On February 17, 2025, Mingming Henmang held its 2025 Cost-Saving Strategy Launch Conference at the National Aquatics Center (Water Cube) in Beijing. At the event, the company officially launched its own private-label products and announced a dual-brand upgrade for "Snacks Henmang" and "Zhao Yiming Snacks", alongside the nationwide rollout of its 3.0 store model. This marks the beginning of a new 3.0 era for the bulk snack retail industry—one centered on "value for money" as the core proposition.

At the conference, Mingming Henmang CFO Wang Yutong revealed that the company’s 2024 retail sales exceeded 55.5 billion RMB, and the number of operating stores had surpassed 15,000. Behind these figures lies the rapid integration of the company’s dual brands, an upgraded and optimized organizational structure, and a significantly more cost-efficient supply chain.

International consulting firm Frost & Sullivan certified Mingming Henmang as:

- “National Leading Brand in the Snack Chain Industry,”

- “No. 1 in Number of Stores Nationwide in the Snack Chain Industry,” and

- “No. 1 in Revenue Nationwide in the Snack Chain Industry,” affirming its leading position in the sector.

At the same time, Mingming Henmang officially unveiled its upgraded dual-brand IP image. Centered on the “M” symbol, the new mascots "Baby Busy" (小忙) and "Baby Ming" (小鸣) were introduced, along with the new brand slogan:

“For savings, shop at Mingming Henmang.” This reinforces the company’s mission of “saving money for the people and building infrastructure for communities.”

Company founder Zhao Ding delivered a keynote speech at the event, stating:

“In the past, Mingming Henmang excelled at offering more products, lower prices, faster updates, and better experiences. In the future, we aim for carefully selected categories, fair pricing, and greater purchasing convenience. We will restructure our cost model, prioritize efficiency, and center everything around the customer to achieve overall cost leadership and truly save money for the people.”

Zhang Xinzhao, Founding Partner of Qicheng Capital, commented that the 3.0 store model of Mingming Henmang represents a business format innovation built on value reconstruction. It reflects three key trends shaping the future of retail:

- Rebuilding product assortments using buyer-driven logic to create new value;

- Utilizing digital tools to construct a channel network and reshape supply chain efficiency;

- Continuously optimizing the in-store experience to form competitive differentiation.

As the world's most deeply integrated market benchmark, China's retail industry boasts a unique combination of dense community networks, advanced digital infrastructure, and a comprehensive manufacturing system—fertile ground for the evolution of retail formats.

In this new phase of stock-based competition in retail, companies like Mingming Henmang, which can revolutionize product categories, upgrade supply chains, and restructure shopping scenarios, are well-positioned to reshape the competitive landscape of the industry.

Industry’s first to launch private-label products

At the press conference, Mingming Henmang announced the launch of its private-label product line, aiming to control costs while pursuing higher product quality. Li Fang, the Group's Product Operations Director, shared a set of key statistics: Mingming Henmang has expanded to 319 cities across China, serving 5.9 million customers daily. Member purchases account for 75% of total sales, and the company has accumulated 126 million membership records.

Behind these massive figures lies a significant responsibility. Mingming Henmang continues to reflect on how to genuinely serve its customers—not only identifying explicitly stated needs but also uncovering unspoken expectations.

Based on consumer insights, Mingming Henmang will optimize in two major areas:

- Collaborating with branded manufacturers to co-develop and enhance products based on data;

- Accelerating overall product upgrades through the rollout of its private-label offerings.

The private-label portfolio includes the Red Label, Gold Label, and future sub-brands, each tailored to different consumer segments.

- The Red Label focuses on eliminating brand premiums, allowing customers to afford and trust the products.

- The Gold Label features carefully selected premium ingredients, offering better choices for quality-conscious consumers.

- Future sub-brands will cater to more specialized market needs.

As the first company in the bulk snack industry to launch its own private-label line, Mingming Henmang is setting new benchmarks for product safety and information transparency. All private-label production facilities are required to have 24-hour surveillance, enabling consumers to scan a QR code and view the production process in real time, ensuring “transparency at your fingertips.” Since October 2024, the company has also pushed its suppliers to eliminate sodium dehydroacetate, promoting industry-wide improvements.

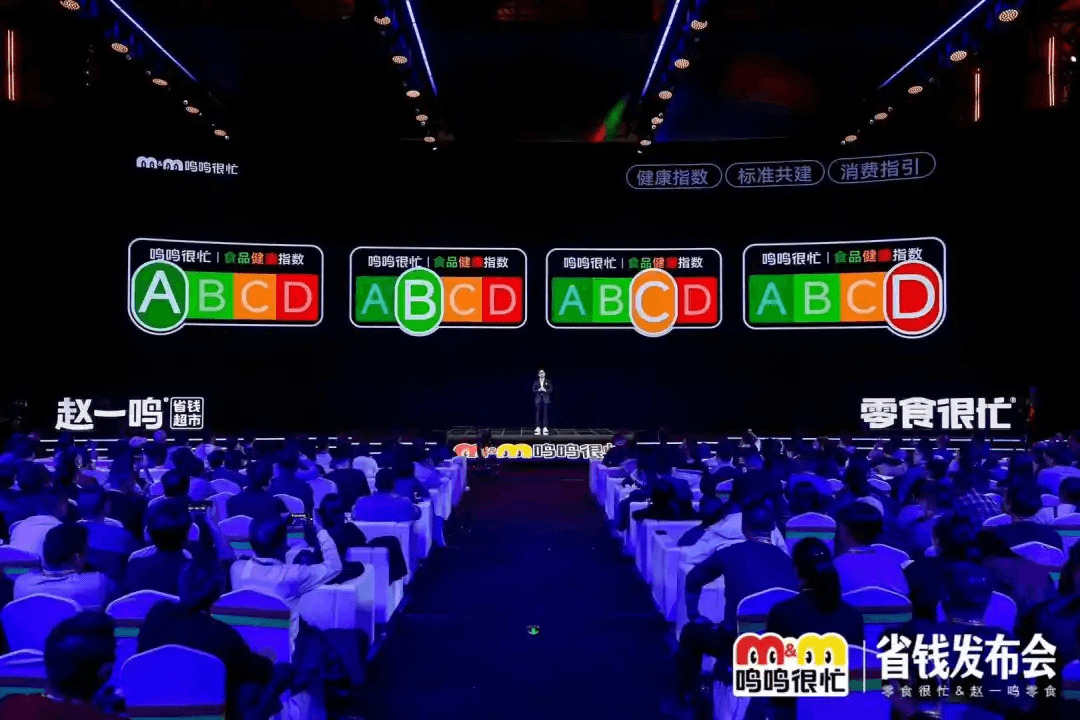

In addition, Mingming Henmang is working with authoritative organizations to develop a "Health Index" labeling system, providing consumers with greater peace of mind when making purchasing decisions. Founder Zhao Ding stated:

“This is a crucial step for the development of China's retail sector and a necessary move for the progress of the food industry. Mingming Henmang will strive to advance this initiative and contribute to the food safety of the Chinese people.”

Private-label products are playing an increasingly important role in the evolution of the retail industry. Drawing on the experience of mature overseas markets, the U.S. private-label market continues to grow: according to the latest PLMA (Private Label Manufacturers Association) report, U.S. private-label sales exceeded $270.6 billion in 2024, accounting for 20.7% of total retail sales.

Back in China, as consumer trust in private-label products deepens, the category is evolving from a focus on price and product strength to a more comprehensive brand strength. Mingming Henmang’s launch of its private-label products marks a decisive first step in building brand equity in this space.

Redefining community retail standards

At the conference, Mingming Henmang announced the full-scale rollout of its dual-brand 3.0 store model and officially launched the “Zhao Yiming Discount Supermarket.”

The exploration of the Mingming Henmang 3.0 store model began in June 2024, with the first pilot store in Guangzhou opening in September. After multiple rounds of testing and optimization, Mingming Henmang officially launched the 3.0 Discount Supermarket in November 2024, marking a successful innovation and transition from snack-focused retail to the broader supermarket sector.

Through category optimization and floor efficiency management, the Mingming Is Busy 3.0 store model has achieved “overall cost leadership.”

In terms of category optimization, Mingming Henmang draws on deep insights from “consumer groups to scenarios to product categories” to uncover more niche segments. The expansion and optimized allocation of product categories are expected to drive further store performance growth.

In terms of floor efficiency management, the 3.0 model adopts an integrated modular shelving system, maximizing space utilization. This allows a 200-square-meter store to deliver the display capacity of a 300-square-meter space, while also improving restocking efficiency and enhancing profitability for franchisees.

With a core focus on “curated product selection, reasonable pricing, and convenient shopping,” the Mingming Henmang 3.0 store model has introduced a wider range of products including general merchandise, household and personal care items, stationery and trendy toys, baked goods, and eggs. It has also added dedicated zones for fresh and refrigerated foods. By restructuring its cost model, prioritizing efficiency, and centering on customer needs, the brand has achieved overall cost leadership—meeting people’s growing demand for a better quality of life.

Opening a new chapter in the alliance of manufacturing and retail

Addressing the challenges faced by offline retail in recent years, Professor Chen Liping, Executive Dean of the Consumer Big Data Research Institute at Capital University of Economics and Business, stated at the conference that these difficulties are not primarily caused by market conditions, but rather stem from the industry's inability to adapt to environmental changes. With evolving social dynamics and increasingly diverse and segmented consumer demands, retail is bound to seek growth within niche markets. Among them, the discount snack sector is the only one demonstrating true counter-cyclical potential.

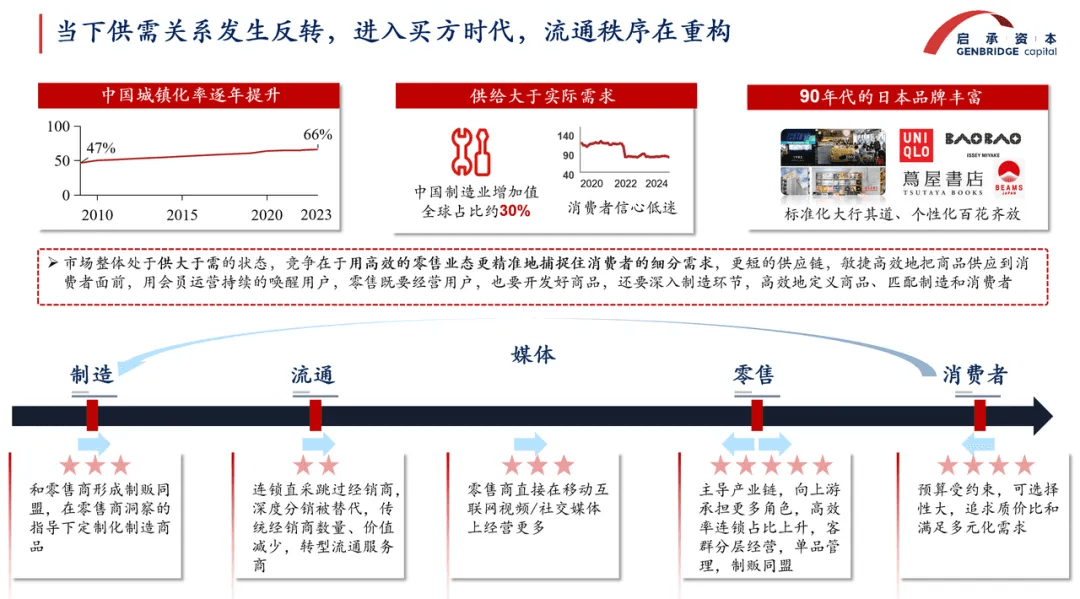

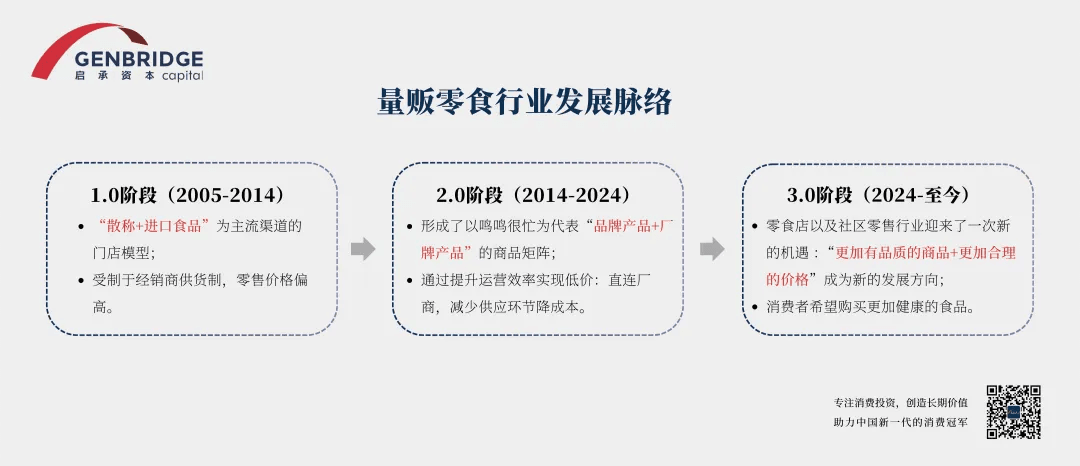

GenBridge Capital has also taken note of these structural shifts. As urbanization progresses in China, supply chains mature, and the internet facilitates more efficient and decentralized access to information, every part of the supply chain has become increasingly saturated. China's retail industry has transitioned from a seller's market to a buyer’s market—where supply exceeds demand and market power is gradually shifting back into the hands of consumers.

In a buyer-driven market, retailers are undoubtedly the closest agents to consumers. They are reshaping the entire value chain and taking on increasingly diverse roles. We are clearly seeing retailers evolving in three major directions:

- Community-Based Retail

China’s new urban communities began taking shape before 2010, and with rising occupancy rates after 2015, the era of community-based retail officially began. Unlike the broader layouts seen in countries like Japan (3 square kilometers) and the U.S. (10–30 square kilometers), China’s communities are typically composed of high-density residential complexes, with around 10,000 households living within a 1–1.5 km radius.

In such high-density environments, one square kilometer can generate purchasing power of up to 500 million yuan. Even capturing just 1% of that (5 million yuan) can support a small-format retail store. As a result, small-scale community-serving retail formats have entered a period of rapid growth, with brands like Mingming Henmang and Qian Da Ma emerging in large numbers.

In this context, a well-planned store density and a highly efficient logistics network will be critical for success. This is precisely where the Mingming Henmang 3.0 model excels—and where it will lead the way in shaping the future of Community Retail 3.0.

- Discount-Oriented Operations

Discounting is a highly effective competitive strategy in China, fundamentally driven by supply chain integration and optimization. Traditional supermarkets face many operational pain points, which retailers are now addressing by streamlining the industry value chain. For example, New Joy Mart integrated fresh milk factories with cold-chain delivery systems to reduce logistics costs, thus creating more value for consumers.

Currently, Mingming Henmang offers products priced roughly 20% to 30% below the market average, providing standard branded goods at lower profit margins and prices. With the introduction of its private-label products, Mingming Henmang will continue to uphold its price-to-quality advantage while also striving for higher product quality—enabling consumers to enjoy premium products without paying a premium price.

- Manufacturing-Retail Alliance

Traditionally, retailers and suppliers played separate roles—one selling, the other producing—with a transactional, and often adversarial, relationship. Today, however, retailers are working to establish a cooperative alliance with manufacturers, becoming not just sellers but also partners who understand production and can even help optimize products.

GenBridge Capital has conducted extensive research on Japan’s retail industry. Under the manufacturing-retail alliance model, 7-Eleven restructured its entire supply chain, working with over 150 dedicated partner factories that focus on producing fresh items such as bento boxes, rice balls, and sandwiches. As a result, 7-Eleven has grown from a convenience store chain into Japan’s largest food company, with private-label sales topping the charts among food brands in the country. This transformation was driven by 7-Eleven’s collaborative product innovation with suppliers under the manufacturing-retail alliance framework.

Today, Mingming Henmang, as an industry trendsetter, is among the first to explore the manufacturing-retail alliance model—paving a new path forward for the bulk-discount snack industry.

From Bulk Snacks to Discount Supermarkets: Mingming Henmang is expanding its product offerings and enriching consumer scenarios. It is extending its mission of helping consumers save money beyond just the “coffee table” setting to include the “dining table,” “kitchen,” “bathroom,” and more—enabling shoppers to access a wider variety of products that are fresher, span multiple temperature zones, and offer greater novelty and enjoyment.

At the same time, as a pioneer in the industry, Mingming Henmang has already led the way in improving supply chain efficiency within the snack category. Now, it is pushing further, exploring full-category solutions at the supply chain level and expanding this “efficiency revolution” to a broader scale.

GenBridge Capital believes that retail formats and consumers evolve together. As consumer needs and shopping scenarios become increasingly diverse, innovative retail models like Mingming Henmang—though initially focused on vertical categories—must continuously break through category boundaries. Such breakthrough capability is not optional but essential, and in a saturated market, it is the most powerful competitive advantage.

We look forward to Mingming Henmang becoming the preferred choice for even more consumers in this new phase, bringing joy to more households. GenBridge Capital also looks forward to standing alongside the new generation of “manufacturing-retail alliances” in this wave of retail transformation, jointly exploring new pathways to category innovation.