Warren Buffett and Charlie Munger once said there are two types of businesses in the world: one is “Smart Once”—create a great product or business model and achieve runaway success; the other requires “Stay Smart”—you must continuously make smart decisions to stay competitive in a changing market.

The retail sector is clearly the latter. In this rapidly shifting and near-transparent market, there are no eternal winners. Retail formats are in a constant state of evolution.

For example, “weekend trips to hypermarkets” used to be a routine part of life for Chinese consumers. As e-commerce developed, sales growth in large supermarkets began to slow, and even turn negative. Smaller formats tend to be more attuned to everyday needs, such as convenience stores, discount stores, and specialty shops. But just last year, large-format supermarkets that had been in decline found renewed vitality through structural transformation and began to flourish again.

The decline and resurgence of hypermarkets exemplify the negative and positive trajectories in retail format evolution. Failing to adapt means falling behind the times; embracing transformation is the only path to survival.

The surge of buyer-side solutions we see today are, in essence, innovative responses born from this very evolution of retail formats. In this article, we analyze the logic behind format evolution and explore new buyer-side solutions emerging across different retail models.

What drives retail format evolution?

Retail is a complex ecosystem shaped by multiple interwoven forces. Changes in demographics, supply structures, competition dynamics, and the relationship between retailers and suppliers all contribute to the ongoing evolution of the industry.

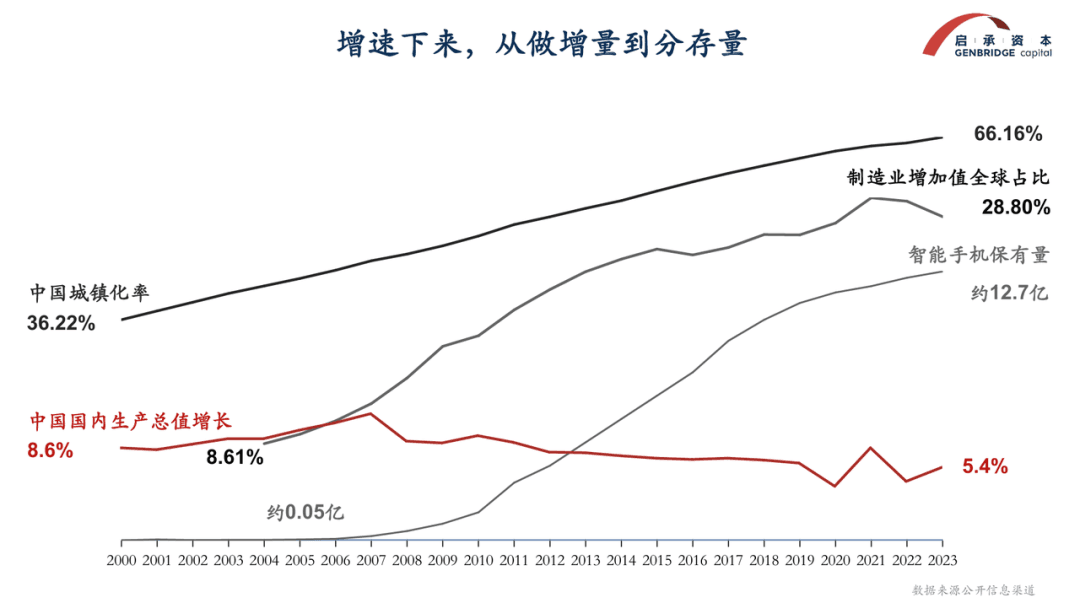

On the demand side, China’s urbanization rate rose from 36% in 2000 to 66% today, but that growth trajectory is now tapering off. Simultaneously, GDP growth has slowed from 8.6% to 5.4%. This reflects a shift from a phase of rapid economic expansion and surging consumer demand into an era of stock-market saturation.

On the supply side, China’s share of global manufacturing value-added has increased from 8.6% two decades ago to nearly 30% today, signaling a massive release of supply-side capacity. The market has entered a phase of oversupply, meaning businesses must now accurately anticipate consumer demand for products to sell effectively.

In the past, during a time of supply shortage, the market naturally gave rise to the strategy of “Big Brands, Big Hero Products, Big Channels”:

As long as a company had production capabilities and goods to sell, it had a shot at success—thus the emergence of big brands. Whoever could distribute their products across the widest network held the advantage, as the rise of big channels. And when reaching into the capillary markets of towns and villages, you needed a hero product with strong profitability to convince distributors to stock your goods—this was the logic behind the big hero SKUs.

But today, as the market shifts from incremental growth to a stock-based economy, the commercial logic of large-scale distribution is gradually losing its effectiveness. In different regions and across various formats, a new wave of solutions has emerged in response to these evolving market conditions.

How are different retail formats evolving?

Retail formats can generally be categorized into four types based on store size:

- Extra-large stores (>5,000㎡)

- Large stores (1,000–5,000㎡)

- Medium stores (200–1,000㎡)

- Small stores (<200㎡)

Extra-large stores were once the strongholds of retail giants like Walmart, Carrefour, and RT-Mart. In recent years, rising rents and the impact of e-commerce have forced traditional hypermarkets to either close down or reduce their floor space. In contrast, the Sam’s Club format has gained momentum over the past five years, becoming a representative of the extra-large store model.

Unlike traditional supermarkets that rely on a "broad and comprehensive" approach, low margins, high SKU counts, and mass-market appeal. Sam’s targets the rising middle class with a membership-based model that precisely reaches its audience. It limits its assortment to just over 4,000 SKUs and reduces intermediate costs through global direct sourcing and private-label products, offering large-pack, high-value goods.

What sets Sam’s apart from other retailers is that it operates more like a product-driven company disguised as a distribution channel. Its strengths lie in product development, quality control, and innovation—hallmarks of a buyer’s market where the channel holds the power. In fact, strong channels like Sam’s can even drive upstream product upgrades among partner brands.

Large-format stores, primarily national chain supermarkets, have had to undergo painful transformation to survive. Meanwhile, formerly low-profile regional players have risen to prominence. Companies like Beauty Mart(比优特超市) and PangDongLai exemplify how localized, concentrated operations can improve supply chain efficiency and generate genuine economies of scale. These cases could be explored in detail in the first article of this series.

Small-format stores, such as New Joy Mart convenience stores, Snack Is Busy(鸣鸣很忙) snack chain stores, and Qiandama fresh community chains, have shown remarkable vitality and adaptability in the latest retail restructuring. Their strengths lie in flexibility, dense network coverage, and deep integration into residential communities, allowing them to respond quickly to shifting consumer needs.

Taking Snack Is Busy as an example, the evolution of small-format stores reveals three key characteristics:

- Category specificity contributes to explosive growth potential.

Snack Is Busy focuses on the snack category, specifically ambient packaged foods. Compared to fresh food, this category involves much lower supply chain complexity. Over half of the products are sold in bulk, suppliers are highly fragmented and hold limited bargaining power, making it easier for channels to step in. Historically, the upstream markups in this category have been relatively high, so when a price-disruptive player enters the market, consumer response tends to be rapid and intense.

- Emotional value drives user stickiness.

These small-format retail chains typically feature eye-catching storefronts and neatly organized displays, often making them the most visually prominent shops in lower-tier markets.

For example, Snack Is Busy opened two concept stores in Changsha—“Snack Is Big” and “Snack Is Spicy”. These aren’t just stores; they’ve become consumer destinations. Customers line up to buy, then carry home oversized spicy snack packs, creating a striking visual spectacle and high social media shareability. This in turn fuels strong brand awareness and word-of-mouth marketing.

3. A mature franchise system was established early on, including unified digital management, payment systems, logistics infrastructure, and a clear franchise model. They proactively select high-quality franchisees to collaboratively build the brand and grow its value.

Medium-sized stores are the most challenging format to operate. Positioned between large and small formats, medium-sized stores were once crowded with hypermarket giants trying to “scale down.” But back then, most were focused on rapid expansion, blindly replicating supply chain systems and product structures from larger formats—while neglecting the unit economics of a single store.

Current best-in-class examples include Fresh Hippo Neighborhood Business and ALDI China, both of which adopt a hard discount model. With around 2,000 SKUs, they aim to cover all key family use scenarios from the dining table and coffee table to the bathroom.

The term “hard discount” doesn’t just mean simple price cuts or promotions. It’s about achieving sustainably low prices through extreme cost control and operational efficiency. Compared to small formats, hard discount stores construct richer and more expansive consumer scenarios, allowing them to capture a greater share of each customer’s wallet.

GenBridge view

The retail industry continues to evolve. The formats summarized above are merely relatively convergent solutions amid the current chaotic phase of transformation—they are not once-and-for-all or universally applicable models.

However, by analyzing the common trajectories across different formats, we find that outstanding retail practices generally revolve around the following core actions:

First, restructuring the supply chain around consumer needs;

Second, establishing brand recognition through well-defined categories or hero products;

And finally, leveraging scale to evolve toward a manufacturing-driven retail model.

Returning to the central question posed in this article: In the retail industry, no matter how turbulent the transformation, the only constant is the ability to remain clear-headed and evolve amidst change.