At the “2023 China Investment Annual Conference” held last week by ChinaVenture and CVINFO, Robert Chang, Founding Partner of GenBridge Capital, participated in the “Consumer Roundtable” to share insights on current consumption investment trends, investor confidence, and how consumer companies can build resilient supply chain advantages to navigate economic cycles.

Deep engagement in the growth phase of consumption, exploring industrial opportunities

ChinaVenture: Over the past two years, the consumer sector has seen dramatic highs and lows. We've observed clear shifts in investment approaches: from focusing on early-stage opportunities to now emphasizing mid- to late-stage deals and increasingly targeting M&A. Some investors are even getting more hands-on, co-creating with brands through incubation, channel building, and digital initiatives. What’s your perspective on the polarization of consumer investment?

Robert Chang: Since its inception, GenBridge Capital has focused specifically on the growth stage of consumer companies, targeting two classic models: the next-generation national brands and next-generation nationwide retail chains. Over the years, we’ve been fortunate to partner with several outstanding companies—such as October Rice Field, YuanShiMuYu—as well as rising national chains like Qian Da Ma, GuoQuan ShiHui, Xue Ji Roasted Goods, and Leisure Snacks Busy.

Our primary investment stage is post product-market fit, once companies have established business models and scaled revenues. We typically enter as their first institutional investor, and many of our portfolio companies have seen 5–10x growth in 3–5 years, with some reaching the threshold for IPO readiness.

Strategically, we remain committed to the growth stage, focusing on identifying and empowering the next wave of consumer champions.

The consumer landscape has changed significantly in recent years. In my view, while early-stage consumer investments may still see some experimentation, they won’t be as hot as before. Early-stage entrepreneurship heavily depends on external macro conditions, and we haven’t seen major new industry-level inflection points lately. Meanwhile, adjustments in A-shares and Hong Kong markets over the past year have also impacted Pre-IPO arbitrage-driven investment logic.

Going forward, we believe mid-to-late-stage growth investments and industrial M&A represent promising opportunities.

- On one hand, the last innovation cycle has produced a group of high-quality, next-generation companies that are now ready to interact meaningfully with legacy giants and global brands.

- On the other hand, both investors and entrepreneurs are more open to M&A as they navigate through a different macro cycle. This shift will likely open up new windows for growth-oriented and industrial M&A.

Some of our portfolio companies, once they reach ¥5–10 billion in revenue, with stable profits and IPO plans, will have our full support to pursue strategic acquisitions in these directions.

Understanding the cycle, and preparing to ride through it

ChinaVenture: How do you view investor confidence in the consumer sector across primary and secondary markets? What’s your read on the current cycle and outlook for the next 1–2 years?

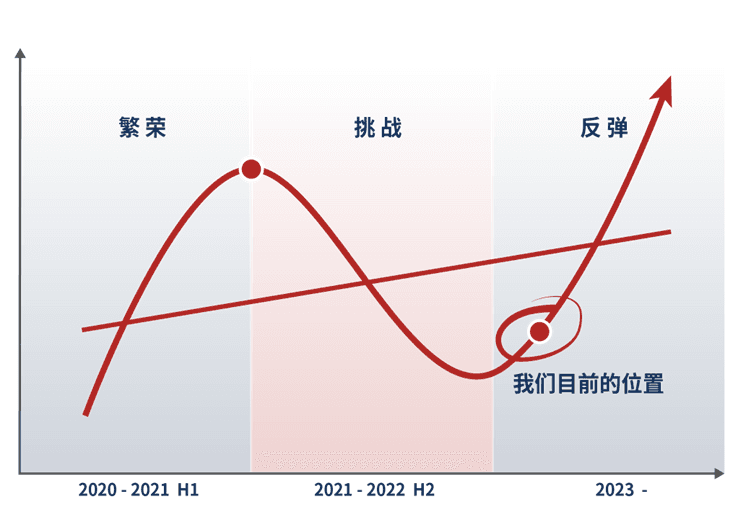

Robert Chang: The consumer sector has two distinct cycles worth watching: the business cycle of consumer companies, and the capital market cycle. From our perspective, the picture is clear: After a period of flourishing innovation, consumer markets slowed down. Last year was especially challenging, but we believe the fundamental recovery just began late last year and is now underway. Since November 2023, we’ve seen meaningful signs of a fundamental recovery. However, the capital market remains under pressure. A-shares are facing shifting policy priorities, and outside China, only Hong Kong remains a viable market for consumer IPOs, though it too is impacted by geopolitical and macroeconomic forces.

So we’re seeing recovery in fundamentals but weakness in capital markets. This inevitably creates challenges for founders and investors—but according to cycle theory, challenges are also when opportunities emerge. Navigating the cycle well is what ultimately matters.

From a capital markets perspective, we also see strategic opportunities for long-term positioning. On May 18, one of our portfolio companies, Deerma, successfully listed on the Shenzhen Growth Enterprise Market (ChiNext). Its journey spanned the full cycle, including adjustments over the past few years.

Meanwhile, two more of our portfolio companies filed for Hong Kong IPOs earlier this year. Despite the macro headwinds during COVID-19, they managed to achieve solid growth in revenue, profit, and market positioning. If they succeed in listing during this down cycle, they will be well-positioned when capital markets rebound.

For both entrepreneurs and investors, the key is to understand the cycle and prepare to ride through it. Challenging times often allow outstanding companies to consolidate the industry, and give investors opportunities to lay strong foundations for outperformance in future upturns.

Supply chain capability is a core requirement for consumer champions

ChinaVenture: The pandemic hit physical retail and chain store formats particularly hard. What’s your view on the current and future state of chains and supply-chain-oriented consumer businesses?

Robert Chang: Our portfolio companies weathered the cycle well in part because we focus on investing in companies with superior supply chain fundamentals. Many past consumer startups excelled at what we might call the “elective courses”—user insight, channel innovation, new product categories. But these successes were always built upon a strong foundation in the “core curriculum”: supply chain mastery.

Among our portfolios: Harvest provides “better rice” with a strong production base in Northeast China.Yeswood offers “affordable, quality furniture” through deep industrial integration. Guoquan scaled to over 10,000 stores in lower-tier markets by offering hundreds of high-value products, backed by robust R&D. Xueji’s roasted seeds and chestnuts taste great because they invest heavily in sourcing and production at origin.

For the new generation of consumer brands, a well-developed supply chain is non-negotiable. Get top marks in the “required course” of supply chain, and the “electives” can be filled in later. This is how companies endure through cycles and build long-term resilience.

Last year, we noticed an interesting pattern: when founders discussed sales growth, the conversations were always lively and optimistic. They could talk extensively about short-, mid-, and long-term opportunities. But when the topic shifted to profitability, the tone became more hesitant. Many viewed profits as something that would “naturally happen later” or didn’t see it as an immediate goal.

We take a firm stance: the ability to generate profit is like building muscle, and it’s best to start early. Ultimately, profits only come from two sources:

From your own unique supply chain capabilities, that is, your defensible "secret sauce." In contrast, marketing advantages (the “elective”) are more easily copied and hard to sustain.

From industry consolidation, when only one or two leading players dominate a category, profit naturally follows.