As a retail giant in Japan, 7-Eleven, founded in 1973, has now reached its 50th anniversary. With its refined business philosophy and uniquely curated product offerings, it has continued to thrive across economic cycles and has grown into the largest convenience store chain in Japan and globally.

In the 1990s, with an abundance of supply, consumer demand in the Japanese market shifted from uniformity to individuality (from “one style fits all” to “ten people, ten preferences”). Meeting these increasingly personalized needs with high cost-performance products became a key challenge for retailers.

To adapt to the transition from a seller's market to a buyer's market, 7-Eleven developed a unique in-house product selection mechanism and vertically integrated its supply chain, forming what it called a "manufacture-sales alliance." This alliance brought together manufacturers, wholesalers, and retailers into collaborative teams to develop original products while innovating in logistics. By streamlining the process from production to sales, it mitigated the "bullwhip effect" often seen in product development and enabled the provision of high-value products to consumers.

Looking at the current situation in China, where economic pressure has intensified, domestic retail partners are facing similar challenges: how to break through fierce competition with distinctive product offerings. Drawing lessons from 7-Eleven’s experience, GenBridge Capital has launched a series of articles on 7-Eleven, hoping to offer valuable insights to retail and startup entrepreneurs alike.

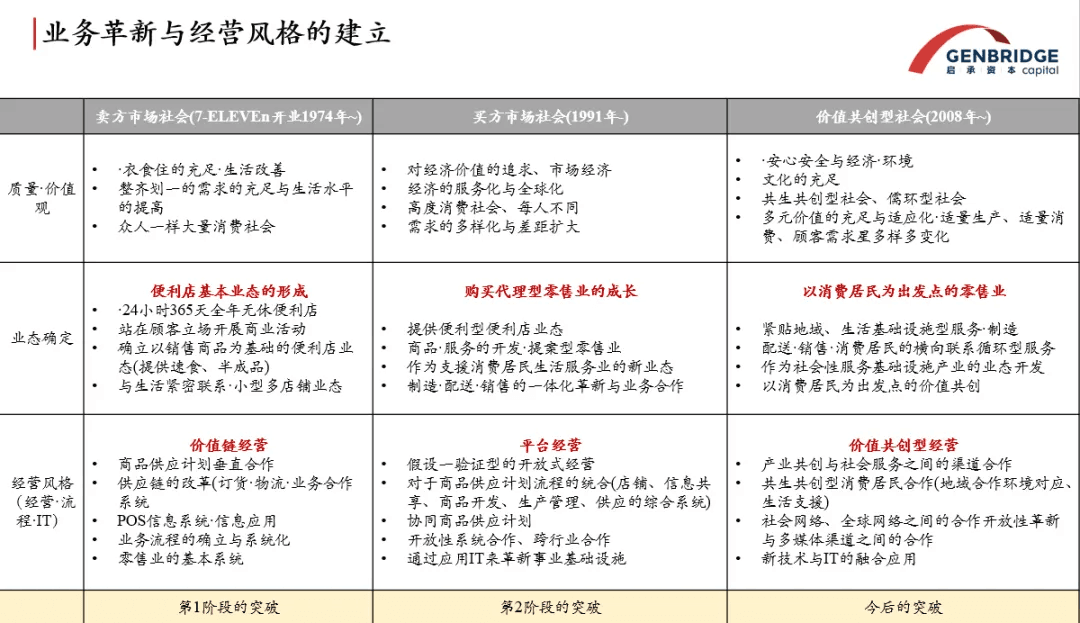

Background: Transition from a seller's market to a buyer's market

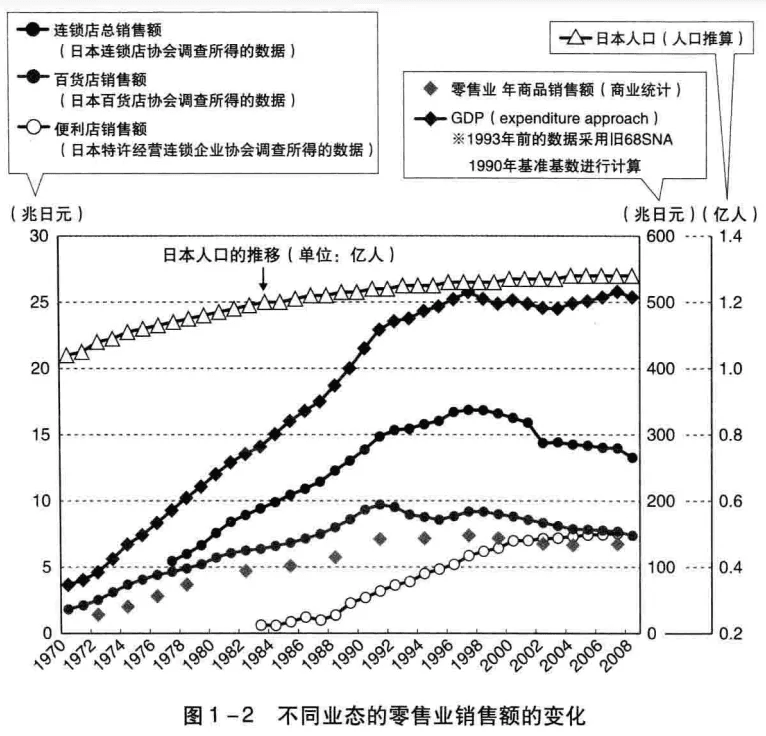

When 7-Eleven was founded in 1973, Japanese consumers had strong purchasing intentions, and standardized mass-market demand dominated (referred to as “one style fits all”). Retailers could meet customer needs by simply offering general daily-use products. This was a classic seller's market, where retail dictated terms. Supply-demand relationships were shaped by production capacity rather than differentiated consumer needs. As long as products could be produced cheaply and efficiently, they would sell in the market. At this time, the dominant retail model was department stores, characterized by wide trade areas and decentralized operations. Each store made its own inventory and sales plans, and the main task of retail was to meet homogenized demand.

However, after Japan’s real estate bubble burst in 1991, the market shifted toward a consumer-driven buyer’s market. People were already well provided for in terms of durable goods and essentials like clothing, food, and housing. To stimulate new demand, businesses had to offer more diverse products tailored to individual preferences—the era of “ten people, ten preferences.” Traditional chains began to fall behind, and the convenience store model, built around consumer needs, gradually rose to prominence.

Since its inception, 7-Eleven has selected and sold only the best-selling products from supermarkets. As market dynamics evolved, 7-Eleven transitioned from a traditional “sales agent” model—where products manufactured by suppliers were simply sold to consumers—toward a “buying agent” model, in which the company develops original products that directly meet consumer needs.

Proprietary product selection and supply mechanism

1. Manufacturer–Retailer Alliance: Solving the challenge of differentiation through original product development

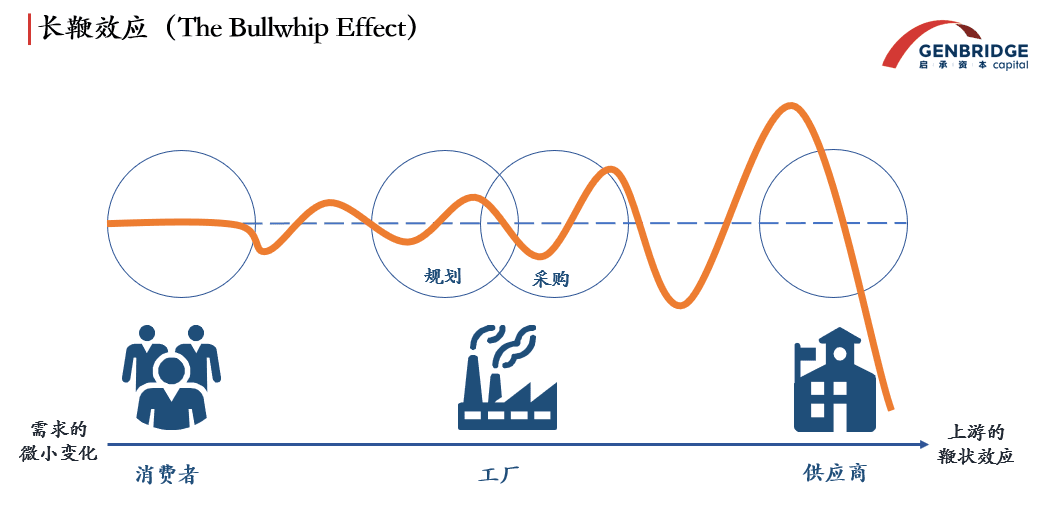

Retailers that failed to adapt to the buyer-driven market often continued to offer generic, undifferentiated products—unable to meet increasingly diverse consumer needs. Furthermore, the separation between manufacturing and retail led to information asymmetries in demand forecasting and exacerbated the classic “bullwhip effect” in supply chain management.

The bullwhip effect refers to the phenomenon where slight fluctuations in consumer demand amplify as they move upstream through the supply chain—from retailers to distributors to manufacturers. Without efficient information sharing, upstream suppliers receive distorted signals of demand, often vastly different from actual market needs—like the exaggerated motion of a whip.

To address the shift from a seller’s to a buyer’s market, 7-Eleven adopted a differentiated product development strategy, forming manufacturer–retailer alliances. These cross-functional teams—comprising personnel from manufacturing, wholesale, and retail—collaborate on original product planning, simplifying processes and minimizing the bullwhip effect. This allows customers to consistently purchase fresh, high-quality products with confidence and convenience.

Under this manufacturer–retailer alliance model, all departments involved in product development operate under the leadership of the merchandising division. These cross-functional teams span manufacturers of finished products, raw materials, packaging, containers, as well as sales and logistics departments. 7-Eleven implemented this approach not only in fast food but also across confectionery, beverages, ramen, cosmetics, and daily goods.

Notably, unlike many private-label strategies that focus on low-cost positioning, 7-Eleven transformed cost structures through its proprietary development process, creating high-value, differentiated products that contribute meaningfully to store profits—not as a weapon in price wars.

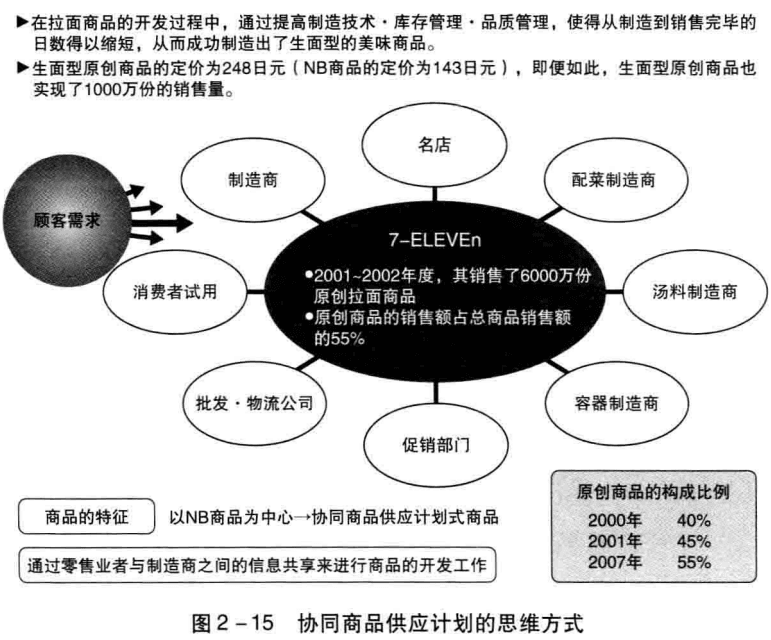

As ramen is a key staple in convenience stores, 7-Eleven launched an initiative in the early 2000s to develop an original premium ramen product. Over the course of a year, the company successfully persuaded renowned ramen chains such as SUMIRE, Ippudo, and Santouka to participate in the project, contributing their expertise in soup bases, broth, and packaging.

Suppliers and logistics firms were included in the development team to optimize freshness management and reduce inventory, enabling the creation of delicious ramen with fresh noodles, prioritizing freshness and flavor.

The final result: while regular instant noodles were priced at around 140 yen and often used as loss-leaders in supermarkets, 7-Eleven’s original ramen was priced at 248 yen generating high sales and strong profit margins without falling into price competition. Between 2001 and 2002, the product sold 60 million units, helping 7-Eleven stand out among competitors.

At one point, 7-Eleven’s rice product sales were growing at double-digit rates, but bread sales remained stagnant. Upon investigation, it became clear that consumers were demanding better taste and freshness. More and more people preferred freshly baked bread, rejecting the long-shelf-life products commonly found in supermarkets and bread chains.

Initially, 7-Eleven asked major bread manufacturers to develop freshly baked bread. When that failed, it pivoted to an innovative model: develop frozen dough technology, use a limited number of dough production factories, and build small baking plants near stores to preserve flavor and freshness. The company collaborated with FRANCOIS, a Fukuoka-based firm known for its technical excellence in frozen dough. Acting as a coordinator, 7-Eleven brought together large food manufacturers with strong freezing and development capabilities, factory and logistics designers, and baking facilities. They even engaged large trading companies to support the initiative.

After a year of preparation and testing, in November 1993, the “Freshly Baked and Delivered” service officially launched. By incorporating original, freshly baked bread into the product lineup dominated by plain bread from major manufacturers, bread sales doubled.

By vertically integrating the supply chain, encouraging information sharing, and facilitating cross-functional collaboration, 7-Eleven was able to develop highly competitive products. This strategy also fundamentally restructured the cost model—realizing cost reductions through bulk purchasing, logistics reform, unified marketing, and synchronized promotions. The savings were then reinvested into premium raw materials and product quality, enabling reasonably priced yet high-quality offerings. This increased the overall gross profit at store level and built a comprehensive competitive edge that rivals found difficult to replicate.

This approach was further extended to 7-Eleven's group companies as the development model behind its private label, SEVEN PREMIUM. SEVEN PREMIUM offers high-value, distinctive products, yet maintains price competitiveness at about 70–80% of national brand prices (a 20–30% discount). In fiscal year 2008, SEVEN PREMIUM offered approximately 800 SKUs across the group, generating sales of ¥180 billion.

2. Logistics Innovation: High-Frequency, small-lot supply chains to ensure efficient stocking and freshness

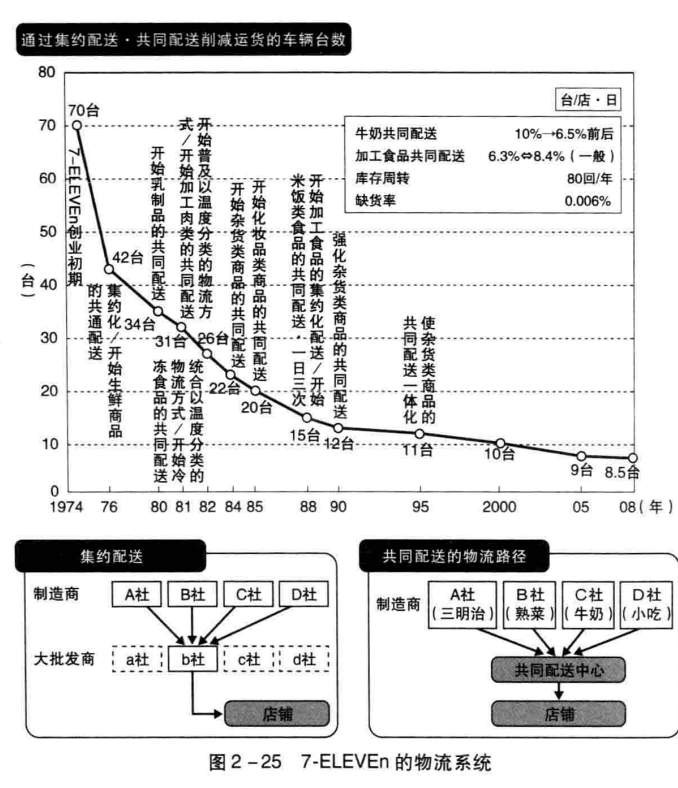

In response to increasingly diverse and sophisticated consumer demand, 7-Eleven was the first to advocate for inventory stocking and quality standards from the consumer’s perspective, which contrasted sharply with the practices of traditional wholesalers and logistics providers. Taking the lead, 7-Eleven fostered a new generation of service-oriented suppliers, implementing consolidated coordination and shared delivery systems to dramatically improve store-level efficiency. This enabled the delivery of fresher, higher-quality, short-shelf-life products to stores, reducing logistics costs while preserving front-end product competitiveness.

At the time, Japan’s supply chain was long and fragmented, with various product categories governed by separate distribution hierarchies, trading customs, and agency structures. The system created layered flows of goods and logistics through national and regional wholesalers. Over 1.1 million retail stores and countless small-to-midsize manufacturers coexisted, while wholesalers—numbering more than 300,000—played intermediary roles in inventory planning, merchandising, distribution, information sharing, and sales support. This seller-dominant system, while efficient from the supply side, often relied on transaction volume and negotiating leverage to determine terms—with little regard for the consumer’s actual needs or product quality expectations.

To guarantee product freshness and quality, 7-Eleven initiated logistics reform based on high-frequency, small-lot deliveries.It reduced minimum order quantities, shifting from bulk cartons to smaller or even unit-based orders.Delivery frequencies were increased according to the turnover rates of individual products.Lead times were shortened, reducing stockouts and improving overall gross margins.Additionally, 7-Eleven introduced strict temperature and quality control systems for perishables such as ready meals, dairy, and prepared foods, enabling 2–3 deliveries per day.

These practices—including higher delivery frequency, smaller lots, reduced lead time, and scheduled delivery windows—raise costs for suppliers. Thus, without restructuring the entire business model and transaction frameworks, such practices would be impossible to sustain.To overcome this, 7-Eleven collaborated with supply partners by product category to build entirely new logistics systems.

Two Types of Delivery Models:

- Consolidated Delivery

For categories like alcohol, processed foods, snacks, and general merchandise—where distribution structures were complex and dominated by powerful manufacturers with exclusive wholesaler systems—multiple wholesalers often operated in a single region. 7-Eleven streamlined these networks by reducing the number of wholesalers per region to just one. By consolidating purchasing and logistics volume, the company achieved greater efficiency and integration in transactions and distribution.

- Joint Delivery

For fresh foods such as rice meals, perishables, prepared meals, and dairy—where each manufacturer offers a limited number of SKUs—centralized delivery was challenging. These categories are core to convenience store operations, demanding: Efficient multi-slot daily delivery (morning, noon, evening); robust quality and inventory management, shorter delivery lead times, small batch deliveries.

To meet these needs, 7-Eleven introduced a joint delivery model. This wasn't a partial fix; it was a comprehensive system overhaul, including: Factory location strategy and reengineering of production processes; operation system development for distribution centers; custom development of sorting machines and delivery vehicles; business and information-sharing systems connecting stores, logistics centers, factories, and raw material suppliers.

This transformation—from factory delivery to 7-Eleven-managed dedicated warehouses—ultimately reduced logistics costs by 25% across 47 logistics centers. For processed foods, logistics costs fell from 8.4% to 6.3% of purchase price per store. Furthermore, delivery lead times to joint delivery centers dropped from 2–4 days to 1 day, while inventory days fell from around 10 days to just 2—dramatically reducing out-of-stock rates.

Thanks to strong system support, 7-Eleven successfully integrated product development, supply, and operations in a seamless workflow—ensuring stable supply, quality control, operational improvements, competitive product development, and lower total logistics costs.

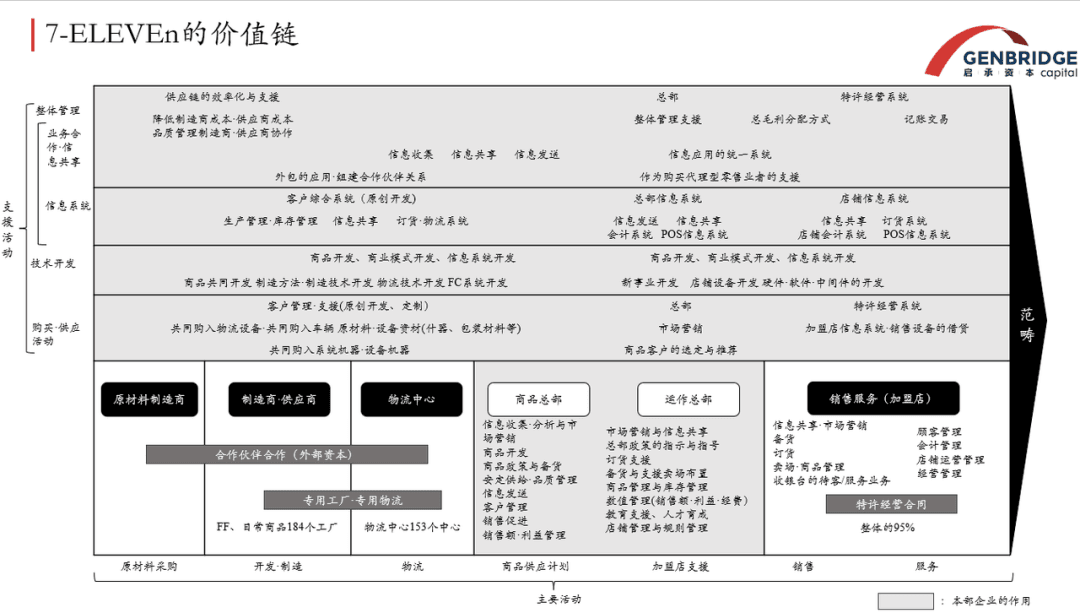

7-Eleven’s value chain

At the core of 7-Eleven’s value chain is headquarters-led integration, combining tight inter-company collaboration with vertically aligned supply planning. The demand chain (customers, stores) and supply chain (manufacturers, logistics, vendors) are closely interconnected, forming a partnership-based business model between supply and demand.

The entire product development flow—from raw material → manufacturing → logistics → headquarters → store → customer—is optimized by reallocating roles across customer → HQ → store, improving service quality for consumers.

Foundational Support: For this cooperative model to function efficiently and effectively, a centralized support structure is required—encompassing shared information systems, technology development, procurement management, and systemic coordination.

While 7-Eleven itself fulfills these unifying functions, it also provides shared business process frameworks and IT systems to suppliers, fulfills its responsibilities under franchise agreements, and dispatches Operation Field Counselors (OFCs)—store-level business advisors—to provide ongoing support at the retail front line.

In the face of market transformation, 7-Eleven executed vertical integration in product development and logistics. The Manufacturer–Retailer Alliance and logistics reform created a tightly knit connection between sales and product development. This mitigated the bullwhip effect, improved end-to-end efficiency, and enabled the creation of differentiated, consumer-centric products—allowing 7-Eleven to stand out in a highly competitive market.