- The Next Generation Champion of Casual Dining in the United States: Chipotle

- Curating High-Quality Ingredients to Meet Customization Needs

- Efficient Store Management and Operation

- Erupting Structural Food Safety Crisis

- Returning to Excellence: Management Efficiency and Omni-channel Transformation

- Our lessons from Chipotle

Chinese consumers’ dining preferences are changing. The maturation of the food industry in the past few years has brought about numerous conveniences, relieving consumers of the culinary yoke and lowering the burden of standardized meal preparation for catering enterprises. However, as an ever-growing number of consumers lean toward matters of food hygiene and healthiness, many chain restaurants have fallen under public censure for serving dishes with excessive seasoning, and the stigmatized “over-processing of food with additives and technology” has stained their repute.

GenBridge team believes that the development of chain dining brands does not imply that companies must compromise on health and freshness. On the contrary, restaurant businesses should leverage innovative business models to offer provide consumers with high-quality food combinations. In previous case studies in the dining industry, the Japanese Italian restaurant Saizeriya provided affordably priced and farm-fresh vegetable salads through direct-operated farms and cold chain transportation. Currently, as Chinese consumers’ demands for quality continue to rise, the ability of dining brands to supply high-quality foods and other premium dishes becomes increasingly urgent.

In this piece of “Consumer Champions Mastering Cycles,” we conducted an in-depth study of Chipotle Mexican Grill, an American Mexican restaurant. Our motivation stems from two factors:

Firstly, Chipotle has successfully balanced “taste-efficiency-customization-value,” achieving a comprehensive business model development. The company utilizes an organic food supply chain to provide consumers with the health values lacking in traditional fast food.

Secondly, after facing a severe food safety incident in 2016, Chipotle emerged from the crisis through a series of reforms. From this, we can also see that even if a restaurant business chooses the right positioning in its initial development, to achieve long-term growth, the company not only needs to prioritize safeguarding food safety risk control systems but also needs comprehensive development to find growth curves that align with the times.

Different from Saizeriya’s positioning of “ultimate cost-effectiveness,” we hope that by sharing the case of Chipotle, we can introduce new perspectives for the development of restaurant businesses and inspire more creative upgrades.

The Next Generation Champion of Casual Dining in the United States: Chipotle

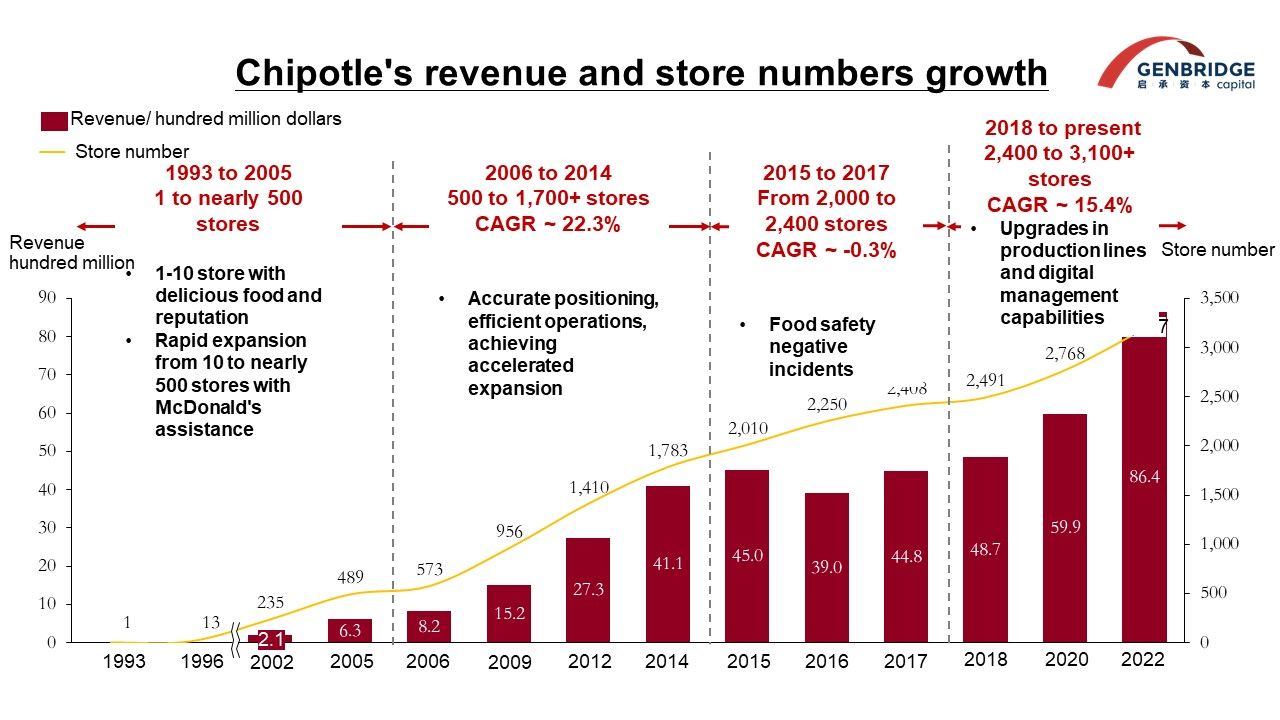

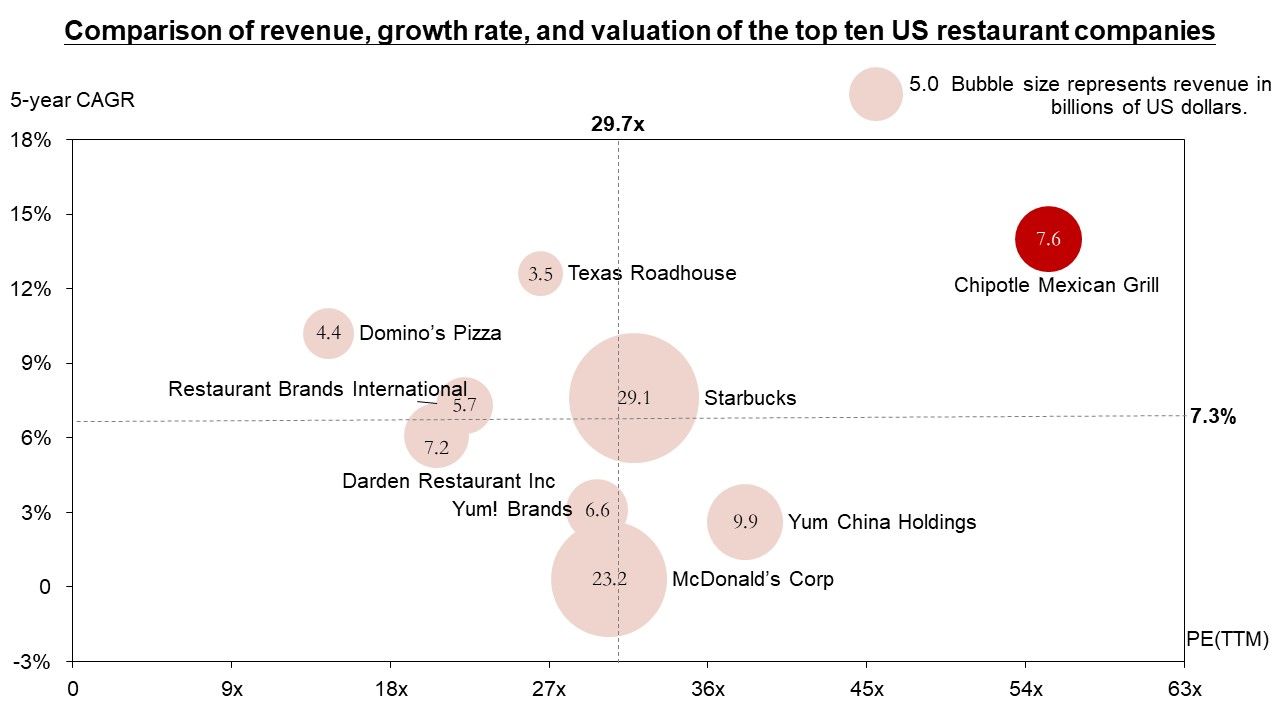

Chipotle is a Mexican-style chain restaurant brand originating from the United States. Established in 1993, the company’s revenue in 2022 was approximately $8.4 billion, with a net profit of $800 million, making it the fourth largest publicly traded restaurant company globally. Chipotle operates 3,182 company-owned stores, with the majority of its outlets located in the United States. The company’s market value is as high as $41.8 billion, having increased 33-fold since its IPO in 2006.

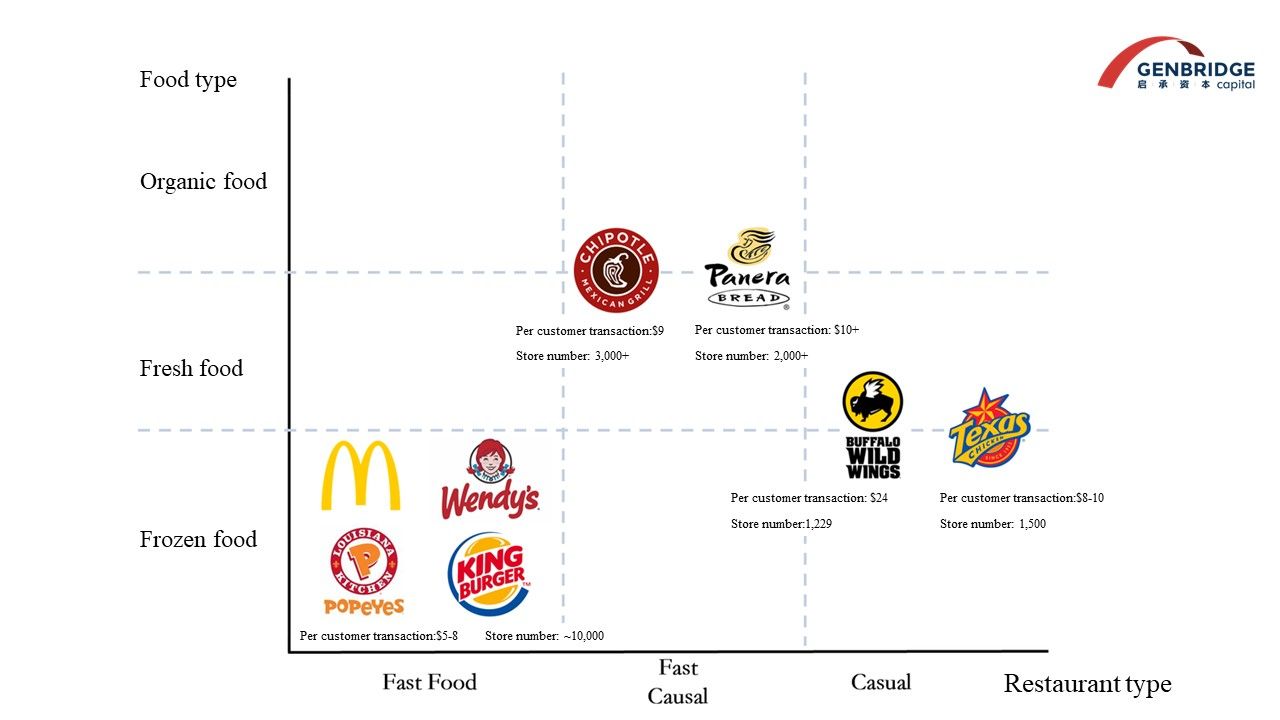

Chipotle’s positioning is “fast casual,” meaning it combines the speed and affordability characteristic of fast food with the quality and customized experience typically associated with restaurants. Consumers spend around $10 for a meal at Chipotle, within which they can choose from main items such as burritos, bowls, and tacos, and then customize their selection with proteins, grains/legumes, vegetables, and sauces to create their preferred combination.

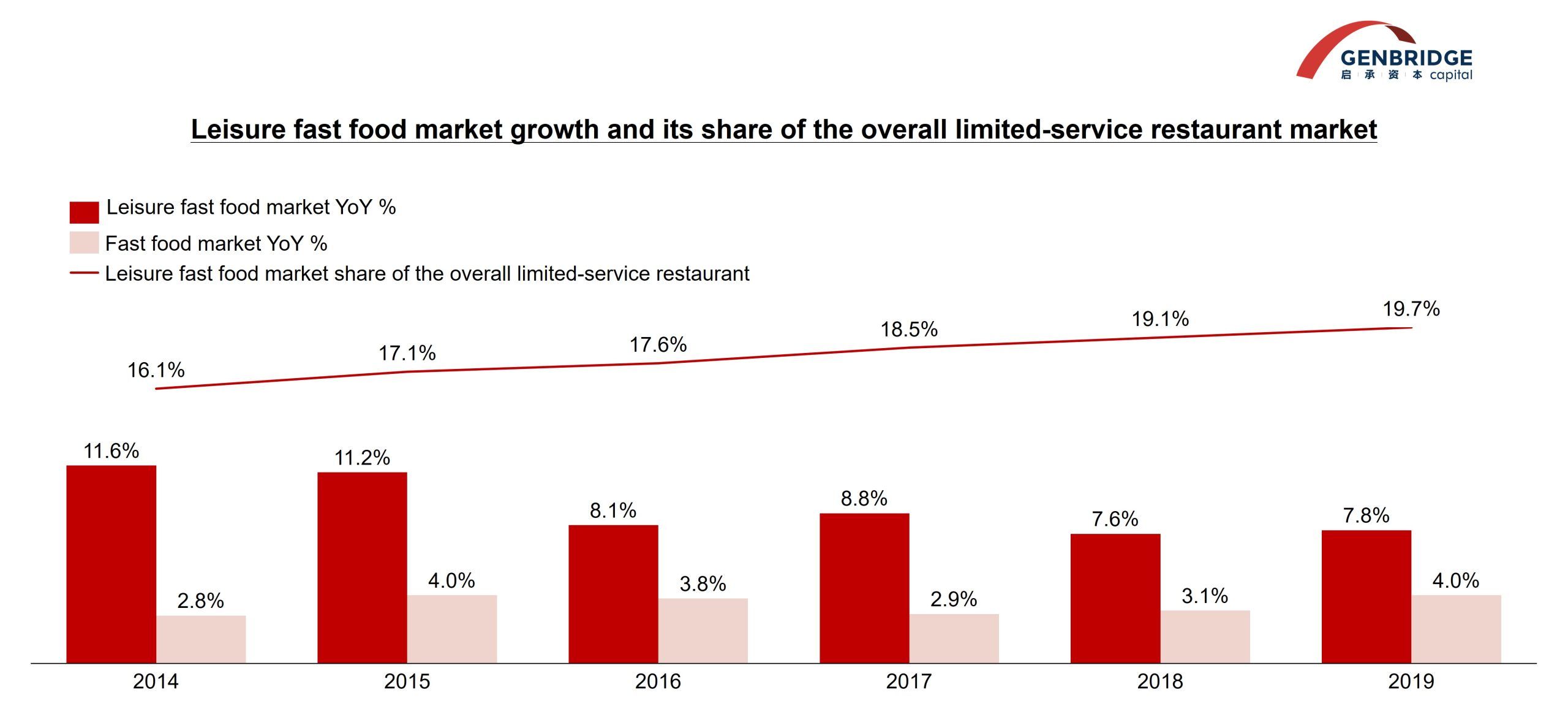

Chipotle’s success can be attributed to two consumer demand trends prevalent in American society at the time. Firstly, the millennial generation in the United States questioned the healthiness of fast food items primarily made from frozen ingredients. Chinese consumers share similar concerns regarding pre-made dishes. At that time, frozen foods began to be widely used in the American fast food industry, leading many consumers to worry about the loss of nutritional value in frozen foods and the impact of freezing on the taste and quality of food. Consumers sought options that offered better quality than fast food but were more convenient and affordable than traditional restaurants.

Another trend was the expanding popularity of Mexican-style cuisine among American consumers. Burritos became a new dietary trend in California in the 1970s and 1980s. Over the following decade, several renowned Mexican restaurants, including El Farolito, opened in San Francisco, further promoting and popularizing Mexican flavors. Mexican cuisine represents healthiness for American consumers, as there are more vegetables and proteins in Mexico dishes compared to typical American fare. Consequently, Mexican cuisine garnered considerable attention from health-conscious individuals, capturing 9% of the entire fast food market in the United States.

Curating High-Quality Ingredients to Meet Customization Needs

Under the dining trends led by health-consciousness in Mexican cuisine, Chipotle has solidified its current position through product differentiation and innovative business models. By ingeniously varying its product structure, Chipotle achieves simplicity and richness, offering consumers the joy of customization. At Chipotle, consumers can enjoy nearly 100 customizable combinations, choosing from 5 main items, 5 protein options, 4 grains/legumes, and over 10 sauces to create their preferred meal. This wide range of combinations ensures Chipotle’s broad audience and guarantees repeat visits. However, behind this customization, Chipotle’s ingredients are streamlined to just 53 varieties. In comparison, McDonald’s has 60-70 SKUs, with the Big Mac alone utilizing close to 70 ingredients.

Focusing sufficiently on ingredients allows Chipotle to deeply manage the quality of each ingredient, providing healthier and fresher ingredients. Chipotle’s “Food With Integrity” principle guides its procurement practices, insisting on sustainable and organic cultivation/raising of animals, land, and crops. The majority of its ingredients are sourced directly from farms, avoiding freezing during transportation and eschewing the use of artificial synthetic seasonings during processing.

Chipotle founder Steve Ells’ philosophy influenced the company’s procurement choices. In 1998, Chipotle received investment from McDonald’s, which was then expanding its multi-brand strategy. In order to leverage resources in the supply chain, Steve Ells visited McDonald’s suppliers’ animal farms. However, the appalling conditions of the farms deeply moved him, raising doubts about the sustainability of such supply chains characterized by industrialized farming and ecological destruction.

In 2001, Chipotle released the “Food With Integrity” mission statement, committing to increasing the use of naturally raised meats, organic produce, and hormone-free dairy products. That same year, Chipotle first attempted using pasture-raised organic pork, doubling the cost of pork and increasing the price of a single item by $1 (+16%). However, this move led to accelerated growth in same-store revenue. Steve Ells mentioned in an interview that despite McDonald’s investment in Chipotle, Chipotle maintains its independent values.

Today, Chipotle continues to upgrade its organic supply chain, adhering to direct farm sourcing, making health, freshness, and organic awareness crucial barriers for Chipotle. Most of the chicken, beef, and most grains used by the brand have already adopted an organic and direct farm sourcing model. In the upstream process, Chipotle goes even further, helping family farms transition to industrialized organic farms, securing high-quality ingredient suppliers, and achieving cost leadership. In 2015, Chipotle became the first national chain restaurant in the United States to completely eliminate genetically modified organisms (GMOs) from its supply chain.

Efficient Store Management and Operation

Chipotle features the minimalist processing of fresh ingredients and tailored dining choices based on consumers’ preferences, the bedrock of its customized dining experience, and a quintessentially American-Mexican culinary tradition. American-Mexican cuisine originates from the streamlined assembly of meat rolls, and the ingredients don’t require intricate processing techniques. This lays the foundation for Chipotle’s ability to meticulously engineer efficient storefront arrangements to ensure controlled pricing and maintain a competitive edge in the fast-casual dining sector.

Central to Chipotle’s operational success is the “assembly line” ordering approach adopted at the storefront. Customers proceed down a service line to select their desired ingredients for each part, a method that proves to be highly efficient especially during peak dining hours. This translates to an impressive number of serving up to 300 customers per hour, namely, an operational time of merely 10 seconds per staff member, which is a stark departure from the conventional 2 to 3 minutes associated with traditional fast-food establishments.

Chipotle’s refusal to use pre-packaged, frozen ingredients and that each staff member specializes in different phases of preparation in the kitchen, have enabled shorter food preparation times and higher output. This choreography involves a total of around 16 full-time or part-time employees down the assembly line and in the kitchen, a lean operation compared to the 20 to 30 staff in McDonald’s stores with the same sales volume.

In terms of personnel management, Chipotle takes the approach of internal promotion. Over 98% of its managers ascend from entry-level positions and exceptional employees have a promising future as store managers, where a single manager may oversee up to 4 outlets simultaneously. Furthermore, managers can earn extra bonuses by mentoring other staff members. This mentorship cultivation model facilitates the seamless inculcation and preservation of the required operational standards for Chipotle’s outlets.

Given the management complexities intrinsic to in-house preparation and farm-fresh supply chain, Chipotle adheres to a fully owned and operated model. This dedication has, in turn, constructed a reliable brand perception, evident in the high-quality services delivered by front-line staff, whose effective communication serves as a conduit for enhancing consumer comprehension of the ingredients.

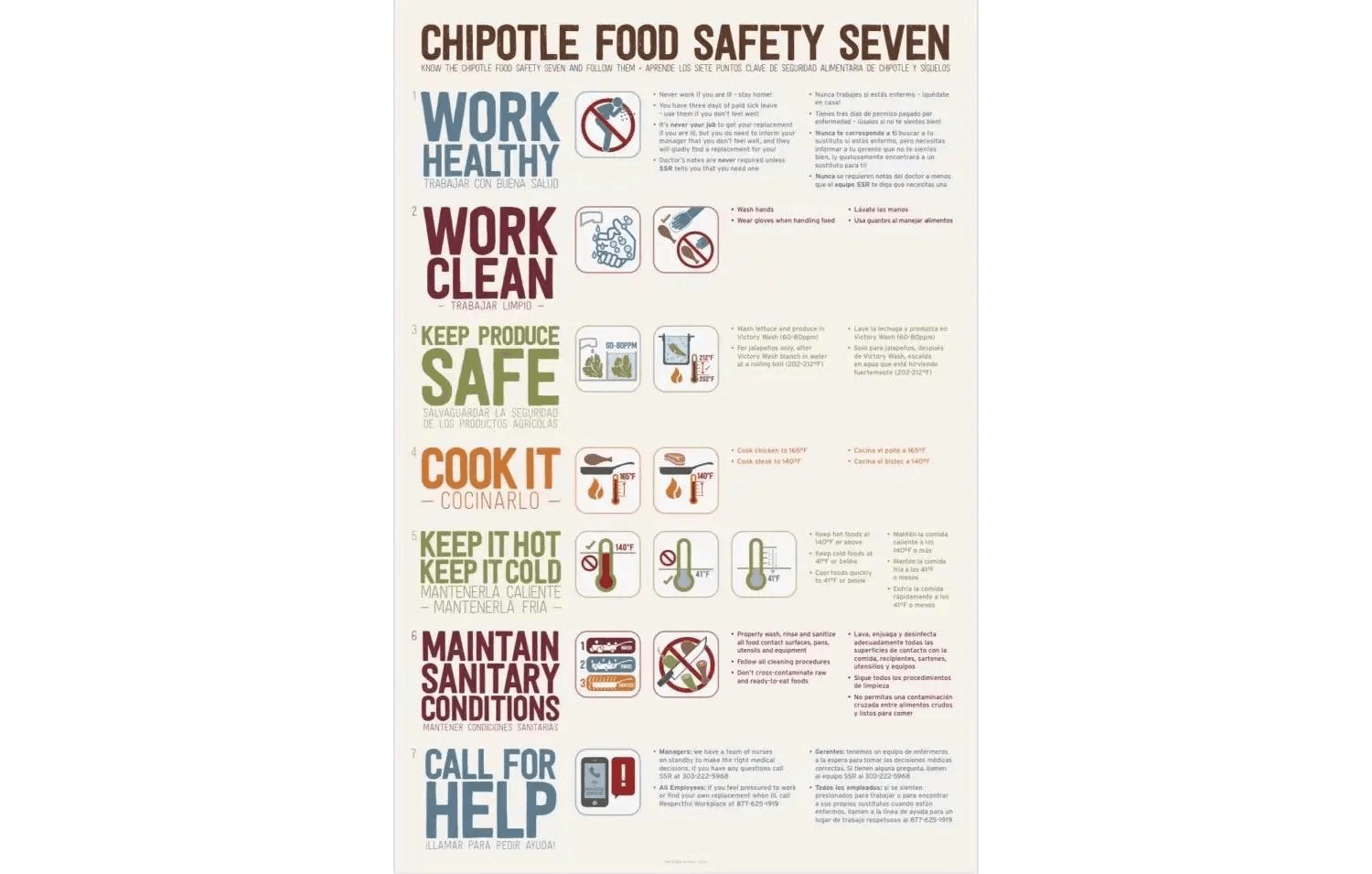

Food safety constitutes the top priority of Chiptole operation and the most challenging terrain for in-house food preparation with fresh ingredients. Boasting “Chipotle Food Safety Seven”, a set of food safety management standards that provide clear guidelines and requirements for each step of the process. Staff members and managers of all Chipotle outlets must receive rigorous training. In handling Norovirus, staff members feeling unwell are granted an unconditional paid leave for 3 days to curb the spread of infection and there is a dedicated hotline and on-site nurses cater to health issues. In case of a confirmed Norovirus case, a specialized rapid response team will be arranged for store sanitization and risk mitigation following national guidelines.

Erupting Structural Food Safety Crisis

The high difficulty of the supply chain and operational demands behind fresh food ingredients raises the barriers to entry for competitors. These barriers have allowed Chipotle to outshine others in the casual dining category. However, these advantages were not built in a day, and Chipotle has also paid a painful price for them.

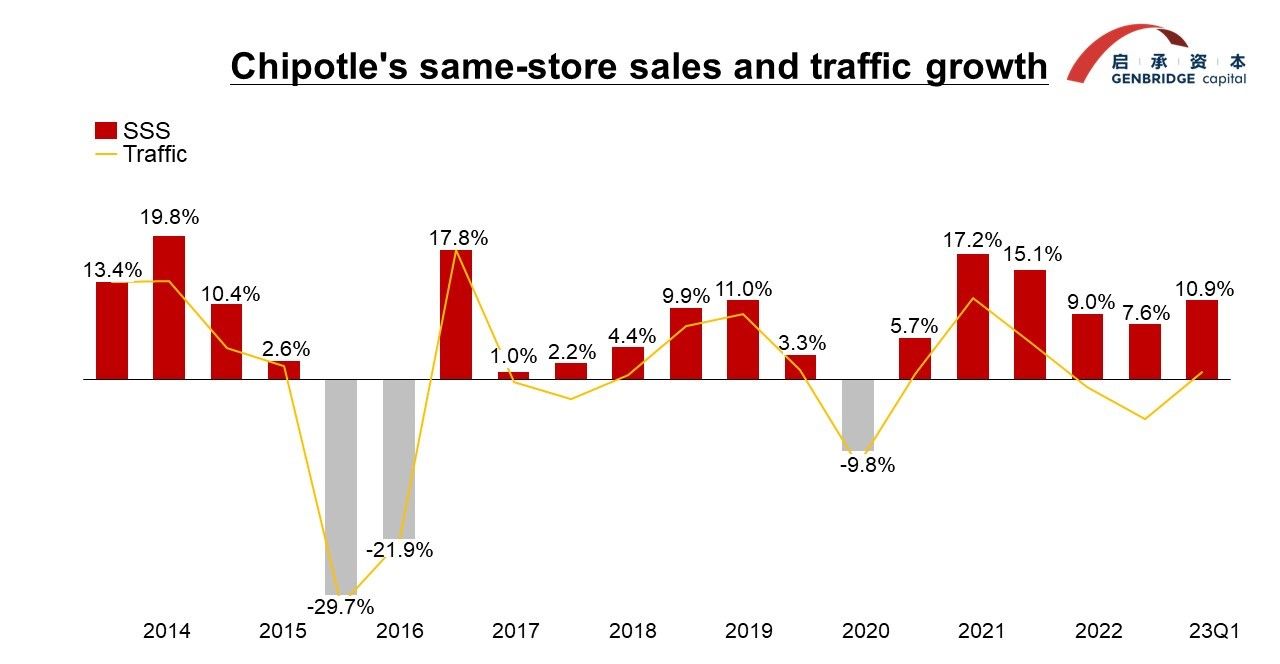

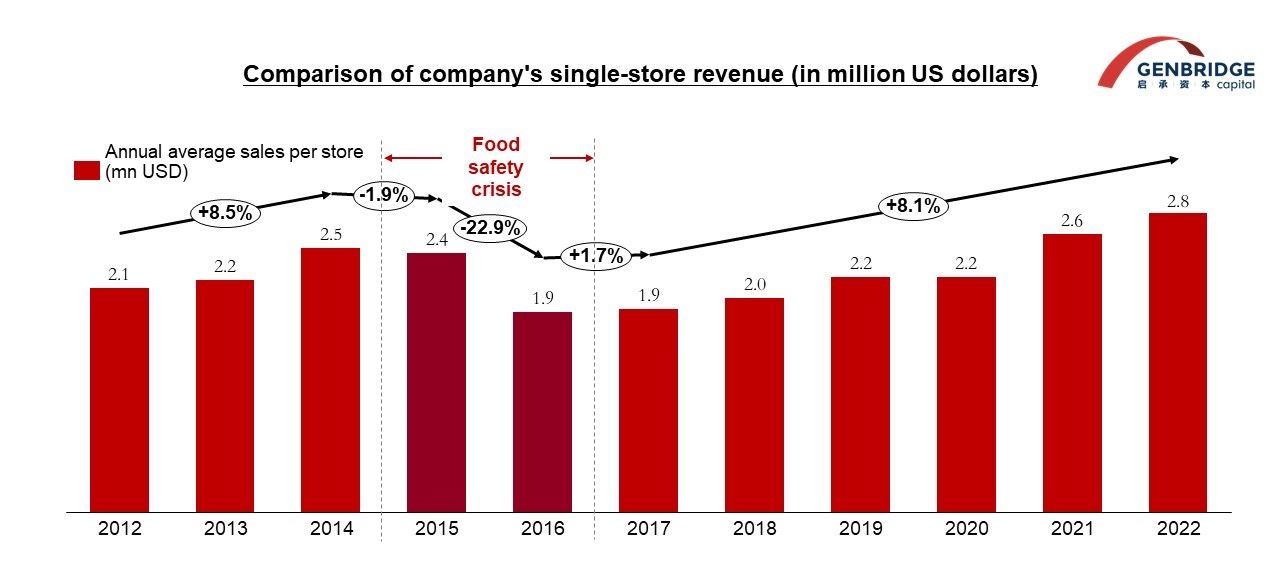

From 2006 to 2016, Chipotle achieved sustained high-quality growth and stable positive cash flow. However, the food safety crisis that erupted in 2016 posed severe challenges to the company—its same-store revenue plummeted by 25%, and its stock price dropped from a peak of $759 to $400. This crisis also became an opportunity for Chipotle to transition its brand into a full-channel model, upgrading its management system.

From 2015 to 2016, Chipotle experienced multiple significant food safety issues in its stores across various states in the United States, each with different causes. For example, in August 2015, a norovirus outbreak was confirmed in Simi Valley, California, affecting 80 customers and 18 employees. Chipotle failed to intervene promptly after discovering that the kitchen manager was ill, instead allowing employees to continue working for two days before sending them home. In the same year, in August and October, stores in Minnesota, Washington, and Oregon experienced food safety issues due to E. coli and Salmonella contamination, attributed to improper food supply chain management and store operations.

Following a series of food safety issues, Chipotle realized that bacteria and viruses were primarily spread due to the use of fresh produce and meats in its stores. For example, the use of organic fresh fruits and meats, especially the use of manure in organic farming, increases the food safety risks of spreading bacteria such as E. coli. Chipotle’s heavy reliance on staff service also exacerbated the situation. These characteristics exposed Chipotle to a higher risk of foodborne disease outbreaks compared to some competitors.

Due to the diverse types of pathogens involved in different events (Salmonella, E. coli, and norovirus), Chipotle faced a systemic issue. However, Chipotle’s management and supervision of ingredients were very loose. Before the food safety crisis erupted, only four people were responsible for product quality control. Considering the scale of its operations and the complexity of store services, the proportion of risk control personnel was significantly inadequate. The company initially outsourced its 53 ingredients to 15 external suppliers, relying solely on contract terms to control quality inspections. Consequently, even two months after the crisis erupted, the company was still unable to trace contaminated ingredients.

Returning to Excellence: Management Efficiency and Omni-channel Transformation

The successive food safety incidents brought painful lessons to Chipotle and accelerated the introduction of a more professional and mature management system. The company first hired a new food safety officer who implemented a series of reforms, introducing a strict Hazard Analysis and Critical Control Point (HACCP) system to scientifically ensure the supervision and management of ingredients throughout the entire chain. Significant adjustments were also made in store and supply chain management and division of labor. For example, stores were required to prioritize the use of dehydrated products over fresh produce, and common ingredients such as lemons and onions were strictly required to undergo high-temperature sterilization. The central kitchen took on more pre-disinfection procedures to control the safety risks of raw materials, and it took over the pre-cooking of steaks, providing more pre-processed ingredients to relieve the pressure on terminal stores to ensure food safety.

Behind the series of operational reforms was a deep adjustment in personnel by the company’s management. In 2018, with the deep involvement of shareholder Pershing Square Capital, the company selected Brian Niccol as the new CEO. Brian Niccol, former CEO of Taco Bell, made two adjustments after taking office: consolidating brand management and improving operational efficiency, and transitioning to a multi-channel model to gain incremental customers.

Brian Niccol

In terms of brand management and efficiency improvement, Brian Niccol optimized core competencies around operational efficiency, allowing the company to “do what it does best.” For example, inefficient promotions like “buy one, get one free” were halted, and the marketing plan emphasized the company’s quality leadership through the “For Real” campaign. In store operations, Chipotle adhered to its principle of refusing to franchise, eschewing rapid globalization, and instead focused on local cultivation, prioritizing coverage of its 7,000 stores across the United States. Regarding products, Chipotle rejected McDonald’s suggestion to introduce “breakfast/combo products” and refrained from introducing frozen ingredients, maintaining the brand’s original value image. These measures further solidified Chipotle’s brand value positioning in the minds of consumers and retained its loyal customer base.

In terms of incremental expansion of the brand, Brian Niccol promoted digital transformation to achieve multi-channel expansion, significantly increasing single-store output. The company vigorously promoted the Chipotle app, encouraging users to order for pickup or delivery, optimizing the SOP for online order delivery. Chipotle’s stores handle online and offline orders separately, with online orders processed directly by the kitchen, reducing serving time by 40%. Chipotle’s multi-channel model allowed the company to maintain positive growth during the pandemic, with the proportion of online orders increasing from 9% to 49%.

In addition, Chipotle introduced the Chipotlane model for drive-thru pickup, which outperformed standard stores by 28%. Through these series of channel reforms, Chipotle’s store revenue increased from $2 million in 2018 to $2.8 million in 2022.

Brian Niccol once said, “The competition in chain restaurants should focus on four dimensions—quality, value, speed, and customization; most brands focus on one or two points, but Chipotle covers all four dimensions comprehensively.” After experiencing the food safety crisis, Chipotle successfully amplified its comprehensive business advantages through strengthened modern management and efficient operations. Subsequently, Chipotle successfully tackled the formidable challenges brought by the pandemic to the restaurant industry, largely owing to these efforts.

Our lessons from Chipotle

Restaurant management is an art of balancing “taste-efficiency-experience,” and companies find it difficult to achieve longevity through a single strength. Therefore, selecting the battlefield of “high value/low competition” through high-scoring model/dish designs and finding key elements that can maximize consumer value and establish long-term competitive barriers are potential paths for brands to achieve sustained compound growth.

Representing Mexican cuisine, Chipotle seems to be a “niche cuisine,” but it is actually a low-competition high-scoring category that balances “freshness and richness (taste)-efficiency of serving/processing-customization (experience).” The company steadfastly creates consumer value around “freshness,” establishing competitive barriers through organic supply chains and high-standard store management. Despite setbacks, the company’s mission of “Food With Integrity” has never wavered, enabling it to successfully rebuild trust during the food safety crisis.

We believe that more excellent Chinese restaurant enterprises will build core competitiveness around “upgrading quality, affordable prices, and diverse choices,” while “casual dining” will be the high-scoring positioning for the birth of a new generation of evergreen restaurants. GenBridge also looks forward to exploring the practical path of “Chinese Chipotle” with more excellent entrepreneurial partners in the future.