In the Spring of 2024, GenBridge team led over 40 partners to a week-long study tour in Tokyo, keen to glean insights andexpertise from dapanese consumer leaders and explore how to apply these leamings back to the Chinese market.

This group of over 40 GenBridge portfolios and partners, comprising founders and key executives from leading Chinese consumer companies: Snack Is Busy, Xueji Roasted Nuts, Guoquan Frozen Food, Qiandama Fresh Produce, New Joy Mart, Duoletun Discount Store, Ripe Fruit Beverage, Hengdu Food and Xianchun Bakery, embodies the rising force of China's consumer industry. Collectively, these companies operate more than 24,000 stores and generate total annual sales surpassing USD 10 billion.

Building on last year's GenBridge's first study tour in Japan's Retail Industry, this 7-day study tour included 4 modules: store visits, company visits, closed-door sessions with industry experts, and FOODEX JAPAN, covering a wide spectrum of Japan's consumer industry landscape.

A core feature of this study tour was the combination of prior research and on-site verification. GenBridge has long been engaged in in-depth research on Japanese retail formats, including discount retail chains like Don Quijote and Kobe Bussan, as well as fresh food retailers like Lopia. During this tour, we visited more than ten uniquely local community retail chains in Japan. We witnessed brightly lit stores, tidy displays, exquisite products, and experienced the freshness of the food and the warmth of the staff — all of which made our prior research come to life.

This article is a reflection and summary of our trip to Japan. We hope that readers who are deeply engaged in the consumer industry or who are interested in Japan’s consumer market can relive the highlights of our journey to Tokyo with us.

An immersive journey for China’s new generation of consumer industry leaders

Community store visits were a key module in this study tour. We're bound to be astonished by the diversity of its stores. Each one boasts an extensive selection of products, meticulously organized and displayed, unbelievably low prices, and exceptional customer service. We embarked on a field trip to explore iconic stores such as 7-11, OK Mart, Donki, Lopia, Daiso, Kobe Bussan, Aeon to discover more.

During these visits, our partners stepped into the role of ordinary consumers to experience the products, displays, and services firsthand. At the same time, as business operators, they also carefully observed the operational logic and management details behind each store. This dual perspective offered eye-opening insights. For instance, while visiting Japanese convenience stores, our members were amazed by the pricing and quality standards: beverages such as green tea, coffee, and alcohol were priced similarly to bottled water. For China’s retail industry, this sets a meaningful long-term goal.

We also curated customized visits for different enterprise types, matching each with leading Japanese counterparts. These included: a 7-Eleven franchisee with daily single-store sales of 70,000 RMB; the third-generation owner of a snack chain with 80 years of history in Osaka; a former executive from Don Quijote

The founder of top-tier Japanese design company Canaria; ACCESS, Japan’s largest food wholesaler; major Japanese ice cream brands; AGF, Japan’s largest instant coffee brand.

After the study tour, many participants praised the experience, calling it “a journey of depth, also a journey of dedication.”

How giants create delicious products

If the first phase of our retail-focused tour helped us understand how Japanese retailers thrive in a buyer’s market through strategic "production-sales alliances," this tour illuminated the other side of that alliance — how Japanese food companies develop outstanding product innovation, production systems, and logistics frameworks to create consumer-delighting products in coordination with the retail channel.

From our visits to Japan’s food giants, we identified three shared characteristics:

Product-driven strategy: going upstream into the supply chain to build full-link business barriers.

Co-creation with retailers: developing, customizing, and iterating products in tandem with Japan’s mature retail channels to meet consumer needs.

Global-local synergy: tightly integrating global strategies with local preferences by developing country-specific products tailored to local consumers.

Calbee

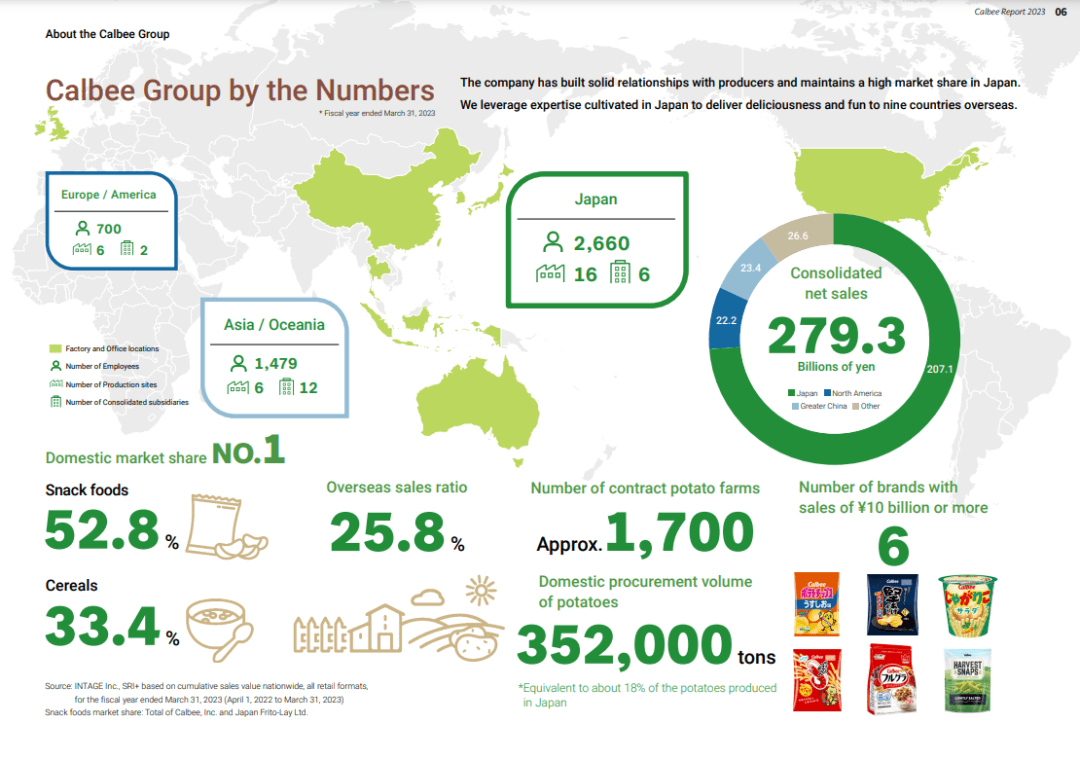

Calbee is Japan’s largest snack company, holding a 52.8% market share in the domestic snack sector. In fiscal year 2023, Calbee’s revenue reached 279 billion yen (approximately 14 billion RMB), with a net profit margin of 7.5%. Overseas sales accounted for 25.8% of the total and continue to rise each year.

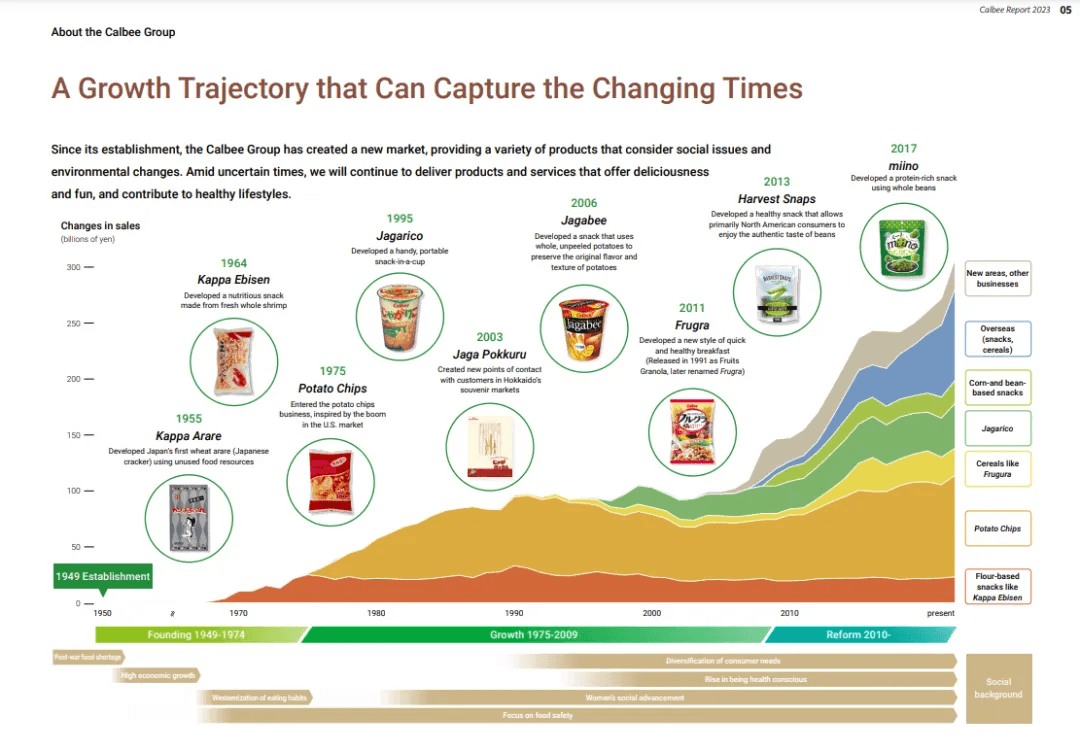

Our visit to Calbee stemmed from the observation that its continued growth is driven by its ability to consistently launch blockbuster products every few years. Through our exchanges, we learned that Calbee’s product innovation philosophy focuses on the effective use of underutilized food resources, transforming ingredients of varying sizes and varieties into nutritious and delicious products tailored to their unique characteristics. Signature hits such as Calbee’s shrimp chips, potato chips, and Jagariko snacks all originated from this mindset.

Behind this approach is Calbee’s deep expertise in raw material sourcing. It is the only food company in Japan that adopts an integrated farm-to-factory production and sales management system. By establishing long-term partnerships with farmers and engaging in direct guidance and procurement, Calbee is able to continuously improve ingredient quality and secure a stable supply. Its efficient use of ingredients and upstream collaboration exemplify Calbee’s corporate philosophy: "Harnessing the Power of Nature."

Kewpie

Founded in 1919, Kewpie is Japan’s iconic salad dressing brand. It holds approximately 50% of the domestic market share for egg yolk-based mayonnaise and about 40% of the vegetable salad dressing market, earning its reputation as Japan’s national condiment brand. In fiscal year 2023, Kewpie recorded approximately 455 billion yen (about 22.7 billion RMB) in revenue, with overseas sales accounting for 17%. It is reported that demand for Kewpie products has exceeded supply in the U.S. market.

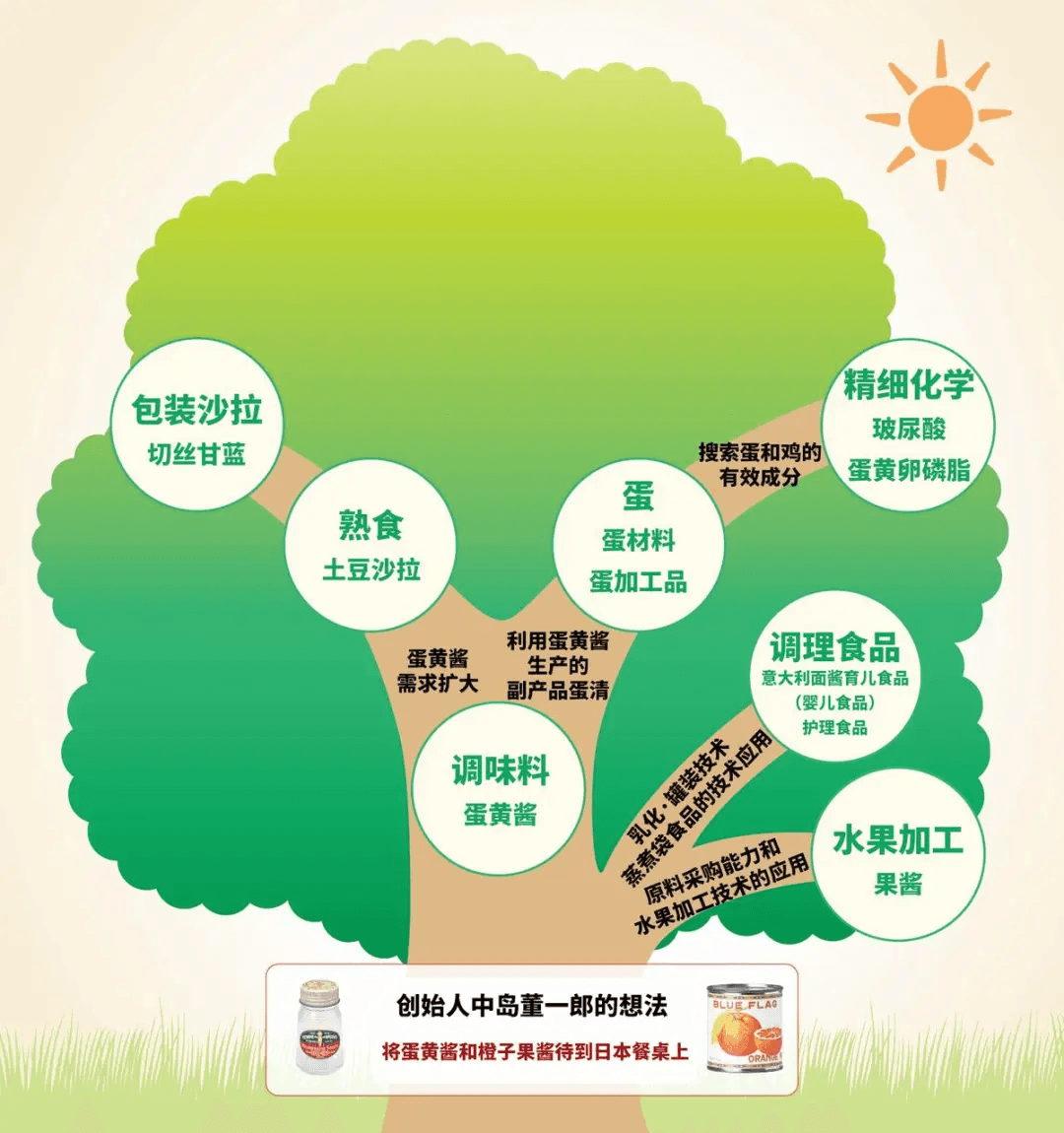

Our visit to Kewpie was not only intended to explore potential business collaborations with our partner companies, but also to learn how Kewpie sustains its high-quality growth. We discovered that Kewpie’s expansion stems from its technological diversification across its product lines. From mayonnaise, Kewpie extended into egg-based products, fine chemicals, potato salads, and packaged salads. Its fruit jam technology has evolved into pasta sauces, baby food, and more.

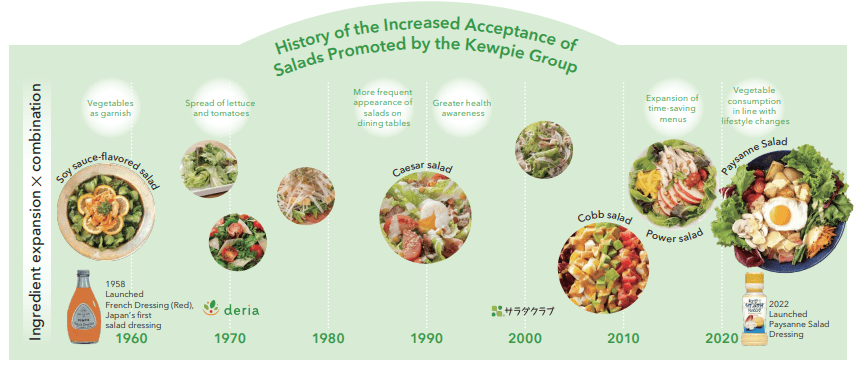

Moreover, we learned that through persistent market education, Kewpie has helped elevate the salad dressing market in Japan to become second only to cooking oil in value—surpassing traditional condiments like sugar, miso, soy sauce, vinegar, and salt. By introducing a non-native product and nurturing the market over 30 years, Kewpie truly exemplifies co-innovation with consumers. For example, Kewpie develops seasonal salad menus based on fresh vegetables, hosts “Salad Dressing Classes” for children, and organizes farm visits for consumers to harvest vegetables—engaging consumers through interactive activities to promote the appeal of salads and gradually build their acceptance in Japanese households.

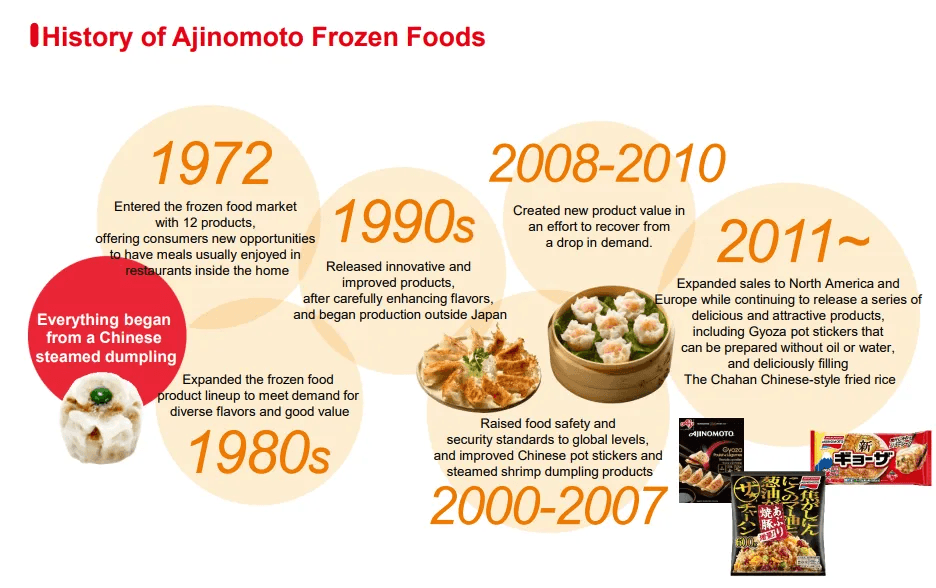

Ajinomoto Frozen Foods

Ajinomoto Frozen Foods, founded in 1972, generated 105.7 billion yen in revenue in 2022 (approximately 5 billion RMB), making it one of Japan’s largest frozen food companies. Its business operates in two segments:

- To C: consumer-focused home-use products

- To B: wholesale supply to restaurants, convenience store chains, and institutional food service (e.g., schools)

Ajinomoto excels in transforming various culinary dishes into frozen food products through research and development, offering safer and more convenient meal solutions. The company established manufacturing facilities in China 30 years ago, with products primarily exported to Japan and the U.S. Looking ahead, Ajinomoto aims to expand in the Chinese market through localized production and distribution.

Product development at Ajinomoto starts with consumer needs. The company uses advanced proprietary technologies to develop products based on consumer preferences, lifestyles, and nutritional demands. For example, its frozen dumplings have undergone dozens of iterations. The latest version can be placed directly into a pan—no oil or water needed—offering consumers a quick yet high-quality cooking experience.

Exclusive insights from industry veterans

During the trip, we organized several closed-door expert sessions. Seasoned professionals from fields such as retail, product R&D, vertically integrated retail, and factory operations delivered inspiring and thought-provoking talks.

"Trends in Japanese retail channel operation" — Mr. Nariaki Kawahara

Mr. Nariaki Kawahara is a retail reform expert in Japan, the former president of Lawson 100 and Seijo Ishii. He previously held positions at Ito-Yokado, Boston Consulting Group, and Lawson, bringing over 20 years of experience in the retail sector.

In his lecture, Mr. Kawahara gave a macro overview of the current state of Japan’s retail industry, analyzed the challenges faced by large supermarkets, and dissected the development status of various retail formats. He also focused specifically on convenience store formats and used the Lawson case study to propose a future direction: evolving convenience stores toward EDLP (Everyday Low Price) specialty formats.

Mr. Kawahara emphasized that retailers should actively integrate upstream operations (as exemplified by UNIQLO) and build transparent, interconnected supply chains that bridge manufacturers and retailers. This would shorten delivery cycles and improve inventory management. At the same time, retailers should collect and feed back consumer data to optimize the entire supply chain's efficiency.

“How to build a vertical integrated retail” — JMAC

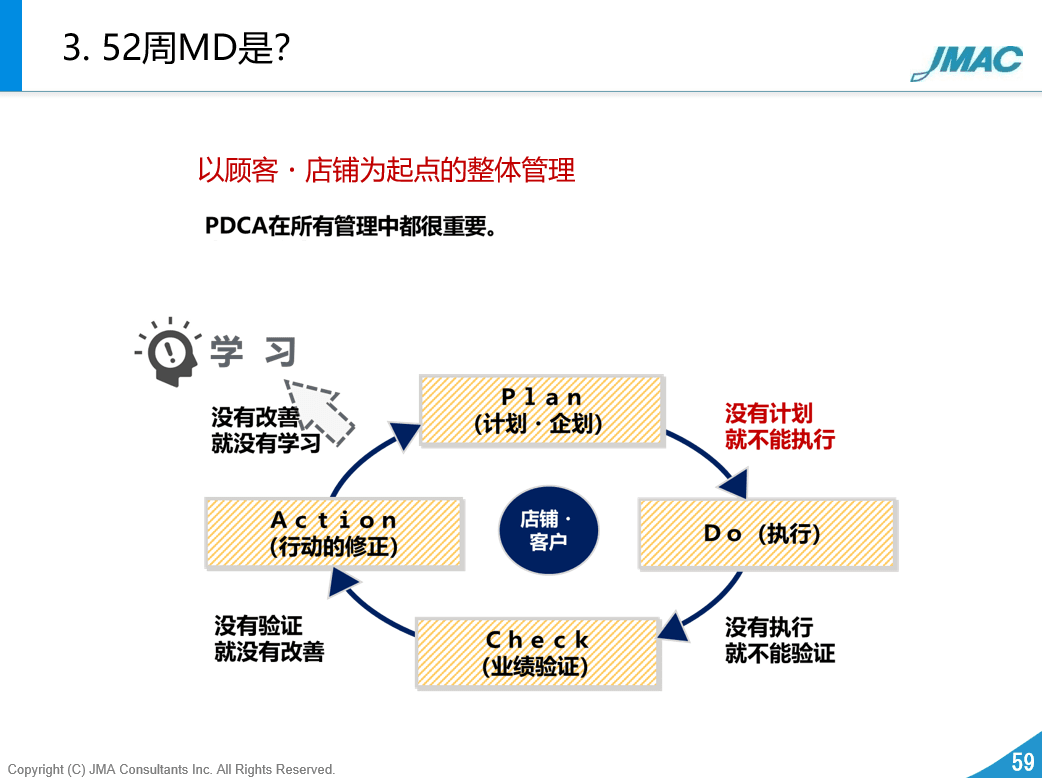

JMAC is Japan’s oldest consulting firm, with projects spanning more than half of Japan’s listed companies. Through its consulting services, it has helped popularize efficiency-enhancing methodologies across numerous industries in Japanese society.

Their presentation focused on the transformation of the retail supply chain. Mr. Katsumi Fujimaki, a senior consultant at the Nohryo Association, introduced three key insights into building competitive supply chains in retail:

Differentiated and cost-effective products through private label strategies

Enhanced in-store product appeal using a 52-week MD (merchandising) strategy

Efficient supply chains resulting from integrated manufacturing and sales operations

In addition, Mr. Yasuyuki Omori, an expert from the Supply Chain Design & Management Department, shared a comprehensive framework for factory construction and planning. He explained that during the industry’s growth phase, factories are built to scale up production and increase revenue. However, as industries mature and competition intensifies, factory investments shift toward cost reduction and efficiency improvement. He also shared risk points in factory construction and how to avoid them.

“Comprehensive capabilities for developing top sellers” — Hiroyasu Yamamoto

Mr. Hiroyasu Yamamoto, an expert in hit product development and latent consumer needs research, shared with the Qicheng study group the secrets behind blockbuster product creation. He previously worked at major beverage company Ito En, where he witnessed the company's rise from a small player to a national brand. Later, he joined Coca-Cola Japan and Japan Tobacco Inc., working as a brand manager for over 20 years. For the past 10 years, he has guided various companies in self-branding strategies.

Focusing on product development logic and marketing, Mr. Yamamoto analyzed the mindset and pitfalls behind successful products using his past case studies. He emphasized that long-selling products must be win-win solutions that earn enduring trust from both companies and consumers. Companies need to think from a long-term perspective, creating products that make consumers genuinely feel they’re being helped — not just sold to.

“Anticipate future trends & design trending products” — Tomoaki Hisazuka

Mr. Tomoaki Hisazuka, a former executive at Ajinomoto and later Deputy General Manager at Coca-Cola’s Tokyo R&D Center, gave a compelling lecture on identifying genuine consumer needs. He emphasized the importance for manufacturers to maintain a bird’s-eye view while capturing subtle changes in consumer preferences — in order to develop products that lead future trends.

Mr. Hisatsuka highlighted the role of tacit knowledge in food development. For instance, when developing white sauce, his team analyzed and quantified the cooking processes of top French chefs. This transformation of expert know-how into measurable, replicable processes allowed for the industrial production of gourmet-level white sauce, enabling ordinary consumers to replicate chef-quality dishes at home.

Deep engagement and collaboration with global F&B leaders

During the trip, we also attended FOODEX JAPAN, one of the world’s premier food and beverage trade shows. Founded in 1976, it is Japan’s most important international food and beverage exhibition, ranking third globally after Anuga (Germany) and SIAL (France), and the largest in the Asia-Pacific region.

At the expo, GenBridge partner companies were able to engage directly and efficiently with potential collaborators from Japan, China, and Europe, successfully identifying a number of high-quality supply chain partners.

The trip received high praise from our partner companies:

“GenBridge’s study tours are the most in-depth and targeted in the consumer industry. Beyond retail visits and peer exchanges, the opportunity to speak directly with the leaders of Japan’s top companies is invaluable. What sets GenBridge apart is that it does the research ahead of time — so when we’re on-site observing Japanese business models, we gain truly actionable insights. Even the visits were customized to our business needs — highly efficient and effective.”

We at GenBridge Capital also gained a wealth of insight from this study tour. In summary, we believe the key lessons from Japan’s food industry can be distilled into three words:

Quality – ensured by a stable and efficient production and distribution network

Innovation – driven by ongoing exploration of new consumer needs

Efficiency – achieved through tight integration of sales and supply chain management

Each of these may seem simple, but they are worth deep reflection and continuous refinement in real-world practice.

Whether in the food sector we focused on this time or the broader consumer space we continue to explore, these are long-cycle industries. Even after Japan’s so-called “Lost Thirty Years,” its food industry continues to evolve in response to changing consumer demands — giving rise to internationally successful food and retail enterprises. This achievement has greatly boosted the confidence of China’s consumer sector. We firmly believe that with continued, step-by-step efforts, China will see the rise of more world-renowned consumer brands in the near future.

Going forward, GenBridge will continue working closely with industry players to explore deeper cooperation with Japan’s food, retail, and restaurant sectors. We invite you to stay tuned for our upcoming research publications, industry exchanges, and study tours — and to engage with us through our official WeChat and video channels.