On April 28, Mingming Henmang Group (hereinafter referred to as “Mingming Henmang”) has officially submitted its listing application to the Hong Kong Stock Exchange, as disclosed in HKEX filings.

According to its prospectus, Mingming Henmang’s GMV for 2024 reached RMB 55.5 billion, with over 1.6 billion transactions recorded throughout the year, continuing its leadership in the “bulk retail” model.

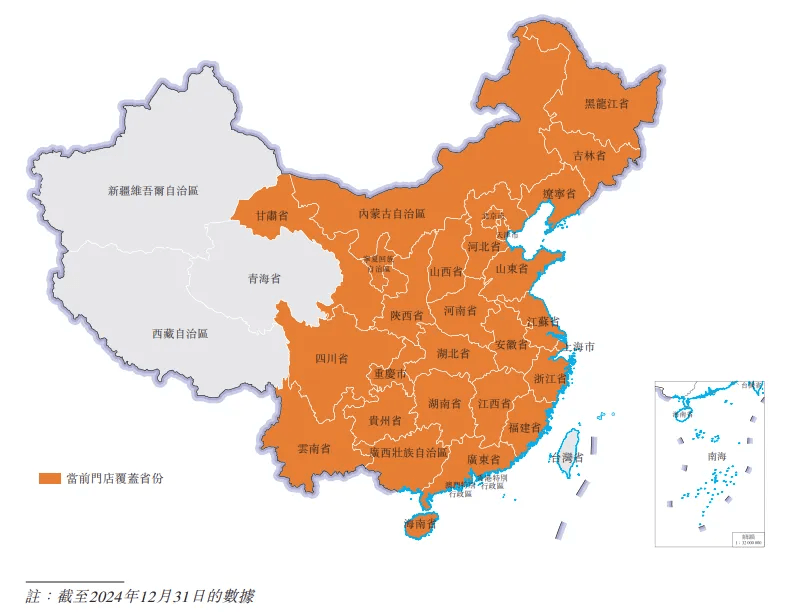

As of December 31, 2024, Mingming Henmang operated 14,394 stores across 28 provinces and all county-level cities in China, with approximately 58% of its locations situated in counties and townships.

Its sub-brands, “Snack Is Busy” (零食很忙) and “Zhao Yiming Snacks” (赵一鸣零食), have become widely recognized as top national value-for-money snack brands. According to a Frost & Sullivan report, by 2024 GMV, Mingming Henmang is the largest chain retailer of leisure F&B in China, and ranks as the fourth largest food and beverage chain retailer overall in the country.

GenBridge Capital has been investing in F&B retail chains since 2017. In March 2019, we visited “Snack Is Busy,” and by March 2021, became its first-round investor. Over the years, GenBridge Capital has had the privilege of witnessing the company’s rapid growth—from a thousand stores to ten thousand, from a Hunan local brand to a national chain, and from a single brand to a merged entity now known as the Mingming Henmang Group.

Today, Mingming Henmang, as China’s largest leisure F&B chain retailer, is preparing to go public on the HKEX, offering a compelling case study of how a buyer-side solution can succeed in a saturated market.

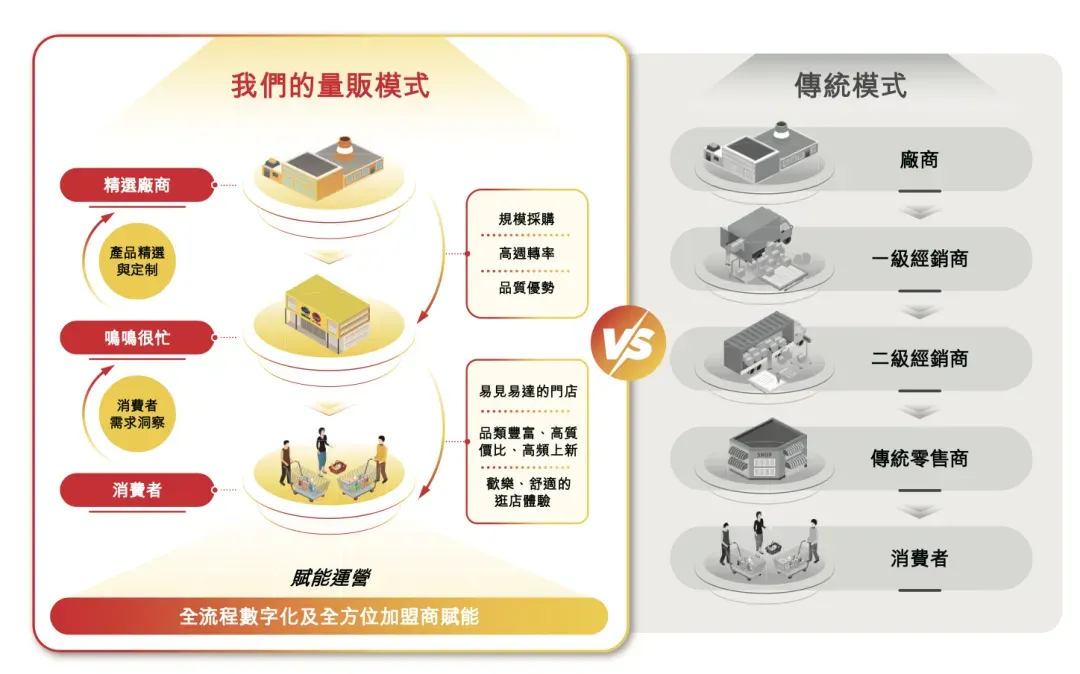

The Bulk Retail Model: Addressing industry pain points

Traditional retail models for leisure F&B are typically built around sales efficiency and production efficiency, representing a classic seller-centric approach. However, this model faces several critical issues:

Lack of deep insight into consumer demand: Multi-layered price markups hinder consumers from expressing their true purchasing needs, while a fragmented sales chain slows down the feedback loop from consumers to producers.

Limited product diversity in traditional retail environments results in aging product portfolios and makes it difficult for high-quality items to stand out.

Underdeveloped infrastructure and supply chains in lower-tier markets mean that strong consumer demand for high-quality, affordable products often goes unmet.

Mingming Henmang has pioneered a bulk retail model that directly tackles these pain points through innovative product development, an engaging in-store experience, and supply chain restructuring:

Innovative Product Development: Focusing on product selection and customization based on user demand. In 2024, over 1.6 billion customer visits took place at Mingming Henmang stores, enabling the company to build deep insights into consumer preferences, purchasing behavior, and taste trends. Thanks to a standardized product selection process, the company launches hundreds of new products each month, maintaining no fewer than 1,800 SKUs in each store.

Creating a Joyful In-Store Experience: Mingming Henmang continuously attracts customers by offering a vibrant shopping atmosphere. Through careful design of lighting, product display, and store layout, the brand transforms retail spaces into destinations that combine shopping, entertainment, and social interaction.

Supply Chain Restructuring to Improve Value-for-Money: By directly linking with manufacturers and cutting out intermediaries, Mingming Henmang leverages a network of 36 warehouses, a 300-km warehousing coverage radius, and a 24-hour logistics system to achieve an inventory turnover cycle of just 11.6 days. The cost savings are passed directly to consumers and franchisees in the form of better pricing.

From 2022 to 2024, Mingming Henmang maintained a gross profit margin between 7.5% and 7.6%, while its net profit margin increased from 1.7% to 2.1%. On an adjusted basis, the net profit margin remained stable at 2.3%. This three-year consistency validates the sustainability of its “low margin, high volume” bulk retail model.

Unique product development philosophy Building exceptional product capabilities

In 2024, hundreds of new products were launched across Mingming Henmang stores each month.

The product portfolio covers 7 major categories and includes more than 750 key brands.

Each store typically offers at least 1,800 SKUs, double the average SKU count of similar-sized supermarkets in the snack and beverage category.

Over 1.6 billion consumer visits were recorded in 2024, enabling Mingming Henmang to gain deep insights into consumer preferences, purchase behaviors, and taste trends.

As of December 31, 2024, the company had around 3,380 SKUs in inventory, with approximately 25% being custom-developed through manufacturer partnerships.

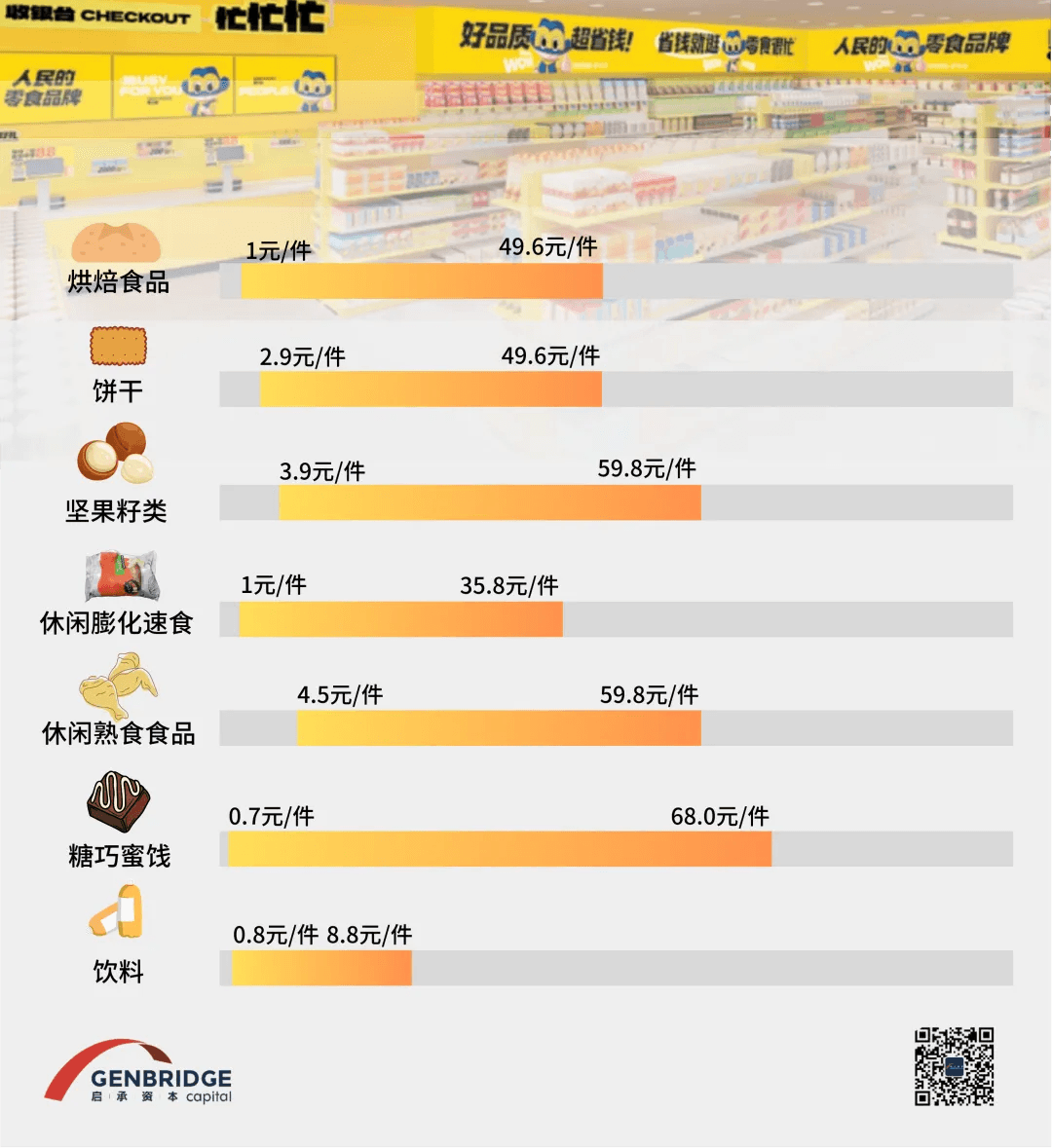

Mingming Henmang strategically works with manufacturers to develop smaller-sized packages and bulk-buy products to lower trial costs for consumers. As of year-end 2024, about 40% of its products were sold in bulk weight format.

The company has established a standardized selection mechanism including pre-selection, trial tasting, sampling, and promotion. As of December 31, 2024, the product selection team consisted of 187 members, supported by a "Crowdsourced Selection" mini program allowing franchisees, store staff, and buyers to give real-time feedback.

For instance, a custom-developed sesame-flavored vegetarian tripe product sold over 100 million units in 2024.

Thanks to its restructured supply chain and economies of scale, Mingming Henmang’s products of comparable quality are priced on average 25% lower than those in traditional offline supermarket channels.

As of the end of 2024, the company had 120 million registered members, among whom 103 million had made purchases, with a repurchase rate of approximately 75%.

Supply Chain Excellence: Scale, efficiency, and quality

Most products sold in Mingming Henmang stores are directly supplied by manufacturers, minimizing intermediate links. By GMV in 2024, the company is China’s largest leisure food and beverage retail chain, enjoying significant cost advantages through volume purchasing.

Mingming Henmang has established partnerships with over 2,300 manufacturers, about 50% of which are listed in the 2024 Hurun Top 100 Food Companies in China.

The company operates a national warehousing network with 36 warehouses, including 25 self-operated and 11 third-party warehouses, covering a total area of approximately 730,000 square meters.

Most stores are located within 300 kilometers of a warehouse, enabling delivery within 24 hours.

In 2024, the inventory turnover cycle was 11.6 days, far exceeding the industry average in warehouse efficiency.

From 2022 to 2024, the overall warehousing and logistics costs (including transportation and storage fees) accounted for 1.5%, 1.6%, and 1.7% of total revenue respectively — placing Mingming Henmang among the industry leaders in cost efficiency.

The company has built a comprehensive food quality and safety management system that covers the entire supply chain — from production and transportation to warehousing, retail, and after-sales — with a dedicated quality control team of 142 employees.

Full-process digitalization Driving operational efficiency

Between 2022 and 2024, Mingming Henmang increased its technology spending from RMB 9.6 million to RMB 53.3 million, building the largest digital operations team among China’s dedicated snack and beverage retail chains. The company has achieved full-process digitalization across product selection and procurement, warehousing and logistics, franchise and store management, and more.

On the supply chain front, Mingming Henmang was among the first in the industry to implement a digital ordering system, and has since introduced both a Warehouse Management System (WMS) and a Transport Management System (TMS).

In terms of sales, the company independently developed an intelligent retail middleware system that analyzes store-level sales data and trends to predict consumer demand using historical data algorithms.

For inventory management, Mingming Henmang was one of the early adopters of remote intelligent store auditing, using video frame analysis to evaluate shelf stock levels. Its smart POS system overcame the industry-wide challenge of digitizing bulk-weighed goods by calculating individual SKU sales volume based on the total checkout weight and each SKU’s unit weight.

In site selection, the company developed a proprietary digital location selection tool, maintaining and updating a database of key retail sites across major markets in China. As of December 31, 2024, the site database contained over 10,000 locations.

Empowering franchisees nationwide deep market penetration across China

In 2024, Mingming Henmang added 7,809 new stores, expanding its network to a total of 14,394 outlets as of December 31, 2024.

Of its 2024 revenue, 99.5% came from product sales to franchise and self-operated stores, while franchise and service fees accounted for less than 0.5%. The number of franchisees grew from 994 in 2022, to 3,377 in 2023, and further to 7,241 in 2024.

With these 7,241 franchisees, the company has established deep coverage across 28 provinces and all county-level cities in China, with around 58% of stores located in counties and townships. The Mingming Henmang brand can now be found in 1,224 counties, achieving a 66% county-level coverage rate.

As of December 31, 2024, Mingming Henmang had a dedicated team of 25 full-time trainers and 44 city managers responsible for providing end-to-end franchisee training.

For store assessment, a 2,398-member store operations team was in place (one-third of whom were store supervisors), conducting regular inspections to ensure operational quality. A performance scoring system is used to quantify and evaluate store operations, focusing primarily on food safety, quality control, and customer satisfaction. Stores with lower scores receive actionable, tailored improvement plans, while high-performing stores are rewarded with incentives such as freight discounts.

From 2022 to 2024, the share of total sales contributed by the company’s largest franchisee declined from 2.6% to 1.0%, reflecting a diverse and healthy franchise network structure.

Joyful in-store experience A deeply resonant brand identity

Most Mingming Henmang stores range from 140 to 190 square meters in size, with flagship stores in premium locations reaching 250 to 300 square meters.

The company has developed 30,000 visual merchandising templates, enabling each store to retain regional uniqueness (“a thousand stores, a thousand faces”), while maintaining a unified brand design language across its nationwide network.

As one of the first F&B retail brands in China to employ celebrity brand ambassadors, Mingming Henmang has significantly enhanced brand awareness and built emotional resonance with younger consumers. Related online campaigns have generated over 2.5 billion impressions.

In terms of IP creation, the brand’s self-developed mascots “Baby Busy” (a cowboy,小忙) and “Baby Ming” (a superhero, 小鸣) are widely loved by customers and help cultivate a cheerful, approachable brand image.

Mingming Henmang also collaborates with multiple third-party IPs and food & beverage brands—such as Milk Dragon (奶龙) and Want Want (旺旺)—to launch co-branded products and expand marketing reach.

In 2024, its concept stores garnered over 1.6 billion views on TikTok China.

In early 2025, its New Year Product Sales Campaign achieved 1.6 billion online exposures.

The company also launched several innovative concept stores in 2024, including:

“Super Snack Is Busy” (超级・零食很忙)

“Snack Is Big” (零食很大)

“Zhao Yiming Snack Lab” (赵一鸣零食研究所)

Notably, the Changsha flagship store “Snack Is Big” recorded over RMB 1 million in daily GMV, making it a local landmark for next-generation retail.

Mingming Henmang: A buyer-side solution in a saturated market

GenBridge Capital has observed that over the past 30 years, China’s consumer market has shifted structurally from a supply-constrained seller’s market to a demand-driven buyer’s market. In this transformation, market power has returned to consumers, and the entire circulation logic of consumer goods is being redefined.

Such structural shifts are often sweeping, but they also open opportunities for industry reshuffling. The companies that emerge successfully all follow one retail truth: the ability to build effective channels and genuinely meet consumer needs determines long-term success.

Retailers—those closest to the end consumer—are playing an increasingly vital role in this new landscape.

Costco, since the 1990s, pioneered the model of “quality and value,” developing its private label Kirkland, which has now become the world’s largest consumer brand by revenue.7-Eleven Japan succeeded by reverse-developing products based on consumer demand, forming production alliances with suppliers to ensure continuous innovation. Today, 7-Eleven is Japan’s largest food company.

These outstanding enterprises, from Costco in the U.S. to 7-Eleven in Japan, flourished in saturated markets. Their success was grounded in deep consumer insight and the delivery of what the times demanded: a buyer-side solution.

Today, we are witnessing the same pattern in China. From Mingming Henmang’s expansion to Yonghui Superstores’ shift toward quality retail, Chinese retail enterprises are increasingly adopting a consumer-centric mindset—and offering corresponding answers to a new market reality.

This is the only truth about the transformation we are witnessing.