In June, a 99-yuan Guoquan Shihui (锅圈食汇) beef tripe feast went viral on TikTok, becoming the platform’s top-selling food product.

By June, this tripe combo had already sold 1.68 million units on TikTok, with total sales exceeding 166 million yuan. According to the latest data, cumulative sales have surpassed 2 million sets. The spin-off “Tripe Dance” became one of the year’s most addictive and trending dances, attracting people across the country to join in.

On one hand, the 99-yuan tripe combo was exploding in popularity; on the other, the hotpot industry had long been embroiled in an intense price war. Haidilao’s average spend per customer has dropped below 100 yuan; high-end hotpot brand “Song Hotpot” under the Jiumaojiu group promoted slogans like “broth starting from 8 yuan, meat dishes from 9.9 yuan”; while Xiabuxiabu reduced menu prices by more than 10%. Faced with three years of losses totaling 800 million yuan, its founder bluntly stated: “The entire restaurant market is slashing prices. If we don’t adjust, we’ll be eliminated. In this market, if you don’t fight for it, you’ll starve.”

As major restaurant chains slashed prices in hopes of survival, yet still struggled to draw customers, how did Guoquan, a relatively late entrant, manage to top TikTok’s food product sales rankings?

Slashing tripe prices

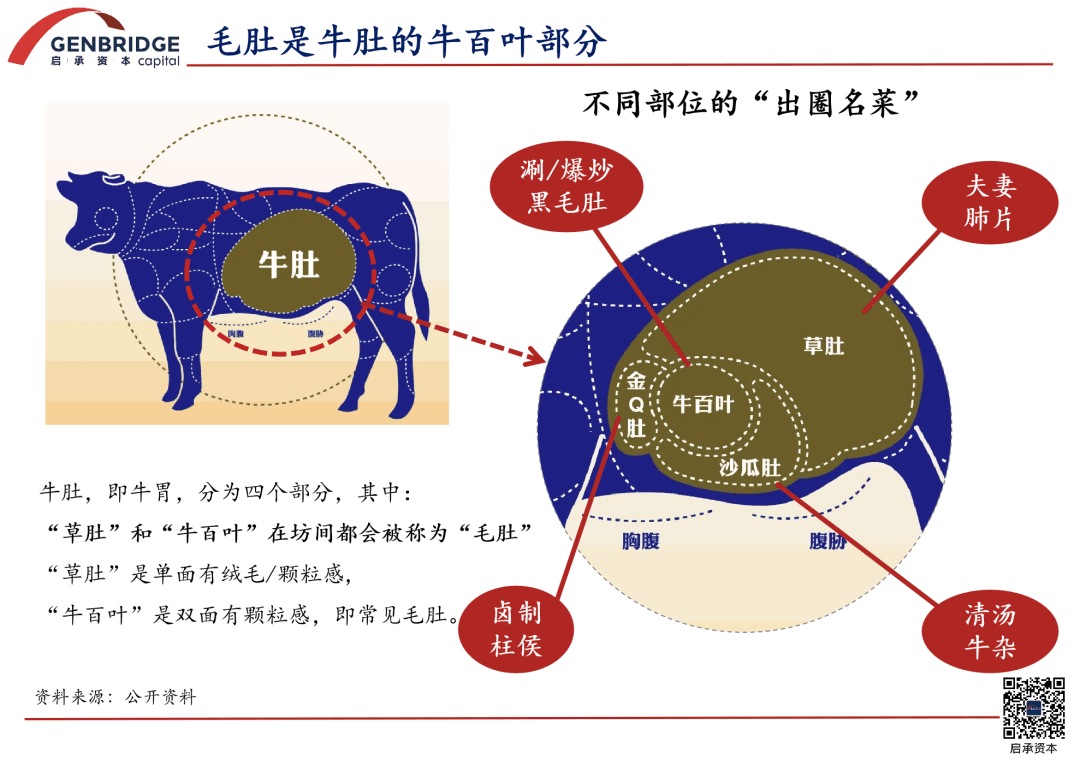

Guoquan’s success on TikTok can largely be attributed to its smart product selection — tripe.

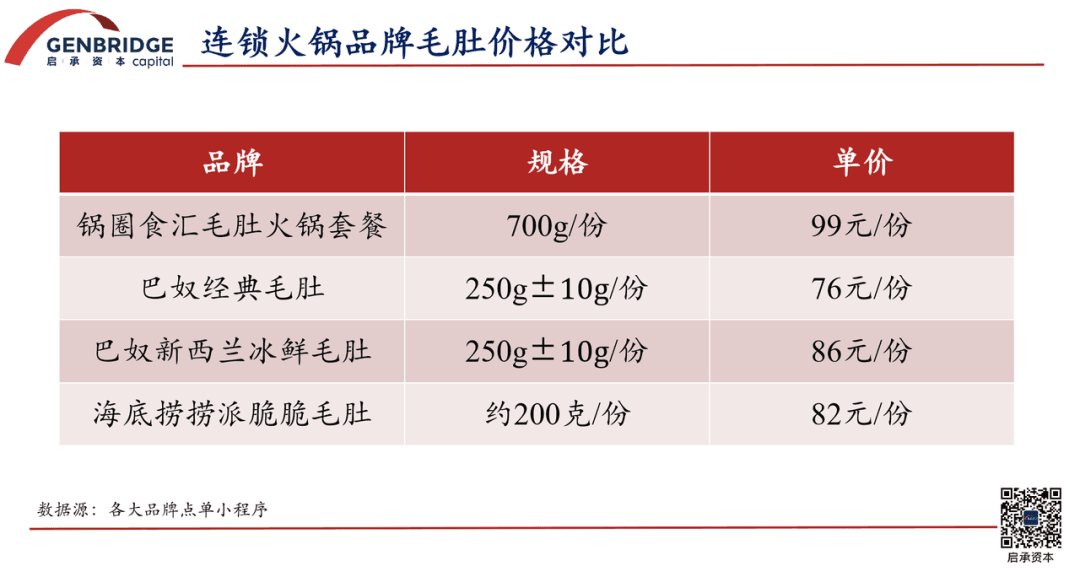

Tripe is widely known as a customer-magnet in hotpot restaurants: tasty but expensive. For example, at Banu Hotpot, a classic tripe dish sells for 76 yuan (approx. 250g); New Zealand chilled tripe costs 86 yuan for a similar weight. Haidilao’s signature crispy tripe is 82 yuan for about 200g.

Guoquan chose a high-perceived-value product and offered a combo of four types — black omasum, white omasum, premium black tripe, and large-leaf tripe — totaling 700g, all for just 99 yuan.

Tripe prices have long stayed high due to supply-demand imbalance. One cow yields only 4–5 kg of tripe. With China producing about 50 million cows annually, total annual tripe output is around 200,000–250,000 tons. Yet in the Sichuan-Chongqing region alone, people consume over 120,000 tons each year. Long-term undersupply has driven up prices.

But Guoquan went against the tide, taking a “delicious but affordable” approach to reimagine tripe, a decision based on deep consumer insight and its own supply chain strengths.

With 18 years of experience in the industry, founder Yang Mingchao is not only CEO but also chief product manager. He positioned Guoquan’s pre-prepared meals as “quick-cook dishes” that retain the warmth of home-cooked food. As early as 2019, Yang started building the Chengming Food Industrial Park in Luyi, Henan, to develop innovative in-house products across eight major categories.

Guoquan’s product development follows a clear process: Defining product direction, expert evaluation and selection, taste-testing and consumer feedback and continuous optimization of product details.

Its tens of thousands of neighborhood-level stores serve as direct touchpoints with consumers, allowing Guoquan to detect emerging trends and incorporate them into product development.

For example, while upgrading its Northeast-style BBQ offerings, Guoquan noticed local consumers’ high expectations for ingredient texture, prompting collaboration with regional suppliers. And when the trend toward healthier food emerged, it quickly launched organic bamboo shoots — rigorously vetted for origin, growth environment, taste, yield, and edible part — which became a hit upon release.

Choosing the right product was just the first step. More crucial was driving the price down through the supply chain.

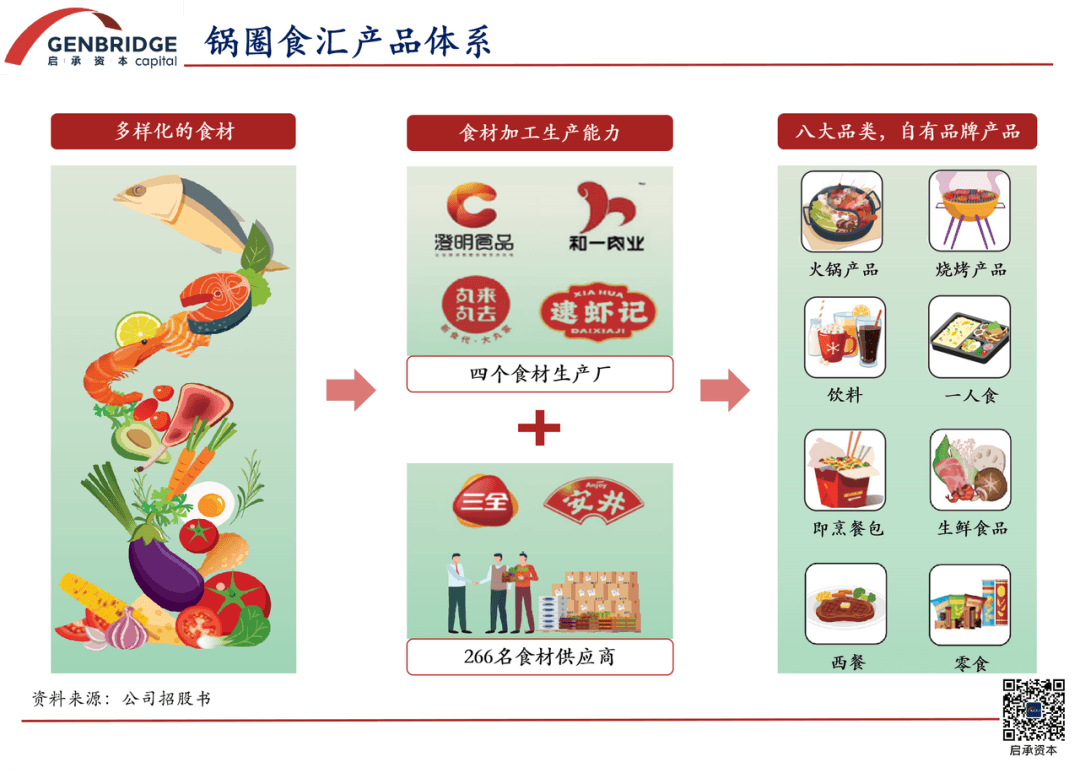

As Guoquan rapidly expanded its front-end store network in recent years, it also built up its back-end infrastructure. Through equity stakes and acquisitions, it now owns three self-operated food production plants (specializing in beef, meatballs, and hotpot base) and has invested in Daixiaji, a shrimp paste manufacturer.

This single-product, single-factory model enables Guoquan to centralize procurement at scale, reducing costs and allowing it to offer products 40% cheaper than supermarkets — and even 10–15% lower than wet markets.

For tripe specifically, the price drop was also aided by Guoquan securing stable supply in advance. Raw material prices for tripe in 2024 are only one-third of previous years. Furthermore, Guoquan’s 16 partner factories run around the clock to keep up with livestream-driven demand surges.

Meanwhile, Guoquan has built a fully integrated supply chain system, covering procurement, production, transportation, warehousing, and sales. Through digital systems and a mature cold chain logistics network, it achieves high turnover rates and low inventory costs.

Currently, Guoquan has established 15 central warehouses, over 30 sub-warehouses, and more than 1,000 frozen front warehouses across the country, creating an efficient cold-chain logistics network capable of direct store delivery. Its digitized store management system has significantly improved operational efficiency — the number of stores a single operations manager can oversee has quadrupled in just three years.

Thanks to these measures, Guoquan has developed a product iteration model based on a “Technology + Experts + Users” triad. This has enabled it to continuously produce viral hits, such as 9.9-yuan craft beer, 1-yuan lamb skewers, as well as popular ingredients like crayfish and Western-style meals, all offered with exceptional value for money.

At present, Guoquan has built a product portfolio covering eight major categories: hotpot items, barbecue, beverages, single-person meals, ready-to-cook meal kits, fresh produce, Western cuisine, and snacks — with over 1,000 SKUs. In 2023 alone, Guoquan launched 339 new SKUs, a year-over-year increase of over 50%.

But Guoquan’s ambitions go much further. At its 2023 franchise conference, founder Yang Mingchao announced a bold vision: to incubate 100 billion-yuan-level food brands via the “one product, one factory” model.

Viral products find their moment on TikTok

For Guoquan, the viral tripe combo not only generated significant sales, but also brought substantial foot traffic to its physical stores.

In just the first half of June, the tripe set sold over 800,000 units on TikTok — and it continues to grow, with tens of thousands sold per day. To date, sales have surpassed 2 million sets. Its offline redemption rate is among the highest, and the traffic it drives into stores has directly boosted group-buying transaction value by 150%.

Capturing the traffic windfall from TikTok’s local lifestyle services was a key move for Guoquan in achieving both sales and exposure.

TikTok’s current strategic focus is aggressively expanding its local services — with “in-store consumption” as the top priority.

With the “lowest price on the internet” strategy, TikTok slashed merchant service fees to 2.5%, while offering generous high-value discount coupons to users. This has allowed TikTok to dominate the local lifestyle sector. According to LatePost, TikTok’s local lifestyle GMV (gross merchandise value) surpassed 100 billion yuan in Q1 of 2024, doubling from the same period last year.

In addition to direct livestream selling by merchants, individual influencers and store-review content creators are a unique strength of TikTok’s content marketing model. This helps stores gain exposure and boost group-buying orders.

In the first three quarters of 2023 alone, TikTok featured 1.27 billion store review videos. These were shared 10.4 billion times and garnered over 119.4 billion likes. Store revenue driven by this content reached 94.6 billion yuan, and the number of commercial posts from restaurants and small businesses rose by 98% year-on-year.

Back in September 2023, Guoquan Food held in-depth discussions with TikTok Local Services and jointly developed a Q4 business strategy. This included a variety of short videos, livestreams, and other formats to drive a seasonal hotpot sales surge.

According to data, TikTok’s group-buying O2O (online-to-offline) model has become Guoquan’s core growth engine — with monthly orders surpassing 1 million, driving store sales up by 20–30%.

Moving forward, Guoquan plans to further collaborate with TikTok to expand its customer base. By bundling popular products into value-meal sets sold at competitive prices during livestreams, users are enticed to purchase and redeem in-store, then guided to join brand groups or register as members — ultimately converting them into private domain users.

So far, Guoquan has amassed over 30 million members, with a goal of reaching 45 million by year-end.

Additionally, users who redeem orders through Guoquan’s mini-program provide valuable insights — such as whether they are new or returning customers, and their product preferences. This helps the company refine its product and marketing strategies on TikTok. With this feedback loop, Guoquan can co-create viral products that match TikTok user preferences and complete the O2O sales cycle.

Guoquan has officially positioned TikTok group-buying O2O as a strategic KA (Key Account). With its 10,000+ offline stores and flexible upstream supply chain, it aims to co-develop hit meals and individual items with TikTok.

On TikTok, Guoquan operates a large-scale livestream matrix made up of dozens of accounts, broadcasting continuously around the clock. According to its 2023 annual report, Guoquan livestreamed and published short videos across multiple tiers of TikTok accounts over the past year, achieving more than 6 billion total exposures.

Having tasted success with TikTok’s local services, Guoquan now plans to further integrate its online and offline sales channels, leveraging its physical stores as satellite warehouses to boost revenue.

As its 2023 annual report puts it:

“Further develop online sales platforms — including third-party food delivery apps, the Guoquan app, WeChat mini-programs, and TikTok. Expand the hybrid business model of ‘one store, one shopfront, one warehouse’ to offer an unlimited shopping experience, expand the product range, and overcome the limitations of brick-and-mortar retail space.”

The rise of private-label brands

Guoquan isn’t alone. In recent years, retailers like Sam’s Club and Pangdonglai (胖东来) have become synonymous with high-quality products.

Pangdonglai has essentially become a consulting model for the retail industry: remodeled Yonghui supermarkets have claimed their product structure must reach over 90% parity with Pangdonglai, and have introduced Pangdonglai’s best-selling private-label items into their stores. BBK Supermarket also aims to cover 90% of its product offerings with Pangdonglai-sourced goods, with the goal of becoming “Hunan’s version of Pangdonglai.”

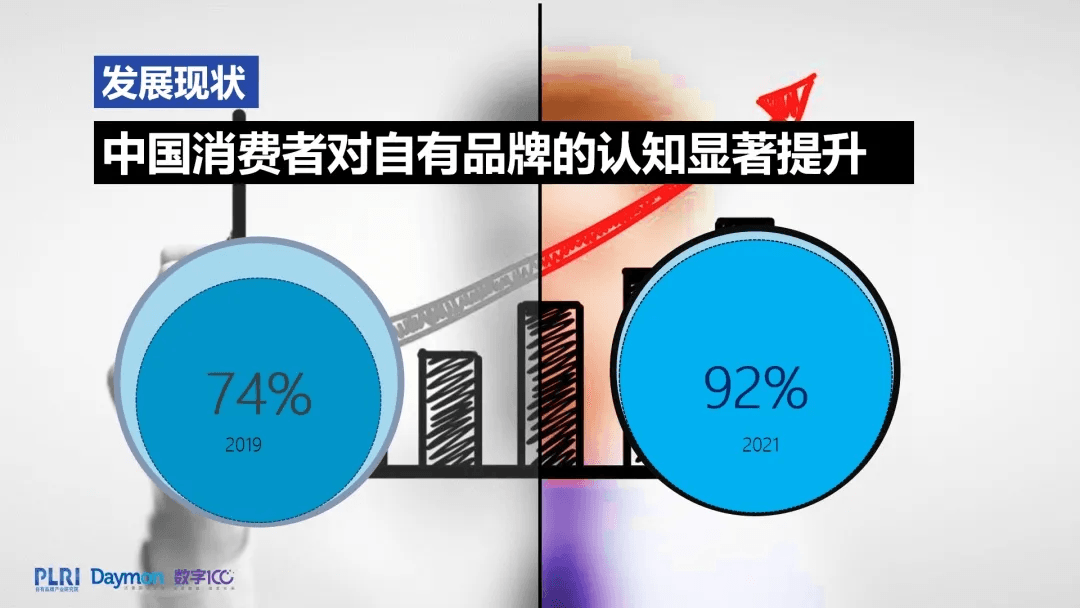

Meanwhile, consumer perceptions of private-label products are improving. According to the 2022 China Private-Label Blue Ocean Strategy White Paper, awareness of private-label brands rose from 74% in 2019 to 92% in 2021.

Big-name branded goods are losing their appeal, while private-label brands from various channels are thriving. Behind this phenomenon lies a new stage in the competition between channels and brands.

On one hand, for retail channels, developing private-label products becomes inevitable once they reach a certain scale. Whether convenience stores or hypermarkets, all are actively seeking differentiated supply sources.

On the other hand, as high-quality supply increases, China’s market has shifted from a seller’s to a buyer’s market. Consumers have become more rational and price-conscious, prioritizing value for money and unwilling to pay steep premiums for brand names — laying the groundwork for the rise of channel-owned brands.

Looking at domestic and international best practices, private-label goods at Walmart, Carrefour, ALDI, and Costco have become core profit drivers. At Sam’s Club and Hema (Freshippo), private-label sales already account for over 30% of total revenue. Retailers creating their own products is now an unstoppable trend.

Take Sam’s Club’s widely acclaimed Member’s Mark wine series: only about 2% of Italy’s 400+ DOP (Denominazione di Origine Protetta) wine regions meet Sam’s stringent selection criteria, which includes blind tastings and expert panels.

Similarly, Pangdonglai collaborates directly with suppliers to create exclusive recipes for best-sellers like DL Baking Soda Enzyme Laundry Detergent, DL Yogurt Fruit Oat Crunch, and DL Craft Wheat Beer — keeping its gross profit margin at a stable 4–5%. Founder Yu Donglai stated that future private-label hits are expected to generate 500 million to 1 billion yuan in annual sales per product.

From a historical perspective, the rise of private-label brands is not a random phenomenon.

The development and emphasis on private-label brands in Western retail began in the 1960s and 70s, peaking after the 1990s.

Today, private-label products occupy a significant share of the market in developed countries. In 2023, private-label brands accounted for an average of 38.5% of food and grocery sales in Europe.

Research shows that private-label market share tends to rise during economic downturns and decline during economic booms. However, this change is asymmetric — the gains during recessions are not fully offset by losses during upswings, because consumer recognition and trust in private-label brands tend to persist.

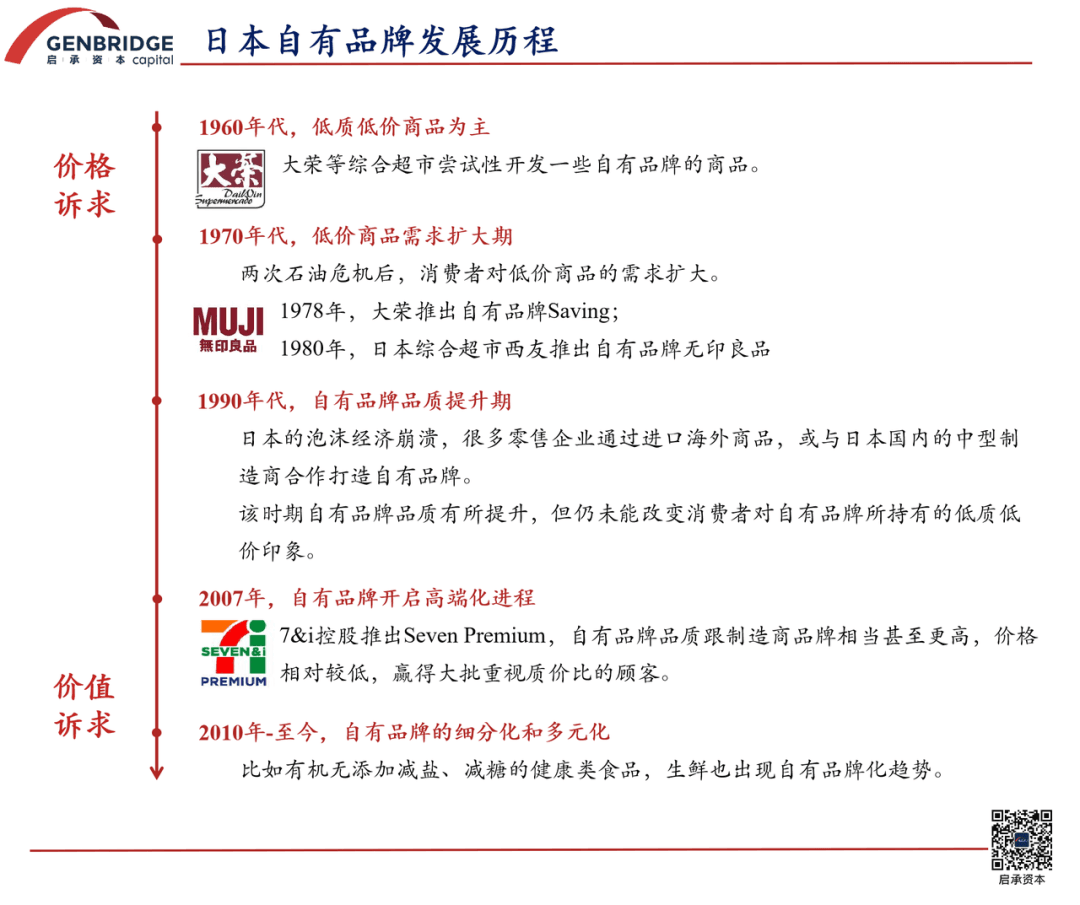

Take Japan as an example. Since the 1960s, private-label products have gone through five stages — evolving from low-quality, low-price offerings to high-end, specialized, and diversified categories.

Driven by events such as the oil crisis and the collapse of the economic bubble, demand for lower-priced goods expanded, laying the groundwork for the emergence of brands like MUJI and other private-label pioneers. During periods of economic prosperity, these brands built robust supply chains and gradually reshaped consumer perceptions. As private labels became firmly established in consumers’ minds, the industry entered a new phase of segmentation and diversification starting in 2010.

Looking back at the rise of Japan’s private-label sector, two key conditions stand out:

Decline in consumer purchasing power – demand for low-cost goods grew, and Japan’s average annual wages have remained nearly stagnant for the past 30 years.

Advancement in manufacturing technologies – the quality gap between private-label (PB) products and national brands (NB) has continued to shrink, enhancing the credibility and appeal of PB products.

Returning to Guoquan, its strategic shift from a “grocery-style ingredient store” to a ‘Community Central Kitchen’ signals a strong commitment to developing private-label products.

The essence of this “Community Central Kitchen” concept lies in Guoquan’s deeper integration with its own upstream factories and supplier partners, treating them as centralized production hubs in its supply chain. Meanwhile, its wide network of community-based stores across counties and cities functions as front kitchens that directly connect with consumers and provide meal solutions.

Today, over 67% of Guoquan’s products are either independently developed or co-developed with partners. As private-label brands increasingly take center stage in the retail industry, Guoquan has undoubtedly secured its entry ticket.

GenBridge Capital, which invested in Guoquan in the first half of 2020, believes that the company has already built strong competitive advantages and defensible barriers in both product development and supply chain.

Rooted in the food industry, Guoquan Food emphasizes high-quality products. Its founding team has decades of experience in hotpot, barbecue, and related fields, with an unwavering dedication to product R&D. At the same time, Guoquan has invested heavily in its supply chain — identifying the best suppliers for each category nationwide, while also building high-standard, capital-intensive food industry parks for in-house production.

In today’s “buyer’s market”, companies like Guoquan tightly integrating manufacturing with retail, representing the future direction of the food industry.