Price wars in food and beverage, product homogenization, declining consumer enthusiasm... What's the next step for consumer companies?

In recent years, a wave of new consumerism has swept across almost every category. Food and beverage segments outside of main meals, such as drinks, baked goods, and desserts, were the first to be disrupted, due to their high frequency, high traffic, and high profit margins.

Traditional brands that were slow to respond to new consumer groups, emerging demands, and evolving channels are now struggling to survive: dessert brand Hui Lau Shan has closed all its mainland China stores; Taoli Bread has seen net profits decline for three consecutive years; and former bakery giant Christine is on the verge of delisting.

Meanwhile, the challengers haven’t succeeded in capturing consumers' afternoon tea moments. Instead, they’re mired in fierce internal competition: new-style tea brands are locked in price wars around the 15-yuan mark; Chinese-style bakeries like Momo Dim Sum Bureau and Hutou Bureau have quietly exited the scene; and ice cream brand Zhong Xuegao, once hailed as premium, is now dubbed an “ice cream assassin,” with revenue shrinking nearly 80% compared to three years ago.

Legacy brands are in retreat, new brands fail without a fight—why is food and beverage consumption so difficult?

The core issue lies in the fact that today’s consumers expect to have it all: they want quality, affordability, and uniqueness. Older brands lack differentiation and personalization, while newer ones often overcharge and fail to offer good value. Only products that combine great quality, competitive pricing, and convenience can earn long-term customer loyalty.

So, where can such products be found?

The new generation of high-efficiency retail formats—such as convenience stores and discount chains—may offer a solution. In a market shifting from growth to saturation, retailers closest to the consumer can respond most quickly to changing needs, giving them control over traffic and positioning them as new power players in the supply chain, overtaking traditional brands.

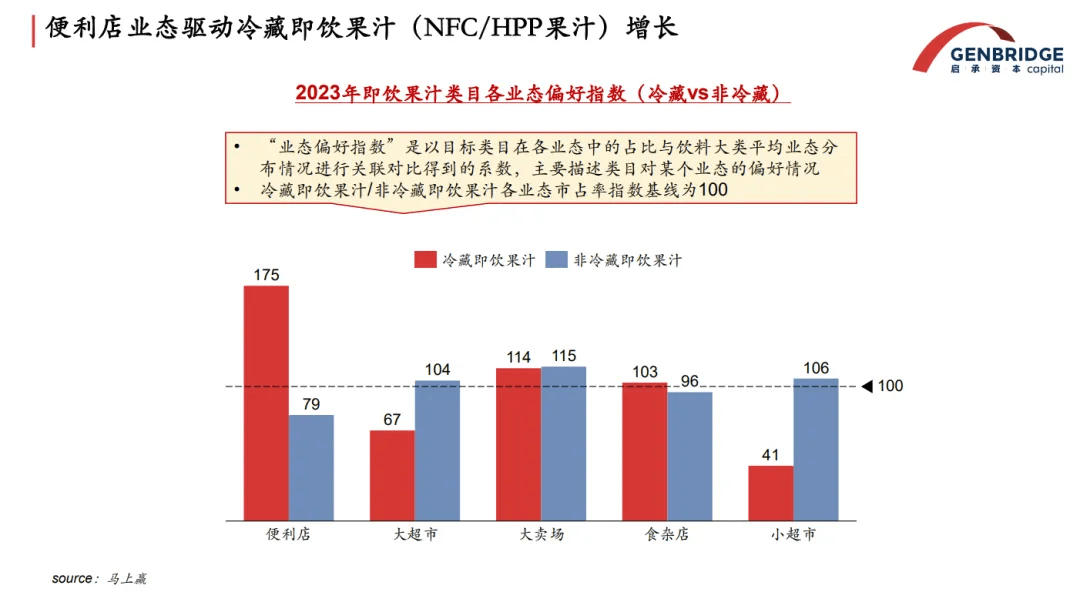

Take the juice category as an example. While traditional supermarkets and mom-and-pop shops have seen their market share shrink year by year, juice sales in convenience stores have steadily risen over the past decade. Moreover, the core customer base of convenience stores—young consumers in first- and second-tier cities—are more willing to pay for healthy, fresh, and distinctive products. For instance, HPP (High Pressure Processing) cold-pressed juices have become a favorite in convenience store channels.

These retailers are capable of reconstructing the efficiency of the traditional production and distribution system. Through upstream and downstream collaboration, they can co-develop products and bring competitive offerings to market, either through deep partnerships or private-label brands.

Looking at the history of convenience store development in Japan, major players like Lawson and 7-Eleven all rely on extensive networks of partner factories. By leveraging affordable and differentiated private-label products, they have successfully expanded into new consumer segments and scenarios, realizing the vision of “gourmet equality” for all.

There has never been a single correct approach in the consumer industry—structural opportunities still exist both online and offline. To explore more possibilities within various categories, GenBridge has launched a series of “Category Day” events. These gatherings bring together top players from all segments of the industry supply chain to form the “New Food & Beverage Development Alliance” and jointly explore future opportunities.

For this Category Day, we invited companies from across the beverage, dessert, frozen treat, and bakery sectors. Guests included star suppliers behind popular products at Freshippo (Hema), regional chain retail leaders, and even hidden champions of online channels. They convened at the headquarters of New Joy Mart in Changsha to discuss breakthroughs and innovations in the bakery, dessert, and beverage categories.

During the discussions, a stream of insightful perspectives emerged. Zhengda Coffee, which integrates green bean processing, coffee production, and tourism, pointed out that "scenario-based" coffee sales are an important trend. Ruguo Foods, supplier of the popular HPP juice at Freshippo, and Daqiaodao, the creator of the viral grape juice ice balls, shared their experience in differentiated product development. Li Mo Tea discussed how it sold RMB 1.5 billion worth of tea in one year through livestreaming on Douyin (TikTok China).

Retailers also shared valuable insights on product development. Qiandama, a fresh food chain, and New Joy Mart, a regional convenience store brand, talked about how they use single items to drive category growth and optimize profit structures. Duoletun, the chain behind the regional-featured Maojian beer, showcased how tying products to geographic identities can unlock new opportunities. Finally, membership store expert Xinlin Li reminded everyone: every product should come with a story, because the story is what sells.

Highlights from guest speakers at GenBridge’s “Category Day” Event:

Mengjun Wang, Zhengda Coffee:

The single-store coffee model is under pressure—scenario-based consumption is the future of coffee Coffee is becoming more affordable and part of daily life. To succeed, coffee sales need to be embedded in everyday scenarios. In the future, relying solely on traditional café models may prove unsustainable. Tapping into diverse contexts like breakfast or fat-burning consumption moments—pairing coffee with different foods and toppings—will be key to improving channel profitability.

Ai Yongqing, Ruguo Juice:

Fresher, healthier products require shared creation and responsibility across the supply chain HPP (High Pressure Processing) juice offers great potential thanks to its rich flavors and freshness, but it comes with high R&D costs (1–2 years) and equipment investments in the tens of millions. Supply is unstable due to climate dependency, and capacity is limited. We hope to co-create with downstream partners strategically to lower R&D and logistics costs, accelerate market responsiveness, and expand product reach together.

Wang Chong, Daqiaodao:

In the ice cream off-season, innovation in non-standard SKUs is the solution The product specs and pricing structure in the ice cream industry have shifted significantly. Traditional models are no longer viable. At Daqiaodao, we focus on product aesthetics, cultural value, and social appeal—especially in healthy, low-calorie, and low-fat subcategories—to create distinct and competitive offerings.

Du Jiao, Li Mo Tea:

Livestreaming makes young people fall in love with tea

- Eliminate user distrust by showing authentic quality and telling our brand story—who we are.

- Justify pricing by explaining the real value behind it.

- Pinpoint consumer pain points and emphasize uniqueness—tell users why they should choose us over competitors.

Wu Minyi, New Joy Mart:

Our goal is to make retail more cost-effective We launch one major product each month. Experience has shown that a strong hero SKU can unlock an entire category and drive store traffic and profitability. The market is challenging, but when viewed from a different angle or dimension, there are still opportunities to be found.

Joanna, Qiandama:

New categories and products are key to growth Starting as a fresh meat retailer, we’ve kept pace with evolving trends in beverage and bakery consumption. We’ve expanded into fresh milk, juice, and baked goods. Fresh milk sales are up nearly 60% year-over-year, and the top-tier fresh juice brand we introduced last month is now selling thousands of bottles daily. Each breakthrough in a single category propels the evolution of our entire model.

Han Wenjie, Duoletun:

“Regional identity” is a powerful lever in product development This year, we launched a proprietary Maojian craft beer. Looking ahead, we’ll explore cross-category combinations of local specialties with existing formats—for example, pairing Xinyang Maojian with Swiss rolls or unsweetened tea—to create novel products with regional appeal.

Li Xinlin, Membership Store Expert:

Every product has a story—and in retail, the story is the selling point The era of hypermarkets relying on massive SKUs and shelf space is fading. The single-product mindset is rising. In every category, there’s potential for breakout SKUs that can lift the entire segment—and even overall store sales—through their momentum.

About GenBridge’s Category Day

At GenBridge, we believe that the more ideas collide, the more possibilities for industry convergence emerge. In the generational transition of retail, categories are no longer just battlegrounds for upstream vs. downstream players—they are becoming a shared identity for collaborators.

Despite turbulent times, categories connect us—to each other, to consumers, and to the next opportunity.

Following our “Meat Category Day” (Related article: China’s Meat Consumption Industry: How Far Are We from Eating Well?) and “Beverage & Bakery Category Day,” GenBridge Capital will continue to host themed Category Day events.

In each event, we examine the development of categories across countries, dissect multi-channel data online and offline, and share insights from upstream production and product development to consumer experience. From these, we aim to discover future category trends.

Our goal is to build a collaborative, win-win environment—one that moves beyond tough procurement negotiations and enables joint product development.