In 2017, Zhengxin Chicken Steak ushered in a new era for China’s F&B industry by reaching the milestone of 10,000 stores. In the food service sector, “10,000 stores” signifies a fully matured single-store model, widespread consumer acceptance of taste, and—most importantly—a high level of supply chain standardization.

The same logic applies to the retail industry. When a brand surpasses the 10,000-store threshold, it becomes a piece of essential consumer infrastructure—penetrating vast lower-tier markets and embedding itself into consumers’ daily routines. Amidst economic pressure, such large-scale operations not only demonstrate strong risk resilience but also promise a more certain future.

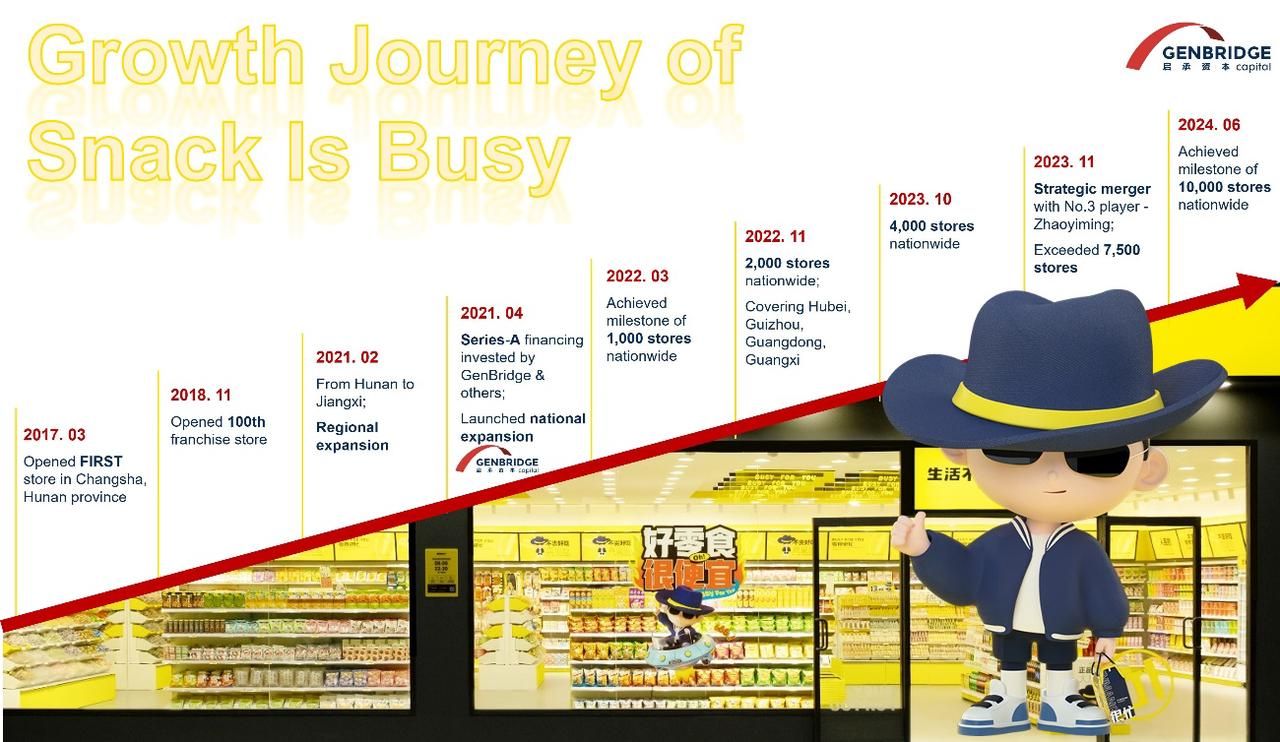

To reach 10,000 stores: KFC took 36 years, Juewei Duck Neck took 14 years, Mixue took 13 years, Zhengxin Chicken Steak took 11 years, Wallace took 9 years, and Snack Is Busy, just took 7 years.

As the fastest brand to reach 10,000 stores in this new retail category, Snack Is Busy’s rapid success stems from its founder’s keen market insight.

Also in 2017, the brand’s first true store opened in a corner of Juyuan Community in Changsha—a small 30 to 40 m² shop packed with over a thousand types of snacks. Though initially created as a snack supermarket because there wasn’t room to display all categories, it quickly won over local consumers.

That same year, Zhengxin Chicken Steak crossed the 10,000-store mark, inspiring many brands to dream of becoming the “KFC of China.” At the time, the term “community retail” hadn’t yet caught on—but Snack Is Busy had already entered residential neighborhoods, embedding itself in the very last mile of consumer interaction.

Targeting China’s trillion-yuan snack market—a sector rich in product variety but lacking strong brand identities—Snack Is Busy precisely captured the tastes of a younger generation of consumers. On the one hand, an endless stream of new snack products drew increasing attention. On the other, eating habits were shifting: “If meals aren’t enough, snacks make up the difference.” The usage scenarios for snacks were expanding rapidly.

Beneath this trend lies an underserved market segment. Mid-to-high-end snack consumers only account for 20–30% of the market; the remaining 70–80%—the mass-market consumer base—holds massive untapped potential. But in the past, the traditional snack distribution system was overly fragmented. By the time products made it from factories to consumers, prices had been marked up multiple times—resulting in so-called “snack assassins” (overpriced snacks).

In this fiercely competitive yet steadily growing red ocean, Snack Is Busy found a latent blue ocean—a key foundation for its “hyper-speed” expansion.

From the opening of its first franchise store in 2017 to surpassing 1,000 stores took five years. But the jump from 1,000 to 4,000 stores took just one year and seven months.

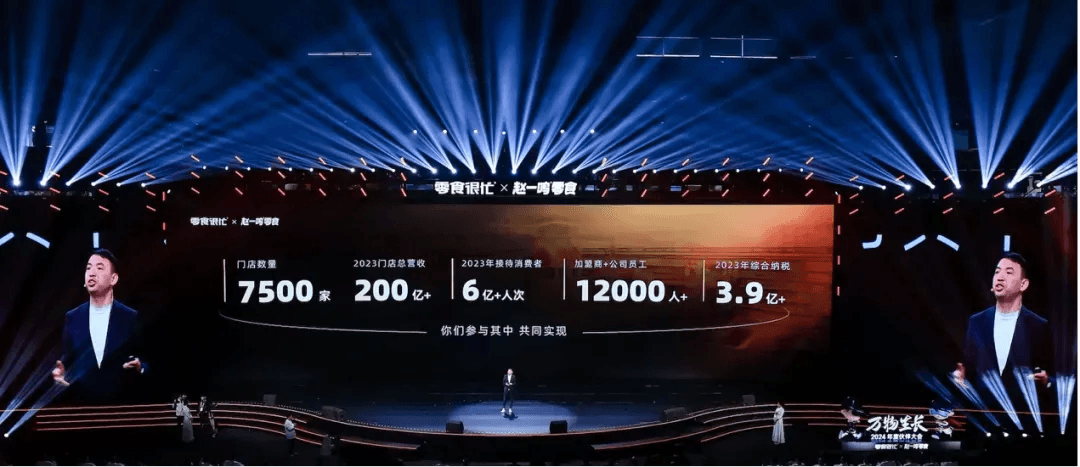

As Snack Is Busy accelerated, traditional snack chains began engaging in price wars. Then at the end of 2023, Snack Is Busy merged with Zhao Yiming Snacks, forming a giant with 7,500 stores—marking a new phase in the competition within the discount snack sector.

After the merger, the newly formed Busy Ming group began to focus on three major strategic directions:

Product Strategy: The group aims to enrich product categories, pursue extreme cost-performance, and drive both product innovation and regional customization.

Operations Strategy: From standardized store construction to digital marketing, the group will offer full-scale support to franchisees—boosting collaboration and making store operations simpler and more profitable.

Franchise Expansion Strategy: The 2024 goal of “opening quality stores and breaking the 10,000-store barrier” has been clearly defined. The group announced six major franchise incentives, including “five types of support reduced to zero cost” and a one-time opening subsidy of RMB 100,000.

Beyond standard stores, launching flagship and larger-format stores has become a key development focus.

During the May Day holiday this year, two flagship formats—“Super Snack Is Busy” and “Snack Is Big”—achieved a combined turnover of over RMB 7.15 million.

- “Super Snack Is Busy” generated RMB 3.97 million in revenue, with a peak single-day sales record of over RMB 910,000—setting a new national single-store single-day revenue benchmark in the snack industry.

- “Snack Is Big,” operating in a 280 m² space, earned over RMB 3.18 million across five days—setting a new “revenue per square meter” record.

On Children’s Day (June 1st), the brand went further by launching a specialty store in Changsha—Snack Very Spicy—dedicated exclusively to spicy snack offerings.

10,000 Stores in 7 Years: The rapid rise of Snack Is Busy

Looking back at the history of brands in China that have reached 10,000 stores, one common factor stands out: all of them relied heavily on lower-tier markets. With over 3,000 counties in China, opening just three stores in each would bring a brand to the 10,000-store milestone.

GenBridge Capital identified the immense potential of these markets as early as 2018:

“China’s lower-tier markets are vast and structurally advantageous. In every category, there’s potential for a ‘10,000-store chain brand’ to emerge. For high-frequency, essential categories tied to daily life, offline chains are becoming a rapidly growing channel, evolving at astonishing speed.”

In this race to win over lower-tier market consumers, “community” is another essential keyword. Snack Is Busy (零食很忙) placed community at the center of its strategy—80% of its stores are community-based.

There are approximately 300,000 residential communities in China, with a typical floor area ratio of around 2.0. A single square kilometer of residents represents a consumption potential of 500 million RMB. Just 1% of that purchasing power is enough to sustain one store. By intercepting this potential at finely-gridded community-level entry points, a wave of retail chains serving neighborhood-level needs has rapidly emerged.

In the snack category specifically, offline chains have unique value, complementing online e-commerce. But before Snack Is Busy entered the scene, snacks were considered only a mid-frequency category, hindered by excessive price markups and limited distribution channels.

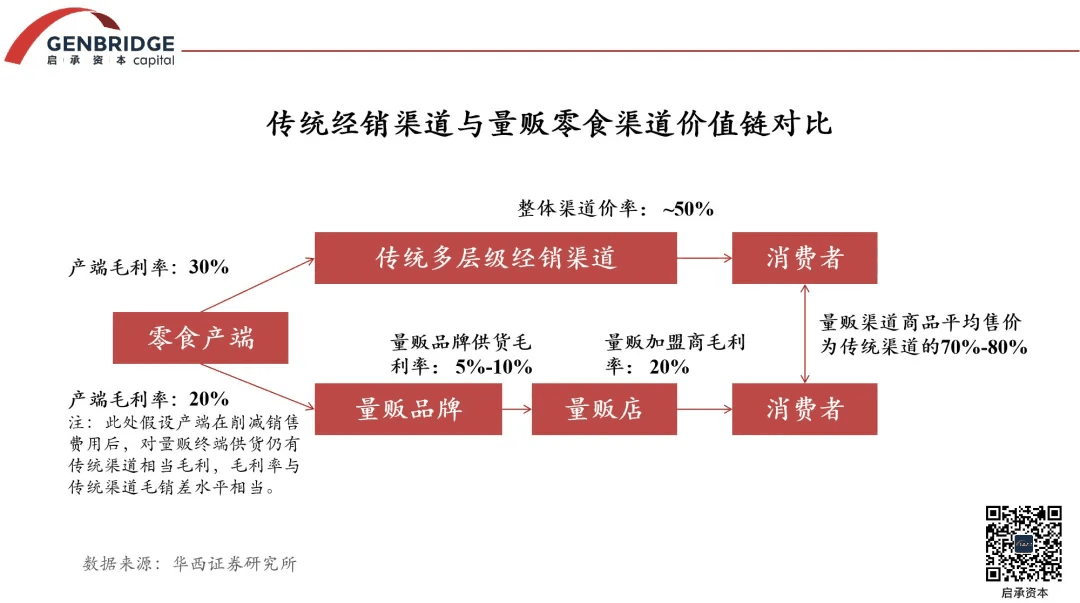

Under traditional retail models, snacks passed through multiple layers—from regional managers and sales reps to agents, distributors, and retailers—with cumulative channel markup rates reaching up to 50%.

Snack Is Busy, by contrast, partners directly with brand manufacturers, cutting out intermediaries like agents and distributors. This dramatically reduces markup, allowing products to be sold at prices 20–30% lower than traditional supermarkets.

With more competitive pricing, more efficient product assortments and displays, better locations, and an average franchisee gross profit margin of 18%, Snack Is Busy rapidly carved out market share from traditional supermarkets.

When GenBridge Capital invested in Snack Is Busy, one key question emerged: how can the company maintain profitability at such low prices?

The answer lies in product mix and operational design:

- Loose/bulk items account for 40% of sales, which eases the consumer’s spending burden while delivering higher gross margins than pre-packaged items. These items account for 60% of total revenue.

- For store location selection, Zhao Yiming Snacks offers franchisees 2.5 months to find sites, with an approval rate as low as 5%.

To reduce operating costs, Snack Is Busy developed a visualized category space management system, enabling remote support for franchisees. Store operators can access display planning support from the headquarters remotely. Each store carries an average of 1,600 SKUs, with a 5% monthly product refresh rate, yet only needs 5–6 employees to operate smoothly.

Since 2019, the company has adopted a “10,000 stores, one face” standardized management system. All stores use a real-time digital operations platform. A remote HQ team of about 300 people supervises stores across the country with real-time scoring.

Via online supervision and in-person inspections, every store’s cleanliness, cashier area, staff service, and shelf displays are translated into numerical scores. These scores directly impact franchise eligibility and deposit requirements. Any store scoring below 90 for three consecutive months is subject to suspension or even franchise revocation.

Thanks to precision in product selection, location strategy, and relentless operational refinement, Snack Is Busy created a virtuous cycle: low prices → scale expansion → even lower prices.

On the procurement side, the company uses a buyout model and a strategy called “Three Highs, Three Lows, Three Zeros” to secure resources from top factories:

Three Highs: high aesthetic appeal, high value, high quality.

Three Lows: low profit margins, low prices, low costs.

Three Zeros: zero after-sales service, zero payment period, zero product returns.

This model provides upstream manufacturers with a stable cash flow in exchange for high bargaining power—fueling a low-price product strategy.

The brand's reputation for speed and reliability—“cash on delivery with no credit term”—has earned it strong trust among suppliers. “Zero-payment-period cash procurement” has become one of the company’s operational hallmarks.

By 2022, Snack Is Busy had surpassed Walmart to become the largest client of Yan Jin Pu Zi, a well-known snack producer. In its financial report, Yan Jin Pu Zi stated that revenue from volume-based snack channels like Snack Is Busy grew over 200% year-on-year in the first half of 2023. The brand consistently seeks top-3 manufacturers in niche segments across the industry—and increasingly searches overseas as well. For instance, China is not a key production region for seaweed snacks, and its crispness often doesn’t match that of Korean products, which also come at lower cost.

During GenBridge Capital’s second retail study tour in Japan, Snack Is Busy actively sought out Japanese seaweed suppliers—particularly those producing for Kirkland—pursuing the goal of sourcing the best products globally for Chinese consumers.

An exemplary model of retail chain transformation

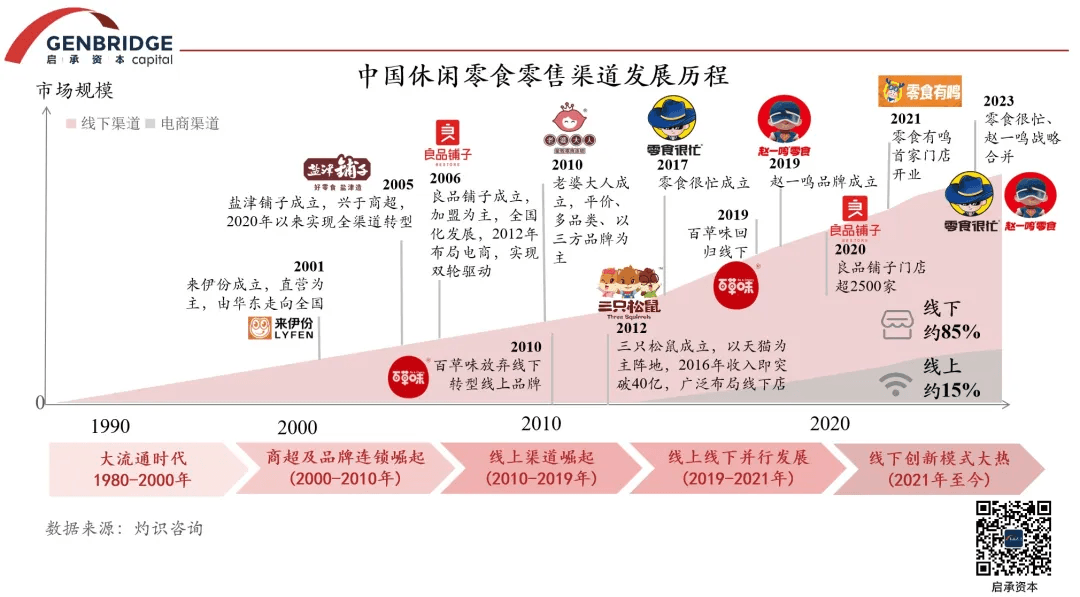

Looking back at history, every transformation in retail channels has driven broader industry change—each wave of channel evolution triggering a reshuffling of the market. Today, a new generation of snack chains led by Snack Is Busy is setting the direction for the industry’s future.

GenBridge Capital observed that over the past 30 years, China’s market has shifted from one of supply shortages to one where supply far exceeds demand. As consumers are presented with increasingly abundant choices and varied experiences, they are now returning to basics—seeking better value for money. At the same time, demand is becoming more segmented, with individuals pursuing products that better meet their personalized needs.

At the heart of these 30 years of change lies a core question: can a company effectively build channels to deliver the right products to the right consumers? This has always been a key measure of success in the consumer market.

The seller’s market—where distributors and retailers controlled the end of the supply chain—has become unsustainable in an environment of oversupply. As the supermarket era fades, Chinese retail has entered a buyer’s market, and retail chains are undergoing three transformational trends: discounting, community orientation, and manufacturing integration.

Snack Is Busy is the embodiment of these three trends:

- Discounting

By bypassing traditional intermediaries and connecting directly with factories, Snack Is Busy adopts a lower markup pricing strategy to offer consumers a broader selection of low-cost products.

To enter Snack Is Busy’s sales system, a product must meet one of two criteria:

It is a top-tier brand, playing a traffic-driving role in the overall product lineup, offering low margins but high turnover.

It is a factory-backed brand with solid supply chain capabilities, able to compress intermediate layers and improve profitability.

- Community Orientation

Operating with a highly localized, community-driven model, the company positions itself as “essential infrastructure for everyday life” through dense store coverage and lean operations—bringing maximum convenience to consumers.

- Manufacturing Integration

By forming a new-generation manufacturer-retailer alliance, Snack Is Busy created a “production-retail alliance” model tailored to China’s snack industry. It collaborates with brands and factories to co-develop products that address core consumer needs.

On March 13, 2019—before Snack Is Busy even formalized its store standardization—GenBridge Capital identified the company and began tracking it closely. In early 2021, GenBridge Capital became the lead investor in its first funding round. Soon after, Snack Is Busy expanded beyond Hunan into Jiangxi, beginning its national rollout.

In recent years, GenBridge Capital has witnessed the company grow from hundreds to thousands of stores, and ultimately merge with its competitor to break through the 10,000-store milestone. Once again, we see that as China’s consumer market fully enters a buyer-centric era, retail chain transformation is becoming an unstoppable force.

The new generation of retailers must act as agents of the consumer, constantly evolving their formats to meet shifting demands. In the case of Snack Is Busy, the role of the retailer goes far beyond offering discounts—it is increasingly moving upstream in the supply chain, gradually replacing brand functions such as product selection, promotion, and fulfillment.

As retailers move upstream, the supply side is also being reshaped. Factories benefit from large, stable orders, allowing them to focus on improving efficiency and product quality. More technology and equipment can be invested in production, converting quickly into competitive products that offer greater value to consumers.

Viewed in this context, the growth potential of Snack Is Busy—the merged group—goes far beyond its current achievements:

- In terms of store count, the snack retail sector may grow to nearly 100,000 stores, with more than 3x expansion potential ahead.

- In terms of market scale, chain brands with a scale advantage will likely extend beyond snacks into other categories, following the trend of “quality-price ratio.” This could give rise to new store formats and novel category combinations in the long term.

In a joint letter from Zhou Yan, founder & CEO of Snack Is Busy, and Ding Zhao, founder & CEO of Zhao Yiming Snacks, the two leaders reflected on reaching 10,000 stores and once again emphasized their shared vision of becoming “The People’s Snack Brand”: “A snack brand for the people—affordable and accessible to all—reliable and reassuring to society.”