Southeast Asia has undoubtedly emerged as a key battleground for Chinese brands going global, with an increasing number of tea beverage players crowding the streets and intensifying competition across e-commerce platforms.

As a leading domestic tissue brand, Botare, rooted in Fujian, has expanded its reach to Southeast Asia and has already tasted early success in this vibrant market.

Over the past year, Botare achieved over 200 million RMB in annual revenue from online channels in Southeast Asia alone, marking a 20%-30% growth and emerging as a dark horse in the daily essentials sector.

According to FastMoss data, Botare opened multiple TikTok shops in Thai market, ranking among top three in the household paper category by the end of 2024. In Malaysia, Botare once topped the home and daily essentials shop rankings in November, while simultaneously securing a spot in Vietnam’s top eight for the same category.

Botare’s initial success overseas can be attributed to two factors: first, riding the wave of Chinese brands expanding globally, with Southeast Asian consumers increasingly recognizing Chinese brands; second, actively seeking growth in overseas markets beyond the fiercely competitive domestic landscape. According to customs statistics, China’s household paper exports continued to grow in 2024, trending toward premiumization, with total exports reaching 1.3635 million tons, a 22.49% year-on-year increase.

However, going global is no easy feat. For a "new force" brand like Botare, it must not only compete with local brands but also avoid being dragged into a price war. This means it must not only adapt to local markets strategically but also continuously enhance its brand and product competitiveness.

To date, Botare has gradually built a comprehensive localization and internal-external synergy system, leveraging its mature domestic market experience to lay a solid foundation for its overseas success.

So, how exactly did Botare do it?

Riding the wave of platform opportunities, setting sail with content marketing

Domestically, Botare has almost perfectly capitalized on every rising platform’s growth phase:

- In 2014, it began producing pocket tissues, and a 9.9 RMB shipped pack of tissues sold 80,000 units in a single day in 2015.

- In 2016, Botare became one of the top brands on Tmall and Pinduoduo.

- In 2021, it pivoted to TikTok, launching the hit "Joyful Orange" cushion tissues, moving from white-label pricing to mid-tier market positioning.

- In 2023, it innovated with hangable pocket tissues, leading the industry and further solidifying its omnichannel expansion, ultimately driving annual sales past 5 billion RMB.

With platform trends shifting rapidly, seizing each opportunity is no small feat, especially for a low-differentiation category like tissues, where capturing attention and creating hits is exceptionally challenging. Yet, Botare stood out by combining deep product and market insights with in-house content capabilities.

For example, after entering TikTok, Botare realized that the small-pack products that sold well on Tmall and Pinduoduo were not suited for content-driven e-commerce. On TikTok, products needed stronger visual appeal, so Botare revamped its packaging, switching to larger, Hermès-orange packs.

Consequently, the product went viral for its size and aesthetics, not only selling 100,000 units in one minute on TikTok but also increasing Botare’s average product price by over 40%, helping the brand escape the brutal low-price competition.

By 2022, the "Joyful Orange" line alone generated 1 billion RMB in sales. Recognizing the power of replicating content from small-to-medium influencers, Botare quickly amassed 40,000 micro-influencers, driving significant sales growth.

Building on its preliminary content production framework, Botare achieved overnight success with its "hangable pocket tissues" in 2023. To this day, the company has institutionalized its content capabilities, allowing it to detect shifts in consumer preferences faster than competitors and respond swiftly.

Specifically, Botare has established an in-house content hub with over 100 team members, capable of producing thousands of videos daily. Centered around this hub, the brand quickly collaborates with a vast network of mid- and long-tail influencers, tailoring content to different audience interests for a "hyper-personalized" approach that precisely targets niche demographics.

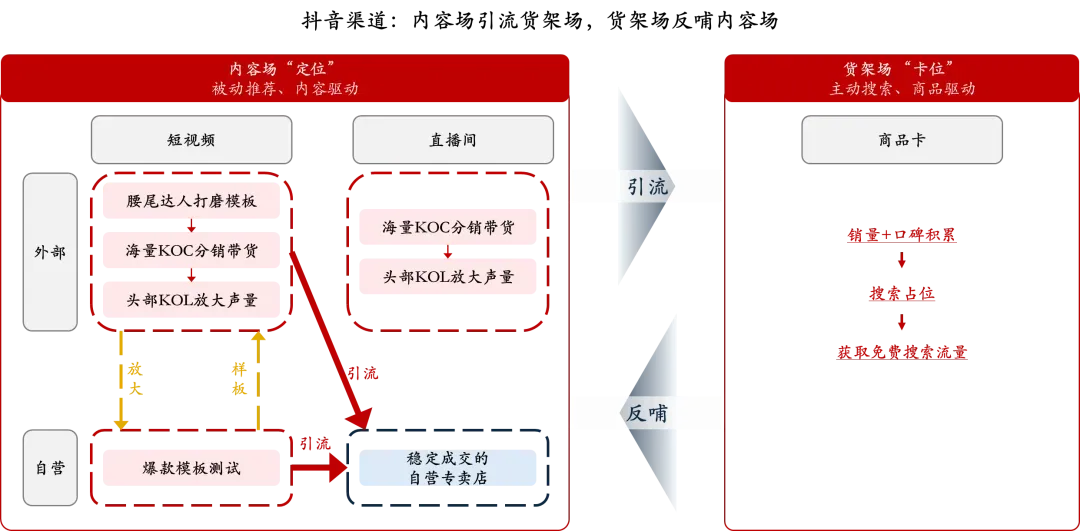

By leveraging these short videos for high-efficiency audience reach, Botare widens the top of the sales funnel and amplifies brand visibility. On the backend, its self-operated live streams drive conversions, while high-quality products and strong repurchase rates solidify customer retention on its e-commerce stores. The wealth of user feedback and word-of-mouth from these storefronts, in turn, fuels further content creation, generating more organic search traffic.

This creates a virtuous cycle: content drives traffic to stores, and store performance feeds back into content optimization.

By 2023, Botare turned its attention overseas—particularly to Southeast Asia. At the time, growth in China’s tissue market was slowing, while Southeast Asia’s household paper demand was surging, with low brand concentration and heavy reliance on imported paper products. This presented a natural opportunity for Chinese brands like Botare, with their scalable production capabilities and systematic product and operational expertise.

Unlocking growth through product micro-innovation

Botare’s explosive success with hangable tissues in 2023 began with a serendipitous insight.

During a meal at a Korean BBQ restaurant, co-founder Guo Ying noticed that hangable tissues were ideal for tight table spaces, and the downward-pull design was more convenient—yet no consumer-facing products existed. Spotting this gap, Botare sourced specialized production equipment, took control of the supply chain, and mass-produced hangable tissues, which sold out immediately upon launch.

Capitalizing on the hype, Botare expanded its hangable product line, introducing hangable kitchen rolls, hand towels, and dual-purpose wet/dry wipes. Today, the brand launches around 150 new SKUs annually.

Botare excels at identifying everyday pain points, using micro-innovations to redefine product usage scenarios. It carves out sub-categories within broader markets, then dominates consumer mindshare—like becoming synonymous with "hangable tissues".

But Botare didn’t stop there. It distilled this seemingly accidental success into a repeatable, scalable innovation model, enabling expansion from household paper into personal care, baby products, and beyond.

Now, Botare is batch-replicating the "hangable tissue playbook"—applying scenario-driven micro-innovations in mature sectors to create multiple breakout sub-categories in personal care.

The Chinese laundry care market is a 100-billion-yuan industry, growing at 5% annually. Yet, it’s also a fiercely competitive red ocean, with traditional giants, regional players, and niche segments like laundry pods, scent beads, and intimate apparel detergents all vying for dominance. Despite this, Botare carved out its niche through micro-innovation.

Noticing that traditional detergent bottles made dosage control difficult and consumers increasingly sought longer-lasting fragrances, Botare pioneered a faucet-style detergent dispenser. Users can pull out their washing machine’s detergent drawer, screw the bottle onto the dispenser, and pour with precision. Paired with a perfume-grade formula, this innovation delivers 168-hour fragrance retention.

Today, laundry detergent has become Botare’s second growth curve. In Southeast Asia, it’s the brand’s top-selling product after the "Joyful Orange" hangable tissues.

Building another Botare through integrated domestic and global synergies

For overseas markets, Botare leveraged its domestic playbook: localized product innovation + content marketing + omnichannel strategies to scale rapidly in emerging markets.

In household paper, for instance, Southeast Asia’s per capita usage (except in Singapore/Malaysia) lags behind China. Preferences also differ—consumers favor 2-ply tissues and quick-dissolving rolls, with distinct packaging needs.

To this end, Botare adopted a strategy of "testing products first, then localizing", using its hit products from China to test overseas markets via low-cost approaches such as TikTokshort videos, influencer marketing, and cross-border e-commerce platforms. Based on market feedback, Botare simultaneously pushes high-potential products while iteratively upgrading them to suit local needs.

For overseas markets, Botare tailors its short video content based on product highlights, aiming to boost brand visibility and impact. This long-term content-driven approach deepens consumer recognition and enhances influence in target markets, ultimately driving sales conversions.

At the product level, Botare initially repackaged its domestic bestsellers for overseas sales, with subsequent local adaptations following market testing. Platforms like TikTokoffer ideal windows for close consumer interaction. A single livestream or short video can quickly test a product’s sales potential, significantly shortening the go-to-market cycle.

For localized product extensions, Botare’s overseas brand benchmarks leading local products and makes differentiated upgrades. The focus is on product uniqueness—refining each product through careful consideration of market demands, in-house capabilities, supply chain readiness, and evolving consumer profiles. This enables Botare to tackle competition from local brands head-on and earn a voice in the market.

Operationally, Botare utilizes TikToklivestreams and short videos to present products up-close. Influencers use live demos, scenario-based skits, and unboxing tests to highlight key features like thickness, size, and softness—lowering decision barriers and building trust with consumers. A vast number of creators on the platform generate diverse scripts and content variations around the same product, creating a viral social feedback loop and exponential business growth.

Botare also focuses on deeper localization across both online and offline channels. In Southeast Asia, for instance, it has expanded through local e-commerce platforms and established regional distributors to create localized brand modules and capture more market share.

After replicating its successful domestic TikTokshop strategy overseas, Botare saw over 50% of its sales in Thailand and Malaysia come from influencer marketing on local TikTokshops. Within just over a year, these regional shops had built up tens of thousands of affiliated influencers and videos, placing Botare among the top 10 brands and forming a rich base of user-generated content.

As of now, Botare achieves around 23 million RMB in monthly sales on TikTok. Its product categories rank among the top three in many countries, with some markets consistently placing Botare first. The brand enjoys a repurchase rate of over 50–60% among its returning customers.

“Going global requires strength and determination,” said Lin Zehong, Vice President of Botare, in a media interview.

Having spent a decade honing its capabilities in China’s household goods market, Botare now boasts a complete supply chain and a mature operating methodology. For the company, expanding overseas is not only about exporting China’s best practices and products, but also about bringing back international innovations to China. This creates a mutually reinforcing cycle between domestic and overseas business units.

Last year marked Botare’s 10th anniversary. At the annual company meeting, Yuezhong Zhan, founder and chairman stated the company’s new ambition: “In the past ten years, we’ve fulfilled all our promises in the Chinese market. But this is only the beginning. In the future, we aim to fully internationalize and build another Botare.”

References

[1] 36Kr Global Expansion Guide: Botare’s Overseas Journey—Fujian DNA Meets Southeast Asian Rules

[2] How a Chinese Tissue Brand Conquered TikTok: Botare’s 23M RMB/Month Breakout Strategy

[3] From TikTokHits to Southeast Asian Bestsellers: 200M RMB Sales in a Year!