In our previous article, we proposed that “category management” is an essential solution for retailers when shifting their business perspective from the seller’s side to the buyer’s side.

This is because category management starts from consumer demand, outlining shared goals for both brands and channels, turning a zero-sum game into collaborative cooperation. At the same time, the restructuring of categories drives format innovation within the retail industry.

For distribution channels, “winning in one category first” is a way to find a path of certainty in an uncertain market.

However, this shift in focus also raises the bar for the channel’s comprehensive capabilities. Consumer insights, product development, manufacturing, and organizational support—each can become a potential roadblock in a retailer’s transformation journey.

So, how can channels leverage the emerging role of the “category partner” to achieve category breakthroughs? Within the category framework, what new forms of cooperation are possible between brands and retailers?

In this article, we would explore new trends and roles in retail transformation through the lens of category breakthroughs—hoping to provide you with helpful insights.

“Winning the Next Category”: How to strategize?

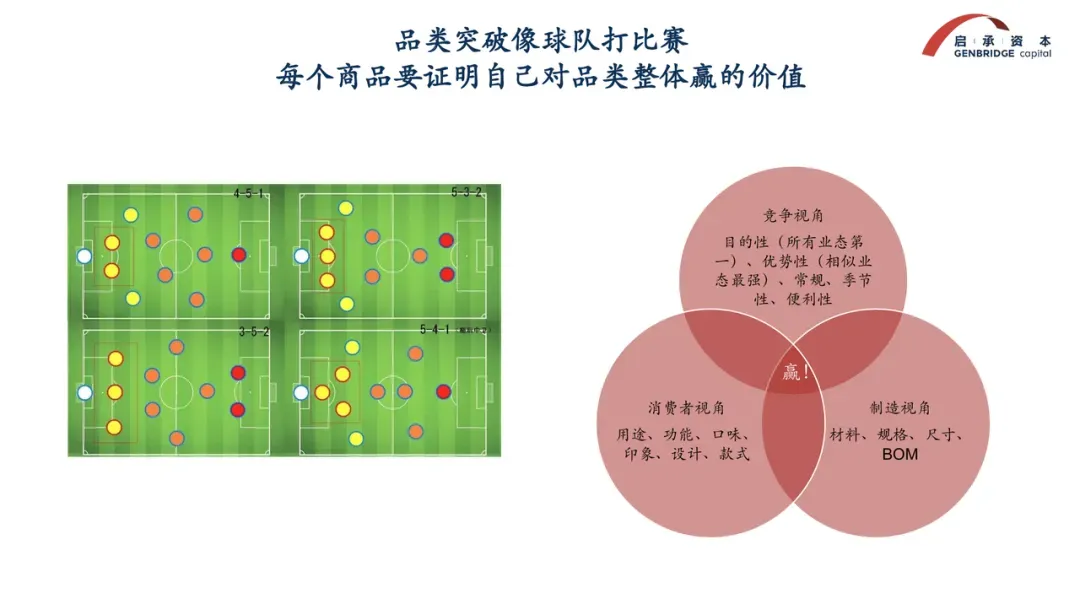

The core principle of category management is this: you must clearly understand the role of each product within a category. Just like in football, every player has a specific role, and only by working in coordination can the team perform well. If a product adds no value to a category, it shouldn’t be on the shelf.

In football tactics, whether you adopt a 4-4-2 or a 4-2-3-1 formation depends on a combination of factors: your opponent’s lineup, your own team’s strengths, and your strategic goals. Similarly, building a successful category also requires consideration from the following three perspectives:

- Competitive perspective

This perspective asks: how can I become the strongest in a given category compared to my competitors? The goal is to become top of mind for consumers when they think of purchasing a certain type of product.

For example, Qiandama’s slogan “never sells overnight meat” positions it as the first choice for consumers buying pork. Similarly, New Joy Mart identified the unmet demand for chilled milk in second- and third-tier cities, quickly entered the market, and became the largest sales channel for chilled milk in Hunan Province, claiming the mental territory for fresh milk among local consumers.

- Consumer perspective

In today’s diversified and stratified consumption landscape, consumers need to resemble a quantifiable decision tree.

Take meals as an example: based on time, they can be divided into breakfast, lunch, dinner, and snacks like afternoon tea or late-night suppers; based on location, meals can be eaten at home, school, or the office; the purpose of eating might be to satisfy hunger, lose weight, or gain nutrition. Lifestyle also affects choices—“coffee + bagel” may be a staple for some, while others prefer “soy milk + steamed bun.” Each layer of this decision tree forms a decision node, branching into multiple possibilities.

Categories are not arbitrarily created by retailers—they are systematically derived from this decision tree. Retailers must gain deep insights into consumption scenarios and constantly evaluate whether consumer needs at each branch point are being met.

- Manufacturing perspective

In more and more categories, manufacturing capabilities and processes directly impact the consumer experience and the brand’s differentiation. This is a critical foundation for the retail industry’s transformation toward “manufacturing-driven retail.”

In summary, a product must fulfill: a strategic role in the competitive landscape, genuine consumer needs, and possess cost, capacity, or technological advantages from a manufacturing standpoint. Only with competitiveness in all three dimensions can a product succeed in the market.

Achieving this inevitably requires multi-party collaboration, aligning resources, capabilities, and understanding to bring the vision to life.

Since last year, the industry has shifted from a growth market to a stock-based competitive market. The brand-dominant narrative is being replaced by one where retailers take the lead. More and more retailers are focusing on private label products, with some even pursuing full private label strategies.

However, creating high-quality products requires integrated capabilities. Most retailers are still developing their skills in product development, category operations, and manufacturing. Thus, support from brands remains essential.

Brands and retailers should no longer see each other as adversaries at the negotiating table, but rather as co-creators in product development.

From brand owner to “category partner”

In a retail landscape where retailers increasingly dominate brand-supplier relationships, what new possibilities exist for collaboration between brands and channels?

We’ve observed that some brand owners are shifting their approach—adopting a “category management” perspective and transforming into service-like providers that offer category solutions to retail partners. These solutions empower channels in traffic generation, product development, and marketing. We refer to this emerging role as the “category partner.”

Many of these companies have evolved from consumer-facing brands. They not only possess product development and manufacturing capabilities, but also recognize the importance of collaboration with retail channels, making them key players in retail transformation.

Let’s look at two representative examples:

- Royal Xiao Hu(皇家小虎)

Royal Xiao Hu began as a DTC (direct-to-consumer) e-commerce brand, specializing in standardized frozen products with high repeat purchase rates—such as egg tart crusts, pan-fried buns, and sausages.

Starting last year, the company shifted its focus to the B2B market. Initially, its products were placed in freezers like typical frozen goods. However, with highly standardized frozen items, the line between foodservice and retail is becoming increasingly blurred. In small brick-and-mortar shops, the most effective way to sell frozen goods is through a ready-to-eat foodservice model.

In response, Royal Xiao Hu adopted a “hot cabinet hot sale” approach—placing freshly baked, steaming egg tarts beside the cashier, paired with an attractive offer like “6 pieces for 9.9 yuan.” This significantly boosted sales.

From there, Royal Xiao Hu began working closely with channel partners to co-create foodservice-style product models. Compared to traditional factory brands or pure B2B players, Royal Xiao Hu better understands traffic operations and consumer psychology, and also possesses a more mature cold-chain logistics system.

From egg tart formulation, sample testing, and pricing strategies, to promotions, poster design, and product display, the brand takes the lead while the channel collaborates—together developing a category solution for egg tarts.

This model has produced remarkable results. For instance, one convenience store of New Joy Mart sold over 2,000 egg tarts in a single day; in a store in Guizhou, sales hit 5,000 in one day, with 10 ovens operating non-stop—a truly impressive scene.

- Nowwa Coffee (挪瓦咖啡)

Nowwa Coffee has evolved through three phases: Initially focused on online coffee delivery; later opened standalone stores in lower-tier cities to build brand recognition; now, it has adopted a more flexible model by opening "stores within stores" inside convenience stores—offering a full-stack coffee solution, from equipment to marketing.

Coffee has long been a category convenience stores seek to expand, but few have managed to scale it successfully. One reason is that ready-to-drink beverages rely heavily on online traffic, but traditional retail lacks the capabilities for digital traffic operation and product definition.

Nowwa’s store-in-store model acts as a plug-in for both online channels and coffee product R&D, while also leveraging its identity as a professional coffee brand. This combination provides retail channels with a breakthrough in a high-margin category. Today, coffee sales from Nowwa’s in-store setups are second only to tobacco in terms of revenue contribution.

In both cases, brands have shifted from “consumer-facing” roles to “channel enablers.” As category partners with R&D, manufacturing, and supply chain capabilities, they provide retail partners with scalable, replicable, and sales-driving products.

This role is especially crucial during the current phase of retail channel transformation.

GenBridge View

As the retail industry shifts toward category-based operations, a new type of role is emerging in the market—the “Category Partner”. These partners focus on creating value for retail channels across four key dimensions:

- Manufacturing Advantage: By leveraging stable, efficient supply chains and standardized production capabilities, they ensure product quality while achieving optimal cost control.

- Product Definition: Through sharp insights into consumption scenarios, they redefine how products are sold and experienced by consumers.

- Brand Value: They quickly build consumer trust and preference through strong brand influence and user recognition.

- Traffic Generation: By integrating online operations with offline scenarios, they actively attract and stimulate consumer demand.

For retail channels, especially in the early stages of capability building, leveraging brand partners is essential. For brands, it’s equally important to shift perspectives and think deeply about how to offer concrete solutions to downstream partners (e.g., driving traffic, acquiring new customers, increasing purchase frequency). Therefore, we can maintain market share amid ongoing transformation.

Today, true category partners remain a rare breed. Both sides should cherish the partnership, foster mutual support, and grow together.