- Dense Display: Bombarding consumers with a massive selection of products and information to weaken their rational thinking during shopping

- Path Planning: Extending the stay time, interspersing high and low-margin displays to strengthen the impression of low prices

- Audience Segmentation: Segregating crowds through category displays, guiding them towards a "customized" path

- Emotional Interaction: Using vivid copywriting tags to awaken consumers' awareness of the value of products

- Hit Product Thinking: Visually Presenting Price and Quantity Comparisons Between Products

- Summary: Low-price Tropical Rainforest, Ultimate Treasure Hunting Experience

In 2020, Don Quijote (Group Name: Pan-Pacific International Holdings), with 800 stores and a revenue of 1.6819 trillion yen (approximately 100 billion RMB), became the fourth-largest retail enterprise in Japan.

In “GenBridge View: The Optimal Solution of Japan’s Discount Business Format – Analysis of Don Quixote (Part 1),” we discussed how the success of Don Quixote’s discount business format was attributed to the substantial supply of residual goods resulting from the competitive environment in Japan in the 1980s. On the operational front, Don Quixote’s ultimate operational strategy is the key to seizing the opportunities of the times, with a prominent aspect being the “Treasure Hunt Experience” highlighted in the repeatedly played theme song in the store.

“First come, first served, a dreamy world,

It’s easy to get addicted to Don Quixote,

Impulsively buying but feeling like it’s a bargain,

It feels like a treasure hunt,

What will I discover tonight?”

— Don Quixote Theme Song

The so-called “Treasure Hunt Experience” is essentially a finely tuned design based on a precise understanding of consumer psychology, including detailed displays, pathways, and interactions. Based on an in-depth observation of Don Quixote’s Tokyo Fuchu store, this article summarizes five things the store did right in terms of in-store operations:

- Dense Display: Bombarding consumers with a massive selection of products and information to weaken their rational thinking during shopping.

- Path Planning: Extending the stay time, interspersing high and low-margin displays to strengthen the impression of low prices.

- Audience Segmentation: Segregating crowds through category displays, guiding them towards a “customized” path, enhancing the density of products that arouse interest in different consumer groups.

- Emotional Interaction: Using vivid copywriting tags to awaken consumers’ awareness of the value of products, actively communicating with consumers similar to live streaming.

- Hit Product Thinking: Visually presenting price and quantity comparisons between products to guide consumer choices and create best-sellers.

Dense Display: Bombarding consumers with a massive selection of products and information to weaken their rational thinking during shopping

In the 1980s, Japan’s consumer society reached full maturity. Amidst material redundancy, consumers found themselves in a state of “confusion” — people no longer knew what products they truly needed, leading them to constantly search for and question what they genuinely desired.

Japanese semiotician Hideyoshi Ishida analyzed in Knowledge of Signs/Knowledge of Media:

“Consumer desires appear to come from consumers, but in reality, they arise from desires interwoven by businesses or the entire consumer society through media tools, and the subject of desire does not actually exist.”

This consumer “confusion” is also substantiated by data. A large-scale survey conducted by the Japan Institute of Retail Economics in 2013 found that the majority of consumers wander around the shops before making purchases, leaving stores with items they hadn’t initially planned to buy. Even in highly purpose-driven supermarkets, drugstores, and convenience stores, unplanned purchases reached 77.4%, 63.8%, and 63.2%, respectively (as shown in the graph).

Don Quixote precisely capitalizes on this consumer state by opting for expansive spaces and displaying a massive array of products. This approach offers consumers a vast “treasure hunt” space, immersing them in a sea of material goods to the extent that they forget their original shopping intentions.

Massive product choices and dense display

Massive product choices and dense display

Furthermore, dense displays induce decision fatigue among consumers, weakening their logical thought process in product selection. In a study by Kathleen Vohs, a professor of consumer psychology at the University of Minnesota’s Carlson School of Management, it was found that when consumers repeatedly encounter a multitude of product choices, they are prone to fatigue and abandon logical thinking. Compared to rational and careful price comparison and product selection, consumers are more inclined to engage in “fast thinking,” choosing products with enjoyable attributes, such as high-calorie snacks and creatively designed packaging.

Path Planning: Extending the stay time, interspersing high and low-margin displays to strengthen the impression of low prices

In Japan, most retail channels other than Don Quixote have evolved into orderly and organized spaces as they matured in operation. Despite the seemingly “disorderly” appearance of Don Quixote’s stores, they do not actually violate the principles of path planning. The formula is as follows:

Per Customer Transaction = Number of Aisles × Aisle Entry Rate × Product Retention Rate × Product Purchase Rate × Quantity Purchased × Product Unit Price

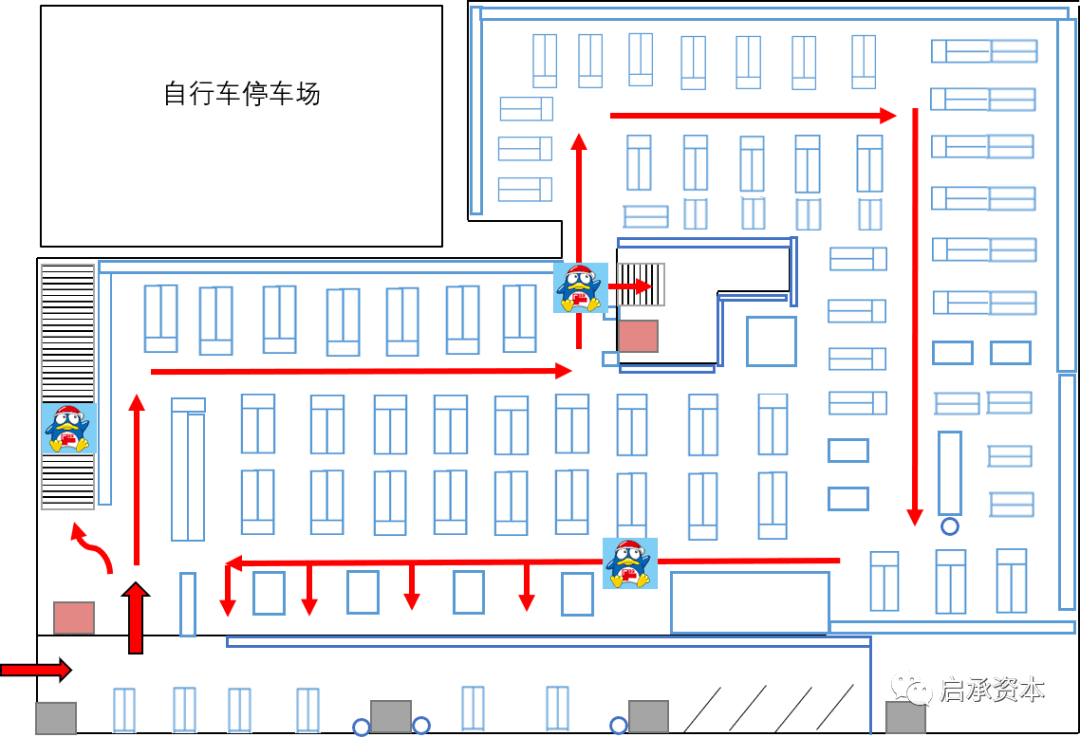

In the case study of the store we explored, the seemingly chaotic display holds a certain mystery. The first floor, covering an area of approximately 1500 square meters, mainly sells high-frequency consumption categories such as fresh food, daily necessities, and seasonal promotional items.

The main aisle on the first floor is a one-way street, intentionally elongating the path to force consumers to see more shelves

In terms of the sequence of the path, after entering the mall’s first floor, consumers sequentially encounter ultra-low-priced anchor products (mainly in the household cleaning category) → Seasonal high-margin products (such as swimsuits, water guns, swim rings, etc.) → Medium-frequency daily consumables (such as tableware) → Personal care and cosmetics → Household items → Fresh food → Liquor → Bulk essential items like rice and tissue.

The mixed-margin model, subsidizing low-margin high-frequency consumer goods with high-margin low-frequency consumer goods, is the basic sales method for large retail formats. Don Quixote, by anchoring products with ultra-low prices, creates the impression of a very inexpensive channel for consumers. Still, within the path, it intersperses the display with medium to high-margin products to stimulate additional consumption.

For example, seasonal products that evoke people’s desire for summer activities like camping or beach outings. Consumers tend to be less price-sensitive to such products, making impulse purchases more likely under strong emotional influences. These “unintentional” purchases precisely contribute to Don Quixote’s high-margin revenue.

The categories that consumers purposefully buy, such as food and alcoholic beverages, are placed in the latter half of the path. Essential items like rice, which consumers often need to purchase, are positioned near the checkout area, visible only as consumers approach with their shopping carts.

It’s worth noting that in Don Quixote’s discount store business, approximately 35% of the revenue comes from food sales, while the remaining 65% is generated from categories such as household appliances, daily necessities, sports equipment, and clothing. Food items, characterized by their difficulty to manage and low margins, were initially not actively sold by several discount stores in Japan, Europe and the United States. While food categories serve as a certain traffic driver, the overall profit contribution to the business relies on categories beyond food.

Audience Segmentation: Segregating crowds through category displays, guiding them towards a "customized" path

The second floor of the store mainly sells non-food products such as cosmetics, sports equipment, clothing, and bags. The shelves on both sides of the entrance are categorically oriented, automatically dividing the audience. This allows consumers, along each route, to have a higher probability of encountering products that may interest them.

For example, male users and single individuals may tend to move left. This route displays sports and health, DIY stationery, travel bags, small household appliances, automotive supplies, luxury watches, clothing, and the checkout counter.

Female and family consumers may prefer turning right, with displays including personal care and cosmetics, beauty appliances, children’s toys, clothing and shoes, luxury watches, and the checkout counter.

Sometimes, deliberately obstructing one side of the aisle with small shelves or leading consumers through a winding path creates a treasure-hunting experience, arousing consumer curiosity. In the attached image, a father stands outside a small display, holding a shopping basket, while his daughter selects snacks, placing the chosen items in the father’s basket.

Emotional Interaction: Using vivid copywriting tags to awaken consumers' awareness of the value of products

There is a slogan in Don Quixote: “High price for cheap stock, low price for expensive ones.” This means that products widely recognized for their value should be sold cheaper than others, while products not widely recognized should convey higher value to consumers. The diverse labels at Don Quixote serve as one means of strong interaction with consumers. Instead of mechanically displaying product names and prices, Don Quixote’s labels are as varied as barrage comments:

Label Use A: Amusing Comedian

To reduce consumer wariness of discounted food and enhance the treasure-hunting experience, Don Quixote marks some special offer products with “reasons for the low price.” Store sales staff would joke on labels to gain consumer understanding.

“I’ve paid over the odds. Come for a bargain hunting now!” / “Bestseller once”

Label Use B: Honest Explanation, Building Trust

In quality-focused categories like fresh produce, Don Quixote explains the reasons for the low price in a sincere manner to eliminate consumer doubts about low-priced goods.

Label Use C: Repetition of Important Things

Sometimes, prices are like temperatures, expensive and cheap are a matter of individual “perception” rather than an absolute objective value. Rather than a single label with a promotion, Don Quixote applies a multitude of labels, repeatedly emphasizing the low price of the product. Slogans such as “Refund if it’s 1 yen more expensive” and “Guaranteed low price” are posted throughout the aisles, creating a lively atmosphere and deepening the consumer’s impression of the channel.

Bombarding consumers with a bulk of labels

Label Use D: Clearly Conveying Product Value

Clearing out excess stock does not mean the product isn’t good enough but that the product’s value hasn’t been clearly conveyed to consumers. Don Quixote actively seizes the opportunity with such products, using labels to promote the products.

The image shows an uncommon ready-to-eat Oden with a net weight of 860 grams, priced at 17 RMB (14 RMB for members with discount coupons), approximately 50-70% cheaper than convenience stores. The POP label reads: “Oden with eggs, just heat and eat. Easy to store, simple and convenient, suitable for stockpiling.” The label repeatedly informs consumers about the value of this product.

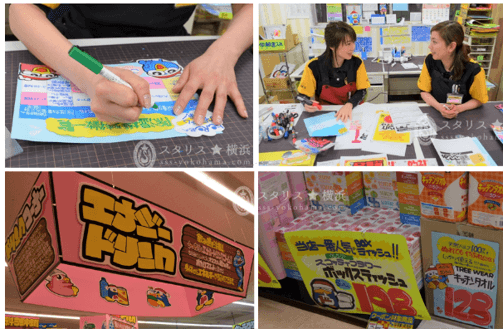

Tag Use E: The “Don-Pen” for Evocative Communication with Consumers

The cartoon penguin, “Don-Pen,” is used throughout Don Quixote’s channel stores, making the channel a cute cartoon character and reducing communication costs with consumers. This adorable image not only prompts consumers to take a closer look and perhaps pause for a photo but also quickly grasp the value of the products.

Each store has 1 to 3 staff members who can draw, contributing to hand-drawn Don-Pen illustrations and labels. Consequently, the appearance of Don-Pen varies slightly in each store.

Hit Product Thinking: Visually Presenting Price and Quantity Comparisons Between Products

The emergence of best-selling products undoubtedly serves as an accelerator for both the channel and the brand. The channel gains greater purchasing bargaining power and higher gross profit. For consumers, excellent products provide reasons for repeated visits to the store, ensuring a stable customer flow for the channel.

During interviews, a former Don Quixote executive emphasized, “The conventional retail approach is that if a shelf sells 5,000 RMB per month with one slot, a shelf with 50 SKUs may sell around 250,000 RMB per month. However, we see this differently. We strive to achieve sales of up to 500,000 RMB for one slot, using product comparisons, labels, and slogans to highlight individual items. Using the same logic, we aim to create more best-selling products on the same shelf.”

In the image on the right, Nestle’s instant coffee is priced at approximately 45 RMB per 180g, while the imported white-label coffee on the left is priced at 13 RMB per 100g. Compared to the national brand Nestle coffee, the cost-effectiveness of the imported white-label coffee is evident. This white-label coffee may be the high-margin product that Don Quixote channels want to sell most. This product may be surplus stock purchased in large quantities, or it could be a PB product manufactured through the supply chain without the Don Quixote name attached.

Summary: Low-price Tropical Rainforest, Ultimate Treasure Hunting Experience

In an era of material saturation, consumer desires are not solely generated by individuals but rather created by the entire consumer society, including businesses. Don Quixote, on one hand, uses intensive displays and refined pathway designs to wear down the rational purchasing awareness of consumers. On the other hand, through strongly interactive attributes and emotionally engaging label designs, Don Quixote awakens the emotional purchasing desires of consumers. Under this combination, Don Quixote provides not just a physical retail space but more like an experientially rich tropical rainforest, consistently delivering a fulfilling experience to consumers.

In the next article, we will conduct further analysis from the perspectives of enterprise development stages, procurement supply chain management, personnel incentives, founder characteristics, and other aspects of business management.

References

“Observation Training Lecture on Retail Spaces” (Japanese, Public Interest Incorporated Foundation Institute of Distribution Economics)

“Passionate Businessman – Revolutionary Retail Management Theory of Tang Ji He De Entrepreneurs” (Japanese, Takao Yasuda)

“Knowledge of Symbols/Media” (Japanese, Hideyoshi Ishida)

“Self-Regulatory Resources Power the Reflective System: Evidence from Five Domains” (English, Kathleen D. Vohs, 2006, Journal of Consumer Psychology, 16 (3), 217-223)

Internal Research Materials:

“Observing Don Quixote’s ‘Scene’ from the Tokyo Metropolis Central Store”

“GCIA Undertakes Consumer Grand Alliance: Insights from Tang Ji He De Special Advisor”

Interviewees:

Mr. W, Former Special Advisor to the Founder of Don Quixote

Mr. Y, Former Personnel Department Manager at Don Quixote