In September, the GenBridge Capital 2023 AGM was officially held in Shenzhen. In 2023, marked by a rebound in consumer sentiment, we gathered numerous LPs and founders to reminisce about our collective journey. Together, we explored how we connected global professional resources, assisting portfolio companies and founders in realizing their champion aspirations.

At the event, Founder and managing partner of GenBridge, Robert Chang, delivered the keynote speech titled “Realizing the dream of consumer champion together along the way”. Below is a transcript of his inspiring address.

We are “Investors” As Well As “Entrepreneurs”

Throughout our investment journey, we have heard countless stories from founders. Today, I wish to share the story of GenBridge.

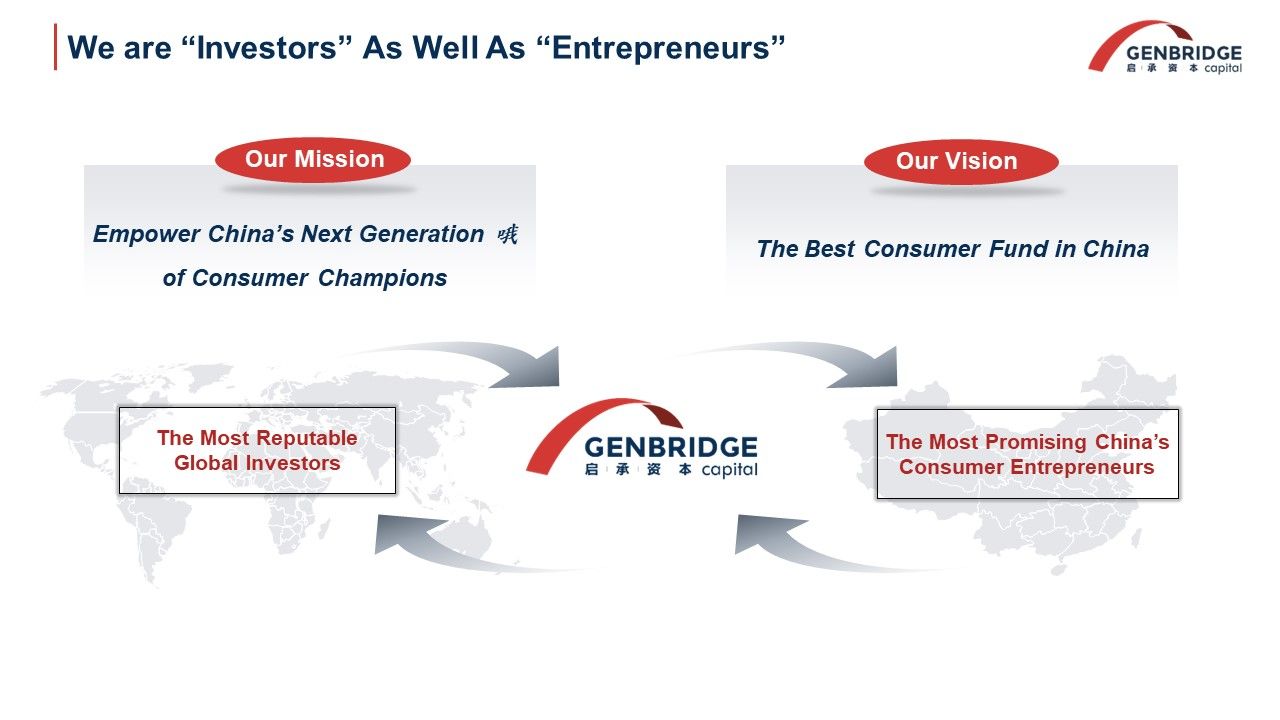

To entrepreneurs, we are investors. However, from the perspective of LPs, our GenBridge team is also a group of entrepreneurs. Established in 2017, GenBridge Capital is a fund specialized in consumer investments. From the outset, we defined our mission and vision: to support China’s “new generation of consumer champions” and become the country’s most professional and outstanding consumer fund.

We were fortunate to have received support from some of the world’s most esteemed investors right from the beginning. Our LPs include top-tier mother funds institutional investors, leading industry venture capitalists, sovereign wealth funds, and family offices. Their trust and backing have been invaluable.

Our primary role is to “connect”: to bring the capital and expertise of the world’s most professional investors to China, channeling them towards the most promising consumer entrepreneurs to create greater value. Hence, our English name, GenBridge, stands for Generation Bridge, while the Chinese name “Qicheng” signifies continuity and forward momentum.

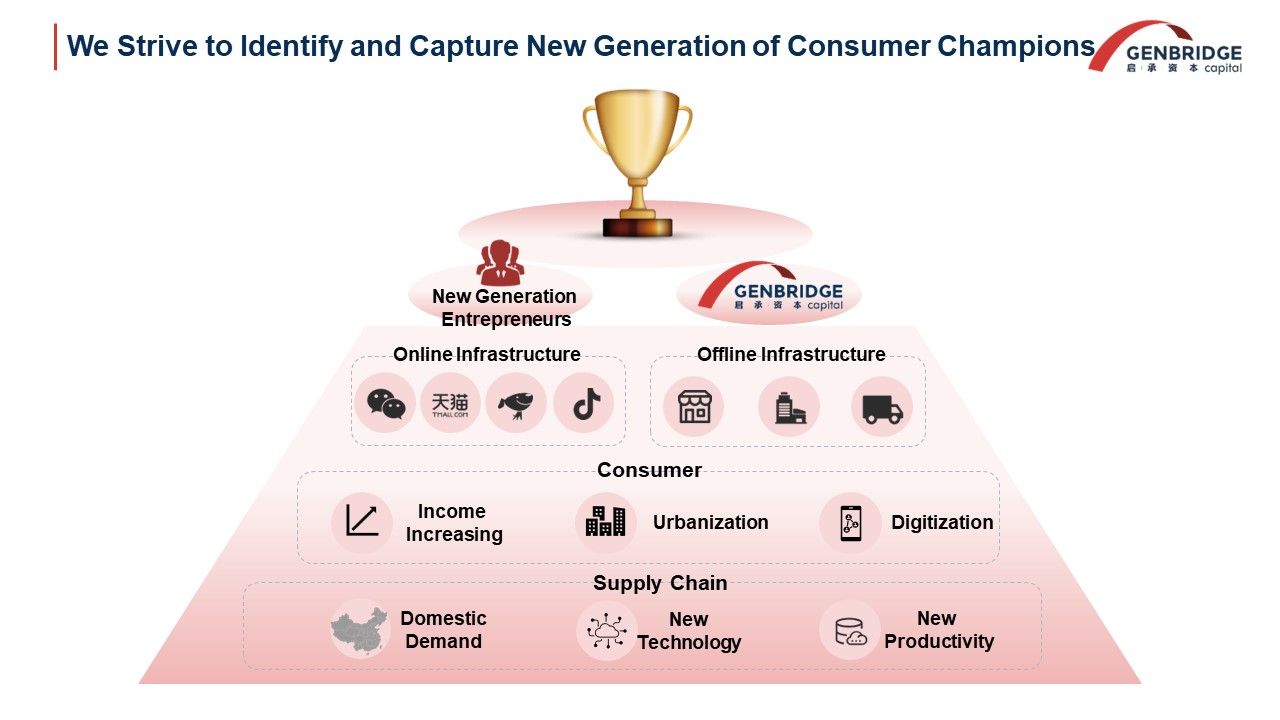

Our entrepreneurial spirit stems from our belief in a generational shift in China’s consumer market. When establishing the fund, we recognized significant potential: China’s established supply chain is already the global manufacturing powerhouse. Naturally, there are immense opportunities when this upgraded production capacity is directed to domestic markets. Besides, China’s world-class online infrastructure, leading e-commerce platforms, and efficient offline logistics and payment networks are also notable edges.

Additionally, we identified China’s vast consumer base. Many only see China’s 400 million middle-class population, yet with urbanization and digitization, there are over 1 billion new-generation consumers seeking superior products. Crucially, China boasts a group of innovative founders, willing to pioneer commercial innovations and create next-generation products and services.

We positioned ourselves as “professional growth-stage consumer investors.” Our core investment strategy focuses on enterprises that have navigated the initial product exploration phase and solidified their business models. GenBridge’s core strength also revolves around supporting these enterprises, assisting entrepreneurs in addressing growth challenges in areas such as strategy, operations, and capital.

Over the past six years, we have been honored to journey alongside numerous founders. From our first investment in 2017, we have partnered with companies such as Qiandama, Milestone, Ludao, New Joy Mart, Botare, HIMO, Deerma, Peilai, Igrow, Guoquan, Yeswood, Harvest, Busy for You, Zhufaner, M Stand, Duoletun, Guozi Shule, Lola Rose, Mr. Ma’s Noodle, and Xue Ji , among others. We feel privileged and proud to have walked this journey with all of you.

Our Portfolio Companies Span "New Generation of National Brands" and "New Generation of National Chains."

Our portfolio companies span various consumer sectors, primarily focusing on three core areas: food & beverage, household and lifestyle. Together, these companies embody GenBridge’s vision of the “new generation of national brands” and “new generation of national chains.”

Under these themes, our portfolio companies have witnessed rapid growth in recent years. Our retail companies have grown roughly eightfold over the past five years, while our brand companies have quadrupled in the past four years. Today some consumer companies sacrificed product quality for growth speed. Our portfolios, despite challenges, including last year’s pandemic,have maintained robust profitability. In 2023, our portfolio companies achieved both revenue growth and operational excellence.

Aggregately, our brand portfolios manage over 50 sub-brands, serving more than 100 million households with daily consumer and durable goods. Combined, their revenue is projected to reach 33 billion RMB this year.

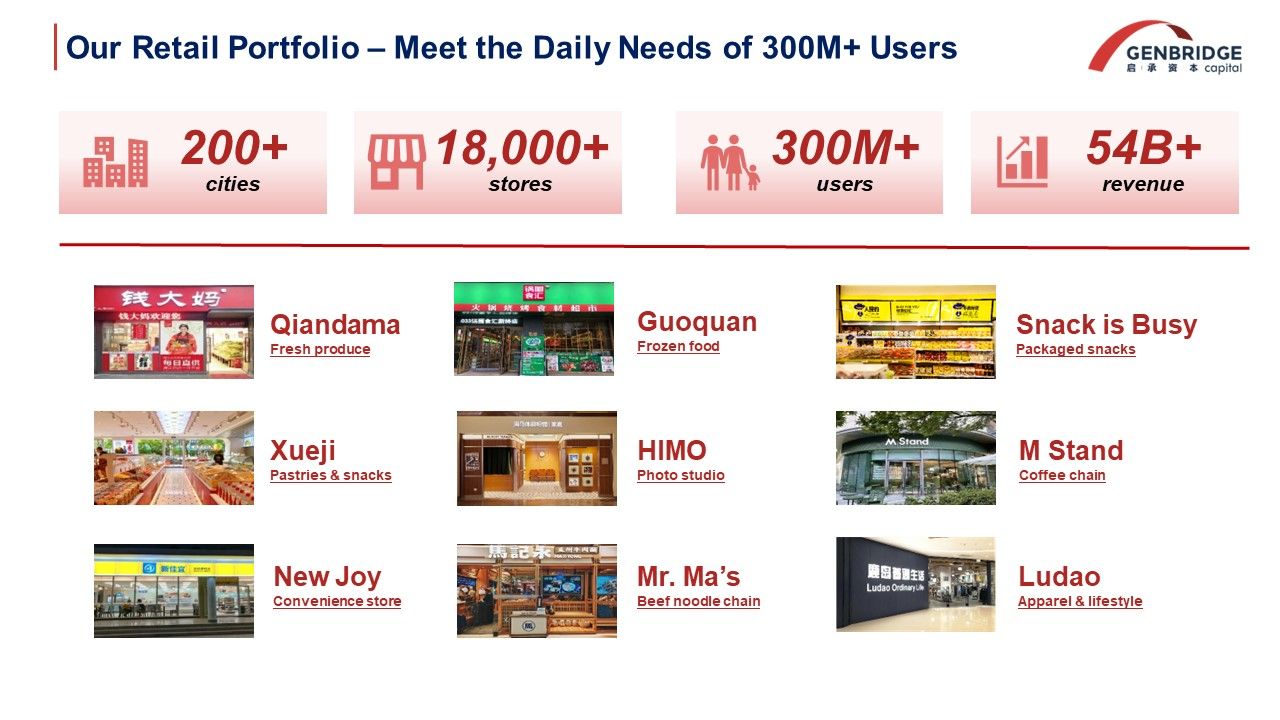

Our retail portfolios have expanded to over 18,000 stores in more than 200 cities, serving over 300 million users. Their combined store revenue is expected to exceed 54 billion RMB. Comparatively, China’s largest offline retailers, Walmart and Yonghui, have approximately one trillion RMB in revenue after three decades in China. Our companies, in just five to six years, have reached half of their scale, with several ranking in the top 15 of China’s offline supermarket chains.

This represents the total scale of our brand and retail companies. We believe that in the next decade, more champion enterprises from GenBridge’s portfolio will emerge in the “new generation of national brands” and “new generation of national chains.”

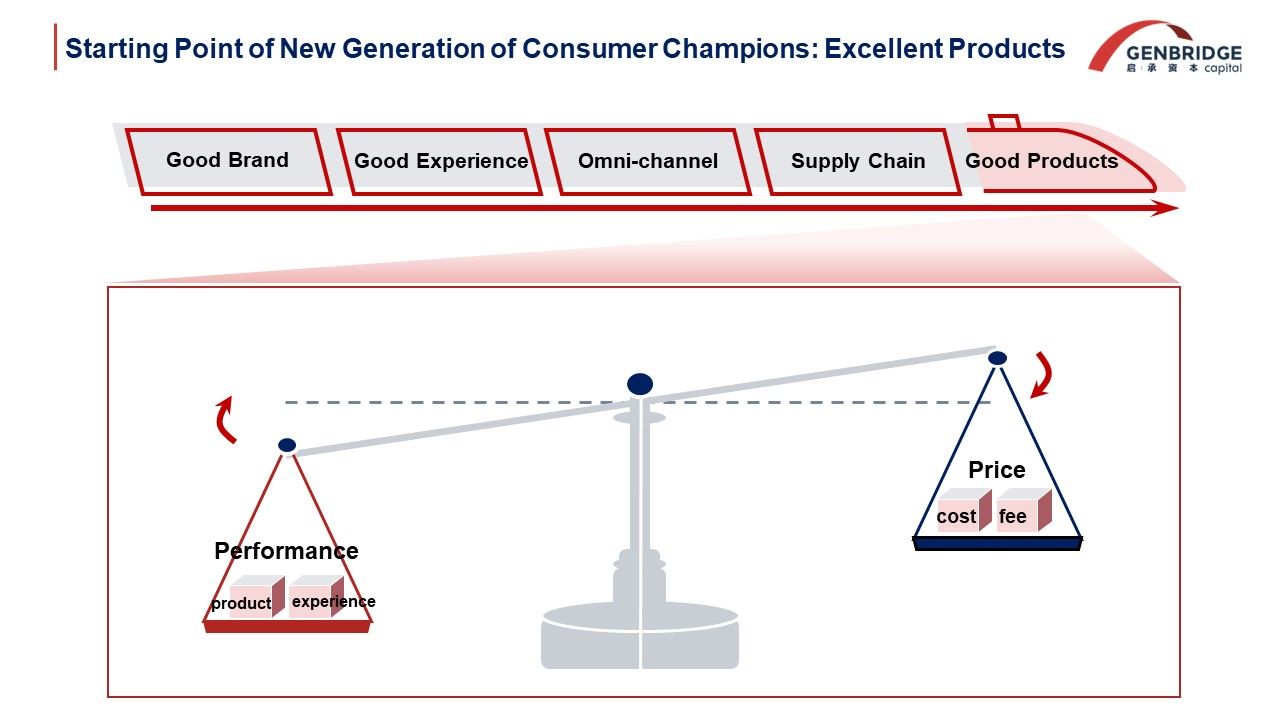

Becoming a “champion” requires a starting point. Regardless of the size of one’s enterprise, the initial intent remains to create excellent products. This product acts as the locomotive, driving the supply chain, channels, user experience, and brand quality. In today’s China, creating an “excellent product” means enhancing performance, improving user experience, and simultaneously leveraging business model efficiency to reduce costs, therefore offering consumers with superior value. If infused with a meaningful brand aspiration, it makes an outstanding product.

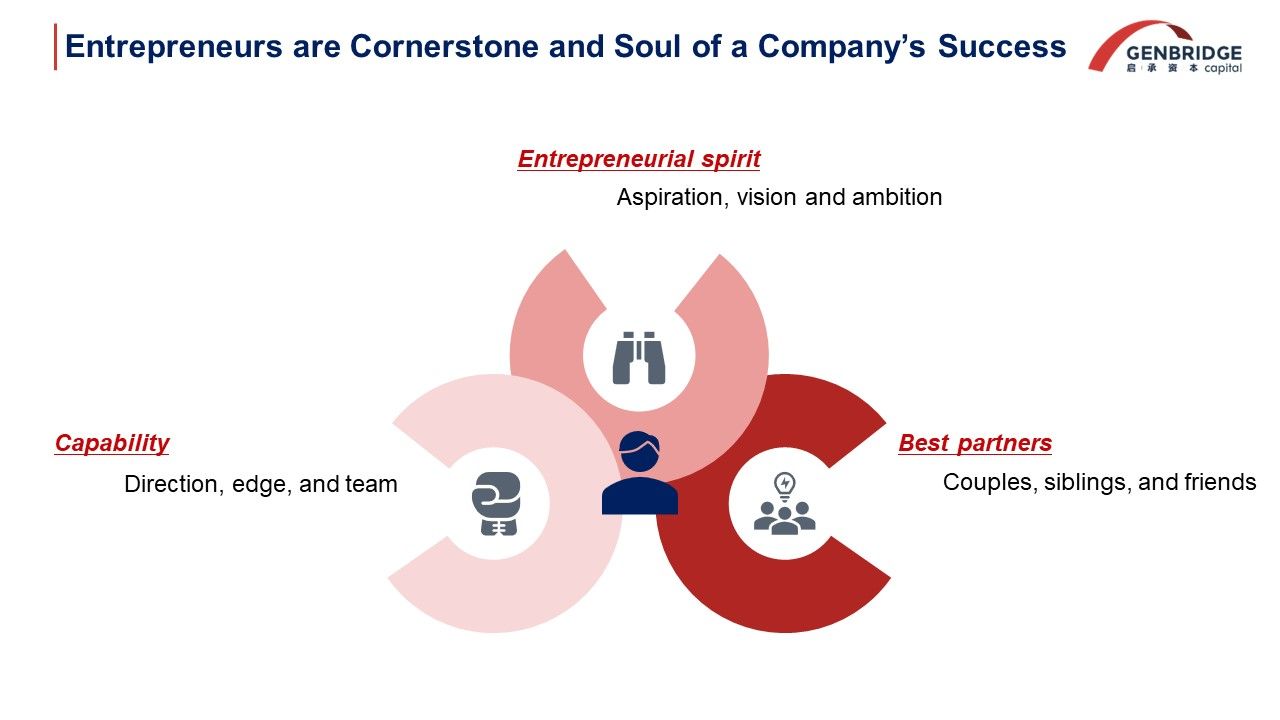

Each portfolio company produces products that are distinct yet efficient, rooted in user value. These creations originate from our founders’ deep insights into user needs, recognizing market opportunities, and leveraging limited resources to establish unique models. With a clear vision and initial support from close associates, some of our portfolio enterprises include co-founder couples where the husband sees to products and the wife sees to design, as well as siblings, and university peers. These original teams fostered exceptional operational capabilities, providing direction, ammunition, and a united front to their companies.

GenBridge's Value Creation Empower to Realizing Championing Aspirations

We are honored to be the first external shareholder for 13 portfolio companies and the primary external shareholder for 17 portfolio companies. Early-stage engagement by founders is not an easy decision, and their trust in us is profound.

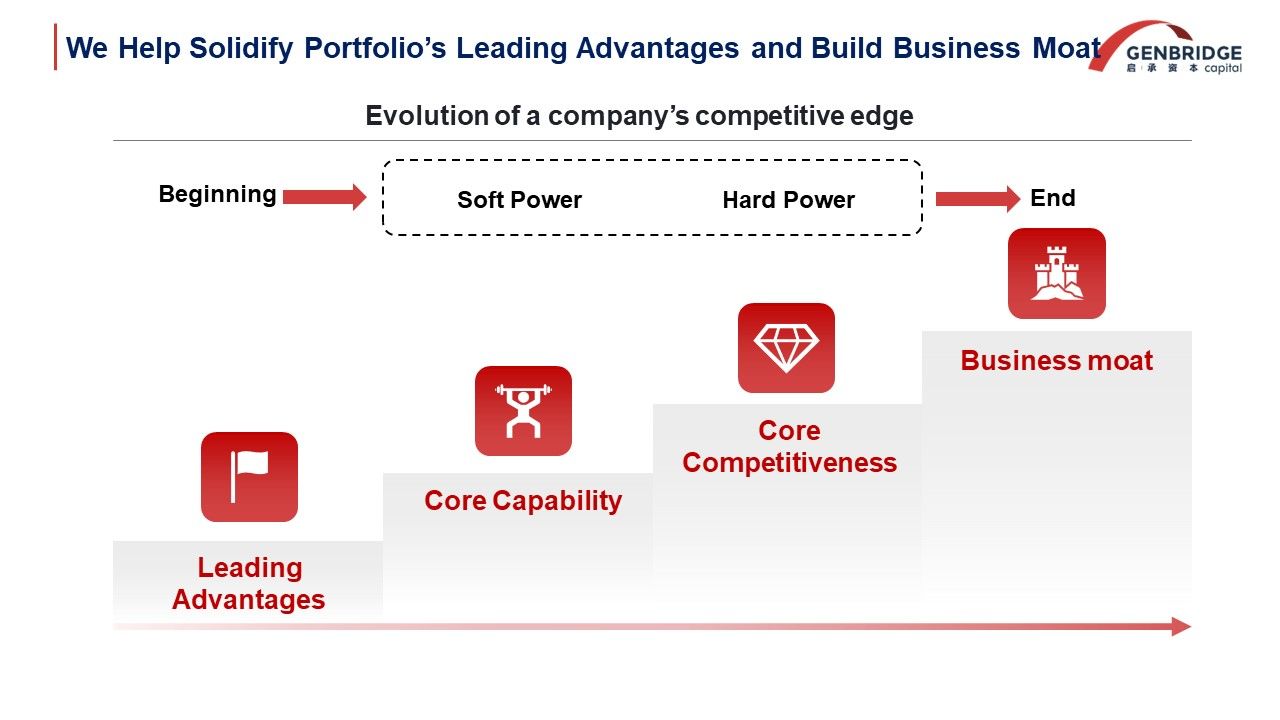

Looking ahead, we aspire to play a more significant role, ensuring not only the growth of the first curve but also aiding founders in creating a second curve, achieving sustained expansion through both organic and inorganic means. Many founders initially possess a few competitive advantages. During fundraising, they often face challenges: “Why you? Why not someone else? What if someone else does what you do?” We assist founders in transforming these subtle advantages into core competencies, eventually fortifying them into formidable business barriers that distinguishes them from everyone else.

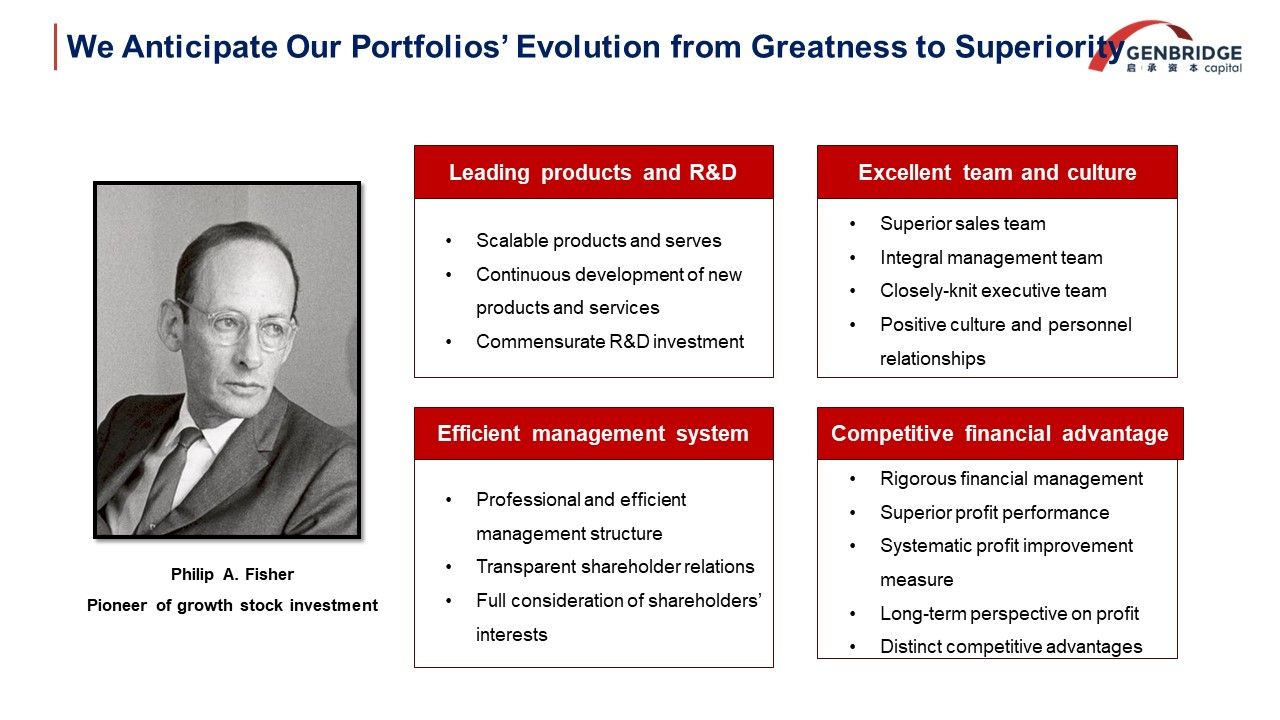

A renowned investor, Fisher, once mentioned the common characteristics of outstanding companies:

- They excel at creating leading and good quality products;

- They possess exceptional teams and cultures, operating cohesively;

- They have efficient corporate governance structures, effectively integrating internal and external resources;

- Lastly, they exhibit impressive financial performance and seemingly unassailable competitive advantages.

We anticipate our portfolio companies’ evolution from greatness to superiority.

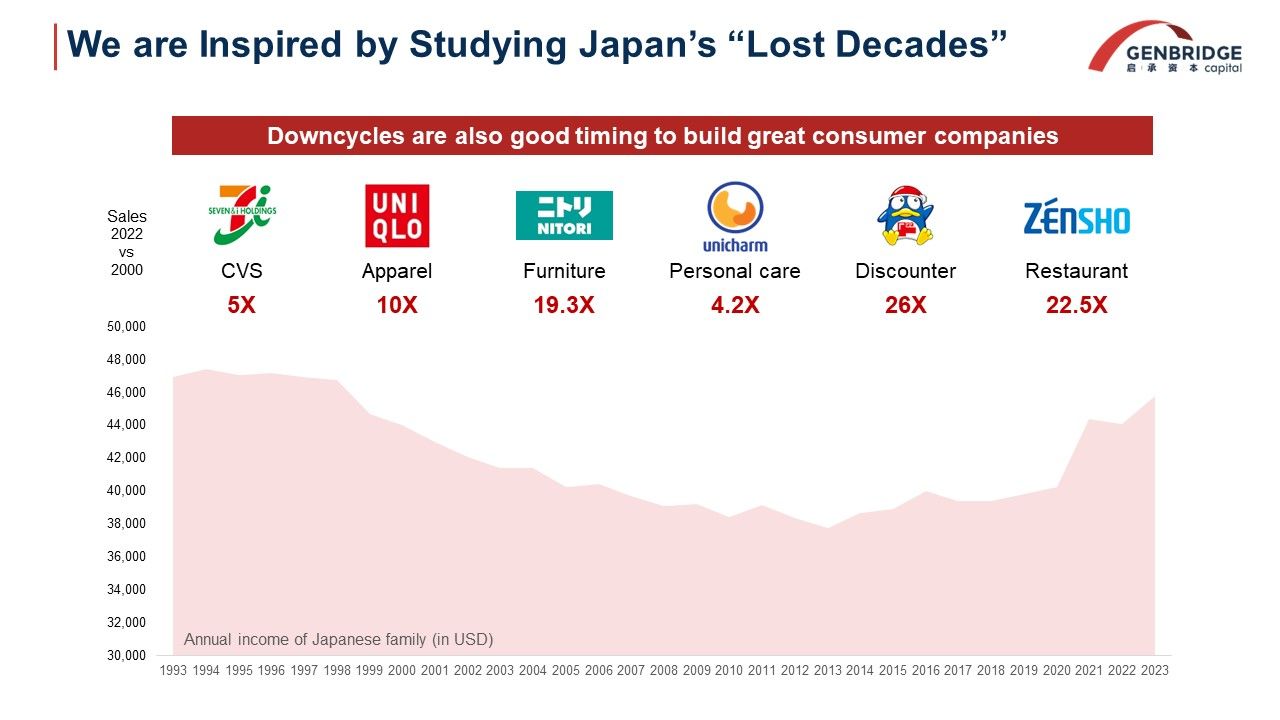

In recent years after the COVID-19 pandemic, China’s consumer market has shown gradual signs of recovery. However, the growth seems to be less robust compared to previous years, causing some to doubt the resilience of China’s economic trajectory and even draw parallels to Japan’s “Lost Decades”.

At GenBridge, we have extensively researched the Japanese market. Our preliminary conclusion is that while China and Japan possess fundamentally different market foundations, they are not directly comparable. Yet, even amidst Japan’s “Lost Decades”, a plethora of outstanding consumer-focused companies emerged, such as the globally recognized 7-11 convenience stores, Uniqlo, Japan’s “IKEA” – Nitori, Don Quijote discount stores, and Zensho’s dining establishments.

From our research, we gleaned four pivotal insights:

- Regardless of economic conditions, Japanese consumers continually upgrade their basic necessities. The quest for superior quality milk, coffee, beer, and tastier noodles never wanes; it only ascends.

- Rising Expectations for Convenience: Our study on 7-11 illuminated that while many channels may attract consumers through discounts, true buyer-centric markets comprehend and cater to user demands, offering distinctive positioning besides competitive discounts. Such market understanding has empowered 7-11 to maintain leadership over the past three decades and sharpen its edge even further. This trend is now evident in China with emerging brands like Qiandanma, Guoquan , and Busy for YOU. This is just a tip of China’s future 10000 national chains.

- Affordable Excellence: Japan, once a bastion of luxury consumption, witnessed a surge in demand for value-for-money products during economic downturns. Brands like Uniqlo and Nitori capitalized on this, as did discount formats like Don Quijote and Daiso.

- Adapting to Societal Shifts in Dining: Japan’s aging population and declining birth rates prompted innovative, cost-effective dining solutions for singles and small families. This underscores the pinnacle of efficiency in Japan’s food industry, where prices for meals like beef bowls and udon noodles remained unchanged for three decades, respectively at 20 and 18 RMB. This is true even when raw material costs surged. Rice in Japan costs twice as much as in China, but a beef bowl at Yoshinoya in Japan is still cheaper than its counterparts in China, demonstrating Japanese dining industry’s extreme efficiency.

While China may face a growth deceleration in the near future, a comprehensive study of Japan instills confidence in our portfolio companies. These enterprises are deeply rooted in China’s foundational consumer demands, consistently striving for enhanced quality— a timeless consumer aspiration.

We believe China’s next-generation “consumption champions” will seamlessly bridge the needs of its 400 million middle-class and 900 million lower-tier city residents, forging truly national brands and dominant chains. While past perceptions centered on the consumption patterns of China’s affluent 400 million spending on mid-to-high end oversea brands like Starbucks or Nike, our reality encompasses a broader, 9 billion-strong mass consumer market. Numerous companies, starting from cities like Changsha, Zhengzhou, and Jinan, can penetrate townships and villages to even fourth-tier cities.

Historically, offline chains struggled to penetrate lower-tier markets, and e-commerce channels were less developed. However, today’s landscape, with nationwide chains, e-commerce platforms, and expansive logistics, witnesses rapid chain expansion in lower-tier markets. Brands like MIXUE capitalized on this, and Luckin’s rise beyond Starbucks underscores this transformation, offering products like Luckin’s Maotai Latte that truly resonate with Chinese tastes.

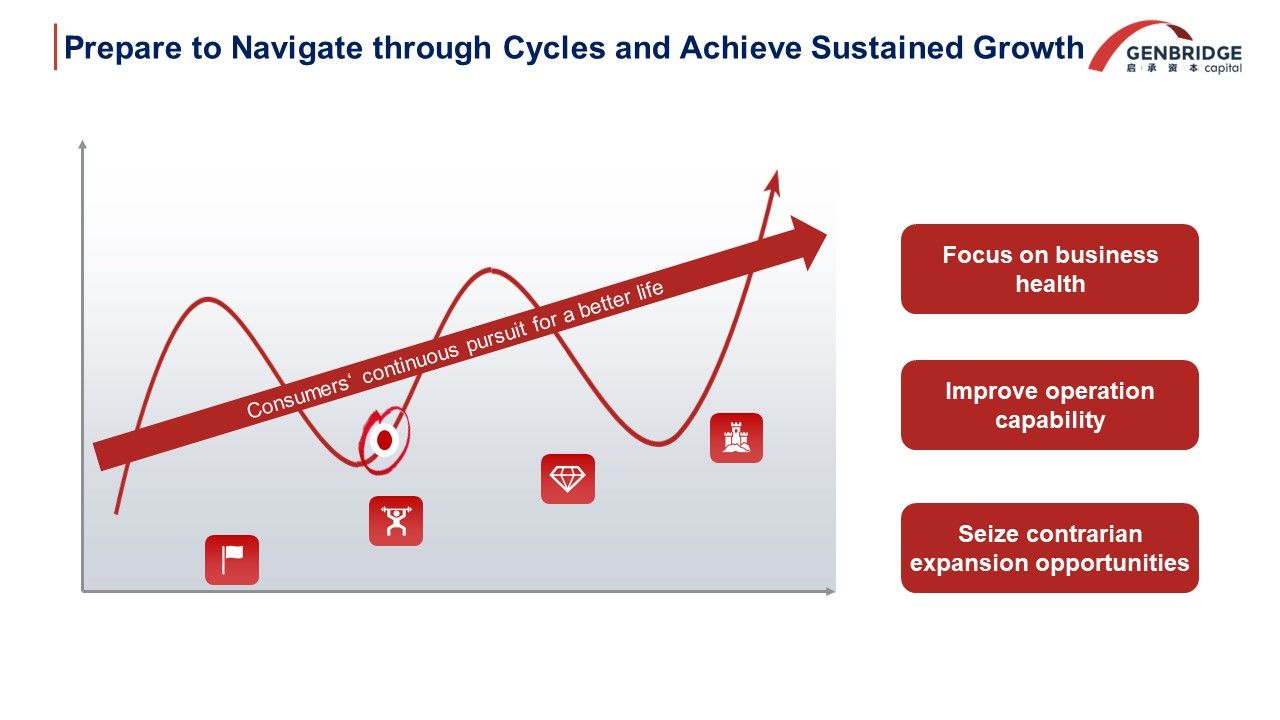

While China’s consumer opportunities dwarf Japan’s, growth trajectories are seldom linear. Over recent years, our pioneering founders faced unprecedented challenges. Reflecting upon our journey, I’m reminded of our collective resilience and vision. Through market cycles, we’ve prioritized business fundamentals, healthy performances, cash stewardship, and operational excellence. Many companies seized expansion opportunities against the odds, scaling new heights. Recognizing that cycles are inevitable, I trust our portfolio companies are well-prepared for a sustainable future.

In conclusion, GenBridge Capital is, the same as everyone else, an entrepreneur, and our entrepreneurial journey is anchored in “connection”. Entrusted with our invaluable LPs, we are committed to nurturing China’s most promising entrepreneurs, fostering truly impactful ventures, and catalyzing the rise of China’s next generation of industry leaders. We extend our heartfelt gratitude for your unwavering support and look forward to collectively realizing our championing aspirations. Thank you!