Meat has always been a constant theme on Chinese dining tables. From primitive hunting to livestock farming to the modern meat market, the pursuit of eating meat—and eating good meat—has been a shared desire across generations of consumers.

Today, China’s food retail sector has shifted from a seller’s market to a buyer’s market, and people have become increasingly discerning when it comes to meat consumption. For example, demand for high-quality proteins like beef continues to rise, and consumer preferences for different cuts of meat are becoming more and more segmented.

However, current meat consumption is still centered around a few major products, and the entire industry is mired in homogenized, low-price competition.

Moreover, the traditional meat supply chain involves multiple layers, with poor communication between suppliers and sellers. As a result, a significant amount of time, money, and energy is lost in the circulation process. Under this “many-to-many” agricultural supply-demand structure, it has long been difficult for fresh food products to achieve brand recognition.

The challenges on both the supply and demand sides often signal opportunities for disruption by new distribution channels.

As the intermediaries closest to consumers, channel operators are best positioned to connect both ends of the supply chain and build influence—this is the precondition for the emergence of “meat category killers.”

In the headquarters meeting room of Qiandama in Guangzhou, we co-hosted a meat industry opportunity symposium with retail enterprises and upstream suppliers, segmented by product type. Participants included upstream companies such as Hengdu Beef, Wens Foodstuff Group, Yuexiu Agriculture & Animal Husbandry, and Guangzhou Restaurant Group, as well as retail peers like New Joy Mart and Duoleton. Experts from Japan’s Distribution Economics Institute also joined the discussion.

We engaged in discussions centered on category trends, insights from the Japanese retail industry, and the current state and potential opportunities of China’s meat supply chain, aiming to clarify both the challenges and possibilities in Chinese meat consumption.

Meat Consumption: The truth is, we’re not eating well enough

In terms of total volume, household meat consumption in China has nearly plateaued, with signs of decline in some areas.

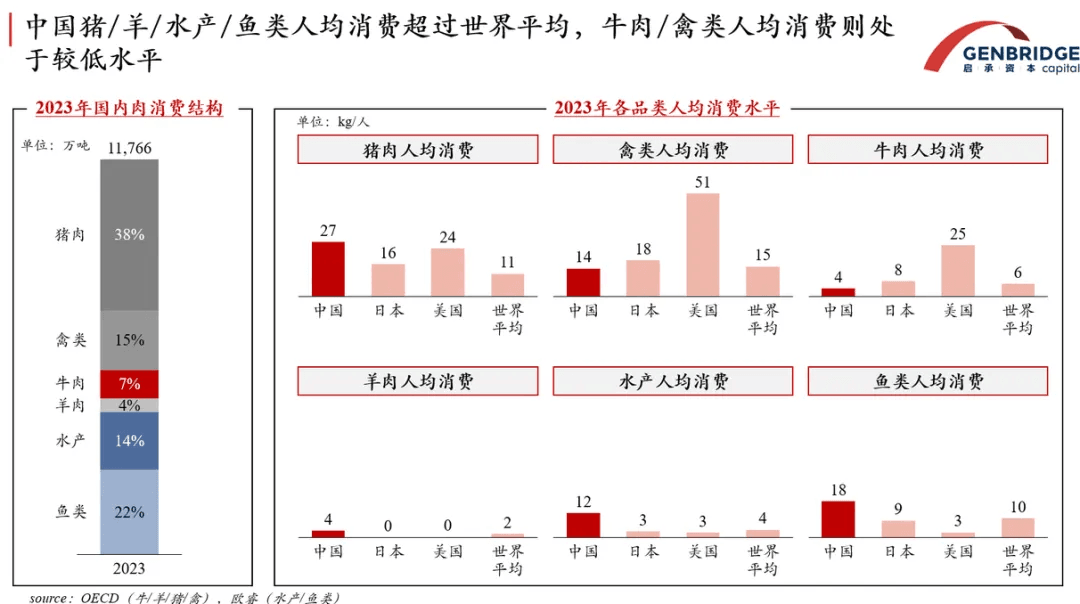

In 2023, the average annual per capita consumption of animal protein in China reached 109.3 kg. This figure is comparable to countries with similar dietary structures such as Japan (99.3 kg) and South Korea (122.7 kg). In other words, Chinese consumers have achieved “freedom of meat consumption” in terms of quantity.

However, in terms of quality and structure, China still lags behind more developed consumer markets.

For a long time, pork has dominated Chinese meat consumption—a reflection of the country’s long-standing pig farming traditions and rich pork-based culinary culture. In contrast, beef and poultry, which contain higher-quality protein and a better amino acid profile, are more mainstream in developed countries.

To illustrate, in 2023, China’s per capita pork consumption stood at 27 kg—well above the global average. In contrast, beef consumption was just 4 kg per person, below the world average, and only half of Japan’s and one-sixth of the U.S.’s levels. Poultry consumption shows a similar pattern.

Overall, while we eat enough meat, we do not eat it well. This reality is shaped not only by cultural, climatic, and historical factors but also by current structural limitations.

From the supply side, China’s agriculture and animal husbandry sectors are highly fragmented. Given the country’s vast geography and the relatively self-sufficient resources in each region, it's difficult for any player to vertically integrate or monopolize the supply chain. For instance, the same type of fresh meat product may be produced in multiple regions at the same time, leading to homogenized offerings and minimal downstream supply chain differentiation—thereby dampening incentives for innovation.

From the consumer side, freshness and price remain the top two considerations when purchasing meat. Yet the non-standardized nature of meat products, along with opacity in farming practices, increases decision-making costs for consumers.

Take pork—China’s most consumed meat—as an example. Even today, consumers’ primary concern is food safety. A common question like “How do I buy pork that hasn’t been pumped with water?” already requires consumers to be highly discerning and cautious.

China’s regional diversity also leads to varied consumption preferences. For example, even on the single factor of “freshness,” regional markets differ. Southern consumers favor "warm fresh meat"—meat that is sold directly after slaughter without chilling. In contrast, consumers in the north are more accepting of chilled meat, which is cooled to 0–4°C before sale.

Moreover, different cooking methods demand different cuts. Stir-frying, barbecuing, and stewing each require specific types of meat, but the current market fails to reflect this diversity.

Meat product segmentation in China is still underdeveloped—both the variety and the perceived value of different cuts are poorly communicated. Many consumers remain unaware of different parts, breeds, or how they correspond to various cooking methods. This gap presents an opening for domestic retailers to explore the concept of a “meat category killer.”

In South China, Qiandama emerged by precisely tapping into local demand for high-quality warm fresh meat. Its early strategy—selling no overnight meat and offering freshly cut portions—established its role as a “meat expert.” To meet the region’s demand for premium ingredients for soups, Qiandama also invested heavily in developing black pork, a high-end niche category.

In 2023, while traditional supermarkets showed sluggish growth, Qiandama expanded to nearly 3,000 stores, holding its ground amid fierce competition from large supermarket chains, wet markets, and e-commerce platforms.

Lessons from Japan: The rise of Lopia, a meat category killer

In Japan’s retail history, certain food supermarkets that centered their business around meat have played the role of educating consumers on how to eat meat, even contributing to a shift where meat consumption overtook seafood in a nation traditionally known for its love of fish.

The emergence of such “meat category killers” can be traced back to shifts in the broader market environment.

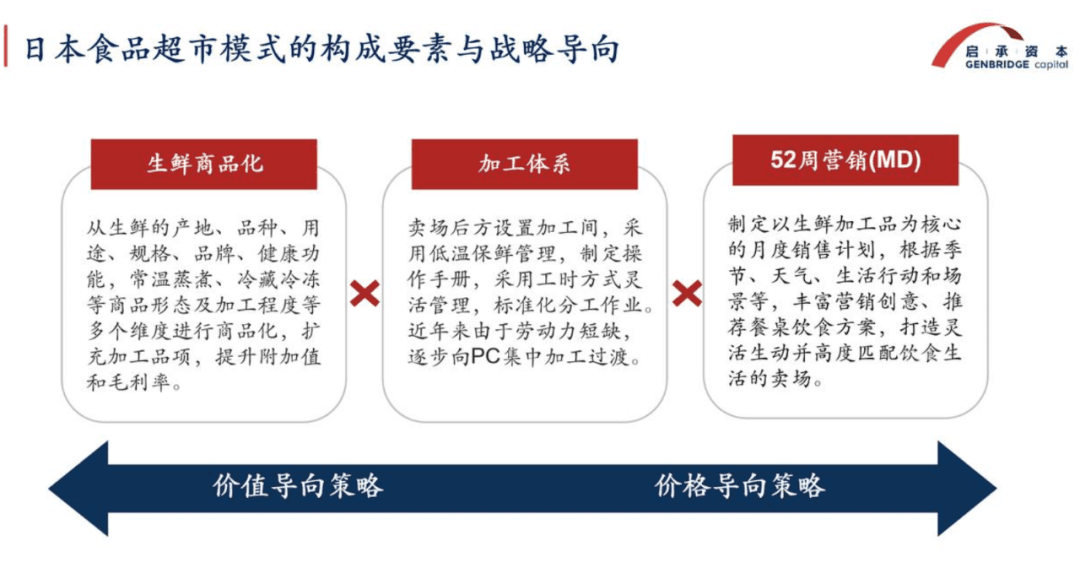

In the 1990s, Japan’s retail industry transitioned from a seller’s market to a buyer’s market. Specialized formats like food supermarkets began to flourish. These formats had light processing capabilities and focused heavily on product selection strategies centered around 52-week merchandising (52MD), gradually replacing the dominance of large-scale general merchandise stores (GMS).

As of July 2024, the number of food supermarkets in Japan is 12 times that of general supermarkets.

The secret behind the rise of these new retail channels lies in their ability to perfect a core product category through efficient product operations and supply chain systems, ultimately becoming category killers.

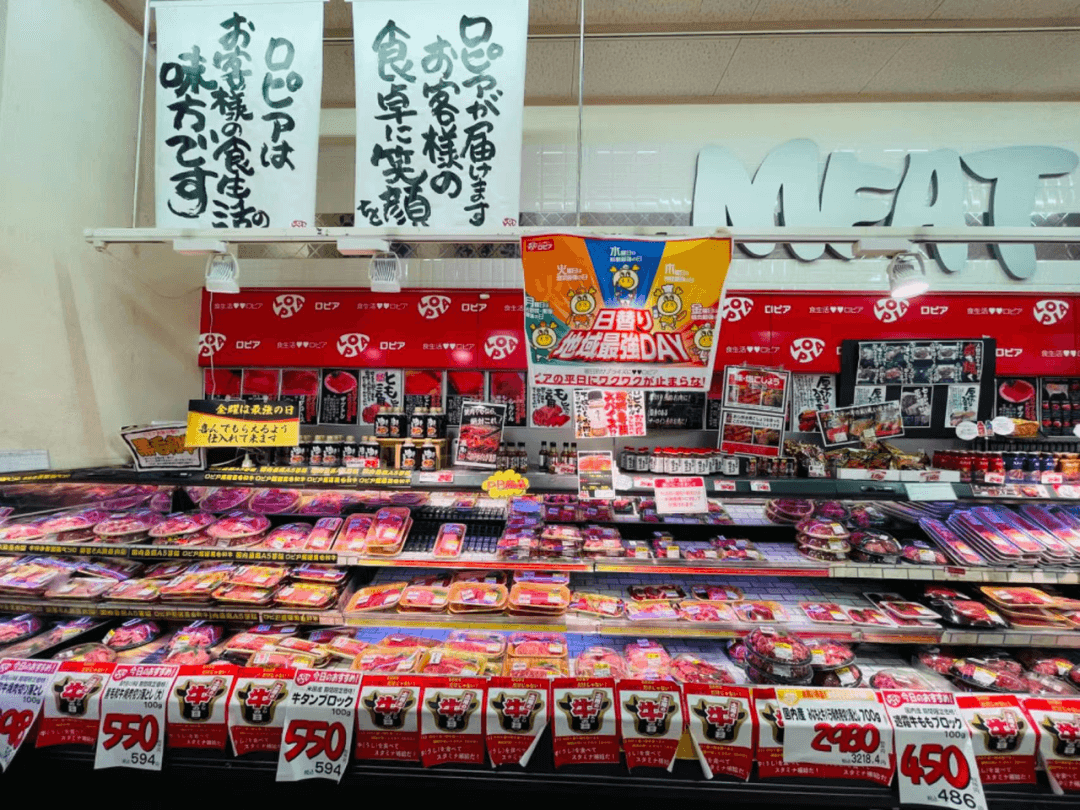

Among them, Lopia stands out as the most representative example. With a compound annual growth rate (CAGR) of 21%, it is one of the few retail companies in Japan that maintains both rapid growth and strong profitability. Although meat accounts for only 30% of its sales, it contributes 80% of Lopia’s total profit. Therefore, rather than calling Lopia a general food supermarket, it would be more accurate to describe it as a meat category killer that fulfills consumers’ bulk-buying needs.

So how did Lopia become a meat category killer?

On the demand side, Lopia capitalized on a structural shift in Japanese dietary habits—specifically the growing interest in meat. By offering high-quality beef at affordable prices and developing a comprehensive meat product assortment, Lopia helped consumers not only understand but fall in love with eating meat.

During Japan’s economic boom in the 1980s, per capita beef consumption rose from 4 kg to 8 kg per year. Even middle- and lower-income consumers came to appreciate the value of eating beef. However, due to high prices, this demand remained largely unmet.

To tap into this market segment, Lopia used premium sliced beef as an anchor product, establishing a strong price-value perception. This product was priced at less than half the cost of beef at general supermarkets and about 30% cheaper than at other specialty food stores, immediately winning the hearts of ordinary homemakers.

In fact, since low-income consumers purchase beef infrequently and are highly price-sensitive, once Lopia established a “good beef at affordable prices” brand image, it could quickly extend that perception across other products and categories.

Beyond its best-selling items, Lopia seized the opportunity in beef and carried out an extremely comprehensive product development strategy for meat. Consumers can choose from a wide range of types, cuts, and slicing styles based on specific recipe needs, with price points covering both high- and low-end segments. This resulted in an incredibly rich and diverse meat product offering.

This product development system meets the needs of consumers across different income levels, turning beef into an everyday consumer good—something everyone can eat and cook.

Achieving this would not be possible without Lopia’s heavy investment in its supply chain. Within Lopia’s system, its back-end factory plays a key role. It takes on the task of product development, utilizing processing technologies and a commercialization mindset to fully develop different parts of the meat, thus maximizing gross profit margins.

Unlike conventional food supermarkets, Lopia prefers to purchase entire carcasses or multiple cuts rather than individual parts. This approach lowers procurement costs by around 15%. Trimmings or offcuts that might otherwise be discarded in other supermarkets are repurposed at Lopia—turned into ham, ground meat for burgers, croquettes, yakitori skewers, or even freshly made sausage pizzas.

These high-margin, fast-moving products in turn subsidize Lopia’s premium meat offerings, allowing it to sell high-quality beef at lower prices through its channels.

Building trusted relationships with suppliers, paying in cash, internalizing both primary and secondary processing, and executing ultra-comprehensive product development—Lopia has done everything possible to maximize the value of meat products. Its founder, Hideo Takagi, still personally visits wholesale meat markets every morning to select ingredients himself. From Lopia’s story, we see what it means to push a single product category to its absolute limit.

Domestic Opportunity: Where is China’s chance to build Its own “meat category killer”?

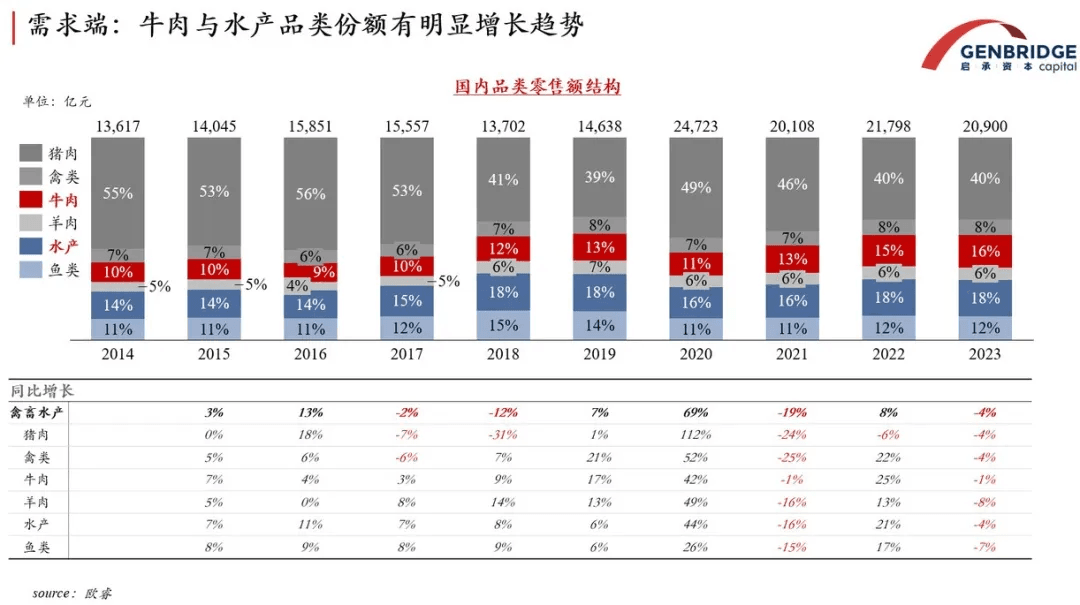

At the macro level, China’s meat consumption is undergoing a structural shift similar to what Japan experienced.

There is a growing demand for high-quality animal protein among Chinese consumers. Over the past five years, domestic beef consumption has risen rapidly. Even within saturated categories like pork, high-quality, differentiated niche products continue to scale up.

What Japan’s market teaches us is this: specialized food supermarkets are the best channels to educate consumers on how to eat meat—a role that ultimately helped drive Japan’s meat consumption to surpass seafood. Similarly, China’s food supermarkets hold immense potential to facilitate the penetration of trend-driven meat products.

More specifically, from both supply and demand perspectives, China’s meat industry has room to grow in both “depth” and “breadth.”

On the one hand, it’s about going deeper into meat development. Take pork, for example: baseline demand remains stable, but the structure is upgrading toward deep-processed and high value-added products.

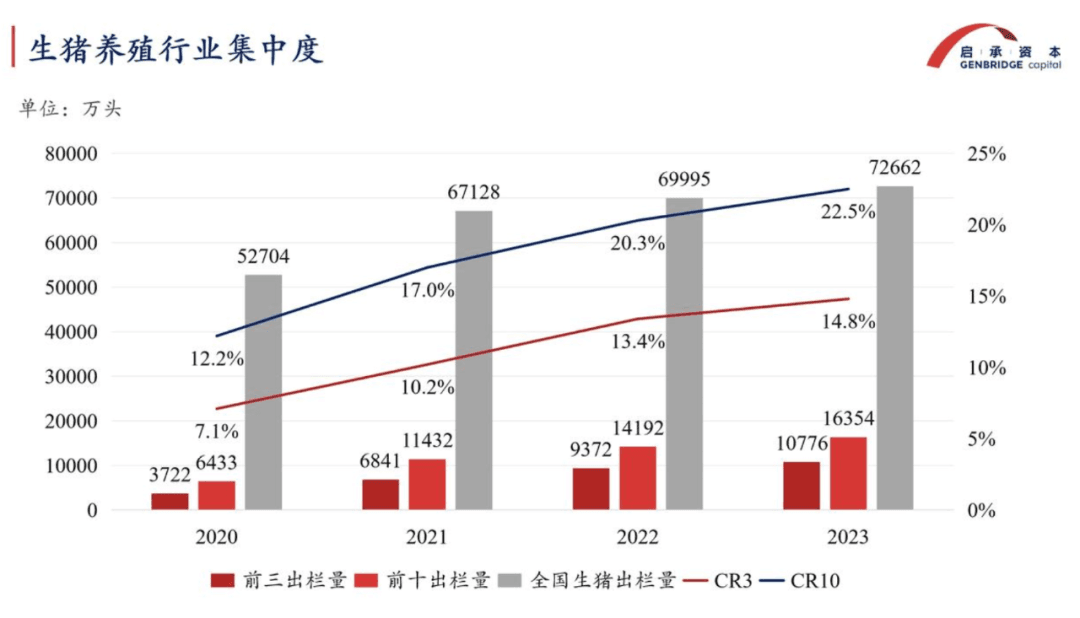

On the supply side, China’s pig farming sector is becoming more consolidated, creating a prime opportunity for downstream channels to strengthen cooperation with upstream players and integrate the supply chain.

If, based on market insights, processors and retailers can go beyond common cuts like ribs, belly, and leg meat to make full use of byproducts and trimmings, the potential for a domestic meat category killer in China could go even further than Lopia.

In addition, shifting consumer habits will continue to push both producers and retailers toward deeper processing and greater product standardization in the meat industry.

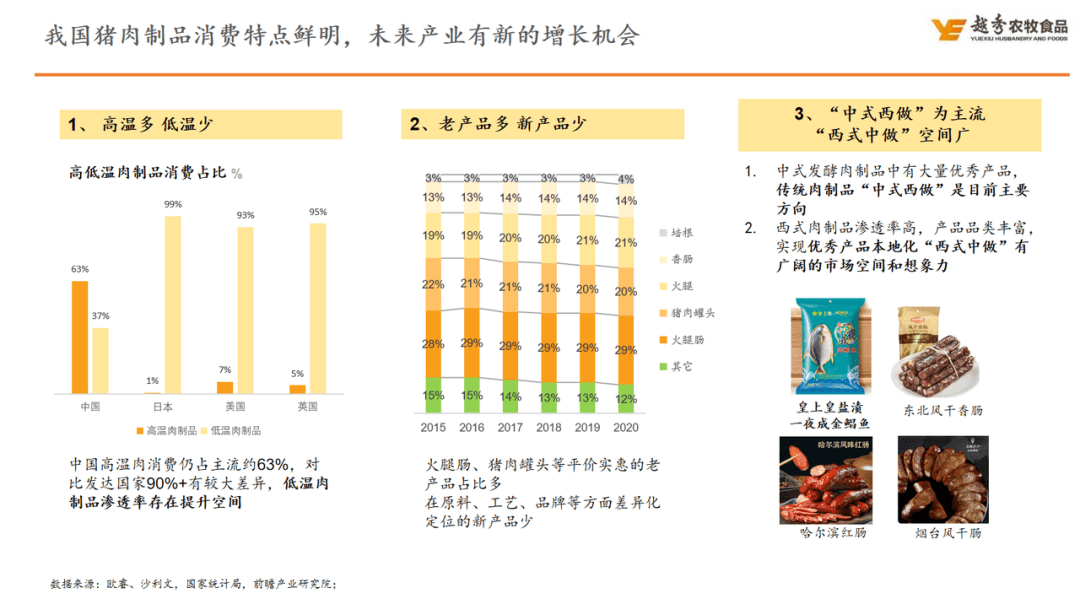

According to observations from Yuexiu Agriculture and Animal Husbandry, there is substantial room for growth in the penetration rate of low-temperature processed meat products in China. Currently, the mainstream trend is “Chinese content with Western methods”—i.e., traditional meat products like sausages being processed using Western techniques. However, the reverse—“Western content with Chinese methods”, or the localization of Western-style products—also holds vast potential for future development.

Another direction for expansion is broadening the category: offering more diverse protein options beyond the dominant pork consumption.

In the highly industrialized poultry sector, a clear trend is emerging: consumers are increasingly willing to pay a premium for high-quality, natural, additive-free chicken.

For instance, Qiandama has partnered with upstream farming enterprise Wens Group to introduce more high-end, certified custom products, thereby building differentiated competitiveness.

When it comes to beef consumption, China is still in the early stage of "not eating enough." For retailers, the opportunity lies in teaching consumers how to shop and cook by cut (e.g., Chaoshan-style Chinese cuts vs. Western-style butchering), educating them about the cost structures of different beef sources, and developing competitive products—in short, playing the role of a market educator.

From the consumer perspective, Japan’s success in boosting beef consumption hinged on two key strategies by retailers: Product diversity (grading and variety) and Value perception (offering top-quality beef at affordable prices).

These were supported by promoting various cooking styles (e.g., hotpot, grilling) to evoke a desirable lifestyle—effectively stimulating consumer desire.

GenBridge Capital believes that in today’s environment—where consumer demand is increasingly segmented, and supply-side players face homogenization and internal competition—retailers, as agents closest to consumers, are poised to play a pivotal role in creating new supplier-retailer relationships and restructuring the entire industry chain.

This, in turn, sets higher expectations for retailers in multiple areas: consumer insight, product development, and supply chain management.

If they can seize the opportunities created by structural changes in consumption habits and the emergence of new supplier-retailer relationships, then China’s own “meat category killer” still holds tremendous growth potential.