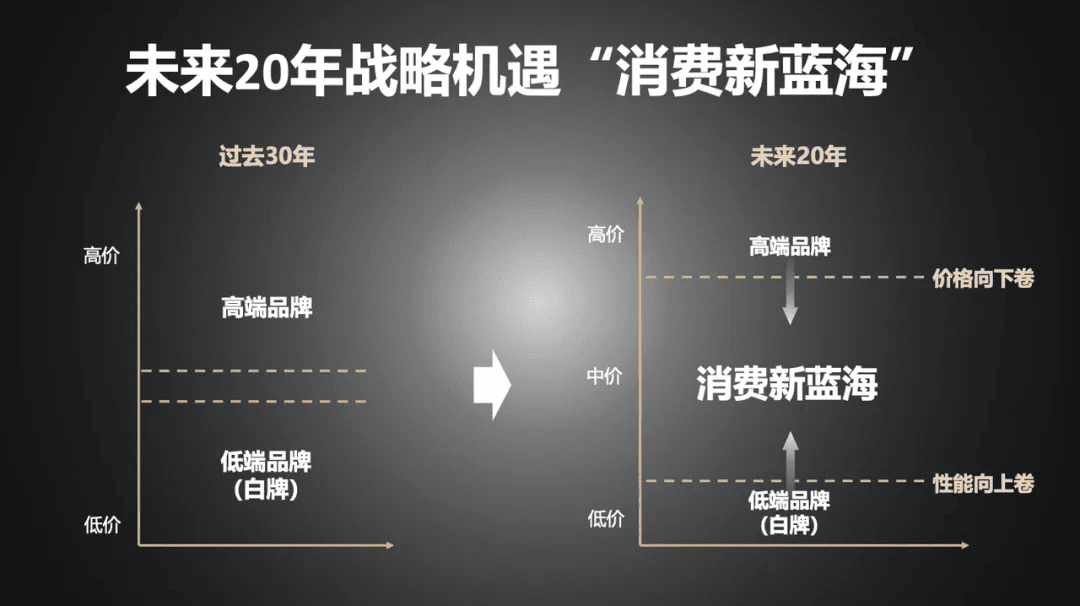

China’s consumer market may appear fiercely competitive, yet beneath the surface lies a vast hidden blue ocean — what we call the “middle ground” of consumption.

To understand this concept, one must first look at the “dual structure” that has shaped Chinese consumption over the past decades.

This dual structure refers to a market dominated on one side by expensive, high-quality products and on the other by low-cost white-label goods, with little in between. In many categories, multinational brands and domestic players have occupied these two extremes. Despite years of effort, local brands have struggled to find a pathway into the premium segment.

Today, however, this once-stable dual structure is beginning to break down. On the premium side, global brands are forced to contend with relentless price wars launched by major e-commerce platforms. On the value side, competition is intensifying as a flood of factory-made white-label products saturates the market, making the upward path even more elusive.

At the same time, online platforms — with their deep penetration and sophisticated operating tools — now give brands the ability to reach one billion consumers. Offline, the rise of 300,000 residential communities and 7,000 shopping malls has physically segmented and concentrated consumer groups. The convergence of these two forces is giving birth to a massive new market: China’s mainstream consumer market.

Under the old dual-structured model, brands focused on meeting one of two needs: either status-driven consumption (“face”) or affordability (“being able to buy”). But today, China’s mainstream consumer market is defined by products that occupy the middle ground — brands that elevate performance while lowering prices. These value-for-money brands represent the new blue ocean of Chinese consumption for the next 20 years.

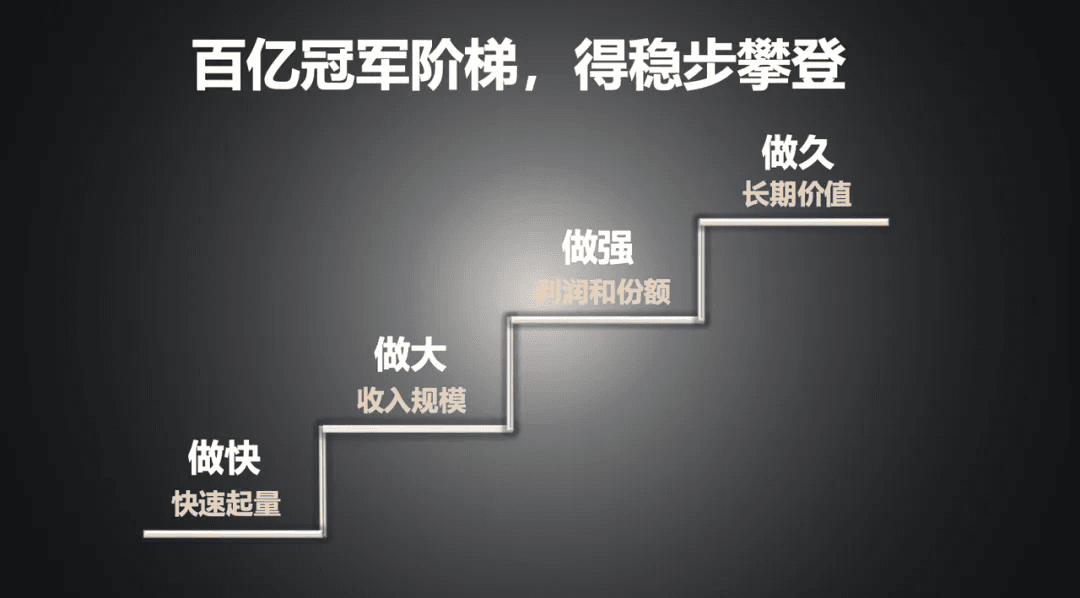

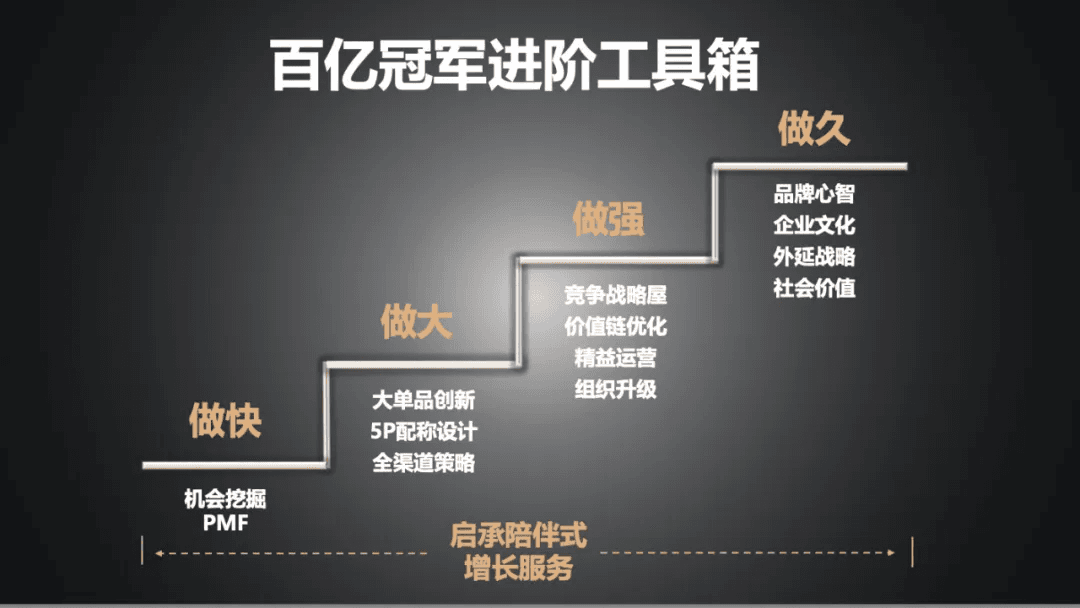

It is within this blue ocean that the next ¥10 billion champion brands are most likely to emerge. To reach that milestone, however, companies must climb four essential steps: Swift to Build, Bold to Expand, Strong to Compete, and Built to Last.

Becoming a ¥10 billion champion “swift to build” is only the begining

In the past, we saw countless startup business plans sketching out a picture of imminent success: a trillion-RMB market waiting to be disrupted, a differentiated solution ready to seize it, and a belief that with capital or traffic support, the company could rise overnight.

Indeed, many of these companies were able to scale quickly in the early stages — gaining a first-mover advantage and capturing the dividends of growth.

But the reality is often far more challenging:

- Fierce competition. Even if you identify a whitespace in the market, others will quickly sense the opportunity and flood in. The advantage of being “half a step ahead” can disappear almost overnight.

- Shifting rules. Platform traffic once created rapid early growth for startups, but platform policies change quickly. The same traffic-driven growth that came fast can vanish just as fast.

The steep, linear growth curves of the past are giving way to a more turbulent reality. After the initial frenzy, companies often face the hardships of execution, slipping into valleys of doubt. Even those who manage to find a way forward at the bottom must still climb a long, winding slope of continuous improvement.

Why? Because to become a true ¥10 billion champion, being swift to build is only the beginning. Growth requires climbing four steps: swift to build, bold to expand, strong to compete, and built to last.

Today, China’s online and offline commercial infrastructure is already highly developed. Speed is no longer the hardest part. The next step — being bold to expand — requires sharp strategic planning: knowing what to pursue and what not to pursue, how to allocate resources, and what costs to bear.

Once a company reaches scale, a new challenge arises: how to be strong to compete. Many firms capture significant market share but fail to turn it into durable competitive or brand advantage. They struggle to raise prices, remain vulnerable in profitability, and lack true pricing power against both consumers and competitors.

Finally, the ultimate value of consumer businesses lies in being built to last. This means embedding the brand deeply in consumers’ minds. At this stage, success relies not only on the founder’s personal abilities but also on the organization’s collective strength. Only when an organization is strong enough can it consistently deliver great products over the long term.

From Rice to Corn, supporting Harvest in being “bold to expand”

Harvest (Shiyue Daotian), which recently released its interim results, delivered an impressive performance to the capital market: first-half revenue reached RMB 3.06 billion, up 16.9% year-on-year, while adjusted net profit doubled to RMB 294 million.

Over the past two years, Harvest has not only carved out a successful second growth curve beyond rice but has also actively broadened its product portfolio — steadily evolving from a kitchen staple brand into a household food brand.

Yet, even on the eve of its IPO bell ringing, the founder shared with us a sense of uncertainty.

The challenge was clear: as an essential category, rice is not a high-growth emerging sector. At that time, Harvest already commanded 30–40% of China’s online rice market, which created real pressure to sustain rapid growth.

At GenBridge, our goal was to work with the founder to identify the breakthrough for being bold to expand. Through joint dialogue and exploration, Harvest set its sights on its next growth curve: corn.

Here, the company holds unique supply chain advantages. The black soil of Northeast China is rich in organic matter, with only one crop cycle each year, producing corn with a naturally sweet and glutinous taste. After harvest, the corn is processed immediately to lock in freshness. To achieve this, Shiyue Daotian built an automated factory right beside the fields, ensuring that corn moves from farm to factory in under six hours.

Every ear of corn undergoes dozens of procedures — from inspection and husking to trimming and brining. This ultra-short supply chain guarantees that within just 3–5 days, tens of thousands of fresh, high-quality corncobs are delivered from Northeast farmland directly to dining tables across China.

In just the past year, Harvest’s corn product alone generated nearly RMB 1 billion in sales, accounting for 15% of the company’s total revenue — with this single item contributing over 15% of overall growth.

This year, the company is accelerating its expansion into southern China. It has already established a sweet corn base in Nanning, Guangxi, which is expected to be completed and operational in the second half of the year.

Beyond its core categories of rice and corn, Harvestn is committed to becoming a household food innovation expert. Centered on consumer needs for light, healthy, low-fat, and convenient meals, the company has expanded its product portfolio to include offerings such as sweet corn kernels, brown rice onigiri, and corn soup buns.

GenBridge has also supported Harvest in building a full-channel strategy: developing multiple online platforms while expanding offline into retailers such as Yonghui, Jiajayue,Pangdonglai, and ultimately entering Sam’s Club. With this comprehensive online and offline presence, the company has scaled from RMB 3–4 billion in revenue to positioning itself firmly on the pathway toward RMB 10 billion growth.

Building private labels from scratch, supporting New Joy Mart in becoming “strong to compete”

This year marks the 18th anniversary of New Joy Mart, a fast-growing convenience store chain. In the first half of the year, the company expanded beyond Hunan province, with nearly half of its 200 new stores opening in Hubei — quickly becoming a local market leader upon entry. Anchored in its positioning as the “neighborhood store for fresh milk, breakfast, and coffee,” and maintaining a steady pace of 50–70 new openings each month, New Joy Mart’s strategic footprint across Central China is becoming increasingly clear.

Looking back, founder Minyi Wu believes that the launch of private label products has been one of the most critical strategies for the company’s growth — a core step in being strong to compete.

Today, New Joy Mart offers more than 200 private label items. While these account for only 10% of SKUs, they contribute over 20% of sales. In 2024, same-store sales rose by 6–10% year-on-year, largely driven by the success of private labels.

The company’s private label strategy was shaped by an industry study tour to Japan, where GenBridge joined New Joy Mart to learn the “52-week MD (Merchandising Development)” approach. After returning, we began working together on how to adapt and localize this model for China.

Given that product development in China’s retail sector is still in its early stages, New Joy Mart decided to start with a “One Hero Product per Month” strategy — focusing on creating one outstanding private label product each month.

At the 2019 strategy meeting, after evaluating 3–5 candidate categories against feasibility, internal capability, and defensibility, GenBridge and New Joy Mart jointly decided to bet on fresh milk as the must-win battle of that year.

To ensure the highest quality of fresh milk, New Joy Mart insisted on sourcing from the best dairy farms of its class in China, conducting on-site inspections that covered every detail — from cattle feed and breeding materials to the full milking process. For example, cows are washed and checked for injuries before milking, and every step of the process — precision, temperature, timing, and hygiene — is closely monitored to guarantee stability and consistency. Though complex and rigorous, this full-cycle quality control is the foundation for producing high-quality fresh milk.

The result was a 500ml chilled fresh milk, priced at just RMB 4.9. Within two months of launch, it became the leading product in Changsha’s chilled milk market.

Building on this success, New Joy Mart went on to launch beer (three 500ml bottles for RMB 9.9) and later its own coffee brand, JOYCOFFEE. Month by month, with each new private label product, the company gradually built its R&D, quality assurance, and merchandising system. Today, New Joy Mart has become one of the most successful convenience store chains in China in developing private labels.

Private label products not only contributed significantly to profitability but also fueled franchise growth. GenBridge further supported New Joy Mart by helping to establish a cold-chain factory, laying the groundwork for sustainable, long-term growth, much like 7-Eleven in its formative years.

Setting strategy, uniting team, supporting our portfolios in being “built to last”

In 1994, Harvard Business School scholar Jim Collins spent six years studying 18 “visionary companies.” His conclusion: what enabled them to achieve their best actions was not pure foresight, but experimentation, repeated trials, opportunism — or more precisely, seizing luck.

Markets are ever-changing. Scale and capability at one moment in time do not guarantee endurance. For consumer companies in particular, staying sensitive to shifts, being ready to adjust strategy, and embracing continuous evolution are essential.

For founders, knowing how to be built to last may be the greatest challenge. Companies that rise rapidly often grow overconfident, making them slow to adjust when challenges arise. Those who can seize fleeting opportunities, remain open-minded afterward, recognize where new capabilities must be built, and have the patience to strengthen them over time — they are the ones most likely to prevail in long-term competition.

This requires a determination to build enduring brand power, combined with an organization rich in capable leaders and united in purpose.

As partners on this journey, GenBridge has consistently stood alongside our portfolio companies, helping refine both strategy and organizational capability.

For one partner facing difficulties, we co-hosted a three-day strategy workshop. Under pressure from new competitors and declining same-store sales, we worked together to chart a new path: shifting from scale-driven growth to efficiency-driven growth, and defining three key battles — cost reduction, channel breakthrough, and category reinvention. That evening, the team went to Haidilao and put a birthday hat on the founder, singing the birthday song. It wasn’t anyone’s birthday, but it was the “rebirth” of the company and its organization.

Another partner also asked us to facilitate a strategy workshop. We spent a full month preparing, interviewing all senior executives. Over two days and nearly 30 hours, we completed the discussions. The next day, we received a handwritten letter from the founder, thanking us for helping the team find clarity, define the second stage of growth, and finally feel that the path for the coming years was “within reach.”

At GenBridge, we believe consumer entrepreneurship is a marathon, not a sprint. Building brand power is never achieved overnight. The path from the “valley of despair” to the “hill of harvest” has no shortcuts — only through persistence day after day, and incremental improvements accumulated over time, can companies ultimately arrive at lasting success.

From being swift to build, to becoming bold to expand, and further to being strong to compete and built to last — at every step upward, countless companies fall away. Along this journey, entrepreneurs often face deep solitude. At GenBridge, what we strive to do — and are doing — is to walk alongside them, bringing our toolbox and hands-on growth support, accompanying companies on their path toward becoming ¥10 billion consumer champions.

As a dedicated consumer fund, we believe that at its core, the business of consumption is about creating a better life for consumers. This is the vision and value that drive every entrepreneur — and it is the direction we firmly uphold at GenBridge.