In the past two years, the retail industry, amid a wave of transformation and upheaval, has experienced unprecedented levels of activity.

Online, old and new forces are shifting rapidly, discussions of "consumption downgrade" are widespread, and content-driven e-commerce platforms are fiercely competing for consumer attention. Offline, while large hypermarkets are facing decline, membership-based warehouse stores are racing to expand. Coupled with an overall slowdown in retail growth and consumers' ever-evolving demands, the industry has clearly reached a turning point.

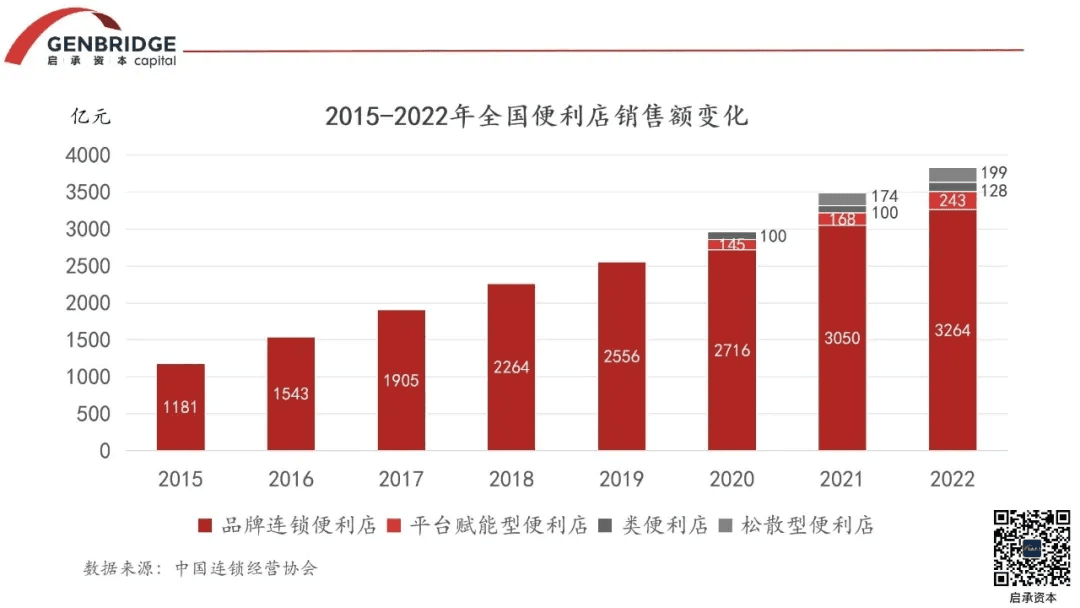

Among all this change, the convenience store sector has emerged as one of the few areas of certain and sustained growth.

Data shows that over the past three years, convenience stores have been among the fastest-growing retail formats in China. In 2023, national sales for convenience stores reached 424.8 billion yuan, with a year-on-year growth rate of 11%. The total number of stores grew to 320,000, representing a 7% increase year-on-year.

The main drivers behind this growth are branding and chain expansion. Over the past decade, the number of branded chain convenience stores has increased from 60,000 to 320,000 locations. Meanwhile, the growing consumer base of young people is pushing brands to iterate and upgrade, drawing many small business owners into the franchise model.

However, compared to the six million individually-owned "mom-and-pop" shops across the country, chain convenience stores still account for less than 5% of the market—meaning there is plenty of room for further growth.

Several years ago, GenBridge Capital already predicted that China’s convenience store market was entering a period of rapid development. Victor Zhang, our founding partner, noted that China's urbanization rate has reached a critical point, forming high-density residential communities of 10,000 households within 10-15 square kilometers. This unique urban density enables consumers' daily needs to be fulfilled within walking distance, creating fertile ground for the rise of local convenience store brands.

Driven by this strong belief in the sector, GenBridge Capital decisively invested in New Joy Mart, a local convenience store chain, in 2018, supporting its transformation toward a powerful franchise model.

Today, New Joy Mart has established a strong foothold in Changsha and has continued to grow against fierce competition, becoming a leading regional chain with 1,000 stores, based in Hunan and expanding across Central China.

Breaking away from consumers' traditional perception of convenience stores as expensive, New Joy Mart offers highly affordable products such as fresh draft beer at just 3.9 yuan per 500g, fresh milk at 4.9 yuan per 500ml, and iced Americanos for 4.9 yuan. These high-quality, cost-effective products have won over many consumers — for example, over 100,000 bottles of New Joy Mart’s draft beer are sold each week. New Joy Mart has even earned the nickname: "Changsha’s favorite convenience store for office workers."

In Hunan — a region known for its hyper-competitive, highly developed offline retail market — how exactly did New Joy Mart manage to break through the fierce competition?

New Joy Mart's strategy of “addition”

In the eyes of Minyi Wu , founder of New Joy Mart, its growth has been fueled by two major tailwinds of the times:

First, product categories are evolving — coffee has shifted from powder to liquid form, milk has transitioned from ambient to chilled storage. When such changes occur, small brands or niche channels have the opportunity to capture incremental growth within more specialized subcategories.

Second, distribution channels are undergoing rapid transformation. Large hypermarkets — especially in the Central China market — have been in sharp decline. Wu sees this shift as a reorganization of the supply chain. When the number of nodes in the supply chain decreases, new opportunities emerge for redesign and recombination.

Minyi Wu possesses an exceptional natural instinct for retail. He keeps a close eye on macro trends while placing meticulous emphasis on details and data. However, looking back at his background reveals that he is not a "born-and-bred" veteran of retail. Originally trained as a medical student, Wu entered the convenience store business later in life, adopting the mindset of "running a convenience store with the diligence and care of a doctor."

This unusual background led him to focus deeply on essentials. Wu believes that the fundamental human needs for food revolve around protein, fat, sugar, and caffeine. Beyond these basics, differentiated innovation is merely a "nice-to-have." To truly create products that move consumers, one must return to the core principle: the value-to-price ratio.

Wu firmly believes that if you can offer better quality at a lower price, you will naturally win over consumers. Thus, his strategy is to break through category mindshare with superior value-for-money, rather than being distracted by flashy but impractical innovations that may not suit the realities of the Chinese market.

This approach sets New Joy Mart apart — distinct from the relatively upscale Japanese-style convenience stores, and from the aggressive but often unsustainable Internet-driven innovations, as well as from traditional convenience stores stuck in ambient-temperature products.

For example, in terms of merchandising, New Joy Mart differentiated itself with a unique store positioning as "a dairy shop + breakfast shop + spicy food/coffee shop," serving nearby communities with fresh, short-shelf-life, temperature-sensitive products — offering added value beyond basic convenience.

Thanks to its fresh food-centric category structure, New Joy Mart has also made continuous improvements in store operations:

Cold Products: New Joy Mart stores are equipped with 4-section open display fridges, double-door refrigerators, and freezers to accommodate chilled meals, sandwiches, fresh milk, ice cream, and other low-temperature products. These offerings align with the preferences of younger consumers. The 7-day repurchase rate for "cold" items among members reaches 36%, and for fresh milk alone, it hits 41%.[1]

Hot Foods: New Joy Mart is well-equipped with hot food facilities, including coffee machines, egg tart warmers, sausage grills, steam bun cabinets, tea egg cookers, and hot food display cases. These setups meet consumers' diverse needs for "five meals a day," with a 7-day breakfast repurchase rate among members reaching 50%.

Freshness: Given the very short shelf life of fresh foods, the earlier products arrive at the store, the more selling time they have. New Joy Mart ensures daily delivery of refrigerated products to stores, maximizing the freshness window and extending the potential selling time.

According to Minyi Wu, New Joy Mart’s category strategy can be broken down into two main steps:

First, select growth-oriented categories that can also build long-term competitive advantages, such as fresh milk, coffee, beer, and so on.

Second, dedicate three to four years to developing and accumulating expertise within each category. Currently, New Joy Mart’s category strategy is focused on expanding from fresh milk into chilled dairy and ice cream. For high-repeat-purchase products — besides spicy food — New Joy Mart also provides high-quality, cost-effective options in categories like fresh draft beer and freshly brewed coffee, and has achieved notable breakthroughs.

By concentrating on core categories like dairy products, breakfast foods, spicy dishes, and coffee — all of which are chilled, short-shelf-life, and high-frequency purchase items — New Joy Mart has firmly established a strong brand perception among consumers: fresher products with better value for money. These core categories have built New Joy Mart’s differentiation moat and significantly driven both overall and same-store sales growth, contributing the majority of the stores’ sales and gross profit.

For instance, New Joy Mart once upgraded some older franchise stores that previously focused mainly on tobacco, alcohol, and ambient goods. By introducing differentiated chilled, short-shelf-life categories along with new marketing efforts, these stores saw an immediate boost of around 2,000 yuan in daily sales. After six months of operation, same-store sales at the upgraded locations had grown by 40% to 50%.

Fresh food has now become the main driver of revenue for convenience stores — a shift closely tied to changes in demographics and consumer habits.

From the consumer side, "younger demographics" have become the primary group of high-frequency convenience store users. Retailers must therefore meet their needs across multiple time slots and consumption scenarios to stay competitive.[2]

Among these needs, standardized brand stores, more complete product assortments, and richer fresh food options have become key factors in attracting this generation of young consumers to place orders.

However, fresh food, due to its short shelf life, often faces the significant challenge of high spoilage rates. So how has New Joy Mart managed to build strong core competencies in fresh food?

The answer lies at its supply chain.

New Joy Mart started by acting as a direct distributor for manufacturers, and gradually built its own logistics system capable of delivering refrigerated and frozen goods daily to thousands of stores. It also developed a highly automated and mechanized multi-temperature logistics network, effectively reducing the logistics costs for cold chain operations.

By stepping into the supply chain, New Joy Mart shortened the chain and integrated data across factories, store sales, logistics and inventory management, and ordering cycles. Whereas the supply chain from factory to consumer used to involve around five decision-making nodes, it now only involves three, and in the future, it might even be streamlined to just one. As a result, overall efficiency increased, waste decreased, and profit margins became more certain.

Today, New Joy Mart operates one of the most efficient ambient and cold chain systems in China, achieving daily cold chain deliveries, with cold chain products accounting for up to 40% of sales at the store level.

Through years of practice, New Joy Mart has gradually found the optimal solution for supply chain efficiency.

Minyi Wu once summarized convenience store operations with this insight: "A convenience store is essentially a porter. The two most critical questions are: what should you carry to make customers buy more, and how can you maximize end-to-end efficiency?"

Deepening penetration in county-level markets

Today’s convenience store competition landscape in China can be summarized as "foreign players dominate the top, domestic players drive transformation." While intense battles continue in first- and second-tier cities, lower-tier markets are increasingly becoming key battlegrounds for major players.

According to the 2023 Overview of the Convenience Store Sector, over 70% of surveyed convenience store enterprises chose an expansion strategy for 2024. However, only 24% planned for cross-regional development, while a significant 74% preferred to deepen their presence in existing regions.

The China Chain Store & Franchise Association pointed out that while foreign convenience store chains are mainly expanding from top-tier cities to new first-tier and provincial capital cities, domestic chains are moving into third- and fourth-tier cities and even county-level markets. The trend of convenience store expansion into lower-tier markets is still accelerating, with many already entering fourth- and fifth-tier cities and counties.

Minyi Wu had early insights into the vast opportunities in county-level markets. He noticed that in many counties across Hunan, branded retail channels were largely absent. Specifically in the convenience store sector, these areas represented untapped markets where mom-and-pop stores still dominated and foreign giants had yet to venture.

At a convenience store conference, Minyi Wu also shared a telling statistic: 15 yuan per hour — this is the average hourly wage of a county-level consumer in China. These consumers have the willingness to spend, but lack access to products that can match both their spending power and quality expectations.

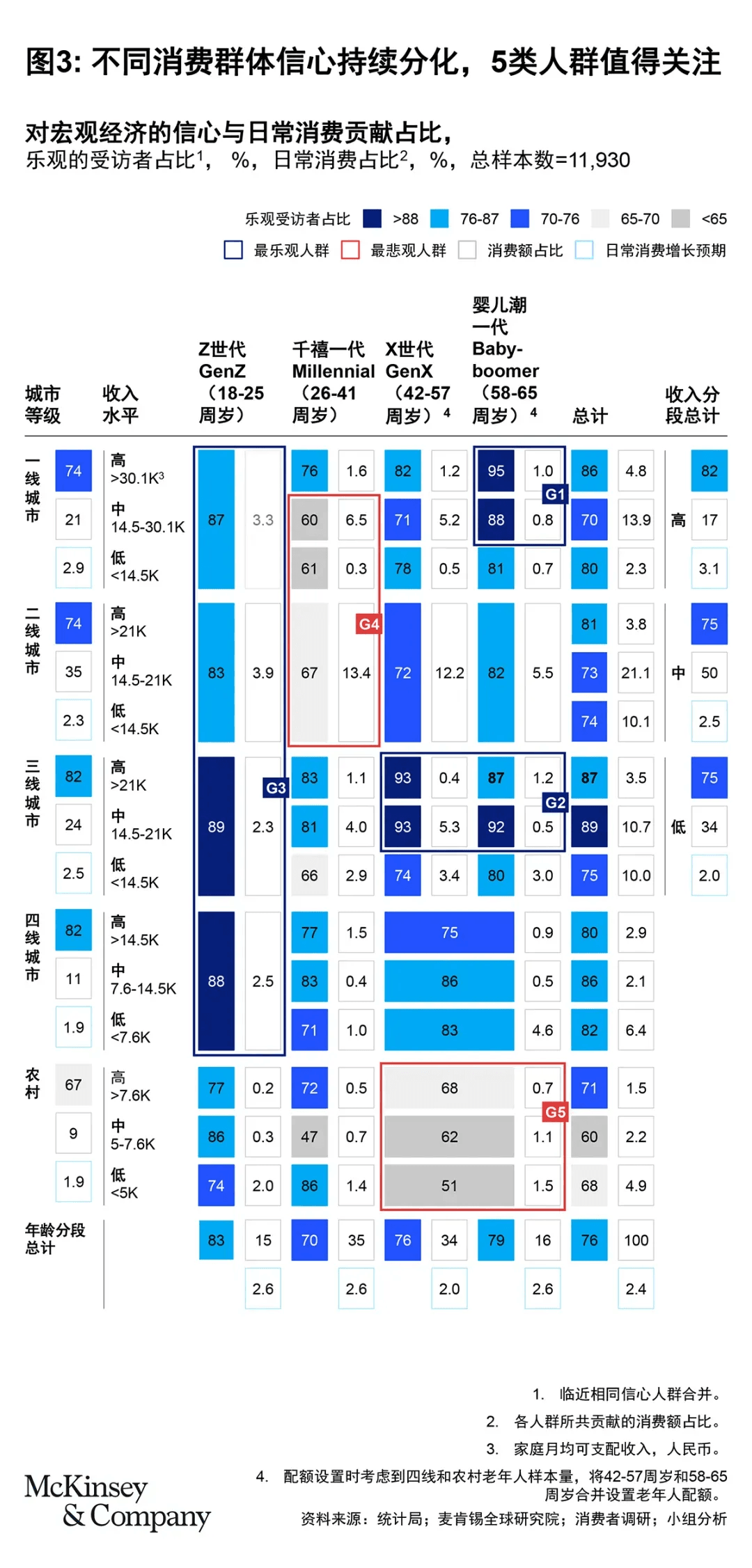

According to McKinsey’s 2024 China Consumer Trends Survey, the urban Generation Z population — largely made up of single students and junior office workers — holds a relatively optimistic view of macroeconomic prospects and family finances. They generally believe their income will grow in the future and do not feel the need to be overly frugal.

Thus, although the daily consumption-to-income ratio among urban Gen Z is relatively lower than that of other generations, they exhibit a stronger willingness to spend.In terms of consumption structure, their spending proportion, total amount, and growth rate in categories like food and beverages, pet supplies, and cultural entertainment all surpass those of other generations.

While there is abundant consumer demand in county-level markets, high-quality supply remains insufficient.This creates a fast-growing blue ocean that New Joy Mart — with its emphasis on cost-effectiveness — is perfectly positioned to capture.

After fully transitioning to a strong franchise model, New Joy Mart's 2024 strategic focus has shifted toward third- and fourth-tier cities. With 40% of its product mix made up of cold chain items, and its strengths in chilled dairy, fresh food, breakfast, coffee, and beer, New Joy Mart has built powerful weapons for market expansion.

Beyond its product strength, eye-catching signage, clean and orderly store environments, and warm, standardized service have made New Joy Mart highly competitive in county towns, where lower rent and labor costs significantly shorten the payback period, enabling stores to operate far more smoothly.

Overall, New Joy Mart's strong franchise model yields the highest store-level profits across all models, even exceeding that of direct-operated stores. According to Minyi Wu, New Joy Mart’s strong franchise stores can achieve daily sales of over 8,000 yuan, typically reaching full return on investment within a little over a year.

For instance, stores in and around Changsha can achieve net profits of 300,000 yuan per year.

Top-performing stores with daily sales exceeding 10,000 yuan can even recoup their investment within one year — a level of efficiency rarely matched by other models.

New Joy Mart’s rapid rise is also closely tied to the booming trend of instant retail.

Instant retail essentially refers to the "takeout-ization" of retail, and to capture the early advantage of this trend, retailers must adjust products, services, marketing, and digital capabilities while also leveraging platforms to better adapt to the evolving environment.

New Joy Mart seized this opportunity, using digital tools to enhance efficiency, and enabling customers to order online and receive delivery within 30 minutes, which provided a more efficient and convenient shopping experience.

According to related data, New Joy Mart’s online channels account for 16% of total sales.It commands 57% of the convenience store market share on Ele.me and 36% on Meituan in Hunan province.[3]

By ensuring product freshness and stability through its highly efficient supply chain, and combining high traffic with strong conversion, New Joy Mart has quickly secured a firm foothold in Hunan, and continues to expand deeper into lower-tier markets.

The new generation of convenience stores chain

The "new" in New Joy Mart is not only about using fresh food categories to push upward into supply chain integration and downward into county-level penetration. More importantly, it’s about not blindly copying foreign convenience store models, but instead adapting and innovating to forge a truly differentiated path for China’s next generation of convenience stores chain.

As the lines between distributors and manufacturers become increasingly blurred, the concept of "manufacturing-retail alliances" has become a hot topic in the retail industry.

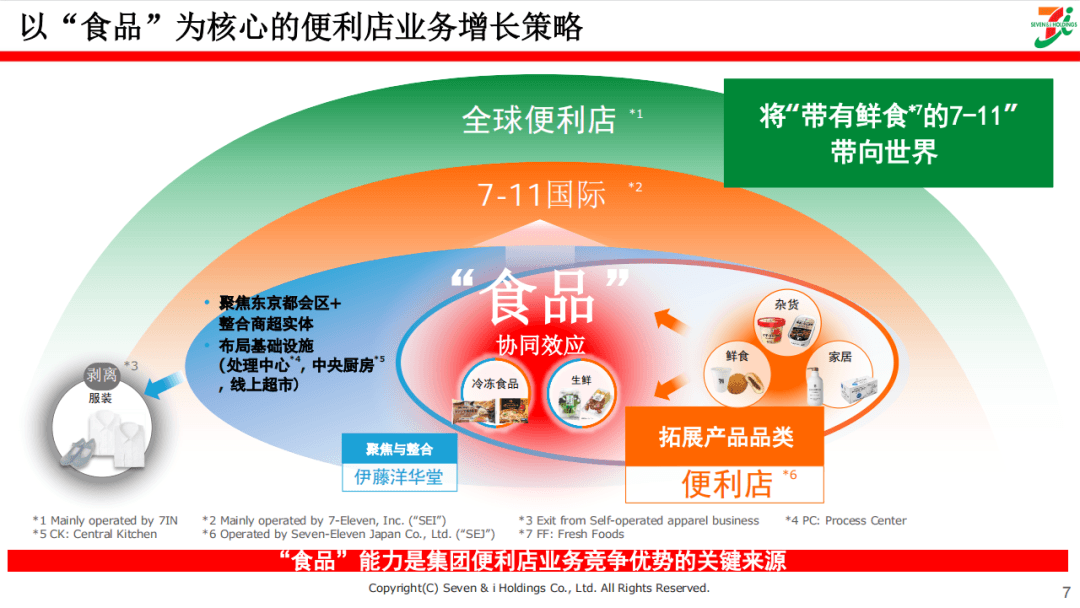

Taking a page from 7-Eleven’s success, we see that manufacturing-retail alliances were a key driver behind 7-Eleven’s counter-cyclical expansion and its eventual rise as a convenience store giant.

In 1979, 7-Eleven Japan established the Delica Foods Cooperative (NDF) to coordinate supply chain partners in producing ready-to-eat meals. By the mid-to-late 1980s, 7-Eleven began inviting Japan’s leading brands to participate in NDF, providing fresh food supply for different regions.

Over the next two decades, the number of 7-Eleven stores skyrocketed from fewer than 200 in the 1970s to tens of thousands.

By collaborating with industry partners, 7-Eleven developed many consumer-driven, channel-exclusive products, such as fresh ramen kits and freshly baked goods delivered daily. Simultaneously, it innovated in logistics, enhancing freshness while reducing costs.

Due to the increased freshness from frequent deliveries, rice balls and bento boxes gradually became 7-Eleven’s stable cash cow products. From the data: In 1979, ready-to-eat food accounted for 10.9% of 7-Eleven’s sales. Today, that number has exceeded 30%. 7-Eleven has thus rightfully earned its reputation as the "white-collar cafeteria" and "the happy homeland for office workers."

Similar to 7-Eleven, New Joy Mart has also started to develop a localized version of the "manufacturing-retail alliance" strategy.

On one hand, Minyi Wu realized early on that the Japanese convenience store model of ready-to-eat foods (such as oden, rice balls, sushi, desserts) does not fully fit the Chinese local market.

Take the Hunan as an example: The annual fast-moving consumer goods (FMCG) market size reaches several hundred billion yuan, yet oden’s annual sales may not even exceed tens of millions.By contrast, people in Hunan consume hundreds of billions of yuan worth of spicy foods every year, along with over 10 billion yuan of milk and several billion yuan of beer. These are the truly essential categories.[4]

On the other hand, after identifying the key categories, New Joy Mart’s strategic approach became clear: Add value on the product and service sides — constantly improving quality within the same price range; subtract costs on the supply chain side — through deep collaboration with manufacturers, building its own logistics system, and continuously optimizing supply chain expenses.

For example, in the fresh beer category, Minyi Wu pointed out:

The core ingredients of beer are simply water, alcohol, hops, and live yeast — the production cost is low, but traditional supermarkets maintain high markup rates. This leaves huge room for optimization, allowing a channel like New Joy Mart to "bring prices down" for consumers.

To address this, New Joy Mart formed a strategic partnership this year with Hunan Xiangjian Craft Brewery. They co-developed custom-brewed products for New Joy Mart, including German-style wheat beer, Belgian-style wheat beer, and IPA craft fresh beer, and distributed them via New Joy Mart’s own cold chain daily delivery system to each store.

As a result, New Joy Mart Fresh Beer was priced even lower than industrial beer. At just 3.9 yuan per jin (half a kilogram), the fresh beer became an instant online sensation, selling over 100,000 cans in just one week.

In May this year, construction began on the second phase of New Joy Mart’s Industrial Park. Once completed, the park will have the capacity to support 10 billion yuan in retail sales and over 5,000 stores, providing a solid foundation for New Joy Mart’s continued rapid growth.

As of now, New Joy Mart has around 1,000 stores signed or pending opening. This year, New Joy Mart plans to open another 500 new stores, gradually expanding from third-tier cities at the intersection of Hunan, Hubei, and Jiangxi provinces.

Today, China’s consumer industry has entered a retail channel-driven buyer’s market.

Retailers are taking greater control over product definition, merchandise management, and store experience and service capabilities, ushering in a new wave of retail transformation.

Amid this era of change, GenBridge will continue working closely with its partners to identify new industrial growth opportunities and to support the rise of the next generation of consumer champions.

References:

[1] New Joy Mart with You, "New Joy Mart Industrial Park Project Breaks Ground!"

[2] Retail Business Review, "Convenience Stores 'Leap Forward' Toward 500 Billion"

[3] Retail Business Finance, "New Joy Mart Continues Evolving: Expanding into County Markets, Boosting Instant Retail"

[4] Zhaibo, "In the Era of Discounting, How Can Convenience Stores Reclaim Their Advantages?"

Our Insights

- Convenience stores like New Joy Mart are becoming the most critical offline channel for food brands in China. Not only do they hold the potential to become the next-generation Key Accounts (KAs), but they also carry the strategic roles of brand building, price anchoring, and new product launches. In terms of scale, convenience stores are likely to become China’s most widespread retail format — with multiple brands building nationwide 10,000-store chains.

- To become a true 10,000-store leader, operators must build highly efficient store operations, a daily-distribution-capable supply chain, and a portfolio of fresh, short-shelf-life products that deliver unbeatable quality and value.

- New Joy Mart represents the convergence of three major forces reshaping food retail in China: localization into communities, a shift toward value and discount, and vertical integration through in-house manufacturing.

- At GenBridge Capital, we approach this space with a dual identity — as both investors and industry practitioners. We’ll continue doubling down on food retail and supply chain innovation, bringing leading international best practices (from markets like Japan) into localized execution for China.

We’re actively growing our “Great Taste” ecosystem - and always open to connect and collaborate with fellow industry leaders.