As we enter 2025, consumer brands find themselves at a highly paradoxical inflection point:

On one hand, supply is abundant and channels are intensely saturated, with price wars, anxiety over viral hits, and public opinion crises unfolding one after another;

On the other hand, users are becoming increasingly difficult to capture. Search activity is declining, attention is fragmented across content platforms, loyalty is weakening, and growth paths are growing more uncertain.

Growth models that once relied on channel dividends, traffic arbitrage, or single blockbuster products are rapidly losing effectiveness. For brands, the real challenge is no longer whether they can still sell, but whether they can continue to be chosen by users over time.

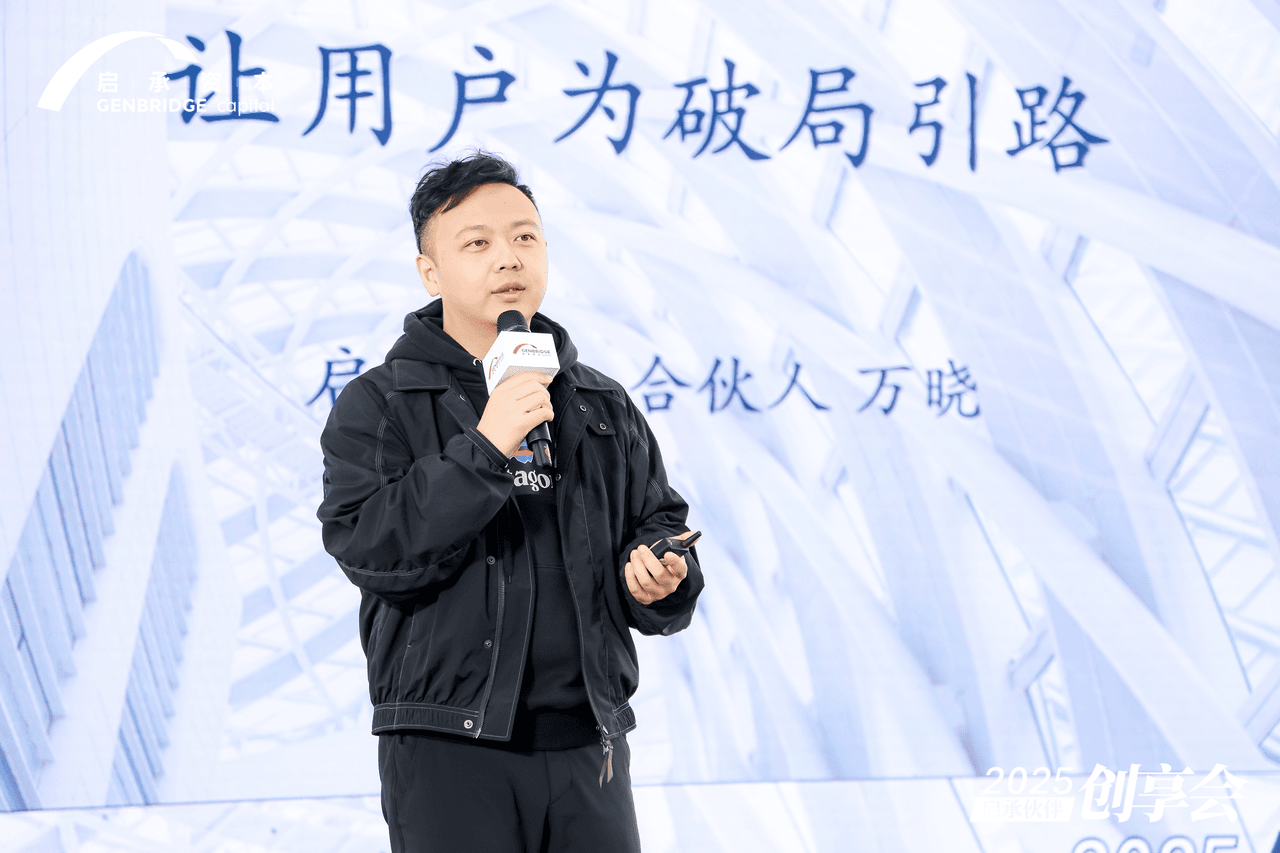

At GenBridge 2025 Portfolios Gathering, George Wan, Partner of GenBridge Capital, offered a clear judgment: in a highly uncertain environment, when companies seek a breakthrough, only two forces can truly lead the way—the founder and the user. The driving force of growth is shifting from channels to users themselves, and brands must move from “supply-driven” to “user-driven,” rebuilding their ability to understand, connect with, and serve users.

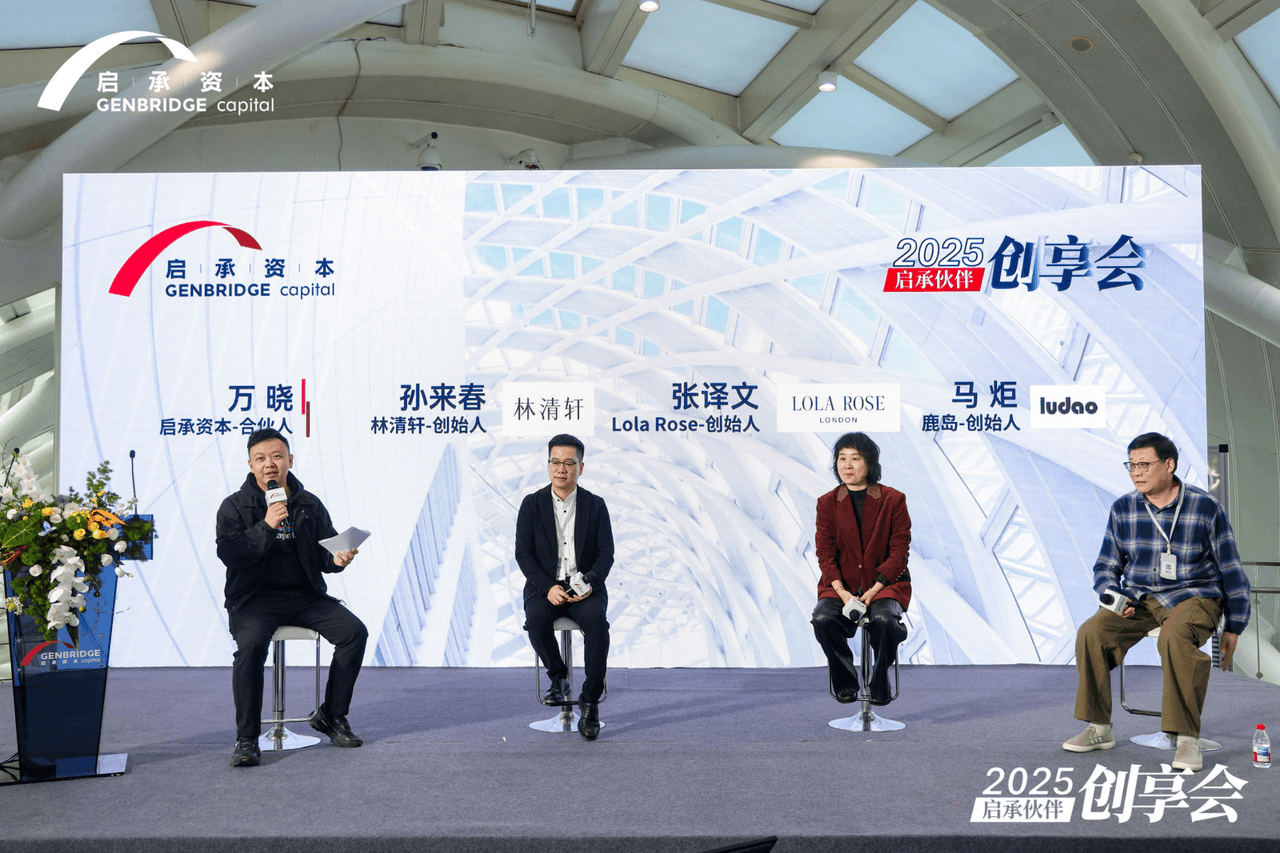

Building on this judgment, George Wan joined Laichun Sun, Founder of Forest Cabin, Yiwen Zhang, Founder of Lola Rose, and Ju Ma, Founder of Ludao, for a roundtable discussion. The insights shared by the three founders all pointed to a clear logic:

Users are not labels for marketing, but the starting point of product decision-making.

Good products are not accidental outcomes driven by inspiration, but the result of long-term insight and repeated iteration.

And when brands enter the scaling stage, what truly differentiates them is no longer isolated capabilities, but whether they can consistently replicate user-centric judgment through the organization.

Users determine direction, products carry value, and organizations determine how far a brand can go—together forming the new foundational structure for consumer brands navigating cycles in 2025.

The following content is compiled from the keynote speech by George Wan,Partner of GenBridge Capital and panel discussion with the founders of Forest Cabin, Lola Rose, and Ludao.

Let users lead breakthrough

George Wan noted that in a highly uncertain environment, companies continuously search for ways out of difficult situations, yet only two forces can truly guide them: founders and users.

In 2025, many GenBridge partner companies identified new opportunities from the user perspective, achieving breakthroughs across products, business models, and organizational structures.

For example, Shiyue Daotian evolved from its original Wuchang rice business into a “corn universe” centered on corn; Forest Cabin identified the strategic hero product “Little Gold Pearl” lotion from user feedback, achieving over RMB 100 million in sales within three months.

Lola Rose incorporated Chinese aesthetics and emotional value into its existing products, elevating its brand positioning; Ludao’s membership stores expanded from lower-tier markets into Shanghai’s core business districts, opening broader space for a value-for-money lifestyle.

Ripe Fruit, Botare, Himo, M Stand, Peley, and other partner companies have continued to create user value through product innovation, cross-industry collaborations, format expansion, and overseas store openings.

Based on these practices, George Wan identified two major trends shaping consumer brands in 2025:

First, the transition from “supply-driven” to “user-driven.”

In the supply-driven era, brands primarily grew through shelf-based e-commerce. Users actively searched, and brands could win transactions by ranking high through pricing and operational efficiency, with relatively low requirements for deep user insight. At that time, brands focused more on supply chain strength and multi-channel expansion fundamentals.

As the stock-driven era arrived, channels changed. Users began to browse content rather than search for products, and brands that relied solely on search positions were easily intercepted by content-driven brands. As a result, more companies are shifting toward user-driven models, embedding content capabilities into their systems and forming a new growth loop of “user insight–content reach–product innovation.”

Second, the organizational upgrade from “distributed” to “integrated.”

In the past, when building blockbuster products, companies operated as distributed organizations, with R&D, sales, and marketing functioning separately. Today, organizations need to be flatter and more focused. Increasingly, companies are building integrated organizations, where a core leader or decision-making group connects all functions from the user perspective and makes unified decisions.

For store-based businesses, store managers have become the scarcest resource; for brand-driven companies, attention is shifting to product general managers and product owners.

As each product’s full commercial unit forms the most fundamental cell of brand growth. Founders are no longer the sole integrators, but must cultivate teams with holistic capabilities to drive multi-category innovation.

In addition, in response to frequent brand crises, intense competition in food delivery, and rising enthusiasm for overseas expansion in 2025, George Wan highlighted three industry signals worth attention:

First, stop trying to educate users—learn to listen. Many founders say, “My product is advanced; users just don’t understand.” Yet what brands should fear most is not aging, but becoming “out of touch.” Every founder should ask daily: Do I respect users? Am I trying to educate them instead of listening?

Second, the battle for instant retail has reshaped user access. Channel density and path efficiency must keep pace. “Speed” has become a basic consumer requirement; insufficient distribution density or overly long chains will lead to missed opportunities. Shortening channel layers and retaining margins internally are essential to capturing growth dividends from new platforms.

Third, global expansion is no longer optional, but a mandatory question to be included in three-year strategic plans. Platforms such as TikTok are reshaping overseas consumption habits through content commerce, and the infrastructure for global expansion is largely in place.

In summary, while channels once powered brand growth flywheels, users will be the core driving force going forward.

User-centric product development

“User perspective” is a shared cognitive understanding; what truly differentiates brands is whether it is implemented in concrete product development.

Around the question of “how to build products centered on consumers,” Laichun Sun of Forest Cabin, Yiwen Zhang of Lola Rose, and Ju Ma of Ludao engaged in a roundtable discussion.

Since its inception, Forest Cabin’s core product, Camellia Essence Oil, has sold over 45 million bottles. Founder Laichun Sun believes its success lies in defining direction through user pain points and deepening the category through long-term iteration, forming a clear and stable brand perception among consumers.

Natural oils offer strong skincare benefits, yet “too greasy, hard to use, strong scent” form the first psychological barrier for users. For over a decade, Forest Cabin has focused on a single core question: how to make oil-based skincare truly address anti-aging and skin refinement needs while reducing the burden of use.

In this process, they chose to “fully master one point first,” building trust through a hero product logic. This was not about sticking to a formula, but about continuous iteration through user dialogue—repeatedly refining the core pain point of “making essence oil non-greasy,” from enzymatic processing and fermentation to molecular weight optimization and sebum compatibility, bringing experience and results closer to the user’s ideal state.

Yiwen Zhang, Founder of Lola Rose, believes that being “user-centric” means adapting to the evolution of consumer demand rather than clinging to traditional category logic. The Ms.Lola watch was born from this philosophy.

During product design, the team realized that watches are no longer purely functional products. What users truly care about are aesthetic expression, styling versatility, and emotional value—meaning it could not be a “traditional” watch. Yet it also could not abandon watch characteristics entirely, as consumers are highly sensitive to elements such as second hands and indices while rejecting excessive formality.

As a result, Lola Rose continuously calibrated between function and ornamentation, making time-reading more engaging through design while retaining structural elements users care about.

On this foundation, the Ms.Lola series gradually established two core design genes: the green dial and octagonal cuts. Colors evolve with aesthetic trends, while the structure carries emotional meaning—“women with edges, unafraid to shine.” Other elements flexibly adapt. Boundaries are defined by real user needs, with stable core symbols carrying change through long-term, meticulous insight and product evolution.

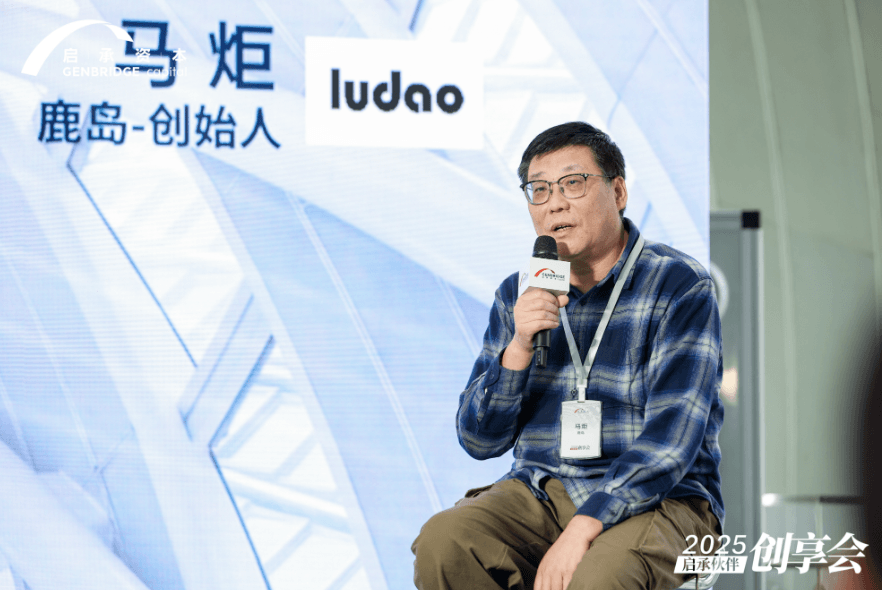

Ju Ma of Ludao believes that so-called blockbuster products are rarely deliberately planned, but instead emerge from word-of-mouth built through long-term use. Product value lies not only in a single purchase, but in whether it extends consumers’ “time spent” in stores.

Therefore, Ludao’s assortment strategy is not built around “hard selling,” but around being “worth browsing.” Products must be interesting yet practical for high-frequency use, enabling spontaneous purchases through relaxed exploration.

Against increasingly fragmented time, Ludao views stores as lifestyle spaces, aiming to package consumption into a complete and enjoyable experience rather than fragmented task-based purchases. This product and scene-building approach, grounded in consumer feelings and life rhythms, has enabled Ludao to evolve from value-for-money retail into a brand that carries “life experiences.”

Organizational capability is the foundation for sustained product excellence

If user-centric product development answers “what products to make and why,” the next critical question is whether these correct judgments can be executed consistently and replicated repeatedly. At scale, the answer depends not on the founder alone, but on the organization itself.

In recent years, Forest Cabin has systematically introduced professional product development systems such as Huawei’s IPD, assigning key stages—initiation, design, testing, value proposition, and pricing—to teams within structured processes, replacing individual intuition with organizational capability.

The success of “Little Gold Pearl” lotion is a direct result of this transformation. The founder approved the project at initiation, while all subsequent decisions were executed by teams within the system. Through clear user pain-point analysis and technical pathway selection, the team delivered a differentiated product with the light texture of water yet the efficacy of essence and cream—achieving systematic innovation.

Through this process, Forest Cabin transitioned from “founder-driven product creation” to “building systems that consistently produce strong products.” Organizational strength built on scientific processes, professional specialization, and long-term experimentation became the foundation for sustained innovation.

Compared with functional consumer goods, fashion and jewelry rely more heavily on creativity. In response, Yiwen Zhang of Lola Rose shared an organizational approach centered on creative capability.

The team first established that “products are the starting point of the brand,” then proactively restructured the organization—dismantling the talent-dense marketing department and concentrating top talent on the product side, responsible for product planning and judgment, replacing fragmented short-term preferences with organizational decision-making.

In its design system, Lola Rose chose a long-termist path. Facing the scarcity of professional jewelry designers domestically, it committed to internal cultivation—developing design capability from the ground up, investing at least three years to train designers capable of independently delivering A-grade products. Through research trips, pace management, and work-life balance, the company preserved space and patience for creativity, avoiding “involution-style depletion.” As the product system clarified, the organization entered a positive cycle of attracting and retaining top design talent.

If Forest Cabin and Lola Rose addressed “how to make product and creativity replicable,” Ludao’s challenge lies in making “good but affordable” a long-term capability rather than a temporary outcome.

Ludao’s ability to consistently deliver “good but affordable” products relies on organizational and supply chain mechanisms built around value-for-money. Product decisions follow the principle of “not expensive first, then well made,” requiring strong alignment across cost structures, price bands, and consumer perception.

To support this principle, Ludao invested heavily in long-term supply chain collaboration, deeply aligning with core factories around product lifecycles, capacity planning, and profit structures. Through scale, planning discipline, and brand standards, product quality and efficiency steadily improved. This organization–supply chain synergy, grounded in long-term partnership, transformed “good but affordable” from repeated selection decisions into a stable and sustainable organizational capability.

Conclusion

GenBridge believes that brands capable of navigating cycles do not rely on accidental hits or short-term dividends, but on long-term construction centered on users.

In 2025, as uncertainty becomes the norm, the answer to brand growth no longer lies in faster channels or more aggressive tactics, but returns to a fundamental question: are you truly standing on the user’s side, and can you continuously embed that stance into products and organization?

It may not be glamorous, but it remains one of the few long-term paths that still works.