- Introduction

- Saizeriya: The consumer champion mastering market cycle

- Extreme cost-effectiveness does not mean a reduction in quality

- Continuous iterative optimization of store operations

- The vertical integration of the supply chain across the entire value chain

- Efficiency is a means, but it cannot be the goal

- The customer-centric corporate culture

- What we learned from Saizeriya

Introduction

As the recovery of offline consumption this year, the catering industry has ushered in a long-awaited resurgence. GenBridge believes that catering chains would enter a new stage of development, and we will continue to focus on chain catering as an investment theme this year.

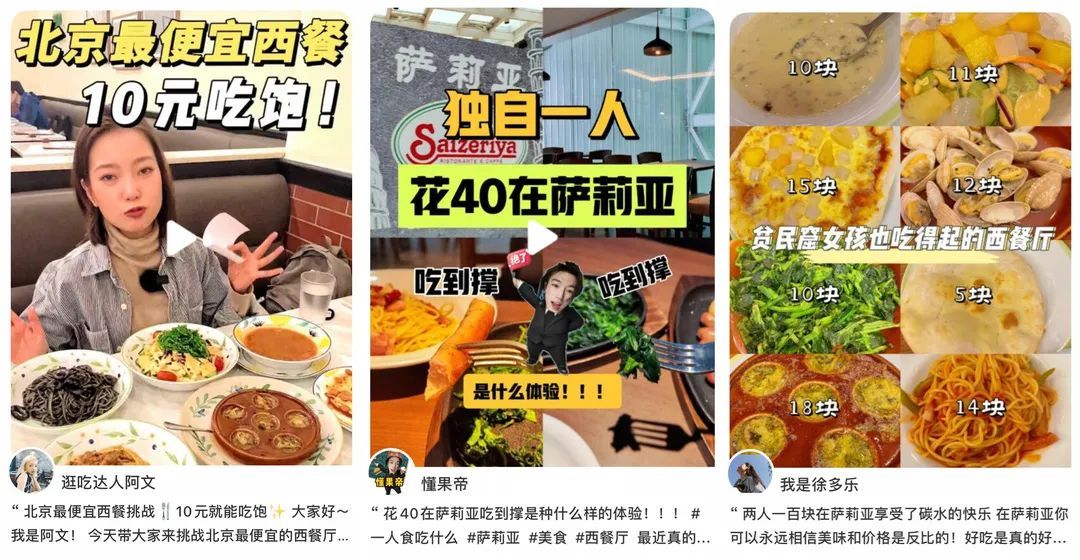

On the supply side, individual catering has gradually declined in the past three years, and chain catering brands have accelerated their national development: direct-operated chains with hundreds of stores such as Mr.Ma’s Noodle, and franchise chains with thousands of stores such as Tastien. On the demand side, consumers’ requirements for quality continue to rise, but their willingness to pay has not increased significantly. We believe that consumers’ implicit demand for “high cost performance” will be one of the biggest opportunities in the catering industry.

By in-depth research GenBridge believes that the new generation of catering chains first needs to deeply polish the combination of dishes and the operation system, find the extreme balance point between “quality” and “efficiency”, and then develop a nationwide chain based on this to obtain scale advantages. We have conducted in-depth research on the Japanese Italian food chain brand Saizeriya: it produces extreme cost-effective products and scales up chain operations, enabling it to continue to grow to about 10 billion yuan in revenue over the past 30 years. We believe that Saizeriya’s method of achieving “extreme cost-effectiveness” is the core capability that is most worth learning for China’s current catering chains.

Saizeriya: The consumer champion mastering market cycle

Saizeriya is an Italian cuisine chain restaurant brand originating from Japan, with the enterprise revenue reaching approximately 8.1 billion yuan in 2022. The brand ranks 9th in the Japanese catering industry, and is the only non-local cuisine brand besides McDonald’s and Starbucks. Saizeriya operates 1547 stores, including 1069 stores in Japan, 449 stores in China, and 29 stores in Singapore, all of which are directly operated.

Saizeriya is a restaurant brand that has polished its cost-effectiveness extremely , and has been regularly selected for Japan’s most popular catering rankings by offering a wide range of choices at low prices. Saizeriya’s success was due to the period of stagnation in the Japanese catering industry from 1996 to 2011. Its extreme cost-effectiveness had significant appeal during this period, standing out in the reshuffling catering industry and achieving counter-cyclical growth.

Firstly, the deterioration of the economic situation led to the cooling of market demand. The scale of the Japanese catering industry entered a period of decline after 1997, average annual household income in Japan dropped from 6.6 million yen in 1997 to 5.3 million yen in 2014.

In addition, the cost of enterprise labor has been continuously increasing due to the reduction of labor force caused by the declining birthrate. The minimum hourly wage for part-time workers has risen from 460 yen in 1985 to 920 yen in 2020. Japanese catering companies are facing the dual challenges of declining demand and rising costs.

The changes in the external environment have brought the Japanese catering industry into a new stage of competition. In such a challenging environment, Saizeriya has always adhered to a high cost-performance strategy, and has even tried to lower prices. While the prices of other market commodities continued to rise, Saizeriya’s pricing made consumers feel more and more affordable, continuously strengthening its price image.

Extreme cost-effectiveness does not mean a reduction in quality

Japanese retail expert Shunichi Atsumi once said: “The best price range for chain restaurant channels is the price that consumers can choose with their eyes closed.” In order to achieve this goal, the highest price of Saizeriya’s dishes does not exceed twice the lowest price, allowing consumers to spend an average of 30 yuan per lunch.

In order to achieve sufficiently low prices, Saizeriya has a low gross profit margin for many of its individual products. Therefore, Saizeriya needs to encourage consumers to purchase more individual products voluntarily in order to increase the average consumption and achieve a mixed gross profit. For example, a glass of imported Italian red wine costs only 6 yuan. The gross profit margin for wine is only 3%, but the founder of Saizeriya, Yasuhiko Shogaki, has always been unwilling to raise prices because the high cost-effectiveness of wine can attract consumers in the office area to order a few small dishes at Saizeriya and have a drink before returning home.

Cheap does not mean compromise, and the founder of Saizeriya has consistently treasured the value that catering brings to customers.

The richness of the dishes is the most direct reflection of value. Saizeriya’s Japanese menu has a total of 65 SKUs, with main courses accounting for about 30%. In order to provide more diverse options, Yasuhiko Shogaki believes that dishes need to adhere to a 6:3:1 ratio. “6” refers to individual products that can sell well on their own, “3” refers to products that the store wants to sell, and “1” refers to essential products.

To protect the brand’s value, there is an unwritten rule within Saizeriya that prohibits the introduction of “single-dining” dishes that are commonly found in Japanese cuisine. The founder believes that Saizeriya is not a fast food restaurant but a place for gathering, and that the core of Italian food culture is the process of “sharing”, which requires a sense of happiness that only comes from eating together. This also allows Saizeriya to better cover scenarios where multiple people are dining together.

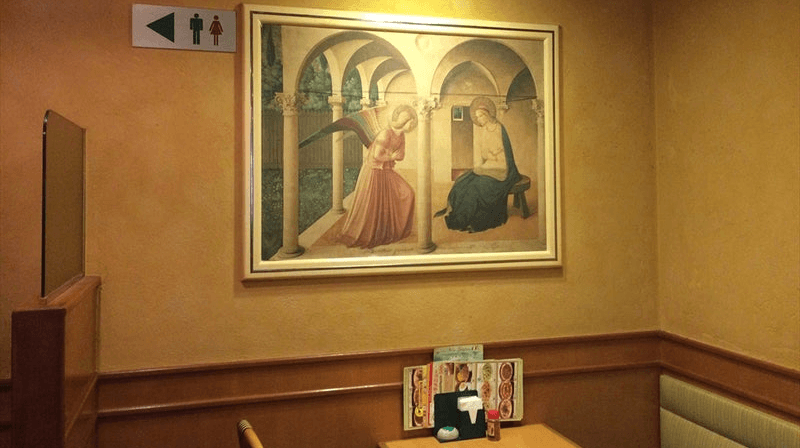

Yasuhiko Shogaki respects the tradition of Italian cuisine. The taste of the dishes is localized, but the product names deliberately retain Italian elements such as Italian names. The stores hang Italian Renaissance paintings such as Botticelli’s “Spring” and “The Birth of Venus”, and Raphael’s “The School of Athens”, reflecting the artistic and strong romanticism of Italy.

Saizeriya combines high cost-effectiveness and abundant dishes of chain catering, as well as cultural pursuit of Italian food. The foundation for achieving cost-effectiveness is efficient store operations and supply chain management.

Italian world famous painting hanging in a Saizeriya store

Continuous iterative optimization of store operations

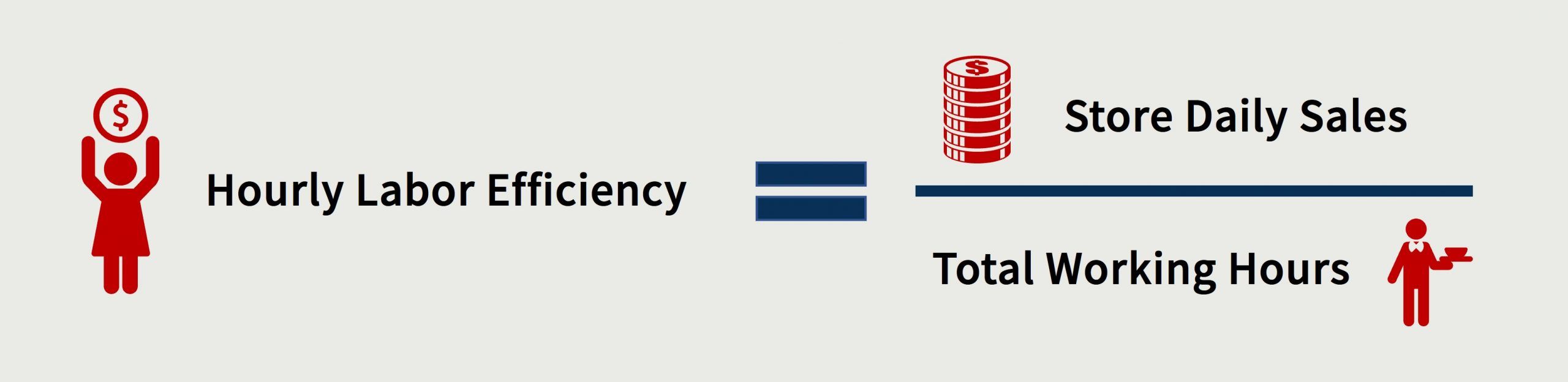

Catering is a labor-intensive industry, and labor costs have a significant impact on performance. In an environment where labor costs are increasing, “hourly labor efficiency” will become increasingly important, and behind this is the need for companies to repeatedly iterate their store operations.

“Hourly labor efficiency” is Saizeriya’s core indicator. Saizeriya’s Japanese stores can achieve hourly labor efficiency of RMB 400-500. Saizeriya’s high labor efficiency comes from the continuous optimization of operational standards. For example, in terms of store cleaning, Saizeriya has improved its mop and optimized the cleaning process, which has reduced the opening cleaning time needed from 60 minutes to 30 minutes. When calculated from the perspective of thousands of chain stores, saving 30 minutes per store can bring a significant improvement in efficiency.

Employee fatigue is an obstacle to standardized operations, but the responsibility does not lie with the employees. The founder of Saizeriya believes that operational errors in stores are not due to employees not working hard enough, but due to inadequate consideration by the headquarters. Therefore, the headquarters will constantly test new solutions: improving the weight to make dishes easier to carry; selecting safer cups that are not easily broken; making oily plates easier to clean, and so on.

Because of the highly standardized working system, the stores have the energy to optimize their operations. To encourage store managers to pay attention to operational optimization, Saizeriya’s promotion is not solely based on sales performance. Saizeriya does not have mandatory KPI requirements for store managers, and the headquarters values the contributions of store managers to the overall operation of the company. Store managers who have successfully been promoted often cultivate their own assistants in the store, stabilize the store’s revenue performance, and release certain energy into thinking about the iteration of store operations. This system allows the concept of scientifically improving operational efficiency to penetrate into the grassroots store operations of the company.

The vertical integration of the supply chain across the entire value chain

Saizeriya’s efficiency comes from the continuous optimization of stores and supply chains. The standardization and pre-fabrication improvement of the backend supply chain further simplifies the operational difficulties of the stores.

The characteristics of Saizeriya’s business model support this bidirectional optimization. Saizeriya is an SPA (specialty retailer of private label apparel) in the catering industry, which means it integrates vertically from retail to production. The company actively invests in vertical supply chains to achieve economies of scale. Saizeriya has a total of 7 self-built central factories, 6 in Japan and 1 in Australia. Domestic factories mainly process ingredients, prefabricate components, and provide logistics and distribution work, while Australian factories take advantage of its price advantage and mainly produce prefabricated ingredients such as beef and cheese sauce.

Saizeriya’s supply chain continues to deepen industrial production on the upstream agriculture side. In order to improve the cultivation efficiency on the farm side, Saizeriya actively engages in the development of agricultural product varieties. For example, Saizeriya has cultivated a new variety of tomatoes that are only half the height of ordinary tomatoes, so farmers do not have to squat continuously, reducing labor time during the harvest period and improving harvesting efficiency. Saizeriya has also made improvements to the lettuce used in salads. Saizeriya has developed a new variety called “Saizeriya No. 18,” which reduces the size of the core so that a single head of lettuce can yield 5-7 servings of salad.

Based on the continuous polishing and optimization of its supply chain, Saizeriya can significantly improve its price advantages. Every time there is enough profit “squeezed out” from the supply chain, the profit is fed back to consumers. Currently, several of the dishes sold by Saizeriya are 50%~70% cheaper than their prices from a few years ago.

Efficiency is a means, but it cannot be the goal

Efficient Saizeriya has had fatal business problems due to the excessive pursuit of “efficiency,” making means an end and overturning priorities.

From 1998 to 2003, Saizeriya experienced a rapid expansion period. Under the direct-operated system, the company expanded with an average of 100 stores per year. However, the rapid decline in single-store revenue, from 130 million yen to 90 million yen, was due to insufficient talent reserves.

To address the staffing issue, from 2003 to 2008, Saizeriya slowed down its expansion pace and had to limit the opening of about 20 stores per year.

Just as store operations were stabilizing, Saizeriya faced a major food safety incident in its supply chain. In 2008, trace amounts of melamine were detected in the frozen pizza dough imported by Saizeriya. Although the amount was minimal and would not harm the health of adults, it still caused significant public concern. Saizeriya immediately withdrew all pizza products from the market and held a national press conference to explain the situation.

These problems all stem from Saizeriya’s excessive pursuit of efficiency and imperfect management system. After learning from these painful lessons, Saizeriya is also trying to make the entire organization more closely aligned with the lives and needs of consumers.

The customer-centric corporate culture

To address the business problems caused by the pursuit of efficiency, Saizeriya’s founder once again emphasized the importance of shaping a customer-centric corporate culture. He refers to customers as “supporters” within the company, constantly emphasizing that “Saizeriya’s growth comes from the support of our customers.” The founder’s absolute value for customers is reflected in Saizeriya’s corporate philosophy of “sharing, honesty, and solidarity,” which is also embodied in the company’s daily operations.

Yasuhiko Shogaki, Founder of Saizeriya

Product development and pricing are the most visible manifestations of Saizeriya’s customer-centric corporate culture. New products should be developed from the perspective of consumers. Therefore, “why are customers willing to come to Saizeriya”, “who are the products for to bring happiness”, and “whether they will be willing to come with friends next time” are the questions that the company should truly focus on.

Facing consumers with an honest attitude is also a culture of Saizeriya. After the melamine incident, Saizeriya’s executives stated at a national press conference that consumers could get refunds at the store with their receipts. As soon as the statement was made, Shimokura grabbed the microphone next to him and answered, “Full refund. As long as you have eaten it, regardless of whether or not you have a receipt, we will refund your money.” The approach to handling this incident inspired Saizeriya’s team and made them deeply understand the meaning of honesty.

Building a corporate culture takes time, but once it permeates, it lays a solid foundation for the company’s long-term development. After facing various problems during the rapid expansion period, Yasuhiko Shogaki’s corporate philosophy gradually permeated the grassroots level. According to experts, during store manager meetings, everyone would reflect on and discuss the problem of excessive pursuit of efficiency. For chain catering companies, efficiency and service are key conflicting factors, but Saizeriya maintains a balance between the two by having a customer-centric corporate culture.

What we learned from Saizeriya

The catering industry is different from the retail industry, and companies would be challenging to increase the average customer spending by promotions and other methods. Additionally, large influx of customers can also harm the dining experience. Therefore, the core of chain catering industry operation is to increase the frequency of customer repurchasing as much as possible. Therefore, providing high-value products and varied high-quality choices are crucial balancing issues for catering enterprises.

This study analyzes the Japanese Italian restaurant chain Saizeriya, which can be understood as a community canteen for all ages and all people. This company achieves its high-value products through super-high-operating efficiency. This high-efficiency comes from the continuous two-way optimization of store operations and supply chain capabilities. In turn, continuous optimization comes from Saizeriya’s cultural emphasis on “practicing and verifying the truth,” viewing the process of continuous experimentation and correction as the driver of corporate progress.

However, catering companies still provide services to customers, and cannot just focus on efficiency without service. Saizeriya has also made mistakes in pursuing efficiency excessively. The core of being able to correct problems in time comes from the corporate culture that founder Toshihiko Shimokura has always adhered to and continues to implement. When making decisions, they never ignore the thinking angle of “customer-centric” perspectives.

In the future, Saizeriya’s standardized operations and vertical supply chain capabilities will be mandatory courses for chain catering companies. Unlike Japan, the competitive environment in the Chinese market is more complex. Chinese catering chain brands must not only focus on efficient operations but also consider how to iterate progress faster, explore business models and dish combinations, and achieve national-scale expansion.

GenBridge will provide more practical solutions for the industry and continuously provide insights for the development of the catering industry in China. We will also build a platform for mutual learning and communication for industry practitioners.

References

Videos:

テレビ東京「カンブリア宮殿:サイゼリヤ」2009年9月14日

Publications and papers:

正垣泰彦,「おいしいから売れるのではない、売れているのがおいしい料理だ」,日経BP, 2011年

生産性総合研究センター,「レストラン分野・コストパフォーマンス№1 企業を支える独自の「製造直販」システム」,公益財団法人日本生産性本部,2014年5月

山口芳生,「サイゼリヤ革命―世界中どこにもない“本物”のレストランチェーン誕生秘話」,柴田書店, 2011年

村山 太一「なぜ星付きシェフの僕がサイゼリヤでバイトするのか? 偏差値37のバカが見つけた必勝法」飛鳥新社, 2020年

日経ビジネス「独り勝ちの研究 企業:サイゼリヤ 安さを実現する”科学”」42-47, 日経BP, 2008年10月27日