Offline retail, empowered by the internet, is now unfolding in a more multidimensional and dynamic manner. With rising expectations for the future, China’s consumption growth has undoubtedly become a core engine of market vitality since 2023.

Recently, George Wan, Partner of GenBridge Capital, delivered a keynote speech at the 2023 China (Hangzhou) New E-Commerce Conference, sharing the latest consumer insights and case studies from the perspective of a seasoned investor.

Hello everyone, it’s an honor to represent GenBridge Capital and share our latest observations and reflections.

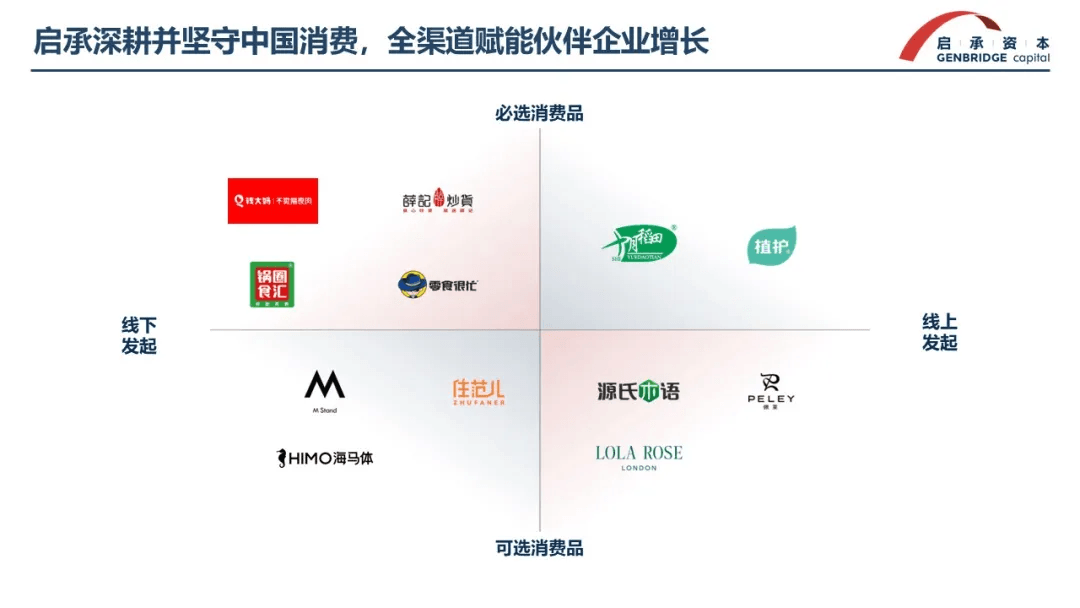

GenBridge Capital is an investment institution focused on the growth stage of China’s consumer sector, aiming to empower the next generation of “consumer champions.” The “next generation” implies constant innovation, which is our unwavering pursuit.

In recent years, through our investments, we’ve woven a comprehensive network across China’s consumer landscape—spanning discretionary and essential goods, online and offline growth. These investments embody a few of our core beliefs:

- We stay committed to and deeply cultivate the consumer sector—broadening only after we deepen;

- We favor companies in essential, large-scale industries whose growth can transcend cycles;

- We focus on competitive advantages, avoiding homogeneity and enhancing long-term value;

- We specialize in identifying quality growth and helping companies realize it.

These principles are our “constants” in a rapidly changing market—they keep us calm amid volatility.

Online category growth plateaus, while offline channels become increasingly specialized

Over the past year, we’ve observed some interesting market shifts.

Online, category growth has begun to plateau, and brands are entering a phase of reshuffling.

Sales have increasingly shifted from shelf-based e-commerce to content-driven e-commerce, triggering a series of chain reactions:

Product competition has become more multidimensional. In the shelf era, brands primarily competed on price for limited core traffic spots. In the content era, those spots are fragmented. Products must now present price, use case, and messaging in more vivid, scenario-based formats, tailored to target audiences. This changes not only how companies acquire traffic but also how they develop products—requiring an overall upgrade in capabilities.

Second, as traffic becomes more concentrated, barriers to brand entry have risen. Talent, traffic, and even capital are now scarce resources. The chances of new brands achieving scale have dropped significantly. In this new phase, a group of players who own strong positions in niche segments will emerge as industry consolidators, driving sector concentration.

Offline, Q1 data shows that while certain lifestyle service categories focused on “self-care” consumption are expanding their store footprints, very few other formats have seen net positive growth. This implies that although consumers have returned, many merchants remain cautious.

That said, we’ve seen exciting momentum in niche innovation within categories like snacks, roasted nuts, coffee, and vertical F&B—led by players that are increasing market concentration. Notable examples include brands we’ve invested in, such as Xueji Roasted Nuts, M Stand, and Snack Is Busy.

We’re no strangers to change—expectations in the consumer market are always shifting. During the traffic boom, expectations centered on acquiring more traffic; in the current stock-based competition era, the focus has shifted to acquiring traffic at lower cost over time.

Yet behind all these online and offline transitions, one core trend remains: user dominance is on the rise. Empowered by new media and infrastructure, users are increasingly influencing the tug-of-war between brands and channels. Focusing on and understanding user value has become a non-negotiable priority for all businesses.

From Online to Offline: Achieving omnichannel growth

Let’s look at the case of YESWOOD—a brand that started online and achieved full-scale omnichannel growth by deeply satisfying user value:

Initial Phase: Yeswood identified a specific user need: “I want to buy high-quality, cost-effective solid wood furniture online.” It began by offering a single hero product—solid wood beds—with outstanding value and rich content presentation. This created a strong brand association with solid wood beds and quickly scaled the brand to RMB 1 billion in annual sales.

Growth Phase: As demand diversified, users began seeking affordable, solid wood options across materials, price tiers, and furniture categories. Yeswood expanded from beds to a wider furniture range, evolving from a “solid wood bed brand” to a “solid wood furniture brand.”

Scaling Phase: User value became more multidimensional, including functional diversity and design aesthetics. Yeswood refined its product system around the core value of “solid wood = health,” upgrading its brand identity from “solid wood furniture” to “healthy furniture,” laying the foundation for becoming a RMB 10 billion brand.

With rising consumer inquiries like “Can you help me match products?” or “Where can I see them in person?”, Yeswood realized that offline was the next opportunity—the only channel that could offer rich, personalized, one-on-one user experiences.

But when Yeswood moved offline, it didn’t just replicate its online strategy. It returned to user value and reassessed the strategic role of offline channels. For Yeswood, the value of offline stores was not about traffic acquisition, but enhancing user experience. Instead of spending on expensive high-traffic locations, Yeswood invested in “good spaces” that offered diverse home styles and in-store experiences, and “good service” through personalized sales guidance. This created a model of “online for traffic, offline for conversion”.

To our delight, Yeswood’s national online presence drove strong brand awareness. Every new offline store felt like a national brand landing locally. Brand recognition, wide SKU offerings, and immersive offline environments significantly boosted conversion rates and average transaction values. Offline transactions per customer were multiple times higher than online. Yeswood successfully transitioned from a product-selling company to a home design solution provider, giving it a real chance to become a top-tier, RMB 100 billion home furnishing brand.

Yeswood’s case reminds us: The key to omnichannel growth is not just about tools or tactics. Any brand moving from online to offline must rethink these questions from the perspective of user value: Who is the user offline? Where do they buy? Why do they buy?

Offline businesses embrace online integration for growth

We’re also seeing a wave of outstanding offline businesses actively embracing online channels.

Starting and operating an offline business is significantly more complex and challenging than online ventures. It may not be difficult to run one great store, but scaling to 10, 100, or even 1,000 stores—each step is a critical test of survival. For offline entrepreneurs, success starts with answering four foundational questions around the core of operations:

- What to sell? This is the starting point of any business model. Though seemingly simple, many companies overlook the depth of this question.

Understanding purpose-driven consumption is key to answering “what to sell.” Purpose-driven categories form the most stable foundation of any business. Companies should build deep supply chain advantages around these core categories, differentiate their products, and establish strong barriers to entry. At the same time, they should construct product portfolios around the core category—boosting purchase frequency and increasing per-store profitability.

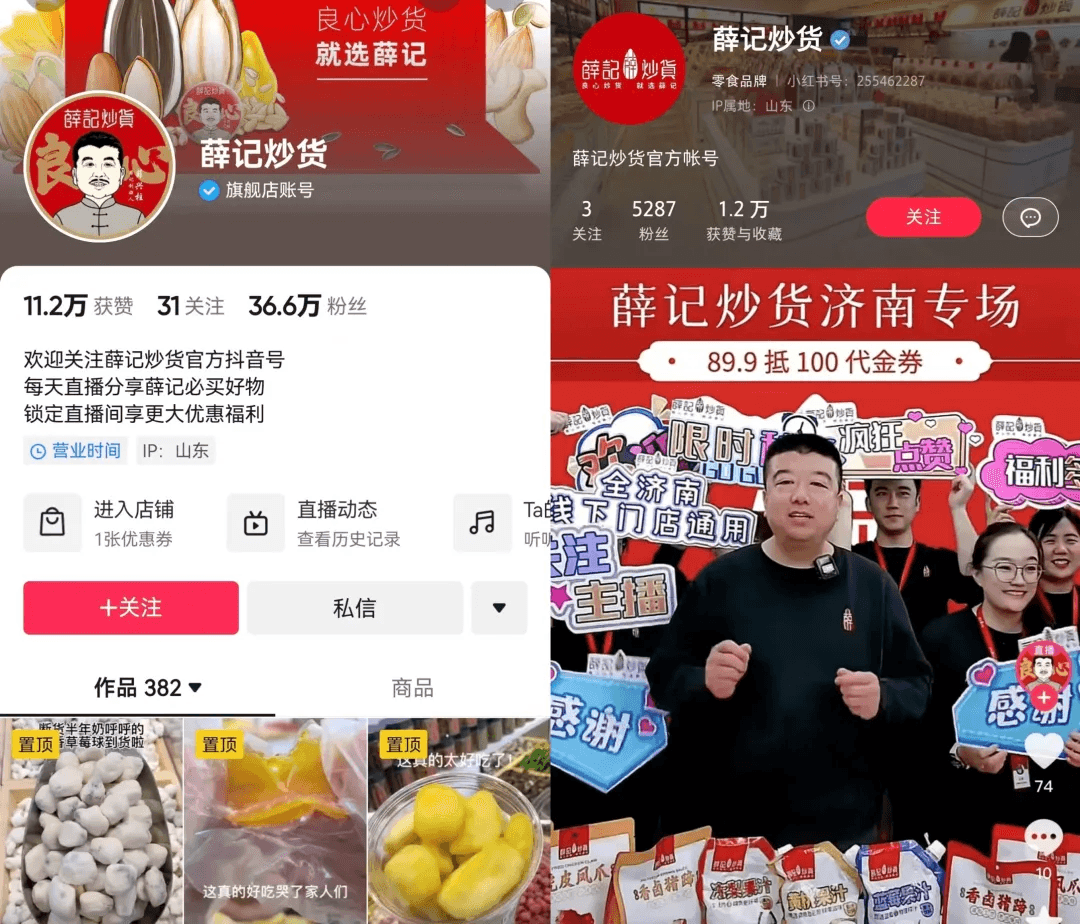

Take Xueji Roasted Nuts, one of our portfolio companies, for example. It built a stable customer base by upgrading traditional categories like sunflower seeds and chestnuts. It then boosted purchase frequency with innovative items like “yogurt mandarin slices” and “milk-stuffed dates.” This product combination is key to Xueji’s high-performing stores.

- How to sell? This determines the boundary of scalability.

What kind of differentiated experience does your store offer? Is the front-end model based on retail, made-to-order, or a combination? Is the supply chain built in-house or outsourced? How many staff does each store require? Every decision here affects your pace and limits of expansion.

For instance, Xueji embeds a “try-before-you-buy” experience in stores, uses a simple mix of made-to-order and retail products, and maintains a lean staffing structure. This approach has laid the foundation for rapid expansion.

- Where to sell? Location affects how universal your product demand is.

We’ve seen many brands perform well in shopping malls due to high foot traffic within a broad radius, supporting store-level profitability. But in truth, demand density in those areas often isn’t strong enough. Malls can be accelerators for chains, but the real long-term growth for offline retail lies outside the mall—in street-level shops and residential communities, where you’re closer to the customer.

However, not all brands are equipped to expand beyond the mall and benefit from its branding spillover effects.

- Who sells? All offline operations rely on frontline staff to fulfill value delivery.

Organizational structure and coordination are critical: how do you ensure that the passion, discipline, and attention to quality from staff remain consistent—whether you're running 1 store or 10,000? In the end, offline businesses live or die by their ability to deliver a consistent front-end experience, which is a function of organizational power and internal collaboration. This demands ongoing reflection and iteration from entrepreneurs.

These four elements shape our core understanding of what we call the “operational origin point.” This origin point is the foundation of everything. All online and digital tools are merely enhancements. If the operational core is weak or undefined, these enhancements will only steer the business further off course.

The next step is connecting online.

By integrating online traffic and tools into offline businesses, companies can immediately unlock incremental value:

First, acquire new customers and expand the boundary of your market;

Second, enhance capabilities—upgrading product development and content strategy based on online feedback;

Third, improve operational efficiency—shifting decision-making from intuition to data-driven insights.

Our portfolio companies Xueji and Himo Portrait Studio have both launched TikTok livestream campaigns in cities where they have dense offline store networks. The majority of traffic acquired was from new users. At the same time, the companies developed and tested viral product bundles to improve online conversion efficiency and began using digital tools to analyze user behavior in depth. Integrating online channels created opportunities to upgrade core organizational capabilities.

Final Stage is full online-offline integration.

Everyone loves to talk about digital transformation. But the real goal of digitalization is not simply to digitize processes—it’s to digitize growth and user value. The greatest competitive advantage of offline retail is the trust built with users, which enables higher lifetime customer value and lowers the total cost of customer acquisition. When a company’s operational core is truly integrated with online capabilities, it results in the digital embodiment of user value.

This integration allows businesses to: Accurately expand into the right categories; adjust store formats with precision; continuously acquire new users; extend customer lifetime value; and lower the marginal cost of operations.

This is a vision we look forward to exploring alongside the best companies in the industry.