“The new generation of national brand” is one of GenBridge’s key investment themes, leveraging the ever-maturing integrated online and offline retail channels and media infrastructure. The massive Chinese population and sizable market provide an expansive growth space for these brands to evolve into enterprises with tens of billions of revenue. Currently, GenBridge’s “new generation of national brands” collectively constructs national brand club with more than 30 billion annual sales revenue. Under this theme, Harvest has made IPO in HKSE in October, and other portfolios are maintaining strong growth momentum and market influence in their respective sectors, jointly serving more than 100 million Chinese households.

“National brands”, in most cases, are born out of “change”, with shifts ranging from alteration in media to structures of retail channels, all hatching the birth of new generation brand champions. Over the past decade, the market engine has continually shifted, transitioning from offline supermarkets to shelf e-commerce and then content e-commerce. Yet even among the turbulent and constantly evolving market landscape, there are always brands that can identify opportunities and turn them into sustained growth, evolving into “national brand”. The unwavering commitment behind these brands turns out to be the key to navigating through cycles and mastering change.

Against this backdrop, the founders of “New Generation National Brands” convened for a thematic roundtable during the Founders Session of GenBridge’s 2023 AGM in Shenzhen. The discussion was themed around “What is the unchanging core of the new generation national brands in the rapidly changing market?” This roundtable featured insights from founders including Max Zhang from Yeswood, Yuezhong Zhan from Botare, Jack Xu from Peilai, Jingrui Fan and Eavan Zhang from Lola Rose, and Bella Zhou from Ripe Fruit.

We believe the philosophy, experiences, and insights from insiders at the national brand club will be a guiding light for many consumer entrepreneurs as well as readers. Below are key takeaways from this roundtable discussion.

Max Zhang, Yeswood

In the furniture category, consumer demand for better products and design has been continuously rising. However, there are still not enough products that truly meet consumer needs. I believe that new opportunities lie in offline channels, as the constraints on outdoor activities due to the recent pandemic have not diminished consumers’ preference for the in-store furniture shopping experience. In the past two years, Yeswood’s offline stores have experienced rapid growth, with offline sales proportion consistently increasing.

What remains unchanged for Yeswood is its commitment to prioritize consumer needs, delivering excellent products and services. We believe that exceptional products have three essential elements. First is design, as home furnishings are associated with fashion and aesthetics. In this fast-paced era of trends, our goal is to lead the industry. Second is quality, as products with style but lacking in quality are superficial; stable quality provides consumers with a superior experience. Third, pricing should be competitive. It’s not about being cheap, but rather having a competitive price within products of the same quality. The formula we follow is: Product competitiveness = (Style x Quality) / Price.

Beyond exceptional products, excellent services are also essential, including services on both online and offline sales fronts and various aspects of user interaction. For instance, a crucial aspect in the furniture industry is the delivery and assembly service, which Yeswood aims to elevate as a key focus to enhance the overall industry standards. We aspire to build the most professional nationwide network for large furniture delivery and assembly services.

Yuezhong Zhan, Botare

We faced two significant external changes in the past three years. The cost of upstream pulp raw material has witnessed a substantial and continuous price surge unseen in 20 years. Simultaneously, the explosive growth of the Douyin (Chinese Tiktok) channel also had a profound impact on sales. Faced with these changes, we adjusted our product positioning, shifting from a focus on cost-effectiveness to elevating both products and the brand to a higher level. This shift was driven partly by the necessity to raise prices due to the cost increase and also due to the identification of new market opportunities. The characteristics of showcasing exceptional products on the Douyin platform differ from the traditional shelf e-commerce era, and we achieved significant growth in 2023 after appropriate adjustment and adaptation.

What has remained constant for Botare is our commitment to leading and changing the industry. In 2015 when we just ventured into the tissue industry, we redefined the product by optimizing bulk shipments through reducing product sizes and increasing pack quantities. In 2021, we further improved the packaging of tissue, making it more exquisite and in larger quantities. This year, we innovatively introduced a new product that caters to consumer habits based on usage scenarios – wall-mounted tissue instead of traditional ones that are placed on tables or countertops. The wall-mounted tissue, introduced in March, became a phenomenon, selling well on Douyin and Taobao. We have already achieved a daily production of 1 million units and are aiming to reach 2 million. Our expectation is that it becomes a star product with sales exceeding 10 billion RMB.

Jack Xu, Peilai

Peilai also experienced a turbulent market in the past three years. After rapid growth from 2020 to 2021, we felt the pressure last year. The pandemic had an impact on field of daily use chemical, particularly on the manufacturing side. There were also changes in channels, with a decline in overall traffic within the Taobao ecosystem, prompting us to shift to the Douyin channel, which offered more traffic dividends. This required numerous adjustments in channel strategies, including enhancing our capabilities in content-driven customer acquisition.

Throughout these years, Peile has been committed to delivering high-value products. Now, we are building on excellent products to create compelling content. We sometimes joke that we used to be an ‘e-commerce operation,’ and now we are an ‘advertising company.’ This transformation involves a significant amount of work. Taking the setup of Douyin live streaming rooms as an example, standardizing content, and building teams—it took about half a year of investment before we truly saw returns. When we sold 10,000 units of UNNY’s double eyelid stickers through attractive content, we truly felt the power of content.

Nevertheless, the fundamental nature of our industry remains unchanged—we still focus on creating exceptional products, ensuring that consumers can trust them and repurchase in the long term. Launching well-reputed products requires efforts in team building, and we have approximately 60 categories, each with a dedicated team working diligently to cultivate and refine products.

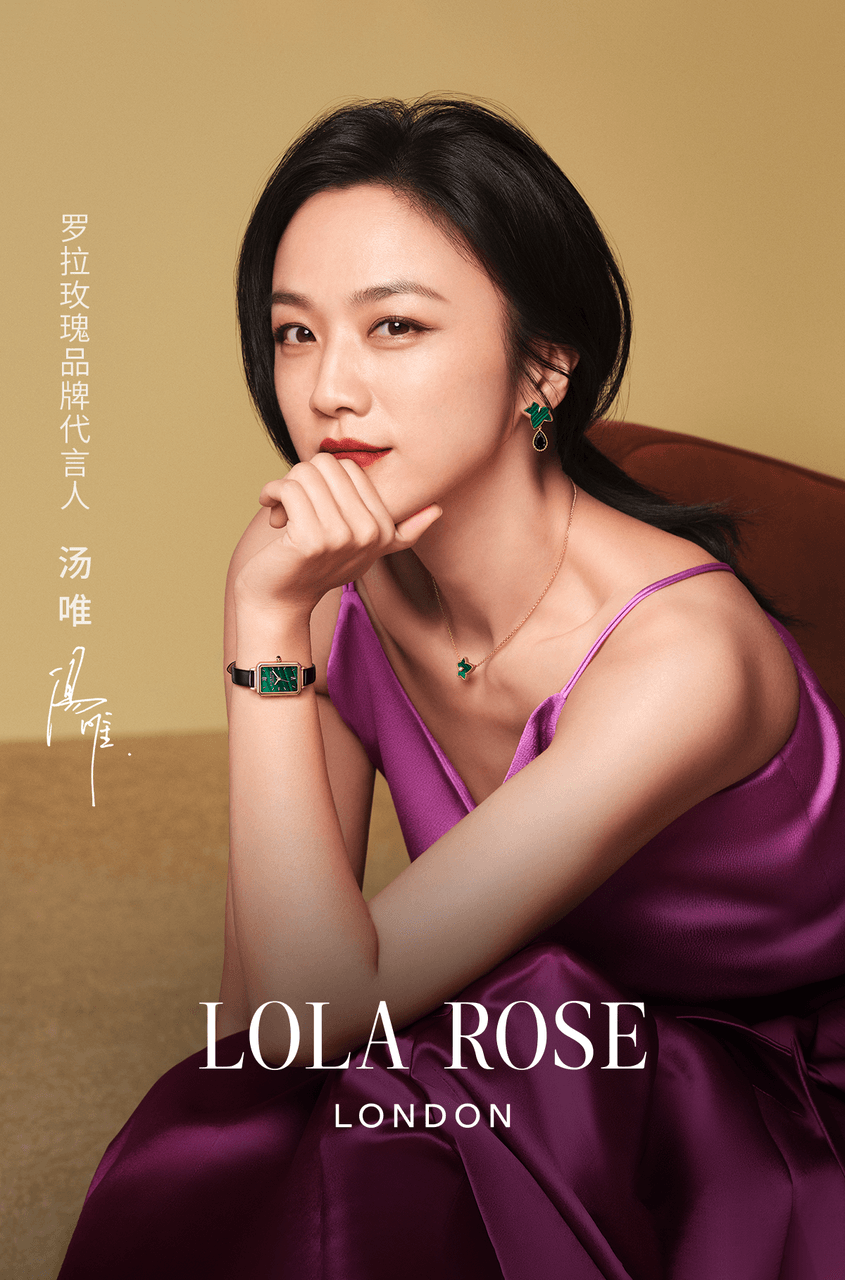

Jingrui Fan and Eavan Zhang, Lola Rose

Lola Rose is a fashion and luxury brand founded in the United Kingdom. We introduced the brand to China and eventually acquired controlling stakes in 2021. During the initial years of operation in China, Lola Rose capitalized on the rise of online e-commerce and social media, leveraging the momentum of the era for brand development. However, as the online boom subsided, we are now returning to the essence of the brand, focusing on its mission, vision, and values.

What has remained constant for Lola Rose is its dedication to serving women. As women play increasingly significant roles in society, we empower them by providing emotional connections and support, allowing the beauty of our products to become precious links between individuals. Regardless of the era, creating excellent products to meet consumers’ needs and establish resonance ensures that they will love your brand and products.

Our vision guides us not only in contemplating long-term strategies but also in effectively implementing initiatives. For instance, we have gradually expanded into offline channels, entering high-quality malls and properties such as Taikoo Hui, K11, and MixC, enhancing our channel distribution. We have also organized numerous emotionally resonant events for new product launches offline, which have proven to be highly effective. In this fast-paced era, consumers greatly appreciate emotional value, and our efforts in this regard have been well-received.

Bella Zhou, Ripe Fruit

The beverage industry, which used to be driven by the supply chain, is now being increasingly driven by consumer demand. The demands of both online and offline channels, including e-commerce, convenience stores, discount stores, and snack shops, are changing. However, the efficiency of brand investments is becoming increasingly dispersed. Faced with these changes, we plan our entire product lineup around consumer needs, with product innovation at the core, while proactively embracing new channels. On the product innovation front, our focus is on creating products that consumers love and are willing to repurchase, such as sugar-free tea for white-collar workers aged 25-35, fruit tea and lemon tea for younger students.

We believe that regardless of market changes, the commitment to continuous product innovation and providing value to users must remain unchanged. For example, when developing sugar-free tea, we pioneered the current rectangular bottle in the industry to meet consumer preferences and filed for a patent. At that time, almost no aseptic production lines in the market could directly produce this bottle shape. The solution for rapid production would have been to compromise on the production process limitations by switching to a round or a regular rectangular bottle. However, we believed that the core starting point was to deliver excellent products to consumers, so innovation and quality were non-negotiable. We decided to transform the production line, facing many challenges and significant costs during the process of exploring and modifying equipment. However, we persisted because creating innovative products that consumers love is our unwavering commitment.

George Wan, Managing Diretor of GenBridge Capital

Market changes create opportunities to build brands, but chasing the trends while neglecting the unchanging essence of a brand often leads to fleeting success. Excellent companies can enhance their capabilities, refine their organizations at the bottom of the cycle, and seize opportunities arising from changes in media, consumer habits, or channel transitions during the rebound.

In our discussions with founders, we have identified two key words for building a brand: first is ‘persistence,’ persistently creating value for users, channel partners, and the entire value chain; second is ‘choice,’ adhering to the long-term core philosophy of the brand and decisively abandoning the impact of short-term gains. I believe this is also a crucial reason why GenBridge’s portfolios go further and last longer. We look forward to exploring more ‘New Generation of National Brands’ in the constantly changing market.