In recent years, pre-cooked food has become one of the hottest trends in the consumer sector. From popular dishes like sauerkraut fish, crayfish, and campfire barbecue, to the continuous emergence of new brands, online marketing, and offline innovation, the pre-cooked food track has maintained its momentum. Naturally, many entrepreneurs and business leaders have asked GenBridge Capital for our views on the sector—whether there are real opportunities worth pursuing.

From the perspective of consumer demand, China's pre-cooked food market has enormous growth potential. The current reality is that penetration is still in its early stages, and this stage presents a key tension: on one hand, the industrial supply chain still lacks many necessary capabilities, and on the other, product-market-channel fit is still under active exploration.

We believe the next stage of acceleration hinges on “dancing with the channel”—that is, leveraging the power of offline retail to better understand consumer behavior, accelerate product innovation, and develop high-velocity SKUs to drive deeper market penetration. Additionally, local government support plays a crucial role: turning regional agricultural resources into national pre-cooked food products requires collaborative effort across the entire industry chain.

At GenBridge, we closely follow the foundational shifts in consumer trends. Among our close network are some of the most advanced retail players in the pre-cooked food sector: Guoquan, China’s largest offline frozen food ingredient chain; Qiandama, a leading fresh food retail brand known for daily meal essentials; and New Joy Mart, a convenience store chain with a high share of fresh food sales.

Recently, Victor Zhang, Founding Partner of GenBridge Capital, shared a comprehensive series of insights on the development of pre-cooked food—summarizing frontline experience from GenBridge and our partner companies. We hope these insights will help pre-cooked food brands accelerate their journey toward becoming category champions.

Challenges facing the development of China’s pre-cooked food industry

1. Early-Stage Development: "Category without brands"

In China, consumer-facing pre-cooked food is still in its early development stage, with a significant gap compared to more mature markets.

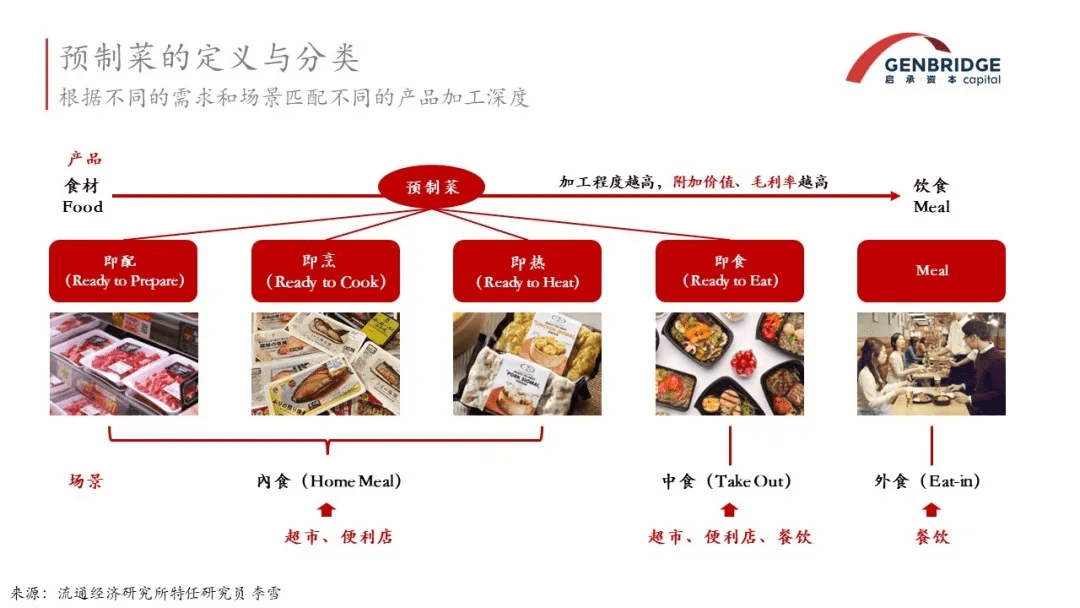

Currently, pre-cooked food generally falls into two main categories: Turning specialty dishes into home meals; making basic ingredients more convenient

Online, some specialty dishes have become viral hits because e-commerce platforms can effectively cater to niche demand. However, most of these products lack sufficient turnover to justify widespread offline distribution.

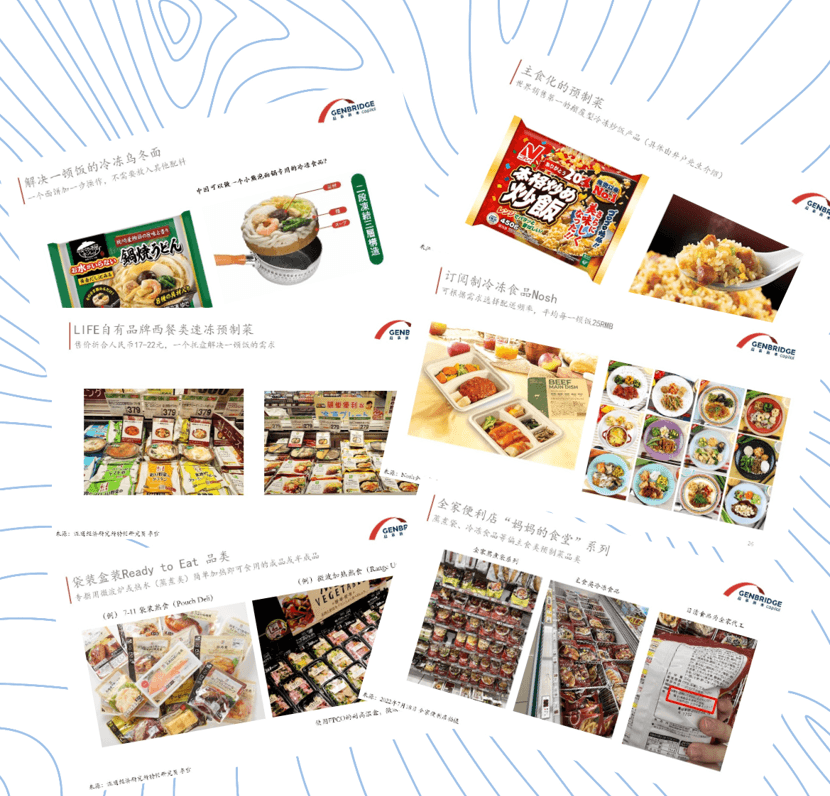

As for basic convenience meals, there has yet to emerge a nationally popular blockbuster product. The market remains dominated by frozen dumplings and other pre-made staples, with no equivalent to Japan’s widespread adoption of frozen fried rice or similar staples.

At this stage, pre-cooked food in China can be described as "category without brand":

- There is demand for certain types of products, but brand differentiation remains weak.

- Consumers are drawn to the category itself, not specific brands.

They may be curious about new products promoted by retail channels, but brand loyalty remains low.

2. Consumer Habits Have Not Yet Reached a Tipping Point

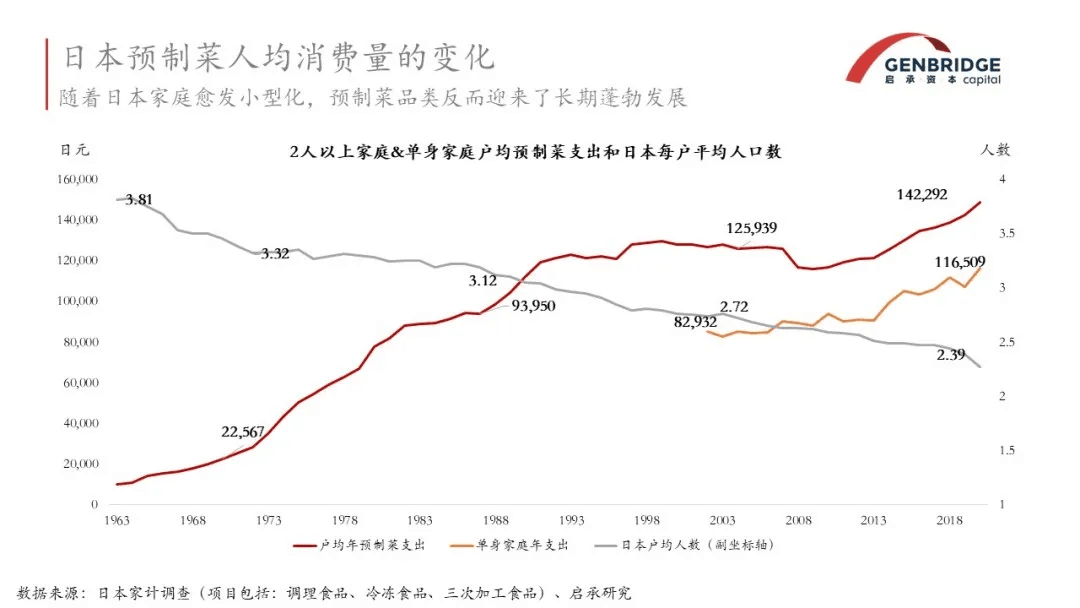

While the pandemic in recent years undoubtedly accelerated the development of the pre-cooked food sector, a true transformation in consumer habits takes time, along with the alignment of the right social and economic conditions. Our research into the Japanese market suggests that China is beginning to show similar social drivers.

First, in the context of smaller household structures, pre-cooked food helps solve the problem of time. Many consumers now see cooking at home as less worthwhile than working—time is money.

Today’s China is increasingly similar to Japan in the late 20th century, when the country began to shift into a "singularized society":

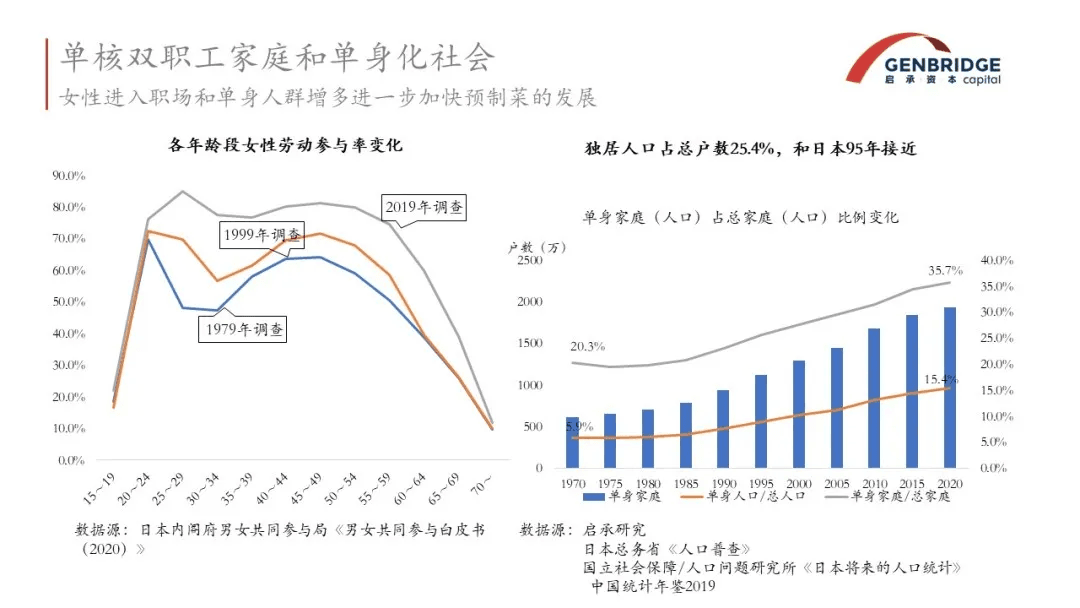

High participation of women in the workforce, including working mothers, means female family members have less time to cook, increasing reliance on outsourced household labor like ready meals.

The proportion of single-person households and solo dwellers is also growing. Currently, around 25.4% of households in China are single-person, roughly mirroring Japan’s situation in the mid-1990s. Some statistics suggest China’s single population accounts for around 17%—though the exact number is debatable, the trend toward a rapidly singularizing society is clear.

In Japan, the increase in the single population and female workforce participation led to a steady decline in time and spending on daily meals. For example, average lunch duration dropped from 33 minutes to 21 minutes as dining became increasingly rushed.

In the 1990s, when Japan’s economy began to decline, white-collar lunch was increasingly outsourced. Many office workers couldn’t afford dine-in or delivery meals but could rely on pre-cooked food or convenience store bento as an affordable, time-saving solution. At this point, pre-cooked meals evolved from being convenient to offering a cost-effective way to meet basic daily needs.

Here, we can distinguish between two concepts: A "single-person society" (独身社会) refers to individuals living alone; a "singularized society" (单身化社会) refers to households and lifestyles that retain individualistic patterns even within marriages.

For example, married couples may not eat together daily or spend weekends together. Each partner has their own hobbies and schedules.

Thus, the demand for pre-cooked food is not limited to those living alone—many married consumers share similar consumption habits with single people.

In China, however, takeout still dominates meal solutions for singles. To win over this demographic, pre-cooked meals must wait until labor costs rise to the point where takeout becomes less affordable. In Japan, a ¥30 dine-in meal costs double when delivered—making pre-cooked food a more attractive option. As labor costs in China rise, the average meal delivery cost (currently around ¥35) is expected to increase. When that happens, pre-cooked food—with its industrialized cost advantages—can occupy the pricing gap, offering full meals at ¥20–¥30 and effectively replacing rising-price takeout for value-conscious consumers.

To win the market, pre-cooked food must “dance with the channel”

1. Compared to online, offline channels are better at building long-term consumer repurchase habits

Online content platforms such as Douyin (TikTok China) are highly effective at convincing consumers to try new products, often combining branding and sales in one go. However, the single-item hits discovered online don’t always translate into long-term brand loyalty or high-frequency repeat purchases. Take last year’s viral sensation—“1-yuan sauerkraut fish”—as an example. It briefly turned pre-cooked food into the center of consumer hype. But in reality, the excitement quickly fizzled out, followed by a significant market correction.

We are still in a phase of exploratory demand validation: consumers are drawn in by highly engaging content, then “vote” through their post-purchase experience to determine which products earn repeat purchases over time.

Currently, most pre-cooked food products in China are chilled or frozen, which means they rely on cold chain logistics. The nature of the cold chain makes offline channels more efficient—the closer to the consumer, the lower the last-mile cost. The lowest cost is achieved when the consumer purchases directly in-store, followed by pre-positioned warehouse pickup.

In the long term, offline retail will be the dominant channel for pre-cooked food and will best represent broad, everyday consumer demand. The key challenge offline is limited shelf space and a finite surrounding population, meaning demand density is critical for a product to earn its spot on the shelf. Currently, market penetration for pre-cooked food still requires extensive consumer education, a challenging ramp-up period where manufacturers and channels must co-invest in activating demand and nurturing high-turnover products.

2. Offline cold chain networks are the infrastructure for prepared food development

We believe that collaborating with offline channels is a necessary path for prepared food companies.

In mature markets like Japan and the U.S., there are companies with very high market shares in the prepared food category. This is because these companies have secured shelf space in retail channels, giving them room to offer both basic and specialty products. Through strategic product portfolios, they win over consumer mindshare and gain market share.

For example, in overseas markets, frozen pizza is already a household staple. Consumers simply reheat frozen food at home to make a meal. However, consumer preferences for pizza flavors vary—some prefer classic options like plain cheese, while others enjoy seasonal or holiday-themed innovations. Companies offer product bundles to meet these needs, ensuring that different product lines can maintain significant shelf presence over time.

Prepared foods are primarily frozen or chilled, both of which incur high fulfillment costs. This makes offline channels a more efficient solution for sales. Building cold chain infrastructure in China is a high-barrier task, but once established, it becomes a strong moat for enterprises. In recent years, a new wave of offline retail companies has emerged in China, forming the closest link to consumers. For instance, our partner companies include Guoquan, which specializes in frozen products; Qiandama, which focuses on chilled fresh food; and Xinjayi convenience stores, which offer multi-temperature zones.

Guoquan, for example, has opened over 10,000 stores nationwide, all equipped with freezer cabinets ideal for storing various types of prepared foods. This is also Guoquan’s core competitive edge—building a highly efficient cold chain network that reaches the doorsteps of Chinese households. Capturing and efficiently leveraging shelf space in networks like Guoquan’s is a key challenge for any prepared food brand.

3. Retail channels play a crucial role in the development of the prepared food sector.

Partnering closely with large offline chains like Hema, Guoquan, or Qian Dama is the best way to cultivate universal prepared food products.

Take Guoquan as an example: it is one of the largest offline sales channels for frozen prepared foods in China, having entered the market via the hot pot category. In the past, chain restaurants like Haidilao popularized hot pot consumption among Chinese consumers. Guoquan further promoted this by offering solutions for enjoying hot pot at home, fostering a habit of in-home hot pot dining.

Even before the pandemic, Guoquan had already opened a large number of stores. However, at the time, demand density within the 1-kilometer radius around each store was still low. During the pandemic, Guoquan launched intensive community engagement activities through its stores—organizing tastings and driving awareness—to significantly increase category penetration. The result was sustained growth in both category sales and same-store repeat purchases.

Moreover, product innovation needs to be grounded in advanced food manufacturing capabilities and a deep understanding of ingredients, often requiring supply chain involvement upstream at the point of origin. Strong industry chain support is crucial for enabling retail players to succeed, and collaboration between supply and retail is key to moving the industry forward. Guoquan works with manufacturers who build factories near production regions and uses retail insights to co-develop products. Consumer needs for ingredients at home differ significantly from those in restaurants (B2B).

Take shrimp products, for example. Guoquan works with top-tier producers in areas like Beihai to co-develop retail-suitable items such as shrimp paste, shrimp balls, and shrimp patties—addressing the consumer’s need for diverse at-home ingredients. Through continuous consumer education, these products have become category bestsellers.

Lastly, the most critical value of a “10,000-store chain” is scale. The affordability of prepared foods is driven by the efficiency of industrial-scale production. In turn, economies of scale lead to cost advantages. Affordable pricing is essential during the penetration phase. Guoquan’s founder often emphasizes the importance of being “delicious and affordable.” Consumers need to like the product and accept the price. Only national-scale retail networks can bring unit costs down enough to turn individual products into high-value everyday items for the masses.

Product innovation must dance with the channel

1. Offline is the closest and most efficient innovation space to consumers

To truly identify consumer needs, prepared food companies must engage in ongoing product interaction with end users. Retail and food service channels play a crucial role in this process. Tastings and product experiences should take place at more offline locations. User education and feedback collection are also far more direct in physical settings. With this information, prepared food companies can develop products tailored to Chinese consumers.

Besides retail, restaurants are another major testing ground for prepared foods—a space of dynamic innovation. Restaurants also serve as a form of brand endorsement, and co-branded prepared foods based on restaurant offerings can become successful dual-brand products.

At the same time, restaurants represent a major B2B market for prepared foods. Faced with pressure to serve meals quickly, they have a strong demand for pre-prepared dishes. With the rise of chain restaurants, many have developed a hybrid model where semi-prepared ingredients are partially processed on-site. This has led to the emergence of prepared products such as shrimp patties and Cantonese-style breakfast items. Deciding which of these products are suitable for at-home consumption and for broader retail channels (i.e., B2C sales) requires further testing in the retail market, building upon restaurant use cases.

When it comes to product development, retail stores and distribution channels must start from consumer demand and stay in sync across all levels of the organization. For example, store managers’ feedback from the front line should be heard promptly by the operations and product teams. Consumers’ preferences also show up clearly in search data and reviews. If companies can capture these subtle signals in time, they can respond with greater agility and precision in their product innovation efforts.

Many companies now have product committees. Executives and middle managers alike provide consumer-oriented feedback during new product launches. Bringing a diverse group together to rate products objectively and iteratively refine the evaluation system significantly improves the success rate of new launches.

2. What can GenBridge offer to support product innovation in prepared foods?

Turning product innovation in the prepared food sector into a systematic process still requires significant external input to improve the hit rate of new launches. GenBridge’s role is to efficiently consolidate external insights and make them available to partner companies.

We are currently focused on several initiatives. First, we conduct international benchmarking. For instance, Japan is 20–30 years ahead of China in the development of its prepared food industry. We study which individual products have succeeded there, which technologies have been effectively applied, and how these lessons can inform China’s market.

We also run joint consumer research programs across provinces, cities, and product categories. For example, in our breakfast-focused studies, we examine consumer needs across northern and southern Chinese cities and across various distribution channels. These first-hand insights are highly valuable for product development.

Lastly, our Insight Center conducts interviews with many upstream manufacturers. The upstream supply chain is highly fragmented and diverse, with new technologies, companies, and production capacities emerging rapidly. Timely adoption of these innovations can be critical for the creative development of new products.

Regional cuisine development must align with channel strategy

Local culinary styles reflect the unique agricultural endowments of their regions. These resources are often suitable for industrial cultivation and can support the transformation of regional dishes into nationally available prepared food products. Agriculture, aquaculture, and land use all involve substantial natural resources, and local governments play a crucial role in promoting regional cuisine.

Governments can begin by mapping local culinary specialties and identifying valuable agricultural assets upstream. With the right supporting policies, these assets can be effectively leveraged. One of the most important steps is identifying a strong retail channel that can help stimulate and educate consumer demand. Retail involvement is essential for recognizing, validating, and amplifying consumer needs, which in turn drives investment across the industry and creates tremendous value.

Today, truly strong offline retail channels remain relatively limited in the market. GenBridge has invested in several such platforms: Guoquan, Qiandama, and New Joy Mart Convenience Stores, each corresponding to a distinct form of prepared food. These are exactly the kinds of retail partnerships that governments can work with to help prepared food companies build deep, strategic relationships.

Local governments, restaurants, retailers, and manufacturers are all key stakeholders in the prepared food industry. As professional consumer investors, GenBridge can act as a bridge—a connector that facilitates ecosystem-building. Through GenBridge’s industry expertise and our network of upstream partners, we help all parties build consensus and coordinate efforts within the same vertical, giving businesses greater support and confidence in their decision-making. This enables innovations to take root faster and flourish in the hands of consumers.