new products did not impact the efficiency of serving traditional dishes.

- Implementing a Testing Mechanism: Before launching new products, feasibility tests were conducted in the headquarters kitchen. Subsequently, the new items were tested for one month in stores in Shizuoka and Fukuoka prefectures to ensure they did not affect operational efficiency.

- Introducing the “Noodle Master” System: Marugame Seimen’s success relies heavily on the skill of its noodle chefs. While some processes have been standardized, many remain non-standardized. The company introduced the “Noodle Master” system, granting the title of “Noodle Artisan“ to chefs who pass an exam. These artisans receive higher pay, and their names are displayed at the store entrance. Exceptional “Noodle Artisan” become regional technical advisors, helping other store chefs improve their skills.

After these adjustments, Marugame Seimen’s store revenue growth rate reached 104% in 2019, gradually returning to normal levels. Reflecting on this, Takaya Kuwata emphasized that in fast food, where efficiency is key, the number of customers is the most critical metric. In interviews, he stated, “Even for chain stores, each store must earnestly attract customers. In the restaurant industry, the most important focus is not on sales figures but on the number of customers, ensuring more repeat visits.”

The lessons learned from this failure helped Marugame Seimen recognize its competitive advantages. During the three years of the pandemic, Marugame Seimen stood out among several Japanese restaurant groups. This success was attributed to the development of a high-value takeout product line called “Udon Bento,” with prices starting at just 19 RMB. By focusing on increasing the number of customers rather than the average spend per customer and matching products to this strategy, Marugame Seimen attracted a new batch of takeout consumers. This approach increased the previously negligible takeout ratio to nearly 30%.

04 McDonald's Japan: Structural Issues Revealed by a Food Crisis

Since entering Japan in 1971, McDonald‘s has been one of the most successful fast-food chains in the country, with about 3000 stores and its own listing onn the Japanese stock exchange. However, it faced significant challenges, peaking in 2008 with sales of about 400 billion yen, only to see revenues plummet to 180 billion yen in 2015, resulting in a loss of 21.8 billion yen – the largest deficit in the history of the Japanese restaurant industry. This loss stemmed not only from a single food safety issue but from a multi-faceted structural problem including corporate strategy, management tactics, and leadership priorities.

1. Short-sighted CEO

The crisis at McDonald’s Japan began with the appointment of CEO Eikoh Harada in 2005. Harada, formerly the legal representative of Apple Japan, succeeded the founder McDonald’s, Den Fujita. Unlike Fujita’s localized approach, Harada aligned closely with the needs and directives of the U.S. headquarters, implementing a series of reforms based on McDonald’s QSC (Quality, Service, Cleanliness) standards and introducing 24-hour operations.

CEO Eikoh Harada

These reforms have boosted store revenues but not the profit margins. In response, Harada drastically altered the company’s structure, shifting the ratio of company-owned to franchised stores from 70:30 to 30:70. This reduced headquarters’ operating costs significantly, including converting corporate employees to franchisee employees. The liquidation of company-owned assets and restructuring enabled McDonald’s Japan to achieve its highest profit margins in 2011. Harada then closed 11% of underperforming stores, further improving financial statements by cutting total assets.

With rising profit margins, Harada pushed for increased store sales and turnover rates. He launched large-scale promotional activities, including attracting new customers with ultra-low prices, such as reducing the Big Mac from 20 RMB to 12 RMB and the cheeseburger from 12 RMB to 6 RMB. He also introduced seasonal high-margin products to capitalize on increased customer traffic, further boosting short-term performance.

2. Underlying Issues Masked By Growth

Despite breaking performance records annually, customer satisfaction declined steadily. The 24-hour operation policy and ultra-low prices resulted in dirty and chaotic stores, driving away families and leaving night-shift workers and clusters of students as the primary clientele. The intense focus on low prices and operational efficiency left staff unable to provide quality service or maintain cleanliness. Thus, what seemed like a strategy to broaden the customer base actually narrowed it.

Harada also increased franchise fees, funneling more profits to the U.S. headquarters. The higher fees and rigid communication from the Japanese headquarters led many franchisees to lose their franchises under dubious circumstances. Consequently, many experienced employees left McDonald’s, significantly weakening store operations and development capabilities.

The shift from a high company-owned to a high franchise model appeared to lighten the company’s load by boosting profit margins and financial performance. However, in pursuing profit margins, McDonald’s neglected strict quality control over its suppliers.

These internal contradictions culminated in the 2014 food safety crisis. In July 2014, it was revealed that McDonald’s supplier Shanghai Husi Food Co., Ltd. had been altering production and expiration dates for years. The problem extended into 2015 when multiple customers found foreign objects such as insects, plastic pieces, and metal fragments in their food. These repeated food safety issues eroded consumer trust in McDonald’s.

By 2014, McDonald’s revenue had fallen 55% from its 2008 peak, reaching approximately 180 billion yen in 2015. The root causes included a loss of customers due to price competition, declining service experience from poor store management, a weakened workforce from talent exodus, and negligence in food safety driven by profit pursuit. These issues were all fundamentally linked to the U.S. headquarters’ misunderstanding of the Japanese market’s unique characteristics and the short-term, opportunistic decisions made by the professional managers to align with headquarters’ demands.

3. McDonald’s Response

Facing continuous performance decline, Eikoh Harada resigned in 2014, and was succeeded by Sarah Casanova from the U.S. Headquarters as the new CEO. Under her leadership, McDonald’s Japan gradually recovered since 2016, bouncing back from losses to annual profit growth.

Sarah Casanova’s efforts to restore consumer trust

- Closing unprofitable stores: In 2015, McDonald’s Japan shut down over 150 unprofitable outlets, reducing the total number of stores from 3,093 to 2,956.

- Gathering suggestions from mothers: Casanova initiated the “Town Meeting With Mom” campaign, visiting every prefecture in Japan to engage with mothers—once a crucial customer base. These meetings helped understand why families stopped visiting McDonald’s and informed strategic adjustments based on consumer feedback.

- Promoting supply chain traceability: McDonald’s consistently disclosed the origin and final processing countries of key ingredients. Casanova enhanced the promotion of this traceability, allowing consumers to access detailed information via QR codes on packaging.

- Store experience feedback system: Since 2015, customers could rate their store experiences through an app, reporting any dissatisfaction or poor service. This real-time feedback allowed McDonald’s to monitor and manage franchise performance effectively.

- Store renovations and image upgrades: Casanova led the refurbishment and relocation of 90% of the old stores, providing customers with a fresh and updated McDonald’s experience.

Conclusion: A Multi-Dimensional Marathon

As highlighted, the restaurant industry is a multifaceted field integrating manufacturing, retail, and service sectors. Due to this complexity, restaurant companies cannot rely solely on a single competitive advantage for differentiation. Instead, success requires excellence across multiple dimensions while significant errors can drastically turn the competitive landscape.

The restaurant industry is like an endless marathon without shortcuts, where lagging competitors are quickly overtaken, and the top contenders continuously strive for superior efficiency, service, and quality.

By Tojiro Kataya, Senior researcher at GenBridge